Crypto News

October 21 Highlights:

1. Coinbase invests $25 million to acquire Up Only NFT, Cobie podcast will restart.

2. Coinbase submits proposals to the U.S. Treasury, calling for the establishment of new anti-money laundering regulations for AI, on-chain analysis, etc.

3.Camp Network announces partnership with KORUS, users can now legally use music from multiple Grammy winners for secondary creation.

4. Solana co-founder responds to building a new perp DEX: it's just an attempt to use Claude for generating tests.

5. BlackRock has launched iShares Bitcoin ETP on the London Stock Exchange.

Trading Insights

Having been in the crypto space for many years, I understand that the core of profitability is not about accurately predicting the market but about adhering to strict rules to manage your hands and protect your capital. The following operational guidelines can help you reduce risks and achieve long-term stable profits!

Insure Your Positions: Avoid all-in bets, use spare cash to enter the market. ① Single asset position ≤ 30% of total funds, high-risk altcoins ≤ 10%, to avoid significant losses from the volatility of a single asset. ② Invest only with "spare money that won't affect your life," maintaining a stable mindset to avoid panic or greed-driven mistakes.

Set Boundaries for Trading: Set stop-loss and take-profit levels in advance, stay out of the market when unclear. ① Clearly define goals before each trade: for example, take profits in batches at a 20% increase, decisively exit at a 10% drop, and avoid the illusion of "waiting to break even" that consumes capital. ② When the market is unclear and trends are ambiguous, it’s better to stay out and observe than to blindly buy out of "fear of missing out," reducing the risk of ineffective trades.

Decouple from Market Sentiment: Don’t chase trends, review and correct daily. ① Avoid following "insider information" and chasing short-term trends; most "good news" is what others want you to see, preventing you from buying at high prices. ② Spend 10 minutes daily reviewing: check if your actions align with your plan? Did you enter out of impulse? Record mistakes to avoid repeating them.

Deep Dive into Assets: Understand 2-3 assets, focus on long-term logic. ① Don’t be greedy: instead of juggling 100 coins, focus on 2-3 mainstream coins, familiarizing yourself with their volatility patterns and capital flows. ② Anchor to project fundamentals: pay attention to code updates, ecosystem progress, and regulatory dynamics, as these are the long-term core logic supporting prices, not short-term candlestick fluctuations.

LIFE IS LIKE

A JOURNEY ▲

Below are the real trades from the Big White Community this week. Congratulations to those who followed along; if your trades are not going well, you can come and test the waters.

Data is real, each trade has a screenshot from when it was issued.

