The real reason for the recent surge and outbreak of pessimism in the crypto industry is that market participants are finding it increasingly difficult to achieve excess returns.

Author: MONK

Translation: Deep Tide TechFlow

Over the past year, Crypto Twitter (CT) has gradually been filled with an increasing number of crypto natives who feel pessimistic about the current state of the industry and belittle the innovations in our field and its asset classes. These complaints do reveal some objective facts and often point out the real issues that exist within the crypto industry as a whole. However, I firmly believe that the pendulum has swung too far in the direction of "apocalyptic" thinking.

In my view, the pessimism in the crypto industry is a well-meaning but dangerous and misleading mindset that has become too prevalent. This article aims to reject this crypto pessimism by reflecting on the experiences of our technological predecessors. The situation is not as dire as some describe.

Let me start with some common positions.

Token and tokenomics are largely imbalanced.

An increasing number of low-quality developers are distracting truly excellent developers.

Scams and profit-seeking behaviors are rampant.

The number of "real" protocols accounts for only a tiny fraction of the entire crypto world.

There are very few tokens worth investing in.

Protocol governance is often inefficient.

The industry still has many historical legacy issues to resolve.

Most of these problems stem from a few core issues:

We are in a period of regulatory uncertainty.

Crypto technology has made the creation and acquisition of assets frictionless.

The industry has historically rewarded bad behavior.

The good news is that these issues are solvable, or rather, they are an inevitable byproduct of an open but still immature industry. But I think we all understand this deep down.

I believe the real reason for the recent surge and outbreak of pessimism in the crypto industry is that market participants are finding it increasingly difficult to achieve excess returns. This has led to a persistent sense of frustration and impatience.

But this is not related to a lack of innovation; it is closely tied to the structure of our asset class.

Let’s first look at what we have achieved:

