Written by: Luke, Mars Finance

When most people (or rather, newly initiated observers) open Polymarket, they see a clean interface that appears to be a harmless "event prediction" platform. Will the U.S. government shut down? Will a certain cryptocurrency bill pass? People bet on their opinions and then… wait.

However, to the sharpest predators in the crypto world, this scene is merely the tip of the iceberg. Behind the simple "yes/no" options lies a vibrant yet still rough financial market that is growing wildly—filled with pricing discrepancies, behavioral loopholes, and structural arbitrage opportunities.

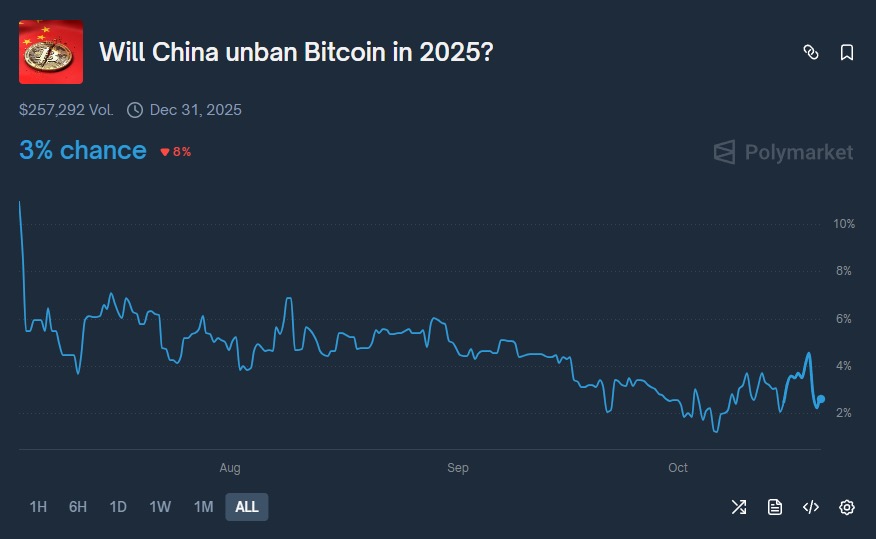

Markets like "U.S. government shutdown" or "China allowing Bitcoin trading in 2025" are no longer mere prediction tools for real players; they are sophisticated instruments that transform "certainty" into "returns."

This article will peel back the gentle predictive veil of Polymarket and take you straight to the core of its financial alchemy. We will explore three distinctly different "play styles" that together form the deep logic of this platform: how to turn high-certainty events into a stablecoin "yield farm"; how to achieve risk-free arbitrage by exploiting market failures; and how to conduct the most precise strategic layout in this anticipated multi-billion dollar airdrop "meta-game."

True winners never predict the future; they simply harvest the present.

Game Rules: Price Equals Probability, Structure Equals Opportunity

Before delving into advanced strategies, we must first understand the basic rules of this "game." The cornerstone of Polymarket is an extremely simple yet immensely powerful equation: Share Price = Market's Real-Time Probability of Event Occurrence.

In this binary market, the total value of any event's "yes" (YES) shares and "no" (NO) shares is always equal to $1.00. That is: 1 YES + 1 NO = $1.00. If the price of "YES" is $0.18, the market believes there is an 18% chance of that event occurring. When the outcome is determined, the shares of the correct side can be redeemed for $1.00, while the incorrect side goes to zero. This core equation is the theoretical foundation for all arbitrage strategies within the market.

Even more interesting is its underlying structure. Polymarket employs a hybrid centralized limit order book (CLOB). In simple terms, it trades off "off-chain matching" centralized compromises for "on-chain settlement" that is permissionless and offers a smooth "Web2" experience. User trading orders are matched at high speed on off-chain servers without gas fees; the final asset settlement occurs on the Polygon chain, ensuring non-custodial and transparency.

This design is a well-thought-out strategic choice. It successfully attracts a massive number of retail users. These users' trading behaviors are often driven by emotions, information lags, or a thirst for immediate liquidity. They might sell shares that are almost certain to succeed for $0.997 just to cash out immediately. It is this "irrational" liquidity that provides a continuous fuel source for advanced players' strategies.

Annualized Thinking: Turning Certainty into a Money-Making Machine

This is the easiest and most popular advanced strategy on Polymarket—"Endgame Sweep." It requires participants to completely shift their mindset: you are not predicting; you are purchasing a short-term, high-yield fixed-income-like product priced in USDC.

When the outcome of an event is nearly certain (for example, a bill has passed, or a game has ended), but the market has not yet officially settled, its share price will approach $1.00, typically hovering between $0.95 and $0.999. Entering at this point essentially means exchanging "time" for "certain returns."

