The world is bustling, all for profit; the world is bustling, all for profit to go! Hello everyone, I am your friend Lao Cui, focusing on digital currency market analysis, striving to convey the most valuable market information to the vast number of coin friends. I welcome everyone's attention and likes, and reject any market smoke screens!

Today's cryptocurrency payment innovation conference once again touches everyone's hearts. Lao Cui did not explain it yesterday; personally, I have a bias towards such conferences. Coincidentally, today sees another downturn, with major cryptocurrencies almost maintaining a decline of about 3%. Let me explain briefly. Most friends view this conference as a bullish counterattack point. From the growth of cryptocurrency concept stocks in the US stock market, there is indeed some positive stimulus, but the feedback to the coin circle is completely the opposite trend. Looking at the conference content, it discusses issues related to stablecoins, artificial intelligence, and tokenization. The name itself gives some clues; it is called the Payment Innovation Conference. The topics include the tokenization of financial products and services, the integration of traditional finance and decentralized finance, emerging stablecoin use cases and business models (this point is likely to be negative news), and the intersection of artificial intelligence and payments.

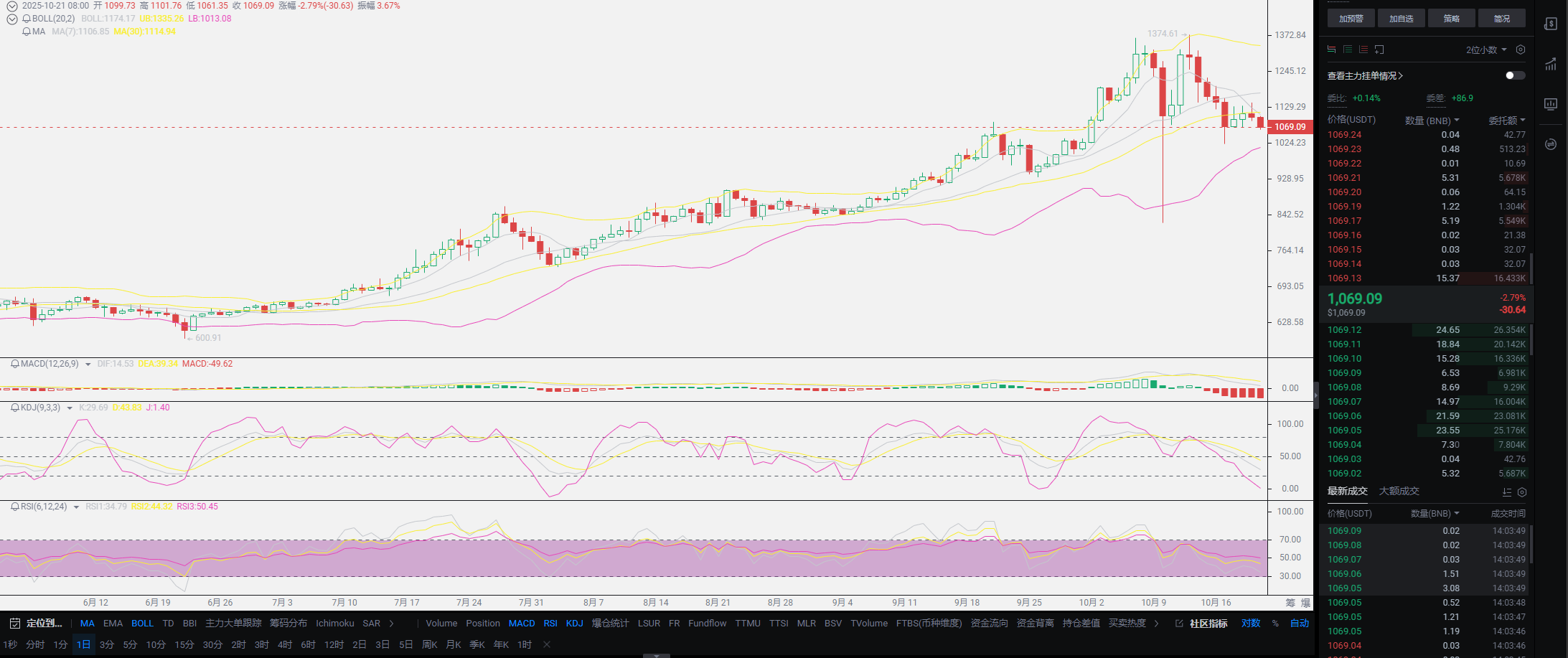

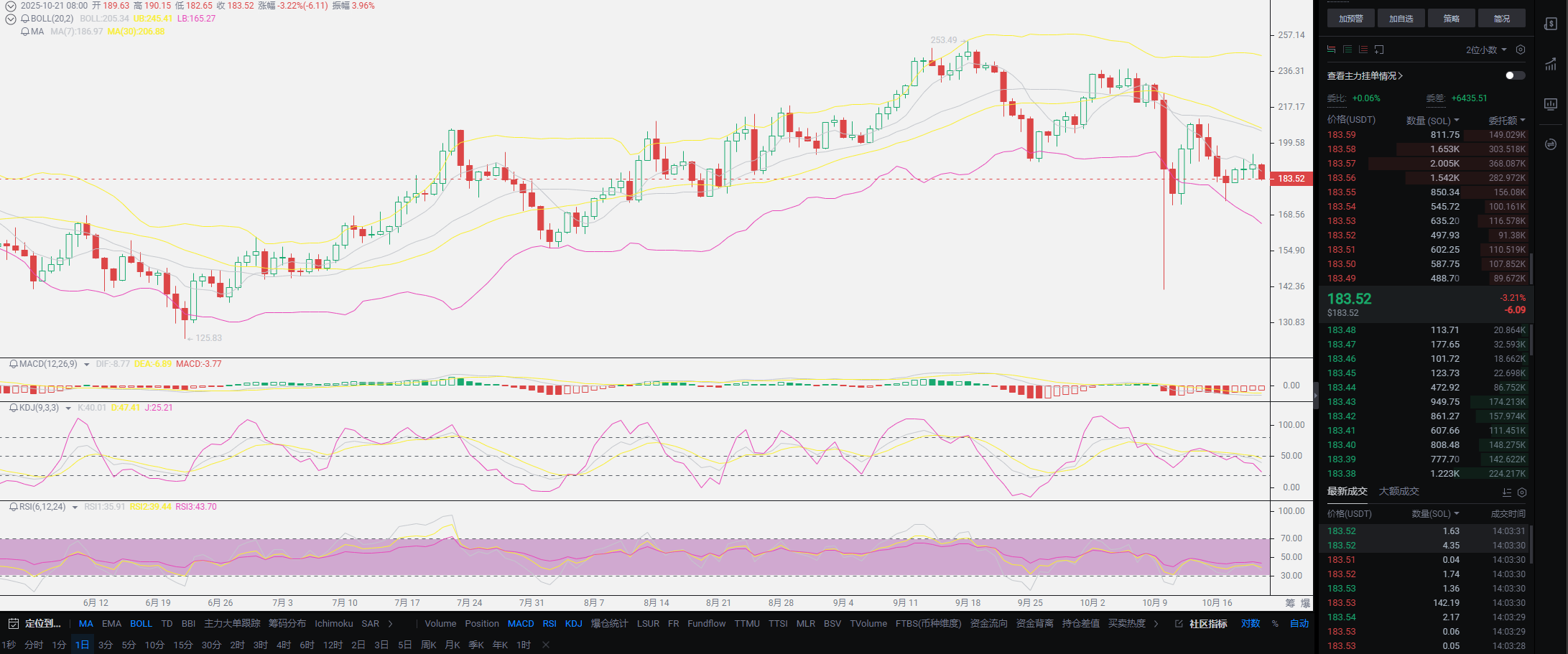

Regarding these four topics, most are unrelated to the cryptocurrencies in the coin circle, and the discussion is also related to stablecoins. Stablecoins need to be distinguished from the coin circle, which I mentioned earlier this year. Stablecoins can provide corresponding positive news for the coin circle, but their actual help is not significant. They can enhance on-chain transaction volume, which is good news for miners, but for cryptocurrencies in the coin circle, it is difficult to have a positive effect. Why does Lao Cui hold this view? It’s simple. In the past month, nearly 1 billion stablecoins have been issued using the SOL blockchain, yet SOL's trend remains downward. Moreover, this issuance has caused SOL's on-chain data transaction volume and processing speed to reach new highs, but the actual feedback on the unit price of the cryptocurrency is not high. Why does this happen? Because miners can earn, it does not mean the unit price can rise. Coupled with SOL's over-issuance capability, the requirements for the unit price to rise are extremely harsh.

