Daily market key data review and trend analysis, produced by PANews.

1. Market Observation

Recently, gold has experienced a dramatic pullback after reaching a historical high of nearly $4,380. Although market analysis suggests that long-term logic such as inflation hedging and interest rate cut expectations remains solid, technical indicators, market sentiment, and institutional positions indicate excessive crowding. The price of gold has significantly deviated from its traditional driving factors such as real interest rates and the dollar's performance, leading to divergent views on Wall Street. JPMorgan and HSBC have warned that if the Federal Reserve raises its terminal rate expectations, gold will face challenges; legendary investor Bill Gross bluntly stated that it has become a "momentum/meme asset." However, Bank of America believes that unconventional fiscal policies will continue to favor gold. Ray Dalio, founder of Bridgewater Associates, fundamentally views gold as the most mature form of currency, a hedge against fiat currency (which is essentially debt), and revealed that he is systematically replacing U.S. Treasuries in central bank reserves with gold as a "risk-free asset."

At the same time, AI has garnered attention as a new macro variable, with Goldman Sachs believing that the massive capital expenditure in the AI sector is sustainable and will significantly enhance labor productivity, while Galaxy Digital's research director Alex Thorn sees it as a core driver of the next bull market. However, Alliance co-founder Qiao Wang warned that if the AI bubble bursts, the crypto market could face a significant adjustment, and it has already entered a high-risk danger zone.

Regarding Bitcoin, after being impacted by multiple macroeconomic news, the price of Bitcoin has returned to above $111,000. Despite the price rebound, market sentiment remains highly divided. On the funding side, Bitcoin spot ETFs saw a net outflow of $1.23 billion last week, marking the second-highest in history. The repayment process that the Mt. Gox trustee must complete by October 31 could bring about potential selling pressure of approximately 22,253 BTC, valued at around $2.4 billion. A large number of whales and celebrities have begun to short the market, including a whale that accurately shorted and profited $160 million before the flash crash on October 11, who has again opened a short position worth about $75.93 million, with an opening price of $109,133.1; additionally, Mechanism Capital co-founder Andrew Kang's associated address holds a $31.14 million BTC short position and a $46.86 million Ethereum short position, with liquidation prices of $115,000 and $4,073, respectively. Crypto KOL Ansem also stated that unless Bitcoin returns above $112,000, he will not be optimistic about the future of the crypto market. Kronos Research's Chief Investment Officer Vincent Liu pointed out that the current key support and resistance levels for Bitcoin are $107,000 and $110,000, respectively. Bitcoin is currently testing the resistance level in the range of $111,700 to $115,500. If it can break through $111,000 strongly, it may trigger short covering and further accelerate the upward momentum. However, significant risks remain in the short term, as U.S.-China geopolitical tensions continue to affect investor confidence. Analyst Crypto Tony predicts that Bitcoin may drop below $100,000 and only find a bottom after reaching the $91,000 to $95,000 range.

However, the bullish forces cannot be ignored; a mysterious whale has increased its long position to $250 million, holding 1,610.93 BTC. Analyst Charles Edwards believes that after breaking $120,000, it could quickly rise to $150,000. Technically, analyst Pat pointed out that the price ratio of Bitcoin to gold has fallen to historical lows, indicating the possibility of a new bull market. Although the fear and greed index has dropped to "extreme fear," the daily RSI has fallen to its lowest level since April, and analyst Sykodelic believes this presents a good opportunity for contrarian trading. Ray Dalio stated that he holds a small amount of Bitcoin as a diversified asset alongside gold but also pointed out its drawbacks, such as not being held by central banks. Overall, if Bitcoin can firmly break through the $111,000 resistance range, the market may welcome a new upward trend; however, if sentiment deteriorates or selling pressure is concentrated, a pullback below $100,000 cannot be ruled out.

Regarding Ethereum, Tom Lee's Ethereum treasury company BitMine has accumulated approximately $1.5 billion worth of 379,271 ETH since the "October 11 crash," and Tom Lee himself reiterated that Ethereum will become a pillar of the digital economy and that we are not at the cycle's peak. Meanwhile, Richard Heart, the founder of HEX, whose associated address has been dormant for two years, has also begun to frequently organize his holdings of 154,825 ETH, valued at $611 million. From a technical analysis perspective, Ethereum's current support levels include the 200-day exponential moving average (200-day EMA) and the lower boundary of the bull market at around $3,500. Renowned technical analyst John Bollinger pointed out that its chart may be forming a "W bottom" bullish reversal pattern. Analyst FOUR predicts that if the rebound momentum continues, ETH prices are expected to break through the $4,450-$4,500 range, and trader Luca even sees the possibility of a surge to a new high of $5,200. On-chain MVRV data also supports the view that prices are entering a new upward cycle; if prices remain above the mean range, the likelihood of ETH prices reaching the $4,500-$5,000 range by the end of October is high. However, it should be noted that if prices fall below the $3,550 support level, it may trigger further pullbacks to the $3,000-$3,200 range. Currently, the market is generally focused on the strong support zone of $3,800 to $3,900 and whether it can effectively break through the key resistance zone of $4,100.