Why does this opportunity exist? Beyond the impatience of a vast number of retail investors who prefer to trade at a discount for liquidity, a significant source of alpha comes from "cross-border information asymmetry" or "cognitive arbitrage."

This is a perfect case of "cognitive arbitrage." For players who are well-versed in the domestic policy environment, "no" is a nearly 100% certain event, but in the global market, there are always those willing to pay for a 5% miracle. This is your profit source. The price for buying "no" is $0.955 (i.e., 95.5¢), with 72 days until settlement. The absolute profit margin for this trade is (1 / 0.955) - 1 ≈ 4.71%.

Substituting into the annualized return (APR) formula:

APR = ((1 / Buy Price) - 1) * (365 / Days to Settlement) * 100%

We can derive an annualized return of up to 4.71% * (365 / 72) ≈ 23.9%. This closely aligns with the 26% calculated by the user in the screenshot (who may have estimated at a price of 0.95), proving the universality of this "cognitive monetization" thinking within the community.

To illustrate its power more intuitively, please see the table below:

Table 1: "Endgame Sweep" APR Calculator

The table clearly shows that even seemingly insignificant profit margins can yield astonishing returns far exceeding traditional stablecoin investments in a short period. Of course, this is not foolproof. The main threats come from "black swan events" and "whale manipulation." Therefore, strict position control is crucial.

Arbitrage Handbook: Utilizing Market Failures for Risk-Free Profits

If "annualized thinking" is about obtaining "near-certain" returns, then arbitrage is mathematically pursuing "100% profit." Arbitrageurs are the "actuaries" of this casino; they do not care about predictions, only about mathematically "free riding," exploiting temporary pricing mechanism loopholes to achieve risk-free returns.

The most classic form is known as "in-market arbitrage" (Dutch betting). It stems from the core rule we mentioned: 1 YES + 1 NO = $1.00. However, when market liquidity is insufficient or the order book is imbalanced, it can lead to a situation where Price(Yes) + Price(No) ≠ $1.00, creating arbitrage opportunities.

A more advanced play is "cross-market combination arbitrage." It exploits pricing discrepancies between different but logically interconnected markets. For example, there may be two simultaneous markets regarding an election:

Market 1 (Election Winner): Democratic Party Wins = $0.48; Republican Party Wins = $0.52

Market 2 (Winning Margin): Republican Party Wins by 0-5% = $0.20; Republican Party Wins by 5-10% = $0.10; Republican Party Wins by 10%+ = $0.10 …

Logically, the probability of "Republican Party Wins" in Market 1 should equal the sum of all "Republican Winning Margin" options in Market 2. However, in the example above, the pricing in Market 1 is $0.52, while the total price of all Republican winning options in Market 2 is only $0.40. An arbitrageur can simply buy "Democratic Party" in Market 1 (cost $0.48) while simultaneously buying all "Republican" options in Market 2 (cost $0.40), for a total cost of $0.88, and regardless of the outcome, can redeem for $1.00, locking in a 13.6% risk-free profit.

For serious players, manually searching for these opportunities is akin to finding a needle in a haystack. Their true weapon is automation—using the Gamma API provided by Polymarket to build scanning bots that continuously monitor all markets and automatically execute trades upon discovering pricing discrepancies.

Airdrop Endgame: Strategic Farming of $POLY Tokens

Above all publicly available trading strategies, there exists a grander strategic opportunity—strategically positioning for the coveted $POLY airdrop. Just earlier in October, the official team hinted again at its $POLY token plan. This is no longer a secret; it is a countdown.

The trend of airdrops in the crypto industry has shifted from rewarding "trading volume" to rewarding "high-quality users." Project teams are attempting to identify those who genuinely contribute to the ecosystem and are difficult for bots to imitate through multi-dimensional metrics.