The issuer does not need the cryptocurrency to rise to profit; collecting fees through the blockchain is also a considerable income. Moreover, the over-issuance of cryptocurrencies can bring more market value benefits. This unlimited supply system cannot prevent inflation, which is no different from traditional financial tokens. Why, under such circumstances, can the downward trend still be maintained? Everyone should be clear that all meetings, regardless of the type of plan passed, have the premise that regulation is ahead. For example, if SOL wants to go public, it must submit the underlying code, as well as the calculation of fees and a series of other data. When the Americans obtain this data, it will cause security issues. A significant part of the growth of the coin circle is due to the lack of regulation, and the trading system is relatively free. If you want to expand market value, you must sacrifice security. Even the recent hacking of 15 billion in Bitcoin caused a sell-off in the coin circle, as many people have only a superficial understanding of the operation of the coin circle.

Even among those reading Lao Cui's articles, many still do not have a clear definition of the coin circle. They cannot distinguish between listed indices and personal assets, and they do not pay attention to the content of the meetings, believing that as long as there is a meeting, it is good news for the coin circle. Anything related to the issuance of the coin circle is considered good news. This understanding needs to be improved by everyone, and of course, this is based on everyone's recognition of the coin circle. The current role of the coin circle is to build a global trade payment system to avoid trade being affected by other factors. The emergence of stablecoins is to seize resources from the coin circle. Simply put, if you hold USDC, you can exchange it one-to-one for the corresponding fiat currency. Under this premise, if you have trade needs, you will not choose Bitcoin, Ethereum, or other cryptocurrencies for trade settlement. You cannot settle trade and then bear the risk of cryptocurrency depreciation, as Tesla's cancellation of BTC payments previously demonstrated. The volatility is too great and not suitable for trade settlement, while stablecoins can solve this problem, allowing you to avoid concerns about volatility and settlement issues.

With this in mind, you can understand that stablecoins, in a certain aspect, form a competitive trading relationship with the coin circle. Currently, the only thing that can provide positive stimulation to the coin circle, leading to the growth of cryptocurrencies, is one piece of good news: the inflow of funds. Everyone must closely monitor the inflow of large funds, which is why Lao Cui still views the trend positively this year. A significant reason is that everyone can intuitively feel that the inflow of funds is positive. There has been no situation of major players selling off. The current downturn is mostly due to ancient wallets waking up and selling off. This is undeniable. If you still hold Bitcoin below 60,000, if it were you, you would also sell. Li Xiaolai maintained an average price of a few hundred dollars, and selling Bitcoin at 20,000 is also a normal phenomenon. At that time, the investment vision was indeed unbeatable, but everyone should look back at this investment based on the current price and feel it is quite a failure.

