After the war, what came was not peace, but a long reckoning.

October 11 was a comprehensive disaster, featuring all the elements of past cryptocurrency crises: the liquidity depletion of FTX, the policy shock from the September 4 incident, the de-pegging of the UST stablecoin, and the "unplugging" of leverage on March 12.

The main storyline remains: Binance and Hyperliquid clashed for the third time. Following $JELLYJELLY and Aster, Binance still could not stop Hyperliquid's continued growth, even though Hyperliquid's ADL was triggered earlier, and the apparent scale of liquidation was larger.

This is not surprising; Hyperliquid's MM alliance strategy continues to be effective. It is excessively strange that Hyperliquid's HLP is competing for profits.

In Extreme Times, ADL Cuts HLP's Appendix

Trump made a declaration at 8 PM, and the market makers were critically ill an hour later.

Under the entanglement of internal and external funds, on-chain and off-chain, USDe became the Achilles' heel of market maker liquidity migration, ultimately breaching Binance's perpetual contract price maintenance system. Under the normal operation of Ethena's minting/redeeming, it broke through the weak liquidity on the Perp DEX.

Binance's price feeding mechanism failed on USDe, not adopting Aave's 1:1 hard-coded peg to USDT, reflecting extreme confidence in its own liquidity. Unfortunately, this confidence was given by external market makers.

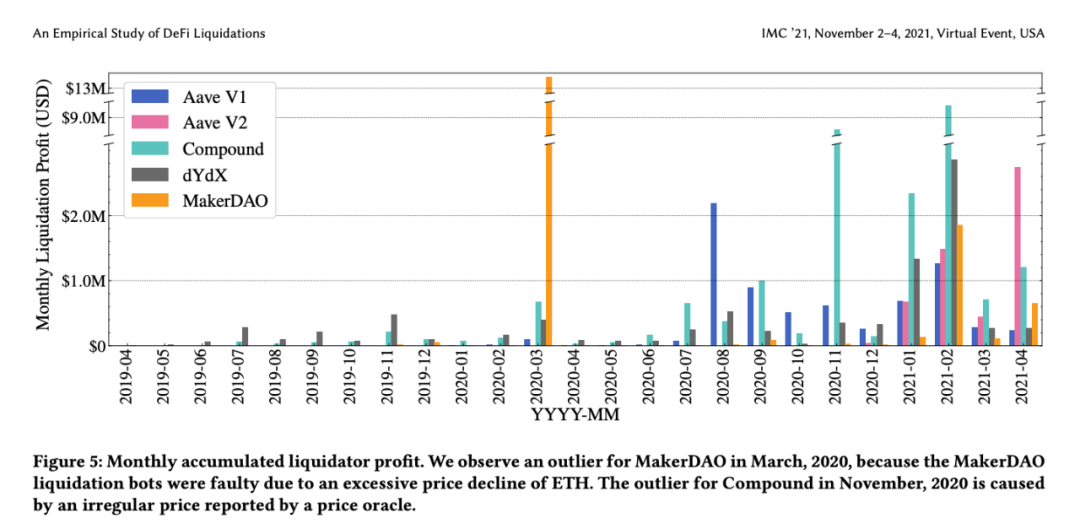

The essence of Perp remains a leveraged lending product. Due to the untimely human intervention, on-chain protocols are more actively considering potential crises. Taking the on-chain liquidation during DeFi Summer as an example, it evolved into the dual giants of MakerDAO and Aave amid huge volatility.

Image caption: DeFi Summer Liquidation

Image source: @KaihuaQIN

However, Perp's performance is more intense, and exchanges/Perp DEXs, in order to compete, will actively raise leverage ratios or change margin collateral rates. The ambiguity between full position and isolated position models allows altcoins to gain collateral capabilities for BTC and USDT.

According to a customer service representative from Binance, altcoins themselves have no value; nearly unlimited leverage will eat away all profits, even the taxes from Goose City would not be enough to repay decades later. Bad debts arise from the indulgence of exchanges, usually composed of transaction fees, ultimately borne by the counterparties, while exchanges can still gain a reputation for stabilizing crises.

Unlike second- and third-tier CEXs that openly and covertly self-sustain market makers, Binance has not faced such accusations. From the previous Web3Port manipulating coin prices to Wintermute and DWF being FUDed during 1011, none can be said to be part of Binance's ecosystem.

