Author: Dingdang, Planet Daily

On October 18, the new coin Astra Nova (RVV) launched on Binance Alpha, sparking widespread controversy. Within hours of its launch, the project's related wallets were found to be continuously dumping tokens, causing the RVV price to plummet from a high of about $0.03 to $0.007, a drop of up to 76%. It is rare in the crypto industry for a project to be so brazenly "dumping" tokens right after its launch on Binance. Why has Astra Nova become such a typical case?

AI, Saudi Arabia, and the "Grand Narrative" Opening

Astra Nova claims to be headquartered in Riyadh, Saudi Arabia, and is an AI-driven Web3 entertainment ecosystem, focusing primarily on gaming, NFTs, and creator tools. Founded in 2020, it is positioned as "the first AI entertainment ecosystem in the Kingdom of Saudi Arabia," with a vision to integrate AI-generated content, blockchain, and player narratives to create "a new era of digital entertainment kingdom."

On October 16, Binance announced the launch of the RVV token presale. The goal of this event was to raise 172.1 BNB, but it received 90,612 BNB, oversubscribing by 520 times. For a moment, RVV seemed to become a "star project."

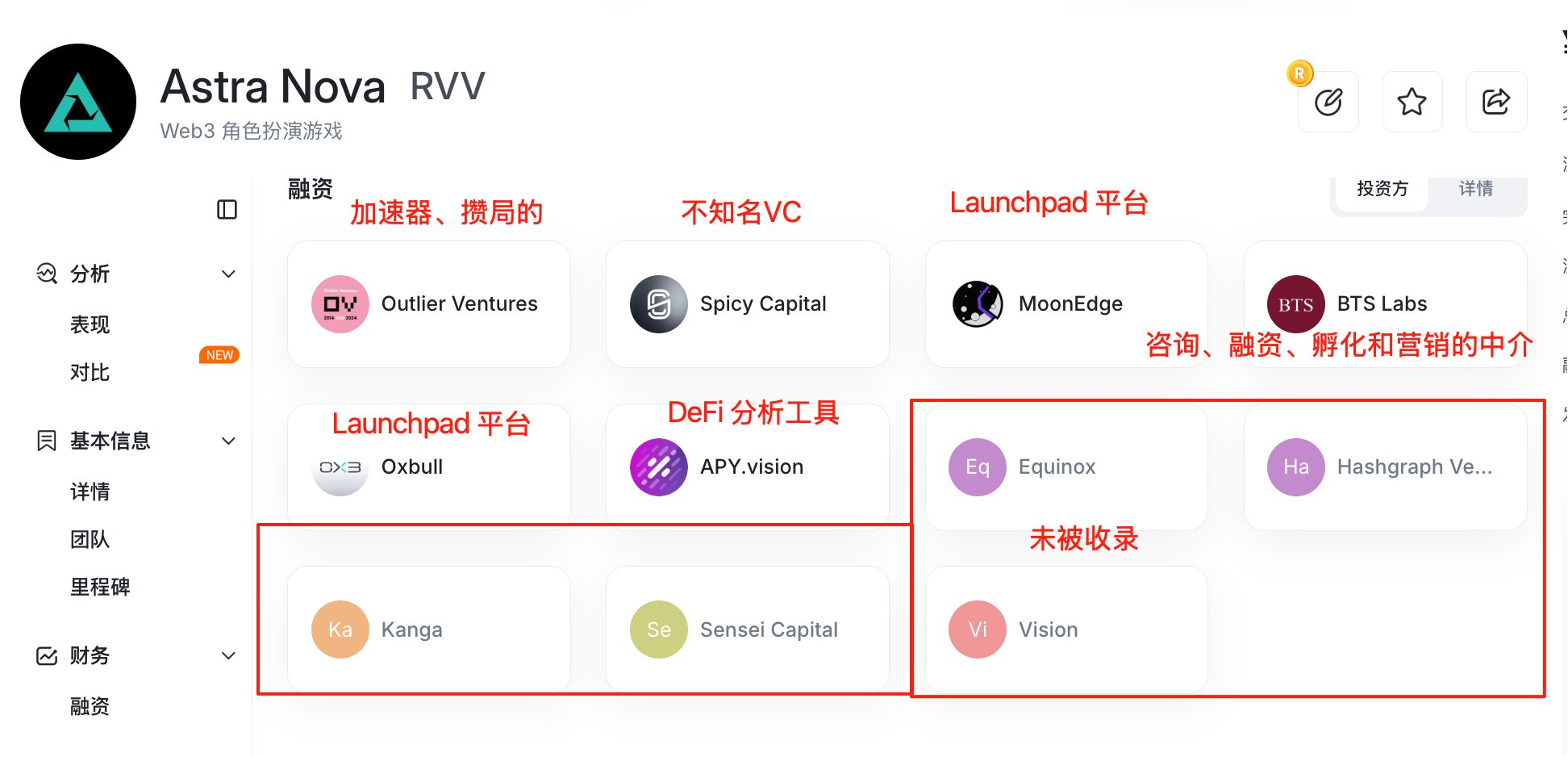

Astra Nova also announced that it had completed $48.3 million in financing, of which $41.6 million came from the latest strategic round. Participants reportedly included family offices and institutional investors from Saudi Arabia, the UAE, and Bahrain. In the current financing environment, such numbers are quite attractive.