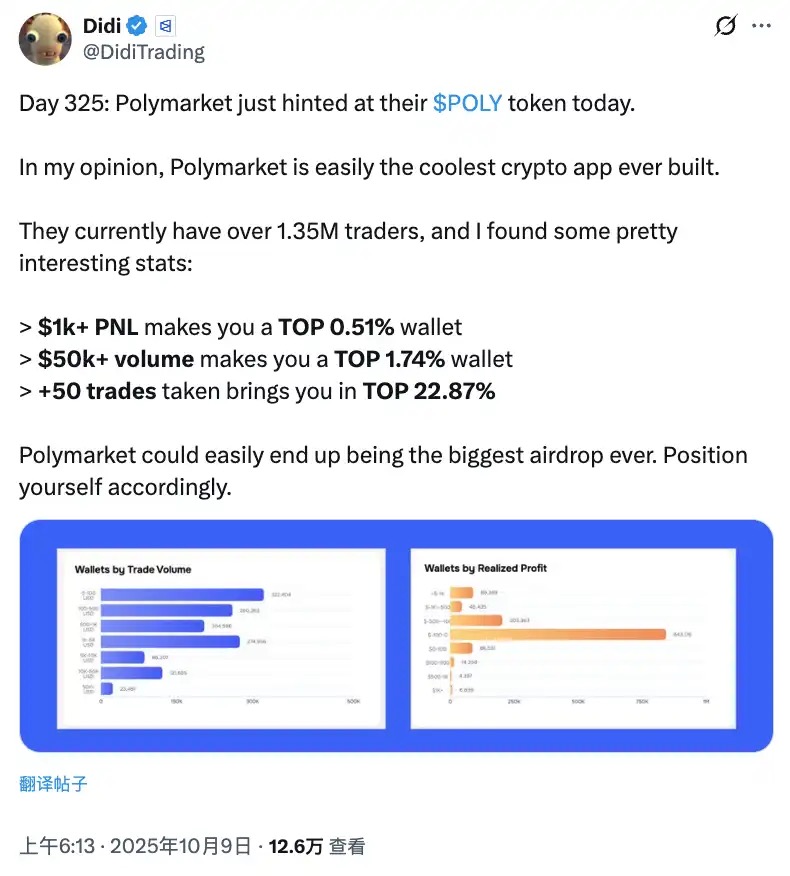

Forget about simply inflating numbers; we no longer need to guess blindly. The on-chain data unearthed by @DidiTrading has already painted an accurate portrait of "elite users":

Profit (PnL) is the Gold Standard: As long as you achieve over $1,000 in profit, you are already in the TOP 0.51% of wallets. Didi's chart shows that among 1.35 million traders, the vast majority (over 800,000) of wallets are in a loss state. This means project teams can easily filter out all "ineffective volume inflation" noise.

Trading Volume is Still a Threshold: A trading volume exceeding $50,000 can place you in the TOP 1.74%. While important, its scarcity is far lower than PnL.

Activity (Trades) is Fundamental: More than 50 trades will rank you in the TOP 22.87%. This is just a basic proof of activity.

These data reveal a harsh truth: among Polymarket's 1.35 million users, the vast majority are "tourists" and loss-making volume inflators. The project team's airdrop design will almost certainly heavily favor those who have genuinely achieved profits (PnL) and proven the platform's "information market" value.

Thus, advanced players' strategies have evolved accordingly. This is no longer a simple multi-account volume inflation; it is a sophisticated "role-playing" and "PnL management." They will assign unique trading roles for each wallet or wallet cluster, but the core goal is to ensure that at least some wallets enter the $1,000+ PnL TOP 0.51% club, supplemented by diverse market interactions and continuous active cycles. This is the most robust defense against witch detection.

Unignorable Battlefield Risks: From Oracles to Regulation

Any high-return arena comes with high risks, and Polymarket is no exception. Besides the aforementioned black swans and whale manipulation, the core risks lie in the platform's technology and regulation.

Technologically, Polymarket's "Achilles' heel" is its oracle. It relies on a third-party "optimistic oracle" named UMA to provide final real-world data. If this oracle itself is attacked, deceived, or provides incorrect data, the market may settle with erroneous results.

In terms of regulation, Polymarket has been operating in a gray area. In 2022, it was fined $1.4 million by the U.S. CFTC for "operating an unregistered trading facility" and was expelled from the U.S. market. However, recently, Polymarket has been paving the way for its legal return to the U.S. by acquiring an exchange that holds a CFTC license. This strategic shift from "regulatory evasion" to "regulatory compliance" is significant. At the same time, institutions including Chaos Labs have publicly pointed out that the platform has been involved in large-scale "wash trading," which has raised alarms for airdrop hunters who focus on trading volume—combined with Didi's data, PnL is the key.

Conclusion: The Last "Alpha" on the Eve of Maturity

Polymarket's image has evolved from a prediction tool to a multi-layered financial arena. For steady yield hunters, it is an annualized yield farm; for savvy arbitrageurs, it is an inefficient market filled with pricing errors; for forward-thinking strategists, it is the ultimate battleground for future large-scale airdrops.

It is crucial to recognize that all the "money-making" opportunities we have dissected today stem from market immaturity, information asymmetry, and the diversity of participants.

With the upcoming issuance of the $POLY token and the platform's return to a highly liquid U.S. market, these two catalysts will fundamentally change the existing landscape. The token issuance will attract more professional market makers and quantitative funds, while legal entry into the U.S. will bring in a massive influx of mature capital. The convergence of these two forces will almost certainly lead to a devastating increase in "efficiency," completely erasing the obvious arbitrage and high annual yield opportunities present today.

Therefore, the final conclusion is: the window of opportunity may be shorter than one might imagine. The best time to learn and execute these strategies is now—on this unique, opportunity-filled eve of maturity.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。