Tracking real-time hotspots in the cryptocurrency market and seizing the best trading opportunities. Today is Monday, October 20, 2025. I am Wang Yibo! Good morning, crypto friends! ☀️ Die-hard fans check in! 👍 Like to make big money! 🍗🍗🌹🌹

==================================

💎

💎

==================================

Last Friday, Trump softened his previously hardline stance on trade, boosting the US dollar index. US stock index futures opened higher on Monday, with Nasdaq futures rising by 0.36%. The probability of a 25 basis point rate cut by the Federal Reserve in October is as high as 99%, and expectations for a rate cut in December are similarly strong. It is worth noting that the US government, currently in a shutdown, will release a series of economic data this week, and the market generally expects a high probability of an upward trend in the last ten days of October. With this macroeconomic support, the overnight cryptocurrency market rebounded across the board, with Bitcoin breaking through the $109,000 mark and Ethereum rising above $4,000, while other mainstream cryptocurrencies also saw synchronized increases. Stay tuned to Yibo for the latest updates, and pay close attention to the Federal Reserve's subsequent actions to avoid blindly chasing high prices in crypto assets. It is essential to control positions and hedge risks to seize opportunities while minimizing risks.

==================================

💎

💎

==================================

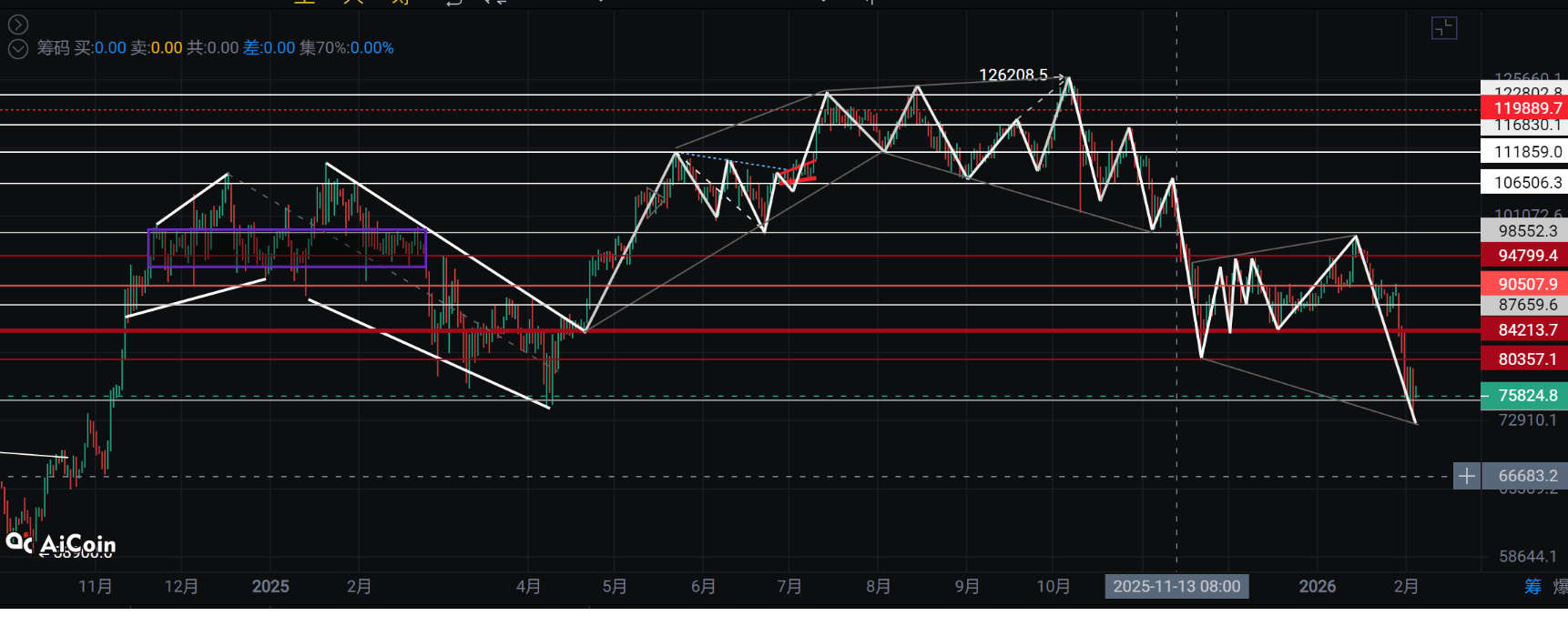

Bitcoin: Consolidation after upward fluctuations, key support determines the height of the rise

Yesterday, Bitcoin continued the weak fluctuation pattern from the weekend, oscillating within a narrow range of $106,500 to $107,200 throughout the day, with relatively low market trading sentiment. This sideways consolidation was broken in the afternoon, with the price quickly testing the support at the $106,000 level. Fortunately, this position showed strong support, becoming an important starting point for the current upward movement.