Regarding the core narrative of the market, crypto KOL Yuzhong Kuangshui believes that the main line of the crypto market in the next three to five years will revolve around "adoption," with stablecoins having the most potential to become the core narrative. He mentioned that saving activities are popular due to low risk and high returns, while the speculation on stablecoin infrastructure tokens carries high risks. However, the market's extreme volatility has also brought risks and lessons; Wintermute's founder pointed out that the "October 11 crash" was triggered by specific news and amplified by high leverage and flaws in trading mechanisms. In the future, liquidity may further concentrate on mainstream assets like Bitcoin, Ethereum, and Solana, while the popularity of altcoins and meme coins may decline in the short term. Mozaik Capital's trading director Joshua Deuk also believes that market confidence has been undermined, and it may enter a phase of consolidation in the short term.

2. Key Data (as of October 20, 13:00 HKT)

(Data source: Coinglass, Upbit, Coingecko, SoSoValue, Tomars)

Bitcoin: $111,125 (YTD +18.78%), daily spot trading volume $56.57 billion

Ethereum: $4,075 (YTD +22.1%), daily spot trading volume $34.77 billion

Fear and Greed Index: 29 (Fear)

Average GAS: BTC: 1 sat/vB, ETH: 0.108 Gwei

Market share: BTC 59.61%, ETH 12.48%

Upbit 24-hour trading volume ranking: ZBT, XRP, ETH, BTC, SOL

24-hour BTC long-short ratio: 49.3%/50.7%

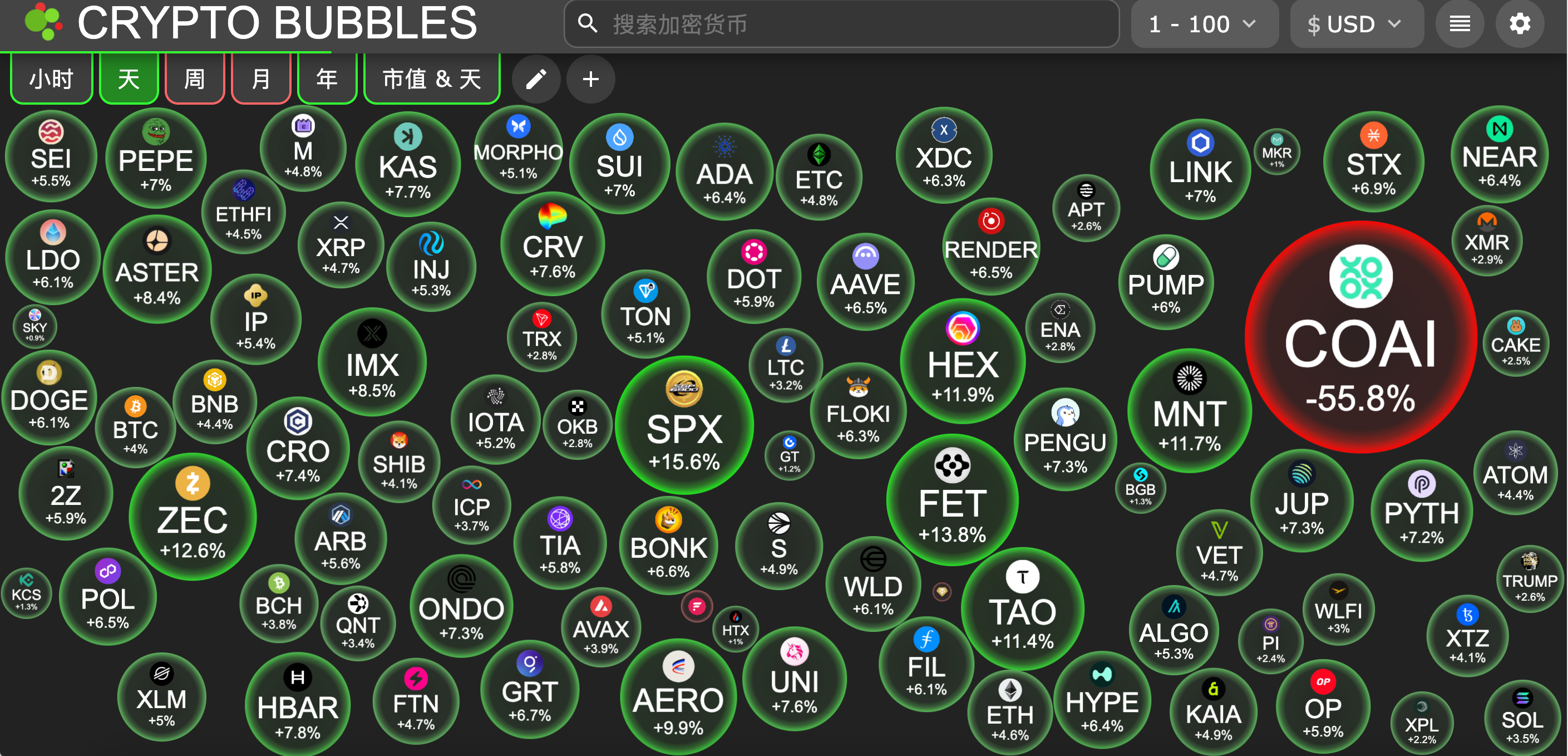

Sector performance: L2 sector up 10.2%, Meme sector up 6.9%

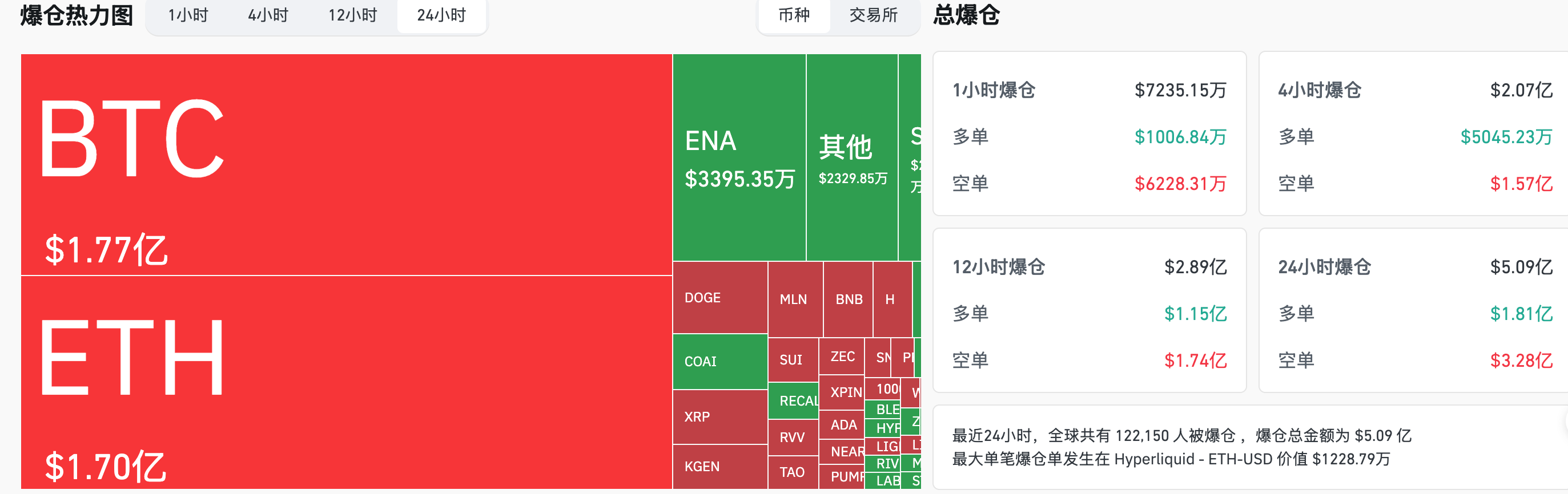

24-hour liquidation data: A total of 122,150 people were liquidated globally, with a total liquidation amount of $509 million, including $177 million in BTC liquidations, $170 million in ETH liquidations, and $33.95 million in ENA liquidations.

