No matter whether you think the market will hit new highs or has already entered a bear market, you should start accumulating "exclusive knowledge" to safeguard yourself.

Author: Route 2 FI

Translated by: Deep Tide TechFlow

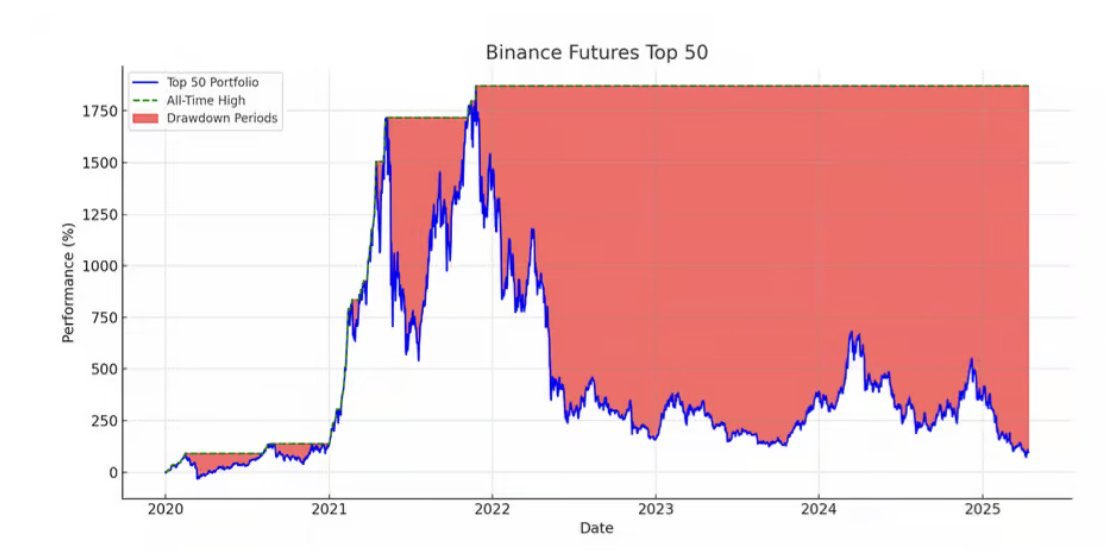

If you are still wondering why most people on Crypto Twitter are feeling down, take a look at this fact: the prices of the top 50 altcoins have already fallen below the levels after the FTX collapse in 2022 (data source: @VentureCoinist).

Moreover, the prices of mainstream coins like SOL, ETH, and BTC have also returned to the levels of December 2024.

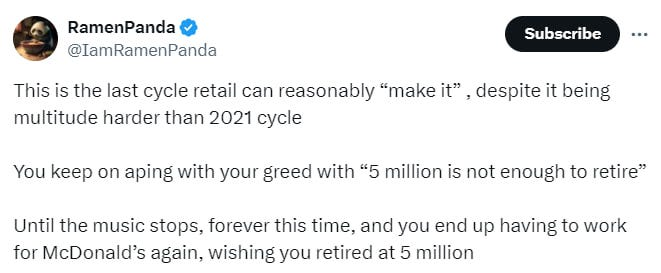

Many traders on Crypto Twitter have not made any substantial gains in this cycle and are becoming increasingly desperate, hoping to seize the last opportunity. However, the current market sentiment is bleak, and according to the "four-year cycle theory," we are already in the late stage of this cycle. In fact, based on historical data, we have already exceeded an 18-month window, which typically marks the top of Bitcoin's early cycle.

The crypto market is quietly changing before our eyes. Over the past four years, most new token issuances have adopted a model of low circulation and high fully diluted valuation (FDV). In July of this year, Polychain Capital sold $240 million worth of $TIA, which may just be the tip of the iceberg for this model. But should they really be blamed? If you think about it, they are just following their investment strategy. In reality, anyone holding unlocked tokens might make similar choices.

Do you remember that "golden age"? Back then, a token would skyrocket in price as soon as it was listed on a centralized exchange (CEX). However, those days are long gone. Now, everyone in the market is feeling frustrated:

Traders are adapting to new game rules; Memecoin players are fighting among themselves; project founders complain that users do not use their protocols; retail investors complain that the market is saturated; venture capitalists have missed the "easy money" days (the tough times that started in 2023).

Traditional finance (TradFi) has entered the crypto space, but they are not buying our altcoins. By 2025, we are facing:

Too many tokens;

Technologies with no real demand;

Projects unable to find product-market fit (PMF);

Unreasonable token economics;

Airdrops being directly sold off by users for stablecoins;

Significantly increased trading difficulty, as any valuable and liquid asset becomes more competitive.

Yes, basically no one has confidence in anything now.

Since "Black Friday," about half of crypto traders have lost all their assets, and many of them may never return to the trading market. While a successful trade means the failure of another, in this event, funds flowed to exchanges, which also means that both retail and professional traders have become poorer.

The altcoin market is entering a new phase. The problem is that too many new projects are launching at high valuations, which not only dilutes liquidity but also weakens those originally high-quality, fundamentally strong projects, leading to a further weakened overall market.

In recent years, there has been a trend in altcoin issuance: high fully diluted valuations (FDV), massive airdrops, low circulation, and later large unlocks by venture capitalists (VCs). This model seems to have become the "standard configuration" of the industry.

We often hear the saying: as long as the conditions are right, all tokens can experience a surge. But is this true? It is important to note that the market is now flooded with many more "functional" tokens than in 2021. Every week, 3-5 so-called "high-quality" tokens enter the market, and Total3 (referring to the total market cap of altcoins) gradually rises, seemingly making everyone happy. But upon closer inspection, who will actually buy these tokens? Without institutional funds or a large influx of retail investors, the market is destined to be a "player versus player" (PvP) battleground.

Now, new "high-quality" projects are launched every week, but they often come with extremely high FDVs. This means the market will face an oversupply of tokens, and if no new buyers come in, the prices of these tokens are bound to decline in the long run.

By October 2025, the selectivity of capital flowing into altcoins will become more apparent, but this inflow is clearly insufficient to offset the pressure from large-scale token unlocks. The market is experiencing an endless cycle of internal competition, and a real way out still seems hard to find.

Despite the market downturn, there are still reasons to be optimistic: whether you think the market will hit new highs or has already entered a bear market, you should start accumulating "exclusive knowledge" to safeguard yourself. The so-called "exclusive knowledge" refers to skills that only you possess or things you do slightly better than others. Everyone has their own innate strengths; focus on these advantages and turn them into your weapons.

For example, I am good at writing, so I prefer to write long tweets rather than make YouTube videos or start a podcast. For you, it might be trading, networking, sales, or other areas. The key is that once you start honing your skills, you can find a place in this industry. Compared to traditional finance (TradFi), the barriers to finding a job in the crypto industry are much lower. Whether it's content creation, CEX trading, research analysis, memecoin trading, NFTs, airdrops, YouTube, newsletters, Telegram groups, podcasts, etc., this industry offers various possibilities.

To connect with top talent in this industry, the best way is to make yourself "visible" on Twitter. Write about topics that interest you, share what you want to learn, occasionally post interesting content, and interact with those you admire. Tweet every day, even if it's just a "gm" (Good Morning). Actively DM others, offer suggestions, and don't expect anything in return. This is how friendships are built; who knows? Perhaps in the future, you will collaborate in some way. Just be helpful, friendly, and consistently participate every day.

Twitter is the "resume" of the crypto industry. You don't need LinkedIn; your best resume is the content you create on Twitter. If one day you need to go for a job interview, your tweets will be the best proof.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。