Binance itself is the largest liquidity provider in the crypto space. The maximization of Binance's interests is to attract the most project parties and retail investors, thereby allowing market makers to automatically maintain liquidity. Binance earns transaction fees, project parties exit, market makers earn spreads, and retail investors pay profits for everyone.

Second- and third-tier exchanges or numerous Perp DEXs cannot replicate Binance. Small exchanges can directly engage in market making to earn profits from retail investors, eliminating the intermediary processes of attracting project parties and raising funds (attracting market makers). Perp DEXs adopt the LP Token liquidity stimulation method pioneered by GMX.

In the end, the strong remain strong, and Hyperliquid takes a middle path.

HLP attracts retail investor retention, while the market maker alliance maintains liquidity after issuing tokens, taking both.

Binance's liquidation volume is a black box, ranging from billions to 30-40 billion dollars. CZ turned to play prediction markets, resulting in a loss of 283 million dollars for retail investors. Referring to Bybit's operations after the hack, exchanges are in a profit-making state as soon as they open. Regardless of the facts, retail investors will eventually forget.

The real danger lies with Hyperliquid. After the major liquidation on October 11, cracks have begun to show in Hyperliquid's alliance route. HLP, in conjunction with ADL (Auto-Deleveraging), liquidated 7 billion dollars, with HLP earning 40 million dollars.

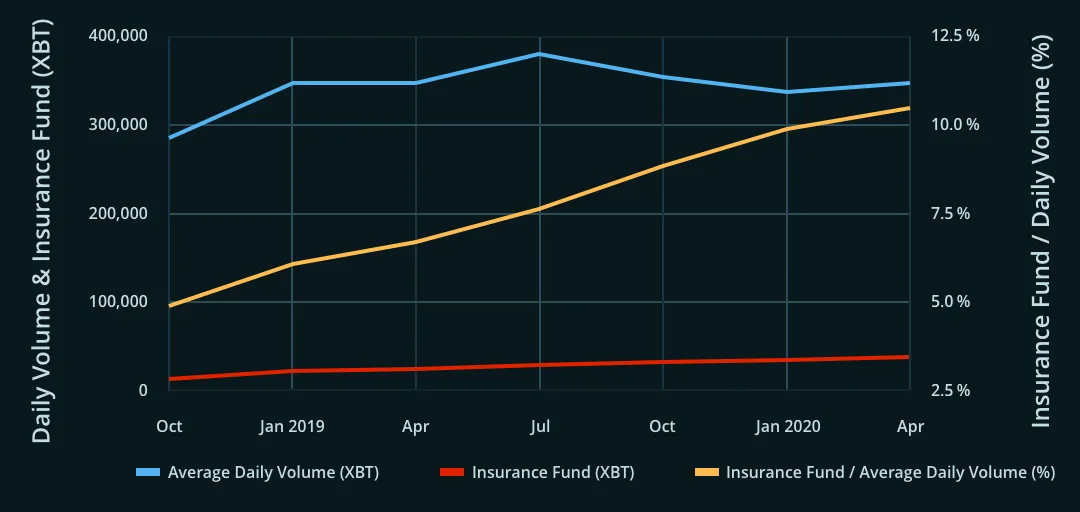

Image source: @BitMEX

ADL is referred to as a nuclear weapon because it takes away the unrealized profits of counterparties that create bad debts, meaning that short positions owe more to long positions, and long positions abandon short positions. Therefore, exchanges will do everything possible to avoid this from happening. If mishandled, it could lead to a situation like BitMEX in 2020, where they did everything to prevent ADL from occurring, saving the crypto space but sacrificing themselves (seen by the outside world as "unplugging," allowing Binance to rise).

The usual emergency response sequence is:

• Exchange: Crisis occurs → Market liquidation → Insurance fund takes over positions → ADL forces counterparties to close positions

• Perp DEX: Crisis occurs → Market liquidation → LP Vault takes over positions → ADL forces counterparties to close positions

In theory, to maintain trading order, ADL should only be triggered after the insurance fund is unable to maintain or is exhausted, or to avoid triggering ADL, bad debt creators should close positions in advance. The price of Perp products would extend towards -♾️, and the crisis would naturally end before the margin is exhausted.

