Author: Golden Finance

Recently, a discussion has emerged in the cryptocurrency community about whether "crypto VCs have already disappeared."

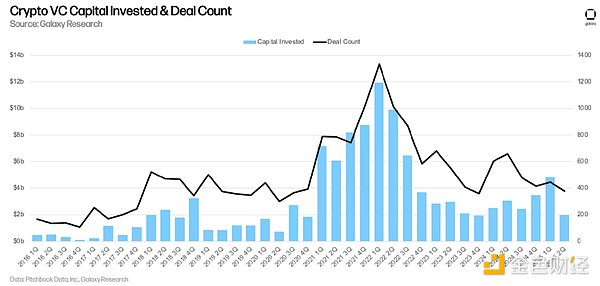

The latest venture capital report from Galaxy Research shows that in the second quarter of 2025, cryptocurrency and blockchain startups raised a total of $1.97 billion across 378 transactions, a 59% decrease in funding compared to the previous quarter, and a 15% drop in the number of transactions. This marks the second-lowest quarterly total since the fourth quarter of 2020.

Independent researcher Haotian pointed out: "It's been four years, and VCs haven't found a sustainable investment model; top VCs can secure the best terms, lowest prices, and earlier exit opportunities, while most small and medium VCs rely on follow-up investments and are treated as backers by large institutions; most VCs are just 'big leeks,' essentially betting on the diversity of their portfolios; the market is looking for a possibility that doesn't require VCs."

How do industry insiders view the demise of crypto VCs? Are crypto VCs really disappearing?

1. Crypto VCs Suffer a Setback

A joint study by Chainplay and Strorible shows that among 1,181 crypto projects that received venture capital from January 1, 2023, to December 31, 2024, nearly 45% have ceased operations, and 77% have monthly revenues of less than $1,000.

In terms of venture capital firms, Polychain Capital has the highest failure rate, with 44% of its invested projects terminated and 76% not generating effective revenue; Yzi Labs (formerly Binance Labs) has a failure rate of 72% for supported projects; top VC firms like Circle, Delphi Ventures, Consensys, and Andreessen Horowitz also have a significant number of supported projects that have ceased operations, with many failing to a degree exceeding two-thirds.

Among angel investors, former Coinbase CTO Balaji Srinivasan has a "zombie project" ratio of 57%, the highest; Arthur Hayes is at 34%, Santiago Santos at 15%, and projects supported by Sandeep Nailwal and Stani Kulechov each have a 10% cessation rate.

Data shows that the scale of fundraising is significantly related to success rates. Projects that raise over $50 million have a notably lower failure rate, while among projects that raise less than $5 million, 33% have failed, and 20% have ceased operations.

2. VCs Becoming More Rational

Jademont, founding partner and CEO of Waterdrip Capital, pointed out: "Why are VCs disappearing? You can look at the announcements of top CEX listings over the past two years; they only tell you that XXX letters are going public, urging everyone to gamble, without wasting a word to explain why this project is being listed and what it does. Many retail investors have been gambling with market makers for months without knowing what they are trading, let alone using the product. CEX has become severely casino-like, and even the casino occasionally cheats.

It is said that the top conditions for listing on CEX currently are community enthusiasm, whether there is sufficient market-making capital, and whether they are willing to offer enough free chips. If these are the conditions for listing, then the existence of VCs indeed becomes less meaningful. Most VCs lack the ability to help projects build communities and are unwilling to help projects gamble with retail investors.

So rather than saying VCs are disappearing, it is more accurate to say that VCs have made different choices. First, they are unwilling to promote. Because apart from PR, promotion has little practical significance. In fact, in cases where projects fail, they may even be criticized by the community; it is important to know that even if the team is responsible, the probability of failure is inherently high. It is better to wait until the project grows before telling the market that this project is one I invested in. Second, many projects have no plans to issue tokens or do retail business, so promotion is unnecessary. They can just celebrate when the listing bell rings. Looking at the schedule, at least 3-5 early investment projects will be listed on Nasdaq next year. Starting a business now is no longer just about issuing tokens as an exit path."

Sylvia To, director of Bullish Capital Management, stated: Cryptocurrency venture capitalists are lowering their risk appetite, avoiding the hot topics of the month, and taking a more critical view of investments. "You really have to start thinking about who is using the infrastructure that this industry is building. Is there enough trading volume? Is the trading volume generated by these blockchains sufficient to justify all the funds raised?"