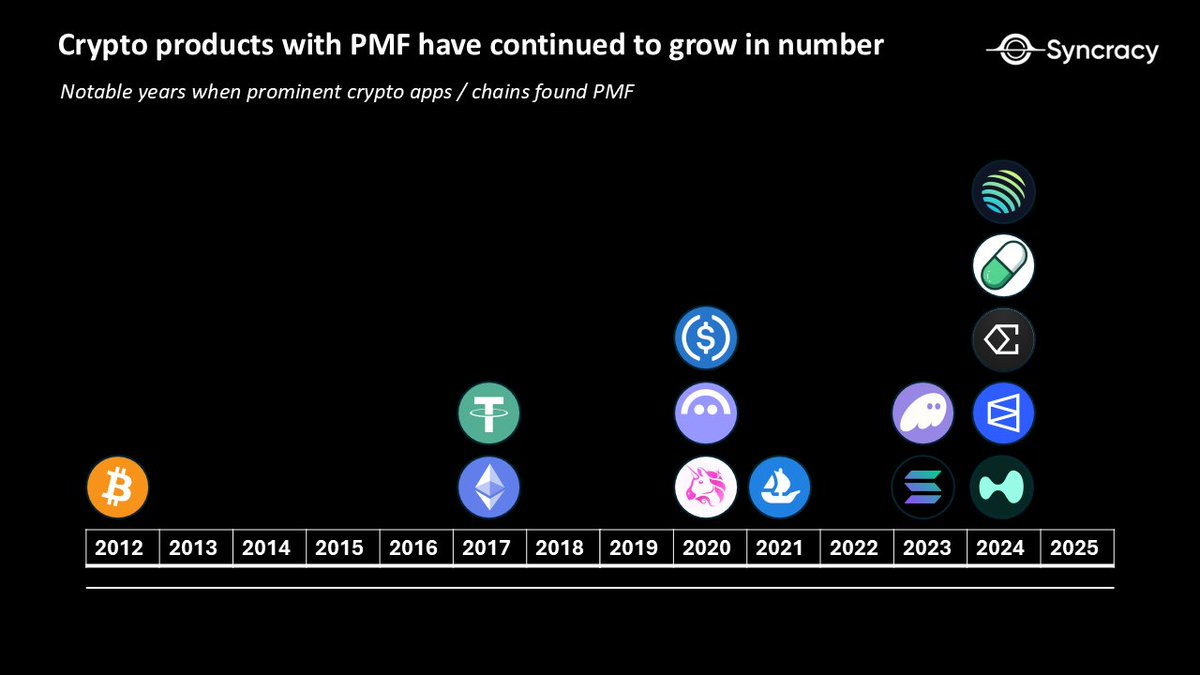

Here are some crypto products that I believe have found product-market fit (PMF) or at least opened the path to finding PMF in the crypto vertical. While the number of such products is not large, as each development "cycle" progresses, we can create more meaningful products based on infrastructure improvements and knowledge accumulation.

Some may see these achievements and realize that good things take time, and perhaps the growth trajectory of the industry is not as bad as you initially imagined.

Conversely, some may respond, "Well, this is not impressive."

For friends holding the latter view, allow me to show you this:

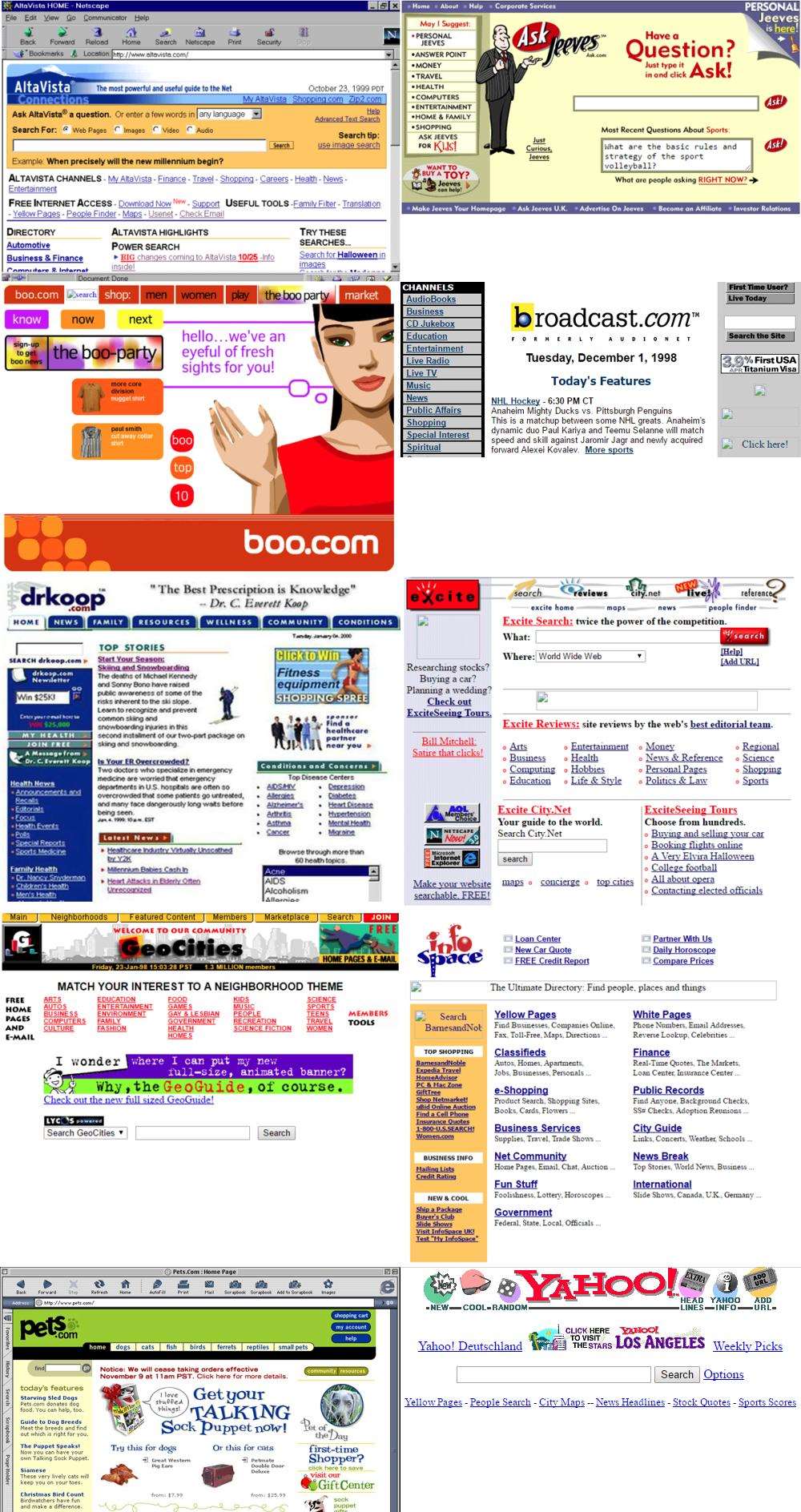

Recognize it? Probably not. These are the old homepages of early internet companies from the "dot-com bubble" era. Of course, these pages are completely different from the internet we know and love today.

