A project initiated by a broke, dropout youth in a bathroom ultimately became part of the mainstream system on Wall Street.

Written by: Thejaswini M A

Translated by: Saoirse, Foresight News

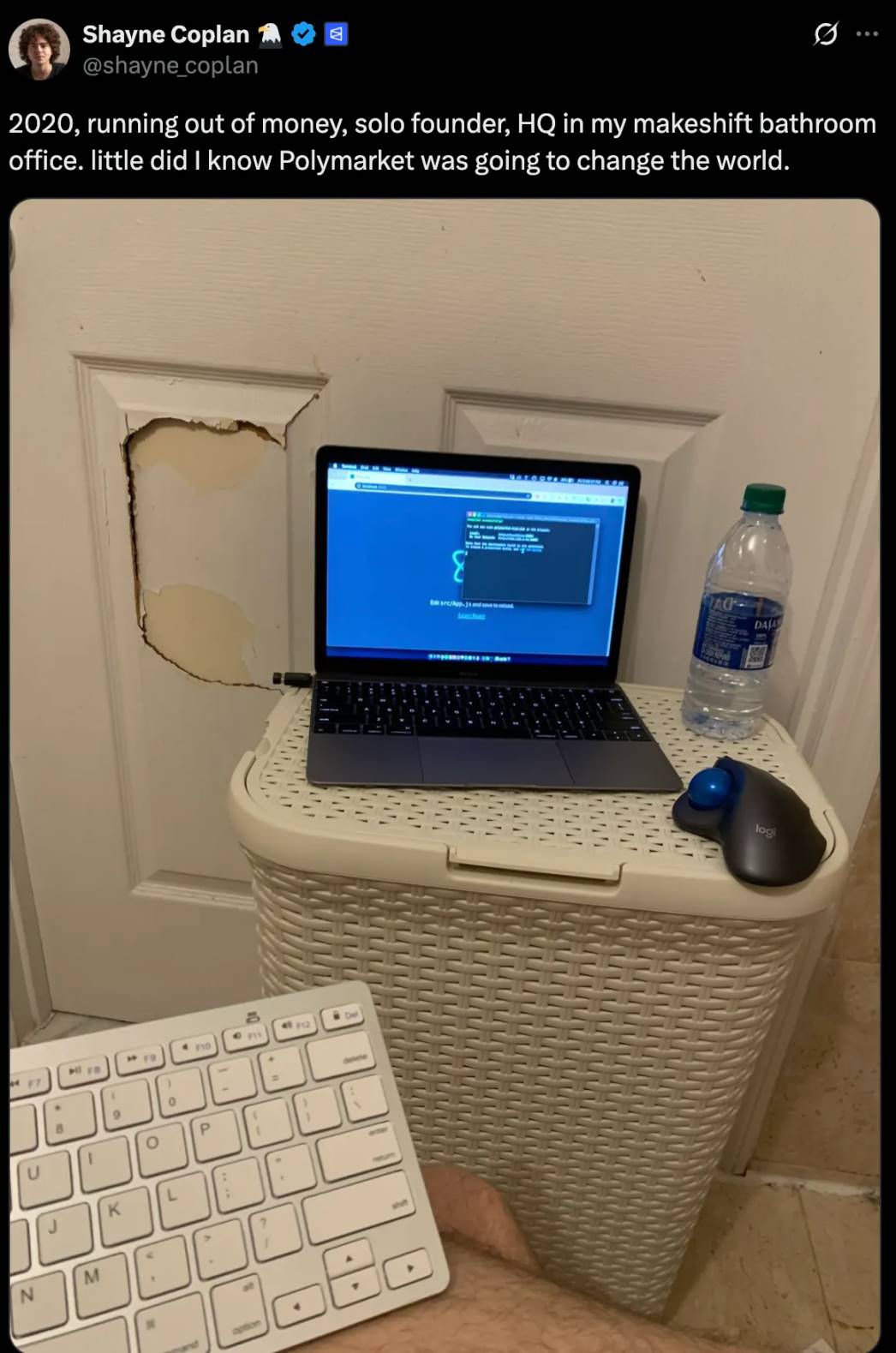

June 2020: A 21-year-old broke kid launched a betting platform in his bathroom during the pandemic.

November 2024: FBI agents raided his apartment, confiscated his phone, but left without filing any charges against him.

October 2025: The parent company of the New York Stock Exchange (NYSE) invested $2 billion in his company.