In 2025, many projects are raising funds at excessively high and often unreasonable valuations, heavily relying on future cash flow projections.

3. Changes in Capital Flow

The long-term correlation between Bitcoin prices and VCs has disappeared and is "difficult to restore." This disconnect stems from a waning interest among venture capitalists and a market that increasingly values Bitcoin accumulation over other investments.

Venture capital focused on cryptocurrencies is struggling to return to the highs of 2021. Source: Galaxy Research

Data from Insights4VC indicates that capital flows have shifted. Digital asset financial companies (primarily raising funds to purchase cryptocurrency tools) have attracted most of the investment this year, with $15 billion raised by August 21 for increasing holdings in Bitcoin, Ethereum, and other tokens.

The divergence between large holders hoarding cryptocurrencies and startups seeking venture capital reflects a change in investor sentiment. Bitwise CEO Hunter Horsley stated that more and more supporters are demanding clearer paths to profitability and sustainable business models. The pursuit of profits is driving Wall Street's investment in Ethereum. "If you take $1 billion in ETH, invest it in a company, and then stake it, suddenly, you start making a profit. Investors have become accustomed to companies that can generate profits."

Nick Tomaino, founder of 1confirmation, stated on X platform that the rise of Ethereum signifies "the death of crypto VCs," with 99% of crypto VCs likely to disappear soon. The right place, the right time, obtaining institutional capital, lacking foresight or creativity, and aligning with users is the only way for long-term development.

4. Market Maturity

Eva Oberholzer, Chief Investment Officer of venture capital firm Ajna Capital, noted that venture capital firms are becoming more selective about the crypto projects they invest in, indicating a shift due to market maturity compared to the previous cycle. "We have reached different stages of cryptocurrency, similar to what we have seen in other technology cycles in the past."

Market maturity has slowed the pace of pre-seed investments, as venture capital firms are focusing on mature projects with clear business models. "It's more about predictable revenue models, institutional dependency, and irreversible adoption. So what we are seeing now is that cryptocurrency is not driven by any meme coin frenzy or other trends, but more related to institutional adoption. Currently, venture capital firms are focusing on stablecoin projects and investing in other forms of payment infrastructure that can generate fees."

The shift in venture capital activity reflects a broader trend of institutional cryptocurrency investment and a focus on revenue-generating digital asset businesses, rather than price speculation that drove investments in previous cryptocurrency cycles like the 2021 bull market.

5. The Future of VCs

Trader Tong Jun pointed out: "In the last bull market, VCs were dream factories, telling stories, inflating valuations, and selling to the secondary market. This time, they found themselves becoming the ones being cut by market makers and traffic. The so-called collapse of investment logic is actually the recovery of discourse power. Today's VCs no longer invest in projects; some have become market makers, some are incubating, and more are learning from investment banks, surviving on liquidity and commissions."

Quant trader Ares noted: The responsibilities of traditional industry VCs are merely to provide funding + resource support, which is particularly effective in an environment where financing is difficult and listing is strict in traditional industries. However, in the cryptocurrency space, the environment seems vastly different, with financing difficulties and listing requirements being entirely different. Therefore, VCs must also make corresponding changes to adapt to the investment and financing environment of the crypto space. I believe that in the future, crypto VCs will be divided into two main categories: top exchange VCs—investing basically means queuing for listings; and VCs with huge traffic—like a16z, who understand the crypto space, excel in marketing, and can provide comprehensive services for projects.

According to Galaxy's research report, in Q2 2025, the mining category attracted a significant amount (over $300 million)—this is the first time in recent years that the mining category has taken the highest share. During the same period, categories such as exchanges, lending, Web3, NFTs, gaming, DAOs, the metaverse, and infrastructure still accounted for a large number of investment projects. Overall, VC activity remains active and healthy, with artificial intelligence, blockchain infrastructure, and trading continuing to attract deals and funding, and pre-seed financing activities remaining stable.

Conclusion

Thirty years east of the river, thirty years west of the river; the crypto VCs that drove the rhythm of the last bull market are encountering a chill in this cycle. VCs are becoming more rational, capital flows are changing, and the crypto market is maturing… Regardless of which viewpoint market participants agree with, perhaps the era of VCs making money while lying down is truly gone, and what VCs should do is not clarify "whether they are still alive," but rather prove through action that "I am living better."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。