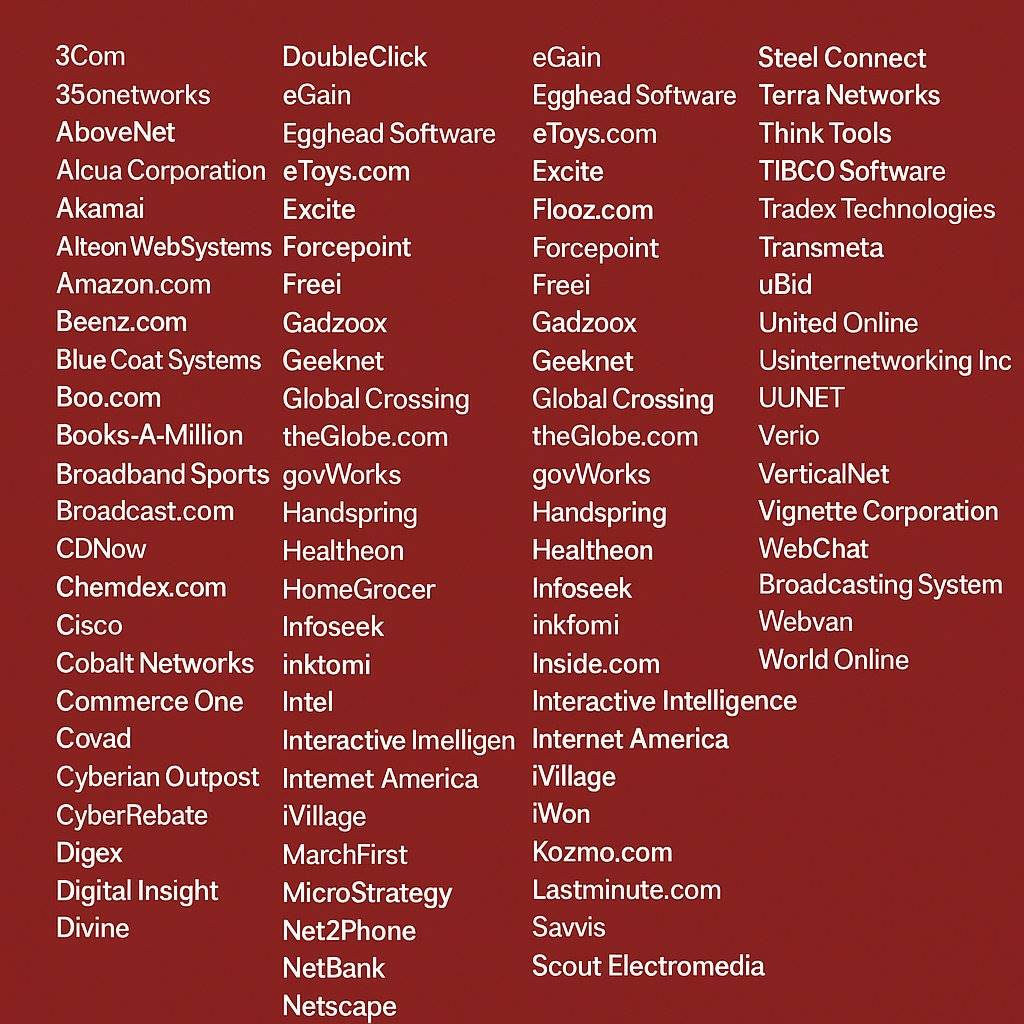

Here are some publicly listed internet companies that failed after the dot-com bubble burst, data sourced from Wikipedia:

Amazon's stock plummeted over 90% in two years, from a high of $107 to a low of $7, and did not fully recover until 2010.

In fact, the number of "failed" companies is much larger. The number of companies that failed to go public is in the thousands, but they may still have caused significant losses for venture capitalists.

The good news is that we also got these brilliant pearl companies:

Amazon — Founded on July 5, 1994.

Netflix — Founded on August 29, 1997.

PayPal — Founded in December 1998.

Google — Founded on September 4, 1998.

Meta (Facebook) — Founded on February 4, 2004.

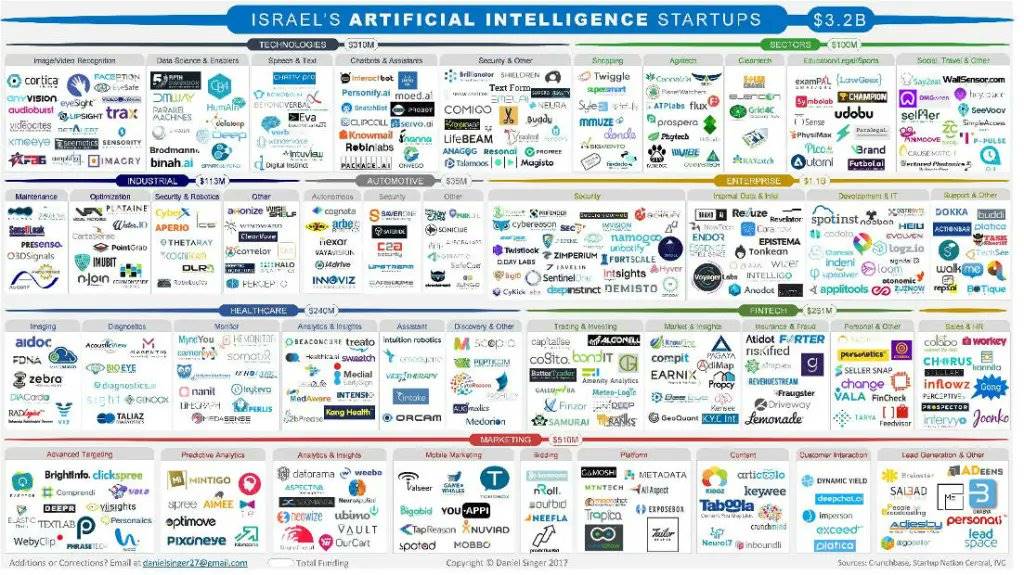

Similarly, although artificial intelligence (AI) is a highly regarded category of innovative technology and growth narrative, I would not be surprised if we see a similar "power law survival rule" (where a few companies succeed and dominate the market) in ten years.

These are the leading AI startups that just emerged in Israel in 2020.

So, if 99.9% of opportunists fail in all leading technology fields, why does failure in the crypto industry feel so painful?

This is because by attaching publicly traded token codes to each project, we have effectively turned everyone into a venture capitalist. Subsequently, we have significantly increased the number of "companies" that can be invested in by allowing any developer to create a viable and investable "startup" without any due diligence. This has led to a large number of retail investors experiencing the feeling of investing in an asset class with a very low success rate, further exacerbating negative sentiment towards the crypto industry.