This is the life trajectory of Shayne Coplan over five years — from counting items in his New York Lower East Side apartment and figuring out what to sell to pay rent, to becoming the youngest self-made billionaire tracked by Bloomberg.

How did someone with "nothing to lose" build a business that even regulators wanted to destroy?

Why could a platform banned in its home country attract the favor of the most powerful institutions on Wall Street?

These details are crucial as they reveal the real operational logic behind what seems to be "impossible." For this reason, Coplan's story should not be simplified to just a timeline — this is also the purpose of writing this article.

The Epiphany from the White Paper

In 2019, Shayne Coplan was thoroughly disappointed with cryptocurrency.

After dropping out of New York University (NYU) for two and a half years, his several entrepreneurial attempts ended in failure. The once-promising "cryptocurrency revolution" had, in his eyes, devolved into a "crypto scam" — these projects aimed not to create value but to extract funds.

Broke and disheartened, he watched as the industry he once believed in turned into a "casino" for scammers.

So, he stopped the "busywork" of entrepreneurship and began to read deeply: academic papers, obscure research reports, especially the economist Robin Hanson's research on "prediction markets."

The core theory of prediction markets is that the market's ability to aggregate information surpasses that of experts, polls, or any traditional forecasting methods. When people "endorse" their views with money, collective wisdom reveals the truth.

This theory has been validated in academia: since 1988, the Iowa Electronic Markets have consistently outperformed traditional polls in predictive accuracy. However, such platforms have always been limited to niche circles, filled with academic jargon, making them hard for the general public to access.

Coplan keenly identified this market gap.

"This is such a good idea; it shouldn't just stay in a white paper," he wrote in an article.

In the following year, he devoted himself to studying the operational mechanisms of prediction markets, the reasons for their failure to scale, and the conditions needed for widespread adoption. Despite his bank account dwindling, he persisted in his research for a full year.

Most people might have found a job to make a living by then.

At this moment, the COVID-19 pandemic swept the globe.

The "Bathroom Office" Startup

In March 2020, the world went into lockdown.

People were stuck at home, glued to their screens, eager to know what would happen next: Would schools reopen? Would a vaccine be developed? How long would the pandemic last?

Traditional institutions like governments, health agencies, and the media struggled to provide reliable answers. Everyone had their own opinions, but no one could ascertain the truth.

Coplan clearly seized this opportunity.

At 21, with empty pockets and two and a half years of dropout status with nothing to show for it, he began to build a platform — as he later described, it was a project launched in his "temporary bathroom office" in his Lower East Side apartment.

In June 2020, the prediction market platform Polymarket officially launched.

@Shayne Coplan

The logic of this platform is simple: users bet on the outcomes of real-world events using cryptocurrency. Each question corresponds to a "market," and users can buy shares representing "yes" or "no" — if the prediction is correct, each share can be redeemed for $1; if incorrect, it is worth $0. The market price itself reflects the collective judgment of the probability of the event occurring.

For example, if a share's trading price is 65 cents, it means the public believes there is a 65% chance of that event happening.

Purely information aggregation, no expert interpretation, no media manipulation, just "views backed by money."

Building a prediction market requires solving a series of technical issues: data feeds, market outcome determination, user experience, and establishing trust among strangers — after all, the areas users bet on cover everything from elections to pop culture.

More importantly, it also needs to find a survival space in the "gray area" of regulation.

In the eyes of some regulators, prediction markets resemble "gambling"; in the view of others, they are akin to "financial derivatives." Their legal status has always been ambiguous.

Coplan's strategy was to build the platform first and seek regulatory approval later.

This strategy worked in the first two years.

In 2022, Polymarket began to gain widespread attention.

The platform's trading volume continued to grow, with users predicting various events from Oscar winners to economic indicators, gradually becoming a "credible alternative" to traditional forecasting methods.

Then, the Commodity Futures Trading Commission (CFTC) came knocking.

The regulatory agency accused Polymarket of "offering illegal trading contracts" and "operating an unregistered exchange." Ultimately, the platform settled for $1.4 million (neither admitting nor denying the charges).

More critically: Polymarket agreed to block all domestic U.S. users.

This restriction created a paradox: the platform could operate globally but could not enter the U.S. market; international users could bet on the U.S. elections, while American citizens could not participate in predictions about their own politics.

However, regulators suspected that Polymarket was still secretly allowing U.S. users to access the platform.

