Do not worry about having no friends on the road ahead; there are like-minded individuals on the investment journey. Good afternoon, everyone! I am the Coin King from the Coin Victory Group. Thank you all for coming here to watch the King’s articles and videos, bringing you different news from the crypto world and precise market analysis every day.

Click the link to watch the video: https://www.bilibili.com/video/BV1NuWRzuEtB/

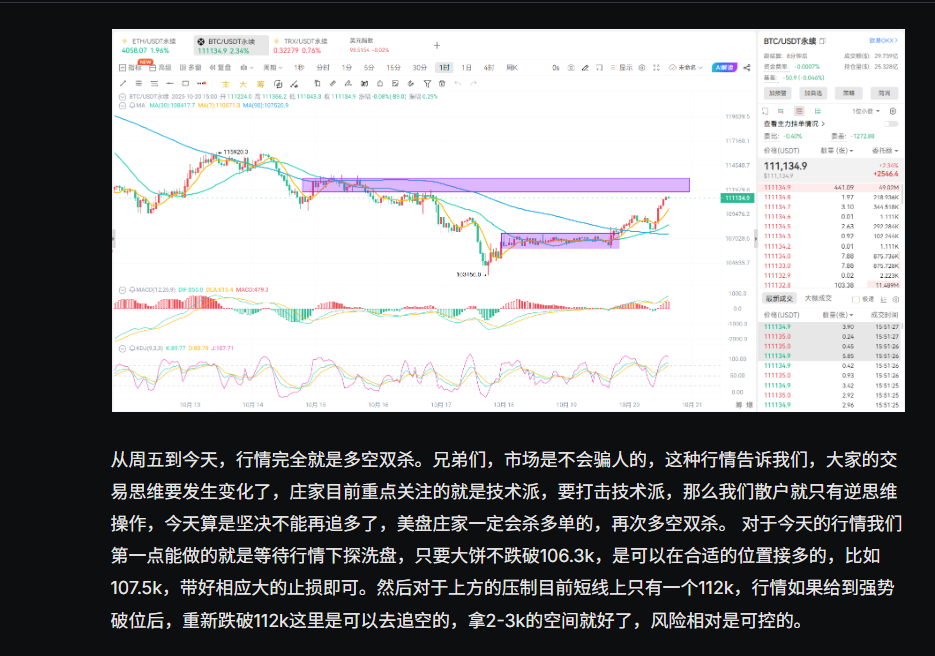

It has been several days without an update. Yesterday, I made a small update; the strategy perfectly took profit, allow me to boast a little. Let the chart do the talking. Yesterday, I provided the support and resistance levels for Bitcoin, and around 11 PM, after reaching the resistance level, it directly fell back. I repeatedly emphasized in yesterday's article that everyone should not chase long positions, as the US market would definitely see a significant drop, and sure enough, there was a waterfall drop during the session. The only position where I could set up a long position was at 107,500, which was also given this afternoon, and the market has currently rebounded slightly by over 500 points. For short-term trading, it’s just a small gain.

Returning to the market, let’s analyze the current environment comprehensively: Recently, global risk assets have warmed up across the board, with the three major US stock indices rising simultaneously, and Bitcoin (BTC) also saw a surge during the day. The VIX index dropped over 10%, indicating a clear retreat of panic sentiment. Overall, funds are flowing back to the risk side, and risk appetite has significantly increased. The recovery of liquidity has become the main driving force behind this round of rebound, with BTC rising in tandem with gold, indicating that the market has shifted from pure risk aversion to betting on the peak of the Federal Reserve's interest rates.

The core logic behind this is two points: 1. US-China trade and interest rate cut expectations: As long as there are no significant changes in US-China trade relations and interest rate cut expectations, the short-term market bottom remains relatively stable. 2. Recovery of liquidity: URPD data remains robust, and an increase in turnover rate is reasonable; the market has not seen large-scale selling.

From the perspective of the crypto market: BTC's decline last night was slightly greater than the night before, but Ethereum (ETH) and SOL did not follow the downward trend, and altcoins showed a mixed performance. This indicates that the expectations for interest rate cuts have been digested in the market, and there has not been any significant turbulence after the cuts. Japan may raise interest rates this month, and if it truly adopts a "hawkish" stance, it will lead to a re-pricing across the board.

Currently, BTC's weekly chart still maintains strength, with decreasing volatility, and its trend resembles that of leading tech stocks in the US. The significant drop from February to April 2025 has proven its resilience, surpassing Nvidia. On the specific chart, the 4-hour BOLL middle track at 108.6K is the lifeline for bulls; if it falls below, bears will dominate. If the 108.6-108.2K range does not break, bulls still have support. As mentioned yesterday, the resistance area for BTC is at 112-114K; it is not advisable to chase long positions before breaking through. It is recommended to buy low and sell high, engaging in short-term guerrilla trading. 107.3K is an important defense line; if it breaks, it will open up a new round of downward space, but it is still worth trying long positions at this level, as long as risk control is in place.

Regarding Ethereum, the daily chart still shows a downward structure. If the 4300-4100 range does not break, the probability of further decline is greater. In the short term, it is oscillating in the 3640-4220 range; if it falls below 3890, liquidity will be quickly cleared.

The crypto market's situation is changing rapidly; the article and video I just posted may become outdated immediately. Therefore, we have created a communication group; friends who are interested can contact me to join. Please do not disturb; we will also be live streaming on Tencent Meeting every night at 8 PM to provide fans with market insights.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。