However, HLP is responsible for both market making and liquidation functions, fundamentally different from the insurance funds of Binance and BitMEX. Market making will strive to maintain price stability, but liquidation has a path that can create crises, and can even reverse leverage this tension.

In the $JELLYJELLY incident, large holders accumulated positions exceeding $4 million in a market with a market cap of $9 million, making it impossible for the market to maintain counterparties and liquidity. Therefore, HLP could only passively take over positions, ultimately costing all HLP holders $12 million.

Bad debts and profits do not disappear; they merely transfer. This time, the profit of 40 million dollars came at the cost of the previous loss of 12 million dollars. For a capacity of 500 million dollars, it is still relatively safe.

The real danger is that HLP's dual functions will divide the interests of users, depositors, and market makers.

Large holders, or professional traders, need to use Hyperliquid's No-KYC and liquidity for trading or strategy allocation. They hope Hyperliquid remains absolutely neutral.

Depositors hope HLP earns more money, maintaining a higher market-making share and participating in more "profitable" liquidations.

Market makers hope HLP liquidates more and makes less, participating less in the coins they can market make, and being able to step in when their liquidity is insufficient.

The Hyperliquid team strives to maintain a balance among the three. Jeff stated that HLP's market-making share has decreased from 2% in March this year to 1% in October. Outside of public relations statements, HLP's market-making volume will decline, but it cannot become zero, as external market makers are not absolutely reliable.

From a development perspective, Hyperliquid needs to break free from HLP to flip T0 Binance; otherwise, it can only be an on-chain version of T1 CEX.

From a practical standpoint, Hyperliquid cannot abandon HLP, as only the losses of retail investors are the source of all profits, and retail investors will invest in HLP.

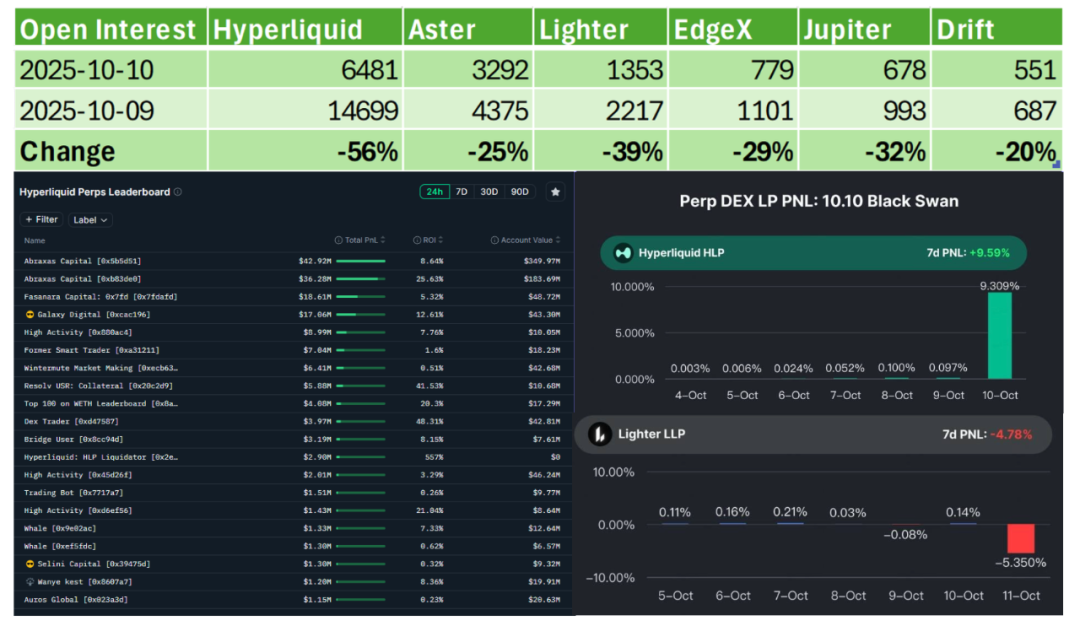

Image caption: Trading Volume and Profit

Image source: Three images stitched together, original author unknown

From the above data, Hyperliquid is undoubtedly the first in Perp DEX, even facing the largest proportion of retracement, yet it remains the absolute king of OI, and the wheel of dominance has already been established, while products like Lighter and other HL Killers still need more practice.

People can debate the correctness of Hyperliquid's premature initiation of ADL, but they will directly mock the failure of LLP's first stress test. You can be bad, but you cannot be weak.

