Red Week With $1.23 Billion Out of Bitcoin and $312 Million from Ether

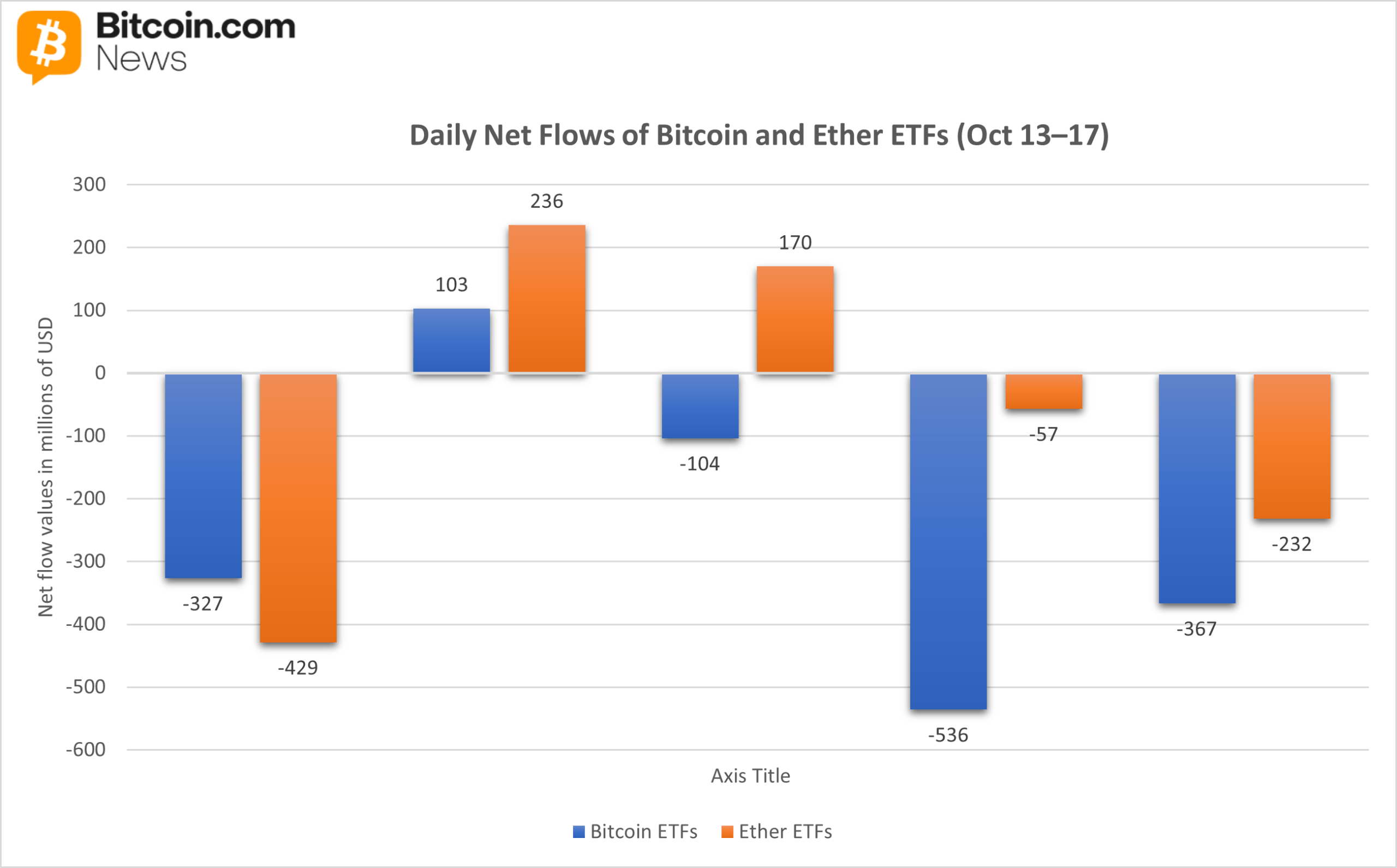

After two weeks of steady inflows and optimism, the crypto ETF market reversed course sharply between Oct. 13 and 17, with investors pulling capital from nearly every major product. Both bitcoin and ether ETFs ended the week deep in red territory, underscoring growing caution in digital asset markets amid volatility in broader financial markets.

Bitcoin ETFs: $1.23 Billion Exodus Across the Board

Bitcoin ETFs saw a total net outflow of $1.23 billion, the second-highest on record, with all twelve funds closing the week negative.

The largest redemptions came from Grayscale’s GBTC with a net weekly exit of -$298.30 million, Ark 21Shares’ ARKB with -$289.51 million, and Blackrock’s IBIT with -$278.61 million.

The other funds that saw significant exits included Fidelity’s FBTC (-$159.97 million), Bitwise’s BITB (-$128.22 million), Valkyrie’s BRRR (-$25.27 million), Grayscale’s Bitcoin Mini Trust (-$22.52 million), Vaneck’s HODL (-$17.56 million), and Invesco’s BTCO (-$11.10 million).

Trading activity remained extremely high throughout the week, with over $34 billion in trading volume over the week, but net assets fell steeply to $143.9 billion by Friday’s close.

Bitcoin and ether ETFs daily flows (Oct 13-17)

Ether ETFs: $312 Million in Weekly Outflows

Ether ETFs also posted a tough week, losing a net $312 million after eight straight days of inflows earlier in the month. The redemptions were broad-based, led overwhelmingly by Blackrock’s ETHA, which alone saw $244.95 million in exits.

Other notable weekly outflows included Grayscale’s ETHE with -$100.96 million, Grayscale’s Ether Mini Trust with -$23.95 million, Bitwise’s ETHW with -$23.65 million, and 21Shares’ TETH with $7.98 million.

Modest outflows of -$3.01 million were seen on Vaneck’s ETHV and -$1.59 million on Franklin’s EZET. Fidelity’s FETH was the outlier for the week, ending with a net weekly inflow of $94.29 million.

Total trading volume for the week was almost $14 billion, with net assets sliding to $25.98 billion by week’s end, marking the lowest level since early September.

After weeks of euphoria and historic inflows, this downturn shows that even institutional investors are taking a breather. Whether this week brings stabilization or deeper redemptions may depend on how the market digests macro headwinds and digital asset volatility.

FAQ 🧭

- How much did investors pull from crypto ETFs this week?

Bitcoin funds saw $1.23 billion in outflows, while ether products lost $312 million between Oct. 13 and 17. - Which Bitcoin ETFs were hit the hardest?

Grayscale’s GBTC, Ark 21Shares’ ARKB, and Blackrock’s IBIT led the redemptions with nearly $866 million combined. - How did Ether ETFs perform?

Blackrock’s ETHA saw $244.95 million in exits, driving total ether ETF outflows to their worst week since early September. - What does this mean for the crypto ETF market?

The sharp reversal signals renewed investor caution, with total crypto ETF assets falling to multi-week lows.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。