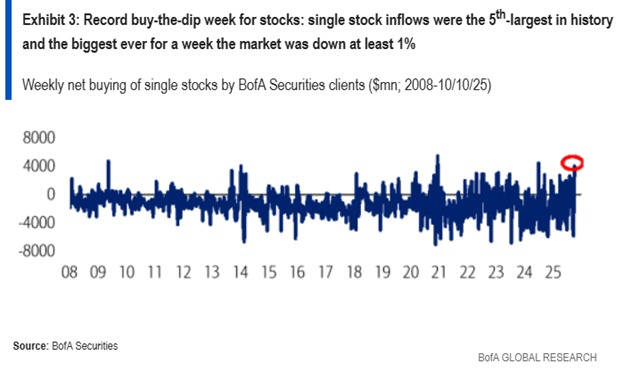

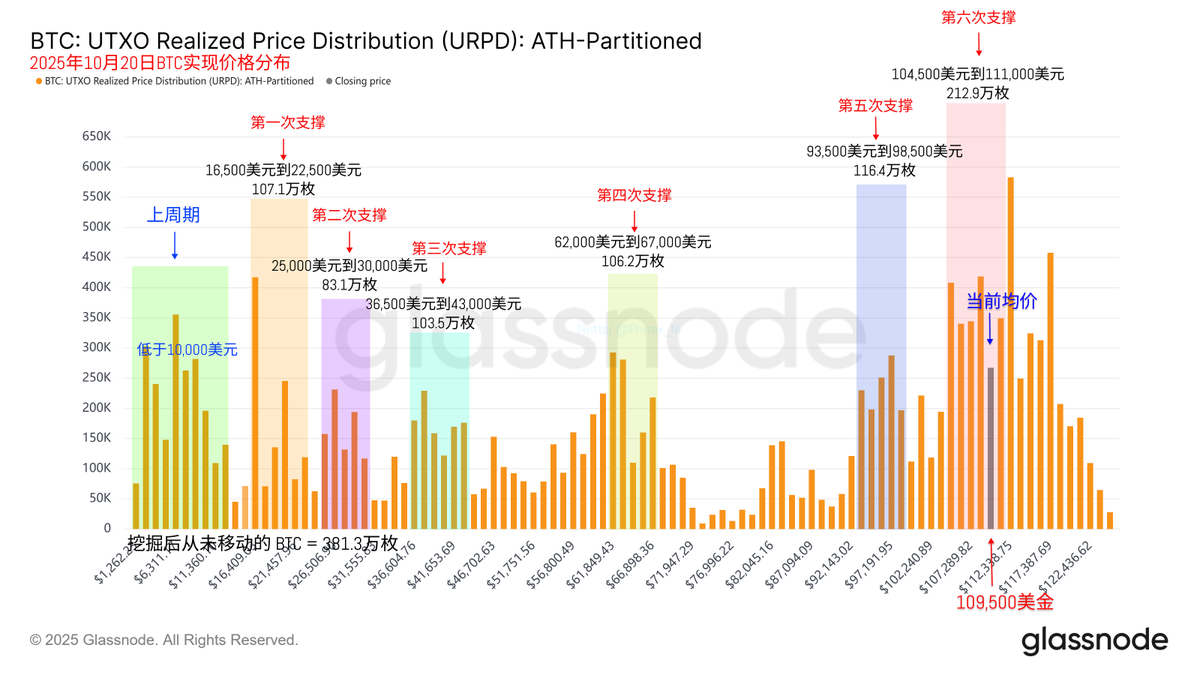

Today is another day for reading. Yesterday, I saw that fund managers were making significant purchases, and the cash position is at its lowest in the past 12 years. Today, I came across more detailed data showing a net inflow of $3.9 billion since last week's decline, indicating that investors are actively increasing their positions during the downturn. The same goes for $BTC; recent data shows that more investors are actively buying in.

My long position of $116,000 now looks quite healthy, and I have no plans to exit for the time being. I'll hold on to it. The most important thing next week is the CPI data; I wonder if it will be released by Friday. Currently, the market predicts a slight increase in CPI data, as inflation due to tariffs is normal.

Today, while communicating with friends in the mining circle, I found that they are also worried that the market won't last until 2025, and some have already started to reduce their positions. This is normal; the impact on bulls from October 11 was a bit too severe. However, from the data of the U.S. stock market, I still see no major issues. After last Friday's decline, institutional funds flowed in $4.4 billion, the highest since November 2022, clearly showing that funds are driving buying.

Even retail investors are actively buying, which is a standard Buy The Dip scenario. Therefore, I haven't seen the liquidity concerns that many friends are worried about, which is also why I dare to position long.

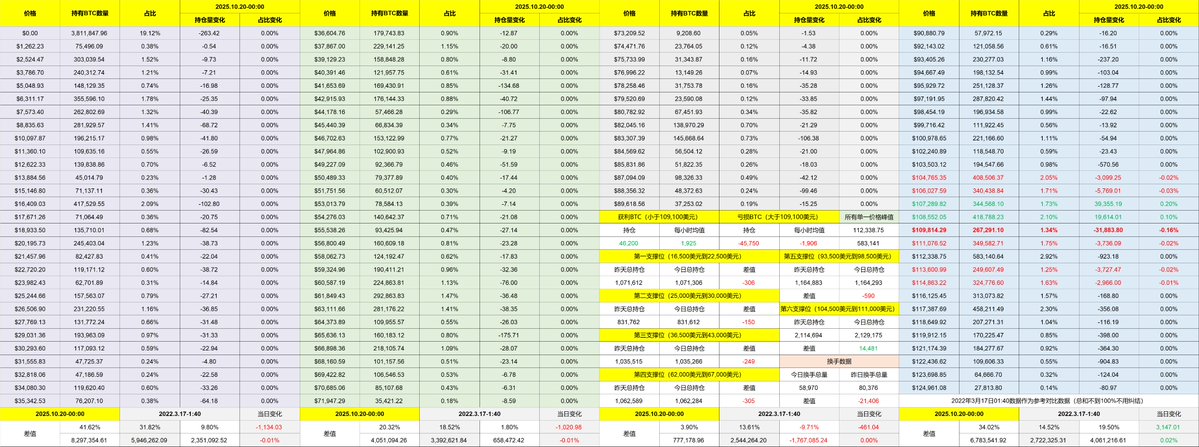

Looking back at Bitcoin's data, today's turnover rate continues to decrease, and investor sentiment is quite relaxed, maintaining a good buying mood. Currently, the main game has returned to monetary policy. The recent U.S.-China trade and geopolitical conflicts have improved significantly, and the issues with regional banks do not pose significant risks.

The government shutdown should have been a problem, but this week the House of Representatives is in recess, meaning there won't be any voting or consensus this week. We will just have to wait for the end of the month for the interest rate meeting.

This article is sponsored by #Bitget | @Bitget_zh

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。