In the extreme PVP market, Hyperliquid at least wins the present. There are indeed giant whales that can profit and exit, and there are indeed HLP users who can receive profit sharing. This is enough to support until the moment of breaking even, but what will happen in the future? HLP needs to find a balance between traders and market makers.

Who is the Ultimate Lender?

Liquidation is a process of cascading dam failures, and liquidity is the strongest gravitational dam.

Liquidation seems to be a failure of market making, but in reality, it is a result of severe price fluctuations, ultimately leading to all liquidity fleeing under panic and runs.

What should have smoothed out price fluctuations has now become a giant wave that makes prices even more unstable.

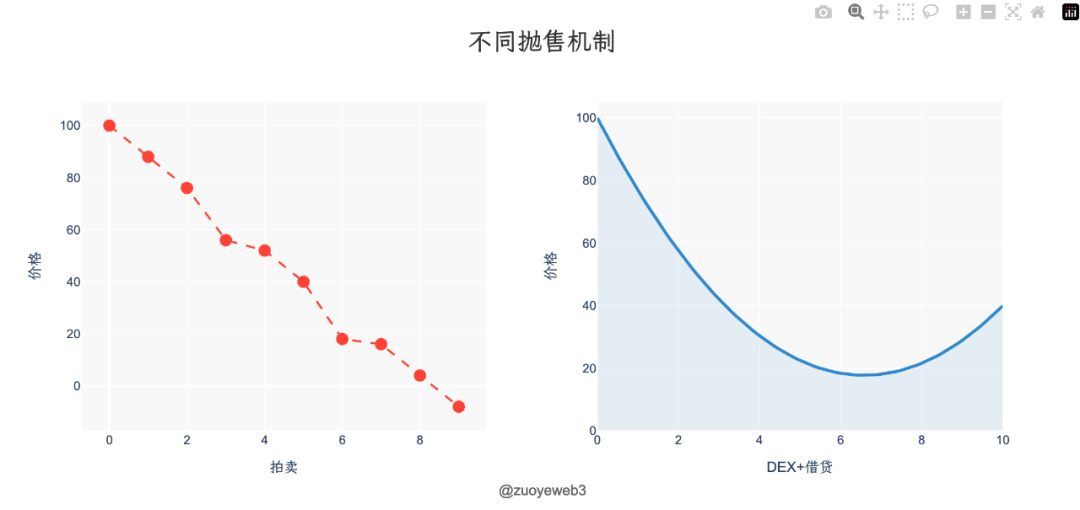

As mentioned earlier, Perp is merely another form of leveraged lending, but lending products are over-collateralized, and the liquidation mechanism has evolved from crude auction bidding and discounts to a fusion of DEX and lending. When the over-collateralization rate decreases, it gradually sells on DEX, transforming discrete downward sell-offs into continuous and smooth recoveries.

Image caption: Price changes under different sell-off mechanisms

Image source: @zuoyeweb3

The integration of AMM DEX and lending is more friendly to liquidation, but the liquidity of Perp DEX cannot escape dependence on the treasury mechanism. Hyperliquid cannot do it yet, so let's not make things difficult for HL Killers.

A word of complaint: anything called XX Killer ultimately fails to achieve great things, as seen with Ethereum Killers like Avalanche, Solana, and Binance Killer FTX.

The extreme liquidation problem of Perp DEX (daily liquidations can be solved through market mechanisms) directly limits price declines, inevitably damaging market efficiency. Establishing insurance funds, ADL, and cross-margin funds or circuit breakers can only alleviate the situation but cannot make everyone convinced from a product design perspective.

Power does not allow for a vacuum.

Binance's large liquidation volume is due to its massive market size, and the scale of HL liquidations is also larger than that of Lighter. HLP sacrifices the interests of traders; in the long run, to make the protocol more neutral, the roles of market making and liquidation must be productized; otherwise, the protocol will inevitably act as the ultimate liquidator.

Who acts as the ultimate lender in the crypto market? Is it assets like BTC, super market makers, or exchanges?

• Perp DEX Protocol: Currently, trading volume cannot sustain its existence; even Hyperliquid has not yet escaped Binance's gravitational pull.

• BTC: It is assumed that assets will slowly recover their market value, but this may take years. The four-year cycle's half-life is about two years, referencing the FTX collapse.