BTC medium to long-term trend channel: upper line ($113,279.91), lower line ($111,036.75)

ETH medium to long-term trend channel: upper line ($4,095.13), lower line ($4,014.04)

*Note: When the price is above the upper and lower lines, it indicates a medium to long-term bullish trend; conversely, it indicates a bearish trend. When the price is within the range or fluctuates through the cost range in the short term, it indicates a bottoming or topping state.

3. ETF Flows (as of October 17)

Bitcoin ETF: -$367 million, net outflow for 3 consecutive days

Ethereum ETF: -$232 million, no net inflow in nine ETFs

4. Today's Outlook

Binance Alpha will launch SavannaSurvival (SVSA) on October 20

Binance Alpha will launch SigmaDotMoney (SIGMA) on October 21

The Federal Reserve will hold a payment innovation conference to discuss stablecoins, artificial intelligence, and tokenization, with Federal Reserve Governor Waller delivering the opening speech. (October 21, 21:00)

LayerZero (ZRO) will unlock approximately 25.71 million tokens at 7 PM on October 20, accounting for 7.86% of the current circulation, valued at approximately $44.2 million;

KAITO (KAITO) will unlock approximately 8.35 million tokens at 8 PM on October 20, accounting for 3.06% of the current circulation, valued at approximately $8.7 million;

Top Gainers Among the Top 100 Cryptocurrencies Today: SPX6900 up 15.6%, ASI Alliance up 13.8%, Zcash up 12.6%, HEX up 11.9%, Mantle up 11.7%.

5. Hot News

Andrew Kang's associated address has increased its short position to $77.97 million

An investor/institution address transferred 1.697 million UNI to Wintermute in the past 5 hours

OpenSea CEO: Plans to launch SEA token in the first quarter of 2026

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。