edgeX - A Perp DEX Incubated by the Well-Known Crypto Market Maker Amber Group

This generation of Perp DEX has fundamentally differentiated itself from the previous generation represented by "GMX, DYDX." Since it is still a Perp DEX, the discussion will continue to use the term Perp DEX.

This article serves as the concluding piece of a month-long series on Perp DEX, focusing on the last member of the top four Perp DEX F4 (according to DefiLlama data) — edgeX, and extending the discussion to the current state and trends of the entire Perp DEX sector.

As the landscape of mainstream players has basically taken shape, the popular narrative phase of Perp DEX may also be coming to an end, making it increasingly difficult for newcomers.

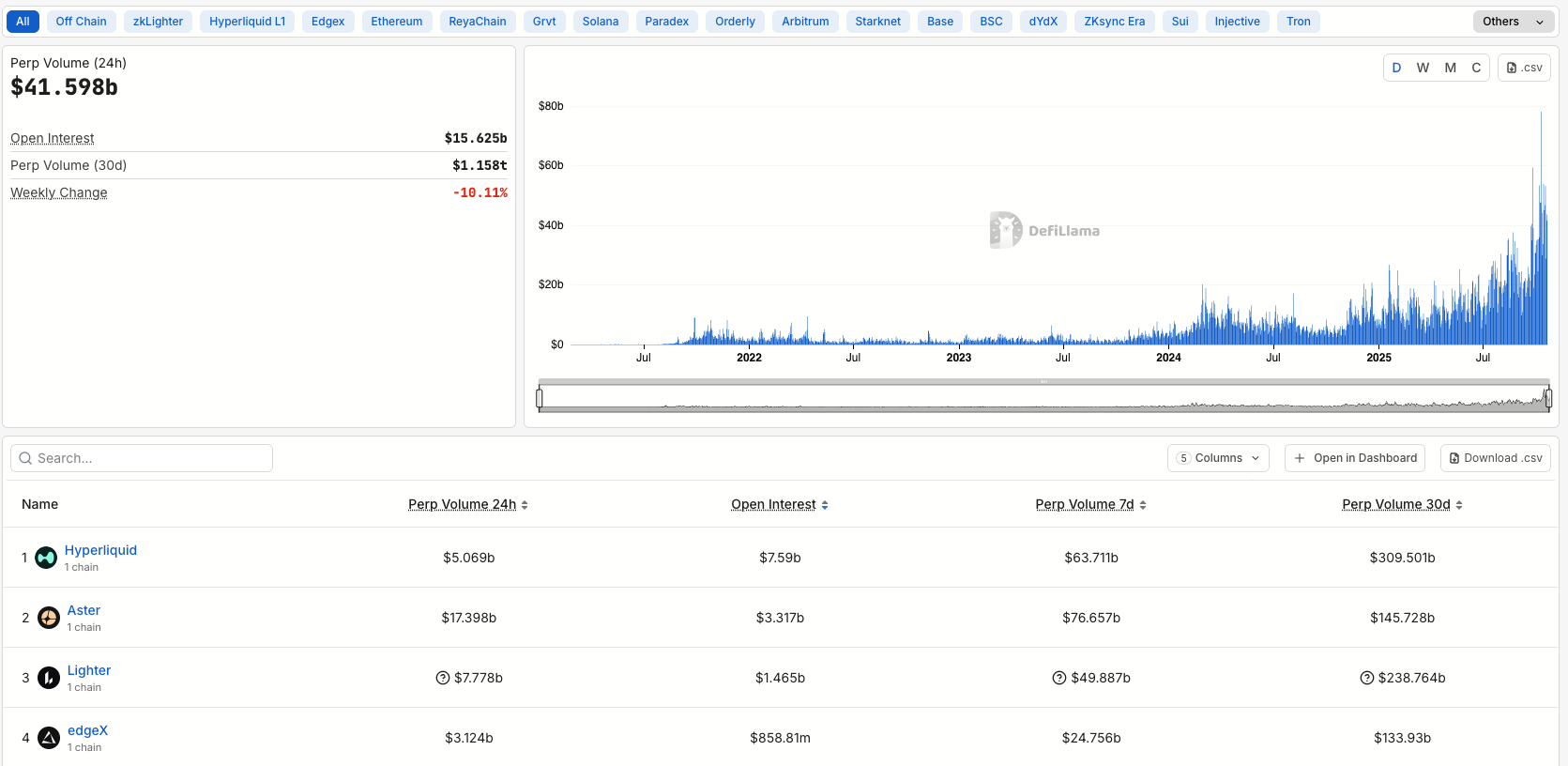

Today's DeFillama data is as follows (2025.10.20):

The total 24h volume of Perp DEX is 41B, with an OI of 15B. Hyperliquid remains dominant, accounting for about 50% of OI, Aster for about 20% of OI, Lighter for about 10% of OI, and edgeX for about 5.5% of OI, meaning that F4 collectively occupies about 85% of the market share.