• MM: As long as they don't go bankrupt, they are fine, and they have no means to force action. Wintermute, GSR, Flow Traders, and DWF's fates are uncertain.

• CEX: Without external regulation, they can hardly establish or operate. Is there really anyone who believes Binance will genuinely look after retail investors' interests?

To add, Binance still far surpasses Hyperliquid. The large liquidation volume this time is also due to scale issues. From the perspective of systemic robustness, HL > BN > Lighter; from the perspective of market stability, BN > HL > others.

If Hyperliquid's trading volume expands tenfold to match Binance's scale, the issues Binance faces now will also become Hyperliquid's future problems. After all, what industrially developed countries show to less developed countries is merely a glimpse of the latter's future.

Regarding liquidation issues, HLP is the appendix of Perp DEX since the continuation of GMX, mimicking AMM DEX LPs. It adds liquidation functions in addition to providing liquidity, but the interests of HLP and Hyperliquid cannot be completely separated. Even if ADL liquidation does not "care for" HLP's positions, no one can guarantee that this will always be the case.

Market rumors suggest that Ethena and CEX have formed a vested alliance that will receive "care" from the ADL system, as the main CEX is an investor in Ethena. If they can protect Ethena, they can protect themselves, market makers, and large holders, leaving only retail investors to suffer.