**Search for the public account: *Big White Talks About Coins*

BTC

Analysis

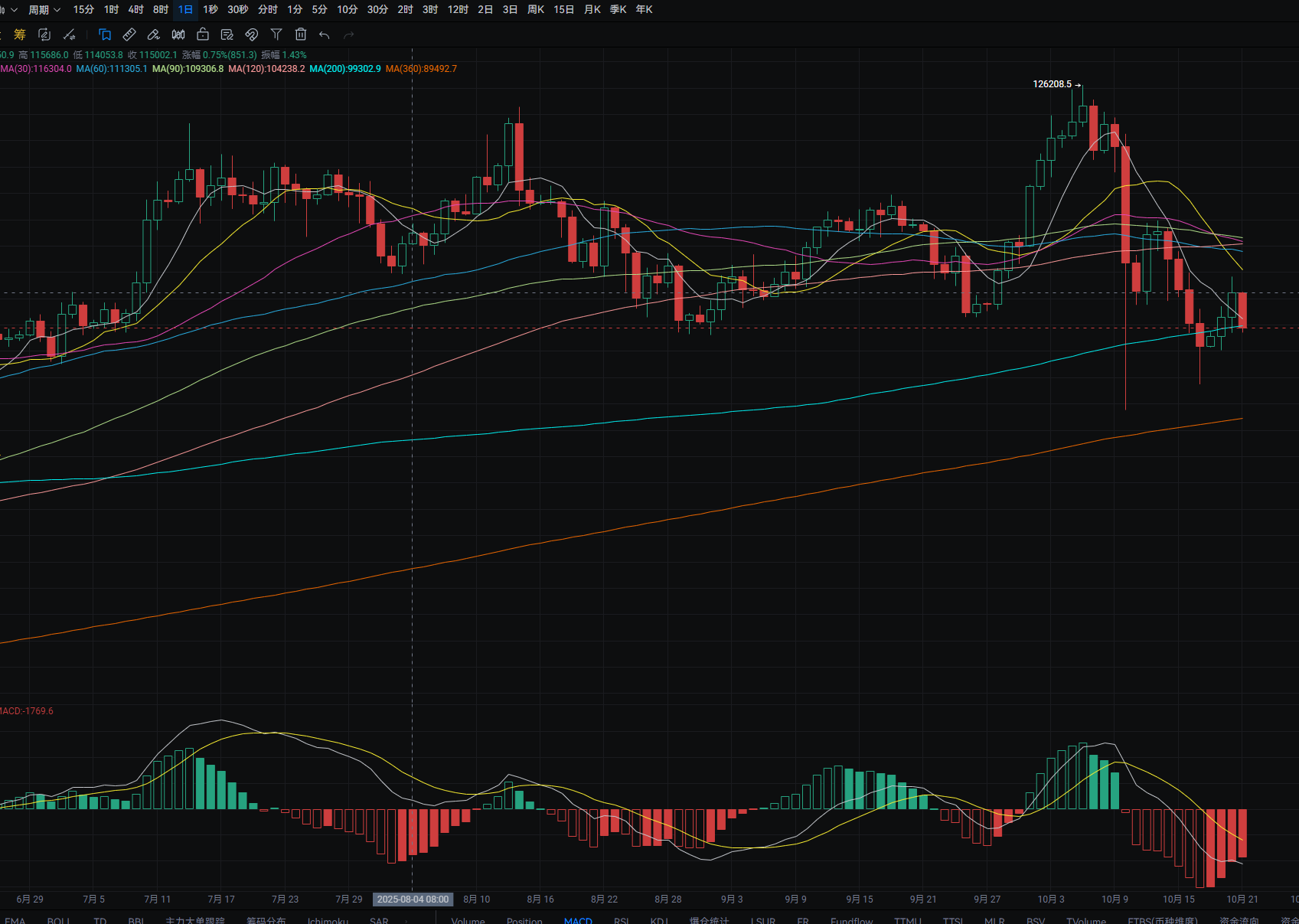

Bitcoin's daily line rose from a low of around 107,350 to around 111,650 yesterday, closing around 110,450. The support level is around 106,300; if it breaks, it could drop to around 104,650. A pullback can be bought near this level. The resistance level is around 109,500; if it breaks, it could rise to around 111,050. A rebound near this level can be sold short. MACD shows a decrease in bearish momentum. On the four-hour chart, the support level is around 107,250; if it breaks, it could drop to around 105,600. A pullback can be bought near this level. The resistance level is around MA14; if it breaks, it could rise to around MA60. A rebound near this level can be sold short. MACD shows a decrease in bullish momentum.