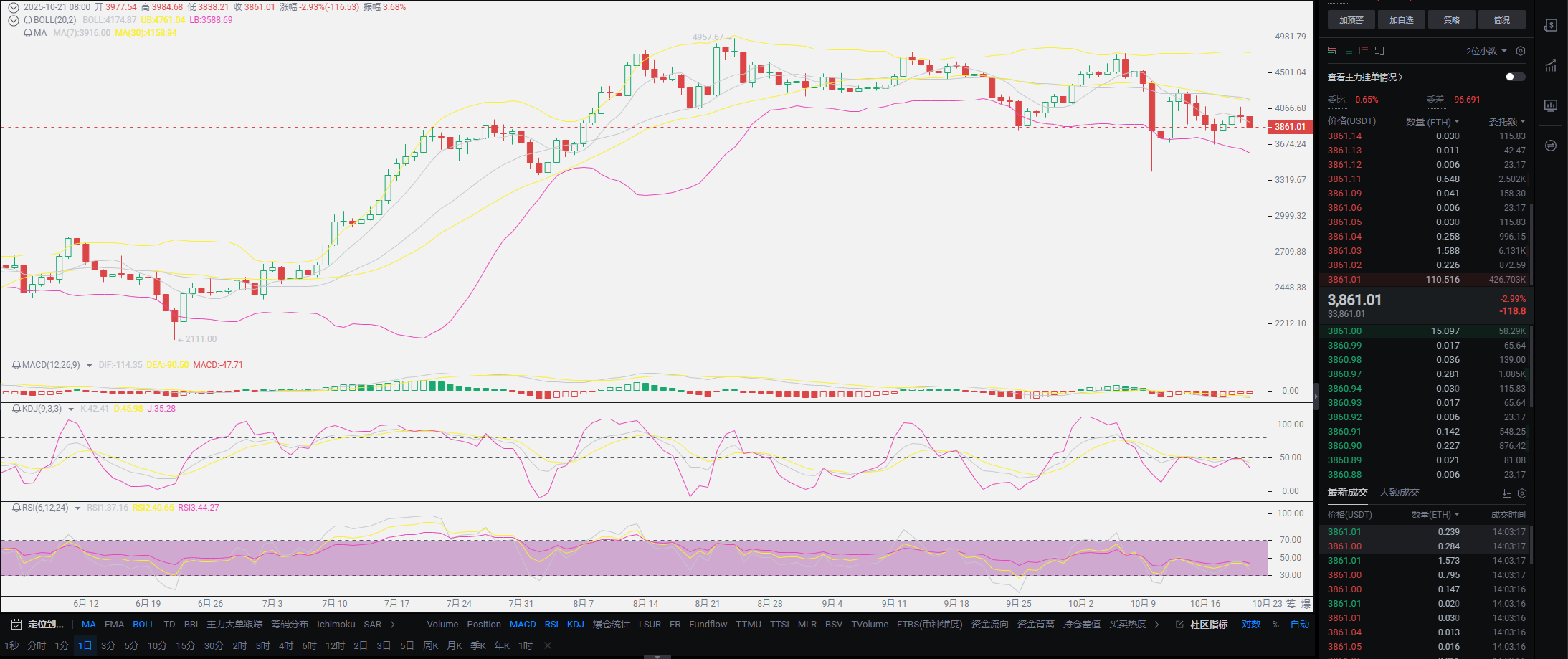

Everyone has their own trading system and their own profit-taking goals. Lao Cui's profit-taking goals are also very clear: Bitcoin 130,000-150,000, Ethereum 5,000-6,000, SOL 300-350, OKB above 300. Once these conditions are met, Lao Cui will definitely take profits without reservation. At the same time, you should look at the current trend and feel that it seems a bit unrealistic. The current trend is one of weak growth and rapid decline. As CZ said, you must firmly believe in your beliefs to validate your views. The above prices are within Lao Cui's understanding. It does not mean that after reaching the profit-taking target, the market will decline; rather, Lao Cui's understanding can only reach this point. Perhaps in the future, it is indeed possible to achieve higher targets, which is not an impossible concept. Lao Cui is just an analyst and can only analyze future trends based on existing conditions. He is not a big figure, and the market trend cannot follow Lao Cui's every guess. Do not overestimate yourself.

To put it simply, when Li Xiaolai made his appearance, Lao Cui also thought about whether what he said was correct. When the market reached 60,000, Lao Cui also wondered if the coin circle would stop there. No one could have imagined that after May 19, the coin circle could be recognized by the Americans. All of this is variable, and most situations exceed Lao Cui's estimates. The same was true last year; everyone thought Lao Cui's predictions were very accurate, being able to predict the market reaching a high of 100,000 before Trump took office. From Lao Cui's perspective, this was not a prediction. It was the certainty of Trump. Before he took office, he also said that as long as he took office, he would promote the coin circle and legalize it, which was once thought to be for garnering votes. The ultimate goal only validated Lao Cui's guess. All of this layout was a guess, not a prophecy. Guessing is to understand the motives and purposes. The motive has been perfectly achieved, but Lao Cui does not have a good outlook on the ultimate goal. After all, this is his last term, and he is about to complete a year, leaving him with little time. Therefore, everyone must complete their goals within the limited time.