Imagine if every founder during the dot-com bubble could have raised funds through an ICO (Initial Coin Offering) from a group of enthusiastic and adventurous retail investors, even if their products barely functioned, and skipped the seed round -> private placement -> public listing process. Moreover, with a "Pump.fun" (a platform for price surges), they could even completely remove the product.

Of course, our asset class would become a minefield filled with token codes, many of which would eventually crash by 90%.

So, back to the question, what have we actually achieved?

Today, BTC (Bitcoin) has become a $2 trillion asset, evolving from a marginalized, cypherpunk fantasy proposed by an anonymous founder in just 16 years.

Since we first had programmable smart contract platforms, over the past decade:

We have built a peer-to-peer internet capable of withstanding a "third world war," protecting hundreds of billions of dollars in value.

We have developed a higher-performing version that allows users to create permissionless assets with just a click of a button, while supporting billions of dollars in daily decentralized exchange (DEX) spot trading volume.

We have enabled the world to have tokenized dollars and send any amount of money instantly to anyone at a very low cost.

We have brought financial primitives (such as lending and passive income) on-chain.

We have created a transparent, borderless, KYC-free derivatives exchange with trading volumes comparable to Robinhood, while returning almost all revenue to its token holders.

We are reshaping market structures, creating new ways for people to buy, sell, go long, and short assets, while creating entirely new asset types (such as prediction markets, perpetual contracts, etc.).

We have made six-figure JPEG images a phenomenon.

We have created absurd internet communities that have pushed some humorous token codes to valuations beyond public companies.

We have pioneered new ways of capital formation, such as ICOs and bonding curves.

We are exploring how to make finance and currency more private.

As I often say, we provide an emerging financial system alternative for anyone with an internet connection, an alternative to the system they are forced to accept due to their nationality. Our alternative is still young, but it is freer, more open, and more fun.

Every year, we provide the market with an opportunity to buy epoch-making technology at extremely low valuations. All you need to do is filter out the real value from the noise.

At Syncracy, we firmly believe that the "FAANG" of the crypto industry (referring to giants like Facebook, Apple, Amazon, Netflix, and Google in the tech field) has begun to emerge, and every one to two years, new strong competitors will appear.

I often think of this quote, which helps me better understand the industry we are in:

"Our intuition about the future is linear. But the reality of information technology is exponential, and this brings profound differences. If I walk 30 steps linearly, I can only reach 30. If I walk 30 steps exponentially, I can reach a billion."

— Ray Kurzweil, The Singularity Is Near: When Humans Transcend Biology

We always expect the crypto industry to make linear, incremental progress every year and invest in a bunch of worthless projects, hoping this year will yield more than last year.

However, this often leads many to feel disappointed and suffer losses. But this does not mean we should face a series of "apocalyptic" tweets, endlessly criticizing our achievements and development trajectory, especially when all other "real" technology fields have also gone through the same growing pains. It just seems sharper in the crypto industry because each of us has become a financial stakeholder.

Looking ahead to the next decade, no one can truly predict what will happen, and I do not believe innovation will progress according to our expected timeline. Some years may see nothing happen, while other times may bring about significant changes in an instant. I believe it is entirely possible that within three years, we will find twenty protocols with product-market fit (PMF) from the current seven.