After receiving support at the $106,000 level, Bitcoin began a strong rebound. After two phases of advancement, the price peaked at $109,397, with a daily increase of nearly $3,000, demonstrating strong bullish momentum. However, after reaching the high, the market saw profit-taking, and the price entered a slight pullback consolidation phase.

For today's market trend, it is crucial to pay attention to the quality of the consolidation in the morning and during the day. From a technical perspective, the current price is still within an upward channel. If it can hold the support at the lower edge of the channel, there is still room for further upward movement. The key support range is between $107,200 and $107,500, which is not only the core area of yesterday's daytime fluctuations but also an important intermediate support level in this upward process. If this support can be successfully maintained, Bitcoin is expected to launch another attack, and the expectation of breaking above $112,000 remains possible. Conversely, if it falls below this range, it may further test the $106,000 level or even lower for support.

Ethereum: Strong rebound after correction, channel resistance becomes an obstacle to upward movement

Ethereum's adjustment rhythm is tighter. After a strong drop to $3,670 last Friday, Ethereum entered a correction phase over the weekend, with both bulls and bears in a stalemate, and the price fluctuation gradually narrowed. In the afternoon yesterday, Ethereum first experienced a strong spike, reaching a high of around $3,822, and then began a strong upward trend.

Entering the evening session, Ethereum showed an overall upward trend, with bullish momentum continuously released, and the price kept refreshing the daily high, currently testing a high of $4,029. However, there is some resistance around the $4,029 level, and after facing pressure at this position, the price is currently undergoing slight consolidation near the $4,000 round number.

From the 4-hour chart, Ethereum shows a pattern of small upward candles, with the moving average system in a bullish arrangement, indicating a relatively clear short-term bullish trend. The key for the subsequent price movement lies in the channel resistance at $4,120, which is an important pressure area formed in the previous trend. If it can successfully break through and stabilize above this level, it will open up new upward space for Ethereum, further launching an attack on higher points. However, until this level is broken, Ethereum is likely to continue consolidating within the current channel, with the effectiveness of the support at the $4,000 round number and the strength of the secondary support at $3,822 becoming important references during the short-term consolidation process.

==================================

💎

💎

==================================

Overall summary and operational tips

The simultaneous upward movement of Bitcoin and Ethereum yesterday marked the official end of the weak fluctuation pattern over the weekend, with market bullish sentiment warming up. However, from the current trend, both are encountering resistance near key pressure levels, entering a consolidation and accumulation phase in the short term.

In terms of operations, crypto friends should focus on the key points of the two major cryptocurrencies: Bitcoin's support situation at the $107,200-$107,500 level, and Ethereum's breakthrough performance at the $4,120 channel resistance. Before a clear breakthrough or breakdown at these key points, it is advisable to maintain a cautious attitude and avoid blindly chasing high prices. Instead, rely on key support and resistance levels for range trading. If clear breakthrough signals appear, adjust positions accordingly to seize subsequent market opportunities. Once again, it is important to remind that although the current macro environment is favorable, the volatility characteristics of the cryptocurrency market remain unchanged. Close attention should be paid to the Federal Reserve's subsequent policy actions and the performance of US economic data, strictly controlling positions and hedging risks to steadily seize market opportunities.

=================================

💎

💎

==================================

If you are feeling lost—don’t understand the technology, don’t know how to read the market, don’t know when to enter, don’t know how to set stop losses, don’t understand take profits, randomly increase positions, get stuck while trying to bottom out, can’t hold onto profits, miss market opportunities… these are common problems for retail investors. But don’t worry, I can help you establish the correct trading mindset. A single profitable trade is worth more than a thousand words, and finding the right direction is better than repeatedly losing. Instead of frequent trading, it’s better to strike accurately, making each trade more valuable. If you need real-time guidance, you can scan the QR code below the article to follow my public account. The market changes rapidly, and due to the timeliness of reviews, subsequent trends will be based on real-time layouts. I look forward to progressing steadily with you in the market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。