The remaining hundreds of Perp DEXs share the remaining 15%, clearly showing a head effect.

*Here, the ranking is based on OI rather than Volume to eliminate noise and present a comparison that is closer to the true strength.

Additionally, we can derive the OI/Volume ratio from the OI and Volume data, where a higher value indicates "more real trading volume and users, while a lower value indicates a more serious 'wash trading' situation."

Hyperliquid is approximately 1.5, Aster and Lighter are approximately 0.19, and edgeX is approximately 0.27.

Hyperliquid has the highest OI/Volume ratio, indicating high user holding stickiness or a significant number of long-term positions; Aster and Lighter's high trading volume but low OI suggest active short-term trading and high turnover (many quick in-and-out trades); edgeX is at a middle level, with an OI/Volume close to 0.27, indicating relatively balanced market depth and activity, slightly better but still significantly behind Hyperliquid.

edgeX Points Trading Incentive Program

Similar to Lighter, edgeX Points is a multi-dimensional point system that is "settled weekly (currently in the 20th week) and split by contribution," used to reward real trading and ecosystem participation.

The current Open Season weightings are: Trading Volume 60%, Invitations/Ambassadors/Activities 20%, Treasury and TVL 10%, Liquidation 5%, Positions (OI) 5%; settlements occur every Wednesday at 00:00 UTC, with distributions the following week at 08:00 UTC.

Scoring dimensions include trading volume, trading volume of invited users, positions (OI), and frequency of feature usage, with weights adjustable. Five tiers of prize pools are set based on the weekly transaction volume across the network, commonly at 150,000 or 200,000 points; actual values may vary. For example, in Open Season week 20, 300,000 points were distributed to 13,668 addresses. For invitations and rebates, whenever a referred user earns 5 points, the referrer earns 1 point (20%). Wash trading and self-trading do not count towards scoring; the platform can exclude abnormal trades. The official statement clarifies that scoring criteria and weights may be adjusted.

High Cost-Performance Strategy for Earning Points (for reference, not investment advice, risk is self-borne)

Concentrate volume on a single main account to enhance VIP status, reducing fees and costs, and prioritize limit orders for lower rates.

Like Lighter, avoid self-trading and ultra-short reversals; moderately extend holding times to balance "trading volume + OI."

Participate reasonably in eStrategy/eLP treasury to gain a "Vault/TVL 10%" share and potential returns. Take advantage of official activities and ambassador programs to stack "20%" weight. Strictly control leverage and liquidation risks, as liquidation points only account for 5%. Additionally, participation in NFT activities can be considered, representing innovation at the operational level, which is commendable. The official has clearly stated that NFT and governance token airdrops are linked, with a total of only 299. Furthermore, edgeX could also consider a meme airdrop similar to Hyperliquid to provide some incentives for early adopters.

In terms of data, a total of 3,471,363 Points have been distributed so far (Open Season weeks 1–20).