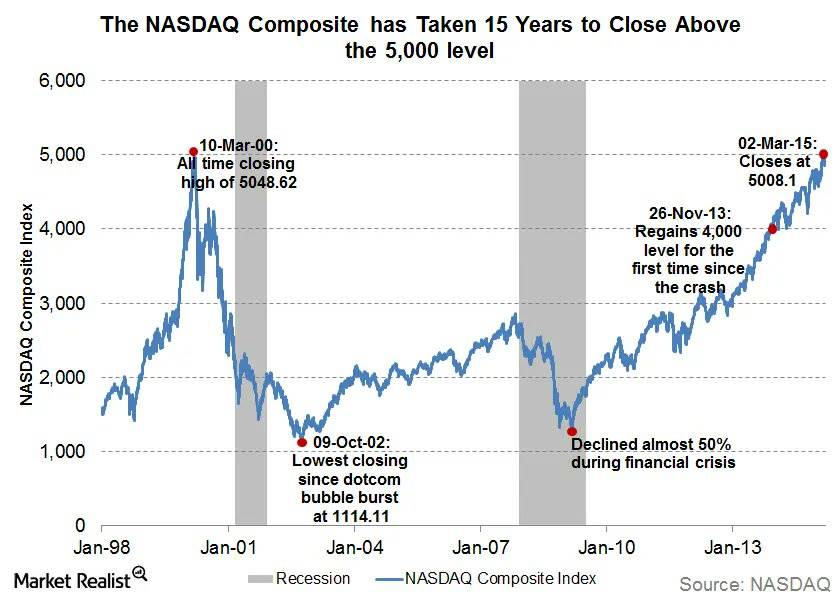

If you want to know how the stories of the predecessors of the dot-com bubble ended, it took us 15 years to fully recover:

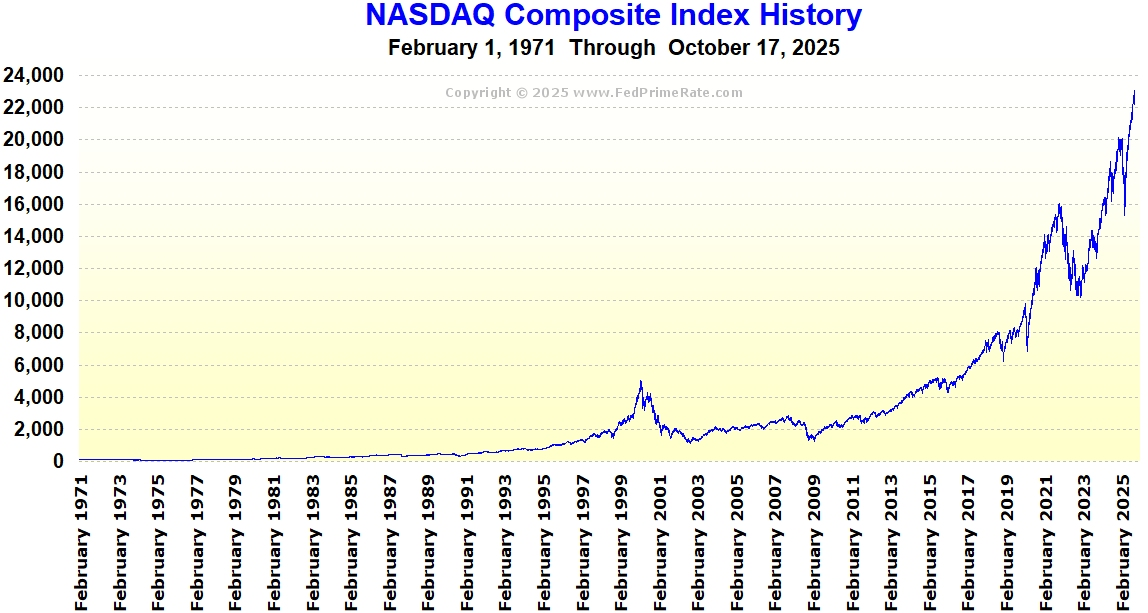

But we all know what happened since then:

And now, just as the old guard, Wall Street elites, and high-level officials in the U.S. government are finally starting to notice and respect the crypto industry, many of our early users seem to be losing faith in our mission. To this, I completely refuse to accept.

Bitcoin is still digital gold, we are still building new financial primitives, and we are still making the world a better and more interesting place.

For some of us, as investors, there are still many opportunities to outperform the market.

Choose to remain optimistic about the crypto industry!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。