ETH

Analysis

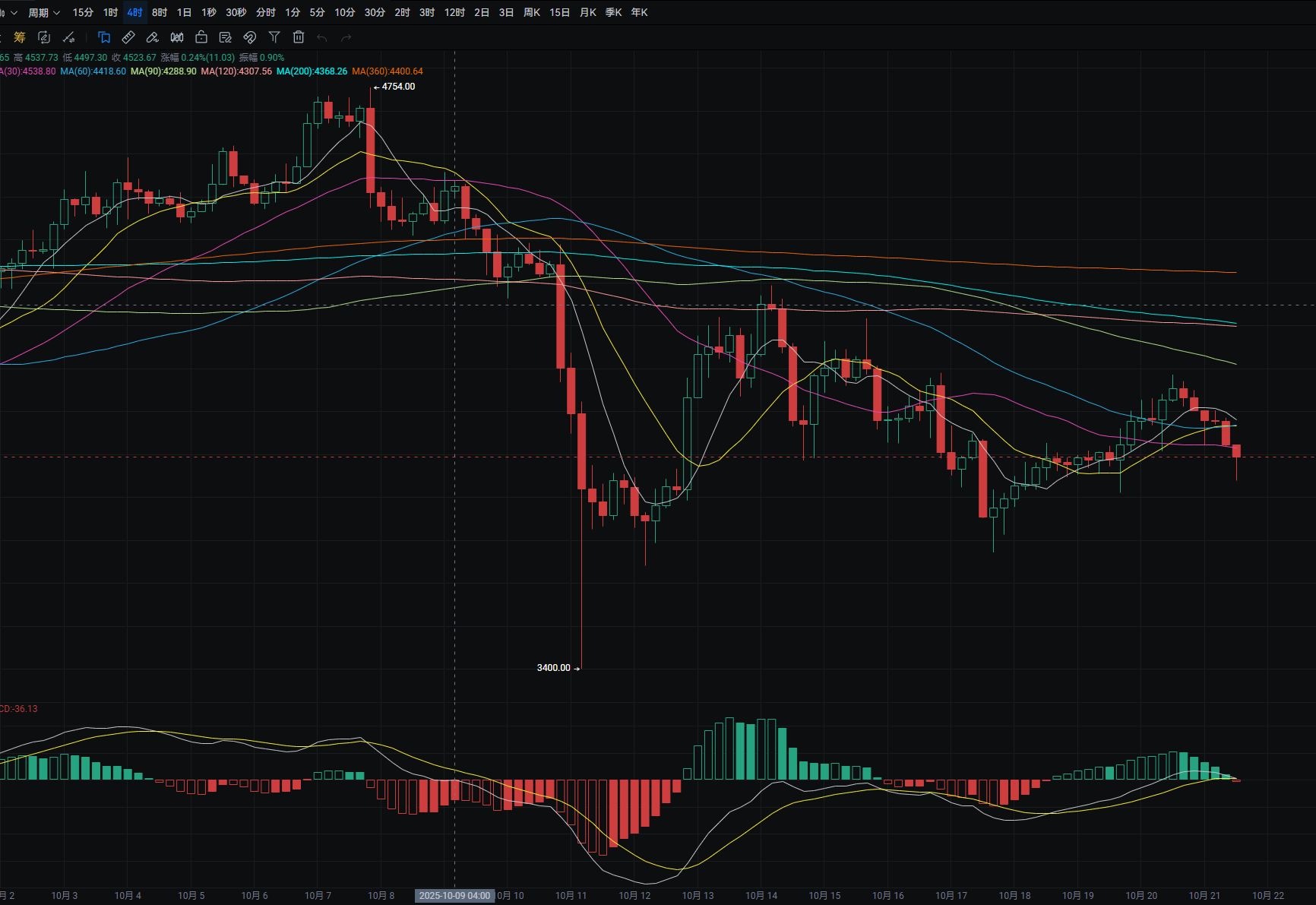

Ethereum's daily line fell from a high of around 4,085 to a low of around 3,905 yesterday, closing around 3,980. The support level is around 3,825; if it breaks, it could drop to around 3,745. A pullback can be bought near this level. The resistance level is around 3,975; if it breaks, it could rise to around 4,070. A rebound near this level can be sold short. MACD shows a decrease in bearish momentum. On the four-hour chart, the support level is around 3,840; if it breaks, it could drop to around 3,760. A pullback can be bought near this level. The resistance level is around MA60; if it breaks, it could rise to around 4,025. A rebound near this level can be sold short. MACD shows a decrease in bullish momentum.

Disclaimer: The above content is personal opinion and for reference only! It does not constitute specific operational advice and does not bear legal responsibility. Market conditions change rapidly, and the article may have some lag; if you have any questions, feel free to consult.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。