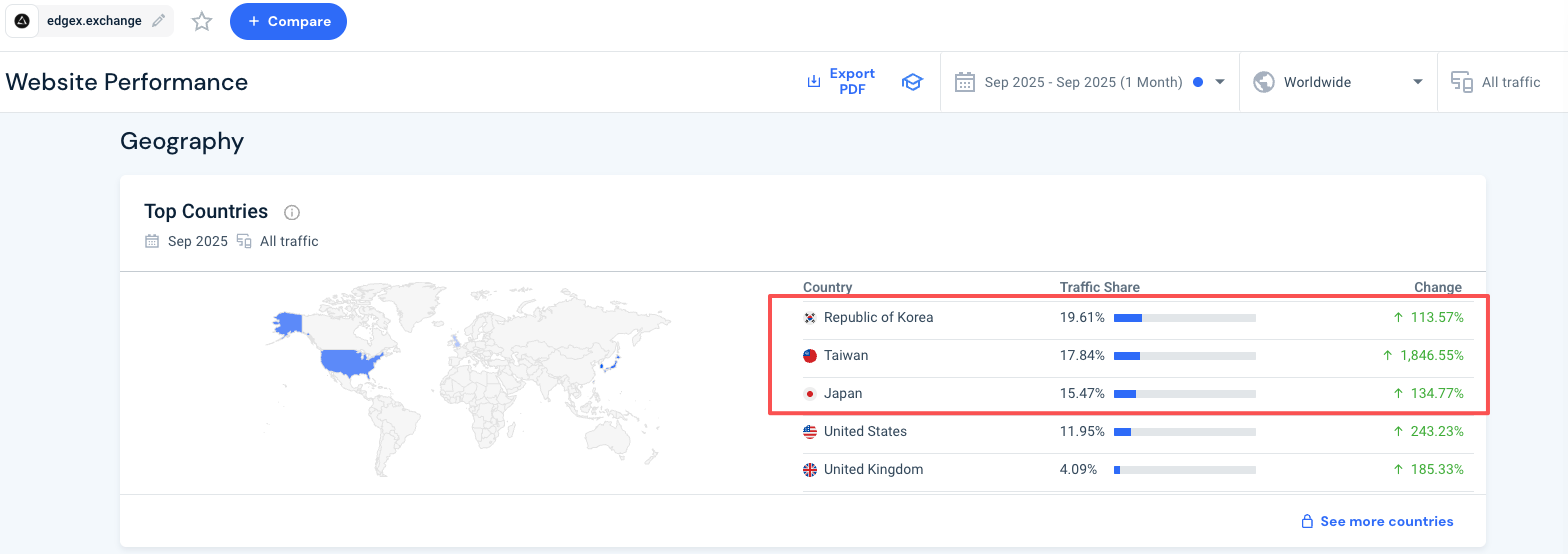

edgeX User Distribution

The user distribution shows that edgeX and Aster have a high overlap, primarily concentrated in Asia, especially in Chinese and Japanese/Korean regions. Although Aster has focused on attracting users from Europe and America, the main user base still resides in China.

The web traffic data shown below (source: similarweb) indicates that Japan, Korea, and Taiwan account for half, with many VPN users from mainland China dispersed globally. From the community situation, the proportion of users from China is also significant.

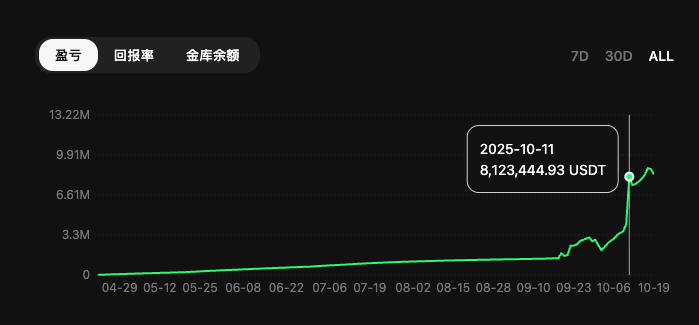

Treasury Comparison

Similar to HLP and LLP, eLP (edgeX Liquidity Pool) is edgeX's liquidity treasury (see the image below).

Currently, the income of edgeX eLP comes from passive market-making profits, liquidation fees, and a portion of the platform's trading fees. In the next phase, eStrategy will introduce customizable pools managed by individual traders or institutions. In this regard, eLP is one step behind HLP and LLP, which currently have both "protocol treasury" and "user treasury."

Comparing the three, Aster's ALP will not be discussed, as it is currently only used in the Simple 1001x mode, with only a few tens of millions.

Treasury TVL rankings (2025.10.20): HLP $628m first, LLP $503m second (user treasury ignored), eLP $147m third. Additionally, during the significant drop in 1011, both eLP and HLP were profitable, while LLP incurred losses (only a small amount of points were compensated).