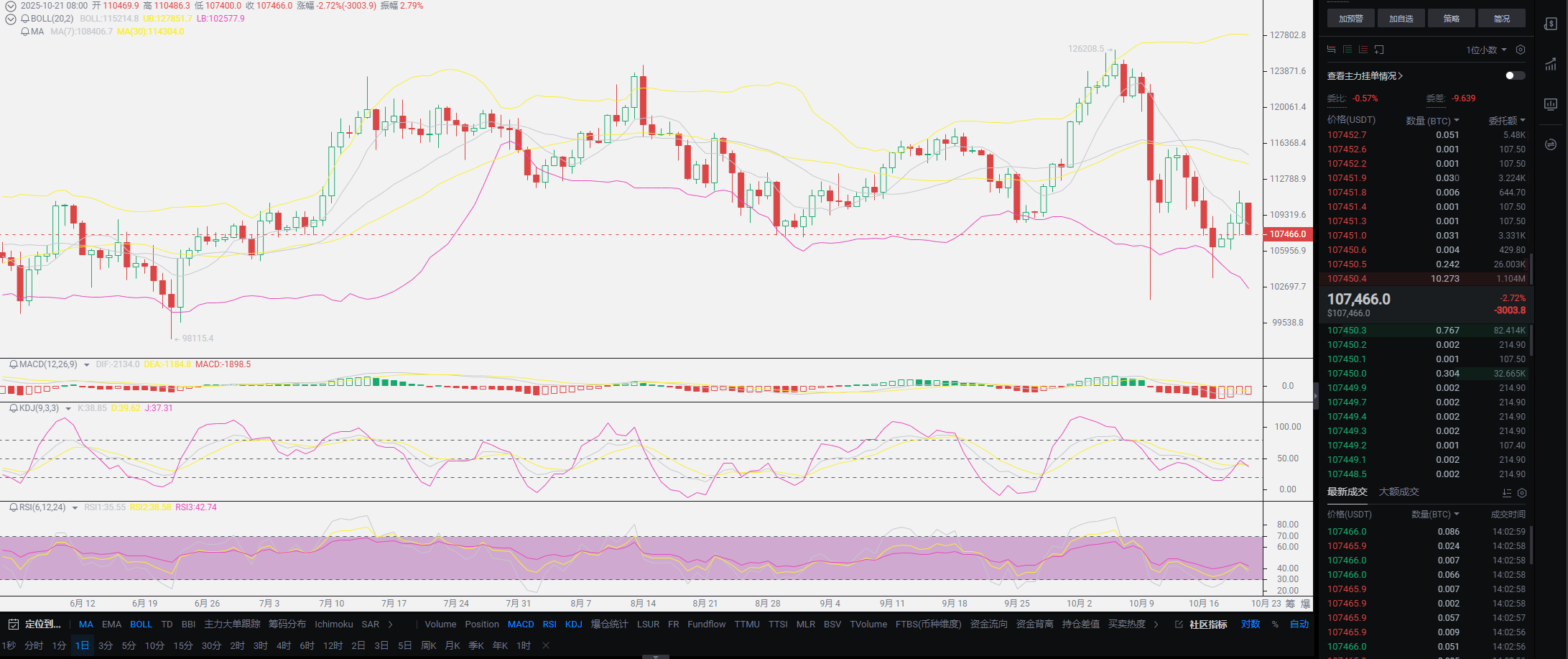

Lao Cui summarizes: Today's theme is still about the speculation and interpretation of the conference. Such news-level stimulation cannot change the trend of the current coin circle. The known information that Lao Cui currently sees still favors the bulls. First, the unchanged Vanguard Group has purchased 21 million METAplanet assets, which indirectly supports the coin circle, representing substantial capital inflow. Secondly, the probability of a 25 basis point rate cut in October has reached 99%. The biggest positive news is that the tapering may end next week, and at the same time, the Federal Reserve may lower the reserve interest rate to alleviate financing pressure. If a series of measures can be achieved next week, Lao Cui can basically confirm that the activation of the coin circle will also begin next week. Everyone should be clear that if a series of measures are achieved next week, it will at least bring trillions of liquidity to the market, which will somewhat stimulate the coin circle. Ending tapering will directly lead to cash depreciation, so no company will want to keep cash on hand and will definitely seek markets that can outperform inflation. This means what? The downward trend of the coin circle will be fully realized within this week, and it is highly likely that the expectation of a rate cut will be speculated, meaning there will be a rebound next week. This is also a double-edged sword; speculating on the expectation of a rate cut also means that there may still be a decline after the rate cut until the inflow of large funds officially starts the bull market phase. The cash flow from the rate cut and the end of tapering requires a certain time lag. Everyone should understand that this week is your buying point for spot trading. Even if the short-term trend is bearish, do not pursue short-term stimulation; it is time to lay out long positions! At the end of the article, if anyone has questions, feel free to ask me!

Original creation by WeChat Official Account: Lao Cui Talks About Coins. For assistance, please contact directly.

Lao Cui's message: Investing is like playing chess; experts can see five, seven, or even more than ten moves ahead, while those with lower skills can only see two or three moves. The skilled consider the overall situation and the big trend, not focusing on one piece or one area, aiming for the final victory. The less skilled fight for every inch, frequently switching between long and short positions, only competing for short-term gains, resulting in frequent troubles.

This material is for learning reference only and does not constitute trading advice. Trading based on this is at your own risk!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。