However, crypto KOL @cryptobraveHQ discovered in the disclosed list of investors that no well-known crypto institutions participated, and the only notable name was the crypto incubation institution Outlier Ventures.

The facade of "AI + Middle East + Big Financing" seems to cover some hollow substance.

Airdrop Rule Changes: Prelude to Trust Collapse

The Astra Nova project team originally promised to fairly distribute 3% of the tokens as airdrop rewards through a points system. Users could accumulate points by holding NFTs, staking, or participating in tasks.

The turmoil began one hour before the launch on October 18. The project team suddenly announced a rule change, limiting airdrop rewards to only the top 15,000 users on the leaderboard, deviating from the previously widely promoted 3% token distribution plan. Even more concerning, thousands of real users found their rankings on the leaderboard collectively "moved back" by about 15,000 places—many loyal participants who were originally in the top 500 (including NFT holders and long-term stakers) were pushed out of the leaderboard overnight and received no rewards.

The community quickly erupted in doubt on the X platform, suspecting that the project team manipulated the leaderboard through bot accounts to siphon off airdrop shares. More seriously, the promised 7 NFTs + 3 special edition rewards were never fulfilled. As the wave of skepticism grew, Astra Nova's Discord and Telegram groups were subsequently locked, and communication channels were nearly severed.

Meanwhile, users who participated in the presale were originally set to unlock 50% of their tokens at TGE, but the project team changed the rules again: it was changed to a 7-month cliff + 12-month vesting period. This change meant that users could not sell their tokens in the short term, and their funds were locked for a long time, further inciting community dissatisfaction.

Plummeting Prices and "Hacker Incident": Who's Behind It?

On October 18, Binance Alpha officially launched trading for the RVV token. With an initial supply of 10 billion tokens, part of the circulating supply was unlocked. The price initially rose briefly but soon exhibited anomalies. Suspected team addresses began to sell off large amounts, leading to a rapid depletion of liquidity.

Binance Alpha subsequently urgently delisted the token, citing "technical incompatibility" or "potential hacker risk," marking one of the fastest delistings in Binance's history. However, token futures contracts continued, causing retail investors to face continuous liquidation under high leverage. Consequently, the community accused Binance of lax review processes.

Under community pressure, Astra Nova later issued a statement claiming that "a third-party market maker account was hacked." After the attacker took control of the account, they began to sell off assets. The team stated that they had promptly notified all exchange partners after the incident and confirmed that the project's smart contracts and infrastructure were completely secure and audited. Currently, the team is working with on-chain security analysis agencies to trace the flow of funds and will hand over the evidence to law enforcement once collected.

At present, spot trading is no longer possible, and contracts still carry risks. The Astra Nova project team stated that they would repurchase tokens from the market equivalent to the affected amount.

In response to the hacking incident involving Astra Nova, voices within the community have suggested that the team may have been "in on it" or "staged it."

Yujin: Which hacker would convert stolen money into USDT and then transfer it to a centralized exchange?

On-chain analyst Yujin stated that about 860 million RVV (8.6% of the total) was transferred from the project's minting contract and sold on-chain, causing a severe drop in RVV. This 860 million RVV was sold for 10.288 million USDT, of which 8.226 million USDT was transferred to Gate and Kucoin, while another 2.041 million USDT remained in the on-chain wallet 0x643. The project team tweeted that it was stolen, but I personally express skepticism. Which hacker would convert stolen assets into USDT and hold them? Moreover, they directly transferred it to a CEX. USDT can be frozen.

AB Kuai.Dong: Offending exchanges, secondary investors, institutions, and bloggers simultaneously

Crypto KOL @AB Kuai.Dong bluntly stated that Astra Nova has offended exchanges, secondary investors, institutions, and bloggers all at once. The project not only dumped tokens on-chain but was also urgently warned by Binance about risks, and it forcibly changed the unlocking methods for all investors under the guise of exchange requirements.

It was even revealed that Astra Nova's actions were not an isolated incident; they had previously learned of a "dumping arbitrage" strategy during discussions with some market makers: if the project could launch on Binance Alpha and open contract trading, it would be a significant positive. Since other major exchanges were out of reach, rather than being pressured by airdrop dumping, the project team might as well join in the dumping. Ultimately, the profits from contracts and dumping would surely exceed the collateral required for listing.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。