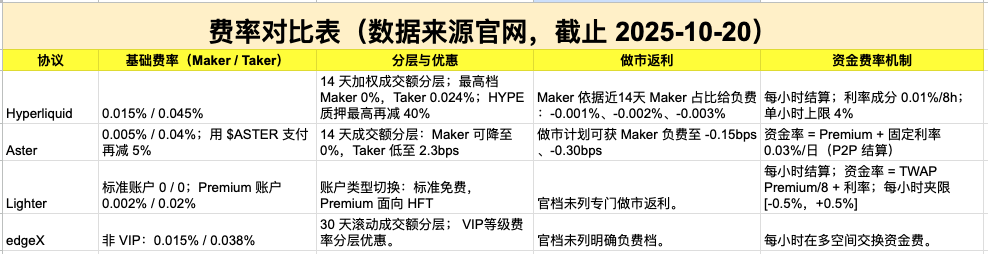

Fee Comparison

The fee structures of Perp DEX F4 have their own characteristics. In terms of scenario selection, retail and low-frequency traders choose Lighter Standard (0 fees), high-frequency traders choose Lighter Premium, passive market-making and large transactions choose Aster or Hyperliquid, and those sensitive to funding fee fluctuations prioritize Aster and Lighter. edgeX's fee structure seems to lack advantages in various aspects.

Finally, Let's Discuss the Perp DEX Sector

The FTX exchange's misappropriation of funds, multiple CEXs betting against users and finding KOLs to lead trades at the expense of customers, and incidents of arbitrary modification of candlestick charts and market manipulation have continuously eroded users' trust in centralized exchanges (CEX), bringing their trust to an all-time low. Additionally, CEXs are under increasing regulatory pressure globally to comply, leading them to transition towards DEX/self-custody structures. On the demand side, users are gradually shifting towards DEX due to trust issues, KYC concerns, and the DEX experience increasingly approaching that of CEX.

The essence of Perp DEX is to decompose the matching, clearing, risk control, and custody of CEX into a verifiable settlement/proof layer, while striving for low latency and depth. The core difference lies in "verifiability"; the order priority, fair matching, and clearing of CEX are black-boxed and based on trust; Perp DEX, through on-chain execution and validity proof, allows "price-time priority" and "rule-based clearing" to self-verify at the cryptographic and contract levels, compressing the space for malicious actions. In terms of custody, CEXs face risks of fund explosions and freezes; Perp DEX is contract-custodied, combined with priority queues/escape routes (priority tx), allowing users to safely exit when there is a loss of consensus while holding private keys.

Trust less in human nature, more in mathematics; in math we trust, code is law is the core narrative of blockchain, and Perp DEX represents the spirit of open transparency and immutability of blockchain.

The current landscape of Perp DEX is gradually taking shape. Hyperliquid leads in depth and performance; Aster and Lighter are catching up with incentives and functional innovations; edgeX is pursuing differentiation, focusing on mobile and stable operations, and building a reputation in Asia. The key to victory lies in usability, ecological resource synergy, and sustainable incentives; users can interact across multiple platforms to earn points in the short term, but in the long term, they need to observe the project's ability to generate continuous revenue and community stickiness.

In terms of narrative and competition, the popularity of Perp DEX is gradually declining. The window for airdrop wealth is likely to close in 2025, with the next wave being prediction markets (for example, YZi Labs has been looking at Prediction Market projects recently, and Hyperliquid's latest HIP-4 is also about prediction markets). Many in the community are beginning to compare the earning potential of Perp DEX to that of early L2s, where early gains were seen in OP/ARB/STRK, followed by increased retracement; HYPE, ASTER, LIGHTER, and edgeX returns may decrease, making it easier for later entrants to be "counter-earned." It is not impossible for Perp DEX earning to become the "next L2." While Hyperliquid and Aster are in fierce competition, the head effect of "F4" has taken shape, and the main focus may shift to prediction markets next year. Perp DEXs that cannot achieve TGE by the end of this year, those with poor initial data, and those without backing in ecological conflicts should be approached with caution. However, real contract users can transfer part of their positions from CEX to Perp DEXs that have not yet achieved TGE for multiple benefits.

CEX owners who are developing their own Perp DEX need to accelerate their progress, taking advantage of the remaining airdrop expectation buff, meme airdrops, NFT mints, point trading competitions… to capitalize on the buff… speed is more important than perfection.

For those looking to earn through Perp DEX trading, focus on interacting with the top platforms, aggressively pursue quality projects, as it will become increasingly difficult over time; make a push and then quickly switch to the prediction market sector… choice is more important than effort.

Finally, I wish everyone great wealth.

_ (The above is just a personal opinion, not investment advice; please feel free to point out any errors.) _

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。