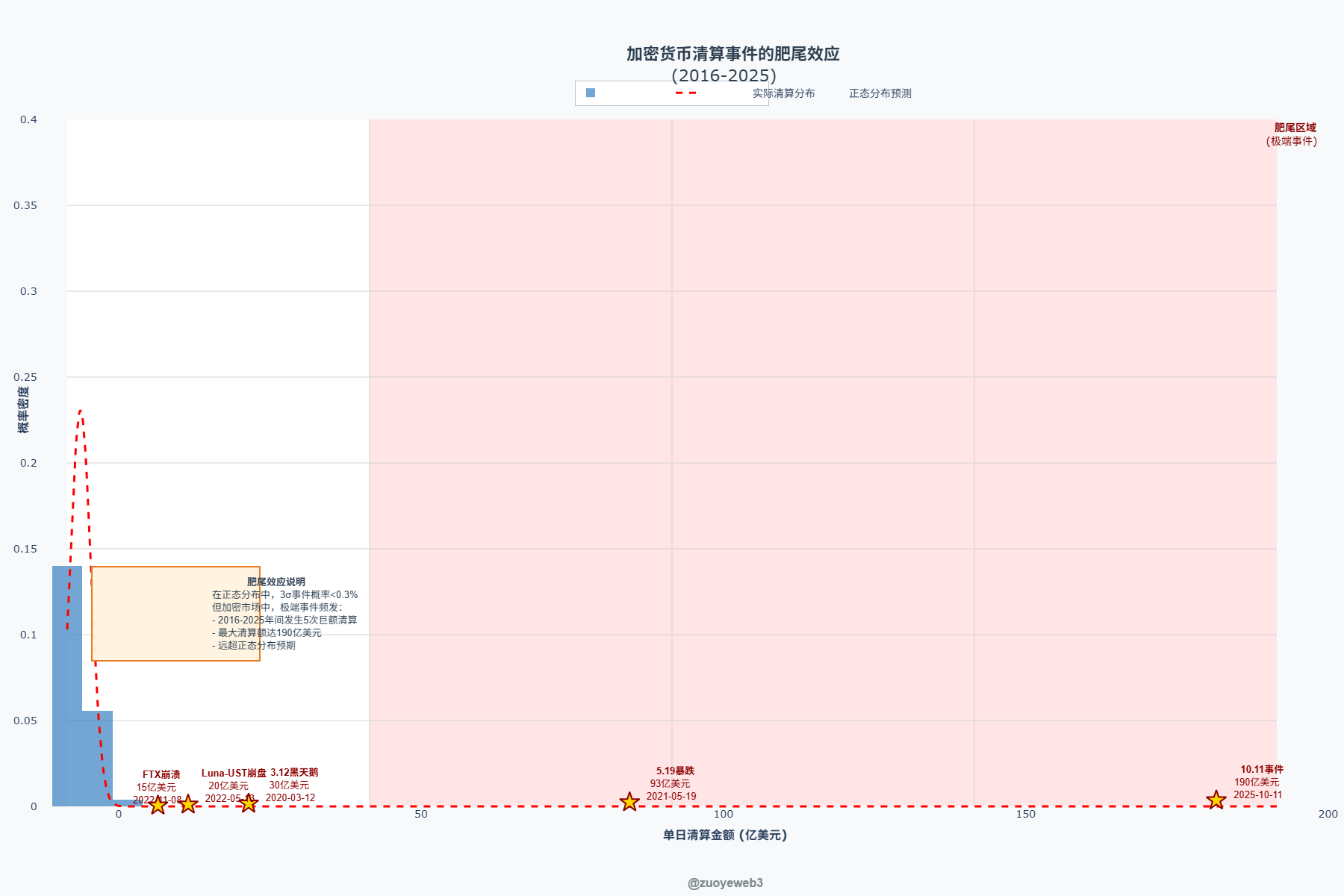

From the perspectives of assets and price discovery mechanisms, the former views ADL as a fat-tailed event. Due to the volatility of cryptocurrencies and the lack of regulation, the frequency of black swan events is far greater than in traditional financial markets, and the recovery mechanism mainly relies on self-healing.

Image source: @zuoyeweb3

Here, I propose a concept for an ADL options product that could be designed based on Hyperliquid's publicly transparent and automated ADL data. This could take the form of a binary option or prediction market product, encouraging participants to place bets when opening positions, or HLP could allocate part of the transaction fees to serve as liquidity for predicting the probability of ADL triggering.

In terms of liquidity sources, since ADL does not occur frequently (although the probability is relatively high, the likelihood of it happening daily, weekly, or monthly is still low), it could be designed to expire monthly to attract market makers or retail investors betting against it, even directly utilizing the HIP-3 mechanism.

Since Binance and other CEXs report liquidation data opaquely, most unrealized profits cannot be reclaimed, so the purpose of ADL options is not insurance compensation. It cannot fully compensate all losses of ADL victims, but as long as it exceeds Binance's compensation, there is a market for it.

To ensure the safety of HLP, the Hyperliquid team has the impulse to trigger ADL early. Establishing options for hedging is the best approach, with spot contract hedging, contract options hedging, and infinite nesting.

Another approach is the price discovery mechanism, which involves technological innovation. Variational adopts RFQ matching and OLP unified market-making mechanisms, as well as P2P liquidation strategies.

• RFQ: Users request quotes from market makers, making users the market participants.

• OLP: Variational uniformly manages the market-making mechanism, where any user trades with OLP, and users depositing into OLP earn returns.

• P2P: After a user places an order, OLP will seek matching orders and fully balance them, ensuring that even if bad debts arise, they will not affect others.

However, this is not a promotional piece for Variational, so it is essential to objectively consider the issues with the above mechanisms, primarily liquidity issues. Yes, everything boils down to liquidity issues.

Variational is essentially a hybrid liquidation protocol that combines on-chain/off-chain and CEX/DEX. You are betting against OLP, which itself may lack liquidity and might even place orders on Hyperliquid or Binance. Thus, users are essentially still trading with market makers on Binance, and the significance of Variational doing this is that large clients can receive discounts.

Furthermore, OLP is the only market maker. Although the protocol states it will not engage in malicious market making, the black-box nature of its market-making strategy makes it difficult for the market to fully recognize it. Even with the fully transparent (Fully 0N-Chain) Hyperliquid, its governance mainly occurs on Discord.

Asset X price corresponds to collateral X leverage, and the infinite extension of leverage ultimately causes the collateral to lose value.

Conclusion

Listening for thunder in silence, the microstructure of the market is always changing.

On March 12, 2020, BitMEX "unplugged" to save the crypto market, sacrificing BitMEX's market share in the process, allowing Binance to rise.

On November 8, 2022, FTX's insolvency ultimately could not save itself, sacrificing SBF and the entire industry, leading to a standstill in crypto.

On October 11, 2025, Binance's partial transparency and public relations saved itself, while Hyperliquid profited from ADL liquidations, with the outcome still undecided.

Regardless, liquidation has become the most challenging ailment for Perp products. As Hyperliquid grows, its inclusion in regulation may only require another liquidation event. Hopefully, before that happens, the crypto space can cultivate its own ultimate lender, reflecting an advancement compared to Wall Street.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。