2024 Election: Validation of Predictive Ability and Regulatory Turmoil

In 2024, the U.S. presidential election approached.

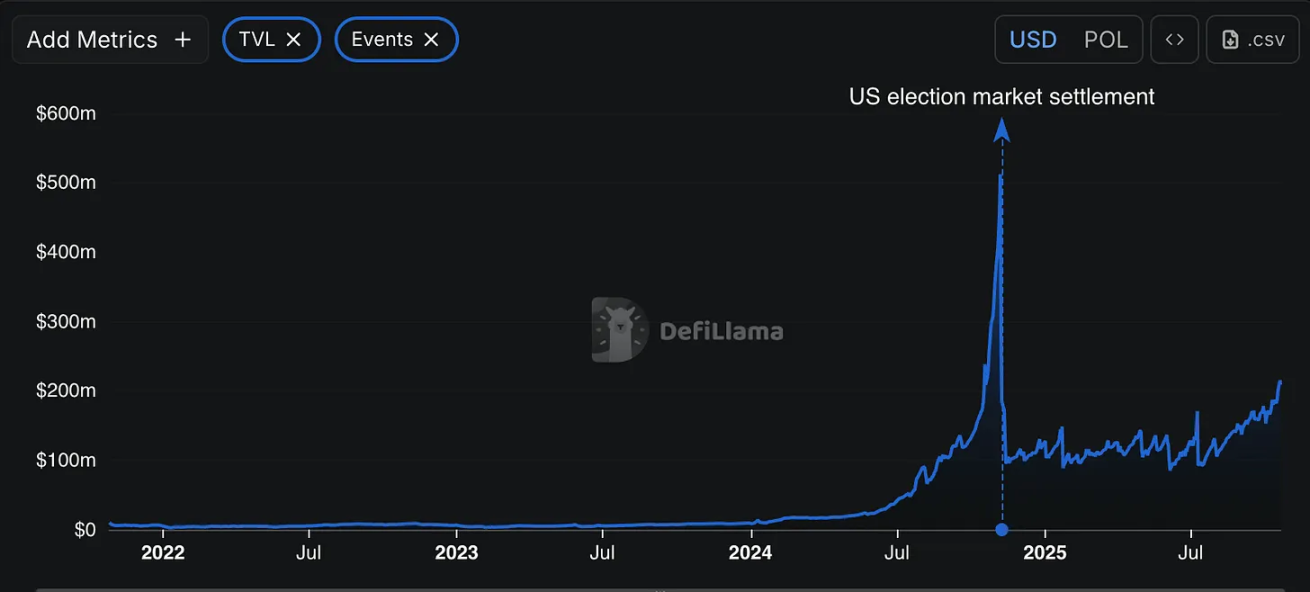

Polymarket became an undeniable presence: users bet over $3.5 billion on the election results. The platform consistently showed Trump leading, while traditional polls indicated a tight race.

A French trader bet tens of millions of dollars on Trump's victory. Reportedly, when Trump was ultimately elected, this trader netted $85 million.

Polymarket's predictive accuracy ultimately surpassed that of traditional polls.

@defillama.com

Then, the raid came.

In November 2024, a week after the election.

Before dawn, FBI agents raided Coplan's apartment in New York, confiscating his phone and electronic devices. At 26, Coplan was neither arrested nor charged.

He responded on X (formerly Twitter): "New phone, who dis?" (referring to his old phone being confiscated)

Polymarket issued a statement claiming this was "an obvious political retaliation initiated by the outgoing government."

The U.S. Department of Justice and CFTC subsequently launched investigations.

This platform, which had just proven its predictive ability, suddenly faced scrutiny from multiple federal agencies overnight.

But Coplan did not stop; he continued to push the platform's development.

In the U.S., situations often change unexpectedly: investigations initiated during the Biden administration abruptly halted when the Trump administration took office.

In July 2025, the Department of Justice and CFTC officially terminated their investigations, filing no charges and imposing no additional penalties.

In the same month, Polymarket acquired QCEX — a CFTC-licensed exchange and clearinghouse — for $112 million. This acquisition allowed Coplan to achieve his core goal since the 2022 settlement: to find a framework for the platform's legal operation in the U.S.

In August 2025, former President Trump's son Donald Trump Jr. joined Polymarket as an advisor through his investment company 1789 Capital. This company, which had been raided during a previous administration, now received support from a family member of the next government.

In September 2025, Polymarket's parent company Blockratize filed documents with the U.S. SEC, mentioning "other warrants" — a term that typically signals a token issuance in cryptocurrency projects.

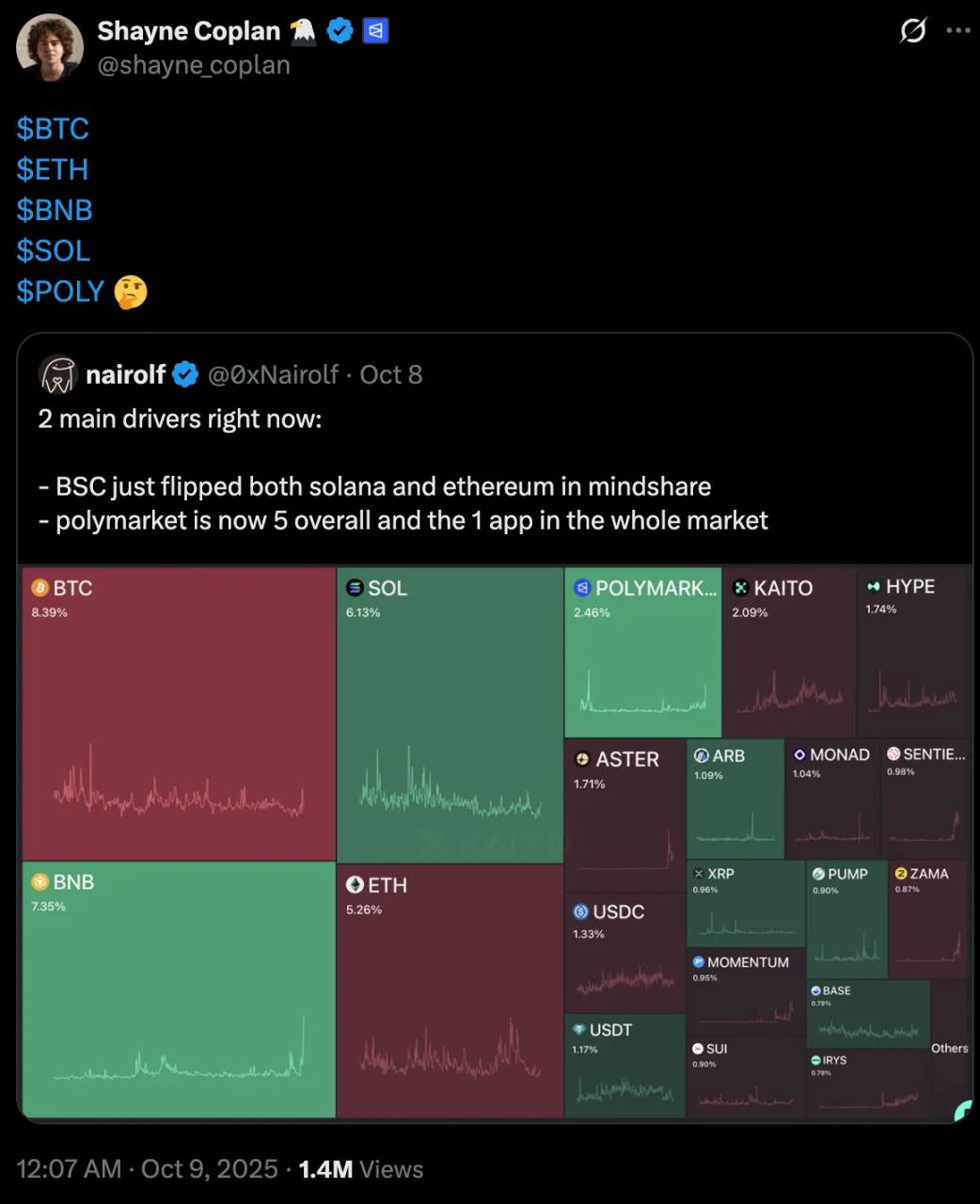

Coplan posted " $POLY" on X, accompanied by the icons of $BTC and $ETH. The implication was clear: the platform was about to launch a token.

@Shayne Coplan

In October 2025, the long-awaited news was finally announced: the parent company of the New York Stock Exchange, Intercontinental Exchange (ICE), invested $2 billion in Polymarket at a pre-money valuation of $8 billion.

ICE CEO Jeffrey Sprecher's wife is Kelly Loeffler — a former senator, head of the U.S. Small Business Administration, and a member of Trump's cabinet.

This collaboration also included a plan: ICE would distribute Polymarket's data globally and collaborate on financial tokenization projects.

A project initiated by a broke dropout youth in a bathroom ultimately became part of the mainstream system on Wall Street.

At 27, Shayne Coplan successfully entered the Bloomberg Billionaires Index, becoming the youngest self-made billionaire tracked by the index.

@Bloomberg

What problem did Polymarket ultimately solve?

Polymarket overcame the challenges that previous prediction markets had failed to break through.

Early prediction platforms (like Intrade) had already proven the feasibility of this model — Intrade accurately predicted the 2008 and 2012 U.S. elections but shut down in 2013 — yet these platforms remained limited to niche circles, with complex mechanisms and an academic feel, making it difficult to reach the general public.

Polymarket, however, made prediction markets as easy to understand as "entertainment."

Its interface is simple, and the range of questions is vast: from serious topics (Will the Federal Reserve cut interest rates?) to light-hearted ones (Will Taylor Swift and Travis Kelce get engaged in 2025?). This combination significantly increased user engagement.

More importantly, the platform accurately captured the changing habits of information acquisition.

Traditional media tells you "what to think," polls tell you "what others think," while Polymarket tells you "the views people are willing to back with money."

For users increasingly distrustful of traditional institutions, this distinction is crucial.

Today, Polymarket has over 1.3 million users, with a cumulative trading volume of about $20 billion and a monthly trading volume consistently above $1 billion.

The 2024 election thoroughly demonstrated the platform's potential: while mainstream polls showed a tight race, Polymarket users consistently leaned towards a Trump victory, and the final result validated this prediction.

Although some argue whether the platform aggregates "real wisdom" or merely reflects "the political preferences of the cryptocurrency user base," this outcome undoubtedly confirms the core claim of prediction markets — views backed by money are often closer to the truth.

Of course, as a prediction market, Polymarket occasionally needs to address some "philosophical" questions, such as "What is a suit?" In June 2025, bettors wagered nearly $79 million on whether Ukrainian President Volodymyr Zelenskyy would wear a suit before July. When a photo of Zelenskyy at a NATO meeting surfaced — wearing a black matching jacket and trousers, paired with a collared shirt but sporting sneakers — the internet erupted: Are the shoes wrong? Does that count as a suit? Is the fabric matching but the cut casual considered a suit? The platform invited fashion commentator Derek Guy as an expert, and his conclusion was "both a suit and not a suit," which effectively left the question unresolved. The outcome of this market ultimately sparked two controversies. This is the cost of "trustless, decentralized verification of real events": it may ultimately require a "blockchain oracle" to adjudicate the semantics of clothing, with the $79 million wager hanging in the balance.

The Future: Tokens, Challenges, and Greater Ambitions

At 27, Shayne Coplan has proven his core belief — that prediction markets hold significant value.

The hint of tokens indicates that the next phase of the platform has begun. The launch of the $POLY token will propel Polymarket from an "experimental prediction market" to a "complete crypto ecosystem."

Token holders may gain governance rights, share in transaction fees, and access special platform features. Specific details have yet to be announced, but the direction of development is quite clear.

However, the token strategy also carries risks: it may draw regulatory scrutiny just as Polymarket has gained legitimacy; it could also alienate users who view the platform as a "prediction tool" rather than a "crypto project."

From a strategic perspective, this decision makes sense: issuing tokens in cryptocurrency projects is intended to decentralize ownership, incentivize user participation, and align the interests of the platform and its users.

If prediction markets truly represent "the future of information discovery," then tokens might accelerate their adoption while rewarding early supporters.

Coplan's recent plans are quite pragmatic: every Sunday, he watches football games while testing the beta version of Polymarket's U.S. app.

Work continues, bets keep pouring in, and the market consistently reveals what people "truly believe."

From a small project in a bathroom to a company valued at $9 billion, Coplan took five years.

The next five years will determine whether prediction markets can achieve greater breakthroughs — becoming "the new infrastructure of collective wisdom" or even "a marketplace for the truth itself."

And now, this 27-year-old billionaire is focused on "getting things right."

The bathroom office is a thing of the past, financial difficulties have been resolved, and regulatory disputes have temporarily subsided.

What has supported him to this point is still that initial entrepreneurial spirit: prediction markets are a good idea and should not just remain in a white paper.

The market has proven him right.

What the future holds will be answered by time.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。