U.S. President Donald Trump and Australian Prime Minister Anthony Albanese signed an $8.5 billion rare earths agreement on Monday, countering the recent move by China to tighten controls on its vast critical minerals supply chain. Bitcoin didn’t react immediately, but by Tuesday afternoon, the cryptocurrency had regained $113K after falling as low as $107K in overnight trading.

Less than two weeks ago, China sneaked in five additional minerals onto its list of seven rare earths that require government permission prior to exportation. Beijing’s announcement was followed by an uproar in Washington, where Trump threatened 100% tariffs on the East Asian nation if it didn’t reverse course. The president’s threat triggered the largest crypto liquidation event in history, with more than $19 billion wiped out.

“One of the Policies that we are calculating at this moment is a massive increase of Tariffs on Chinese products coming into the United States of America,” Trump said.

But long before Beijing’s announcement, the Americans were already wary of China’s uneven dominance in the industry. The Asian country controls roughly 90% of all rare earths, which are used in a plethora of products, from smartphones to electric vehicles.

Washington’s concerns over Beijing’s intentions led to private meetings with Australia, which have been ongoing for the past “four or five months” according to the president. And finally on Monday, Trump and Albanese closed what has now turned out to be an $8.5 billion deal, a move that appears to have restored confidence in Washington’s ability to de-risk itself against dependency on critical minerals from China.

“In about a year from now, we’ll have so much critical mineral and rare earths that you won’t know what to do with them,” Trump said at the official White House signing event with Albanese.

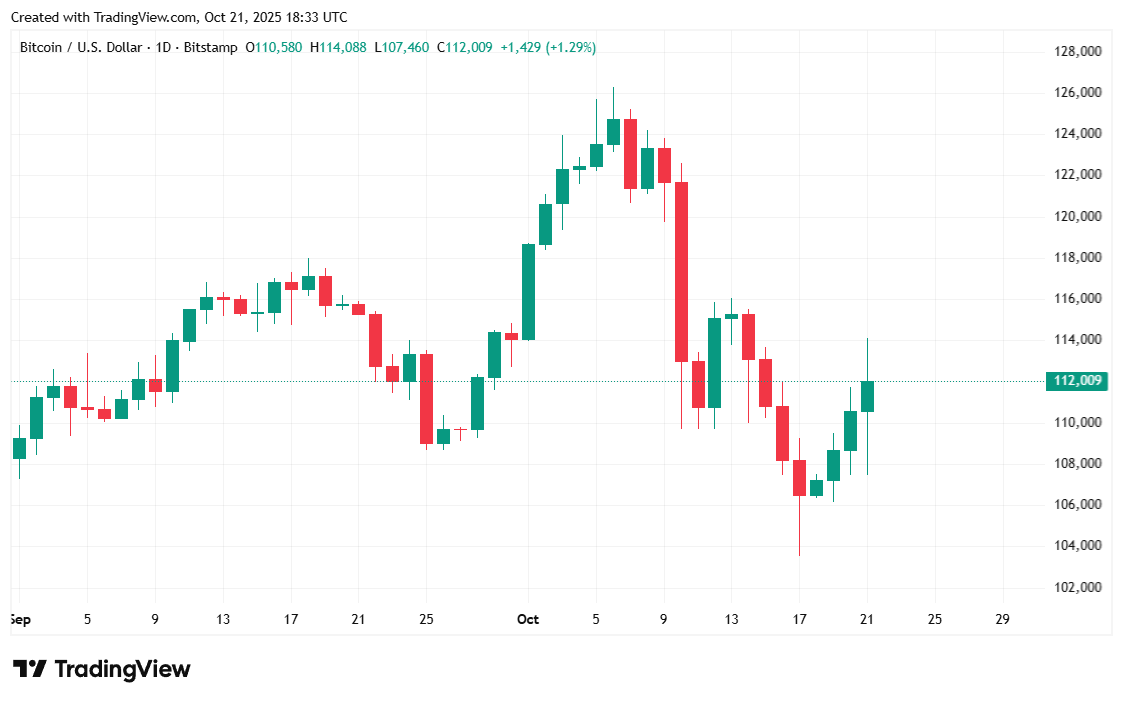

Bitcoin was priced at $111,936.71 at the time of writing, up 1.13% for the day, after trading as low as $107,534.75 overnight and topping $113,996.35 in the early afternoon, Coinmarketcap data shows. However, the cryptocurrency is still 1.27% in the red on a weekly basis.

( BTC price / Trading View)

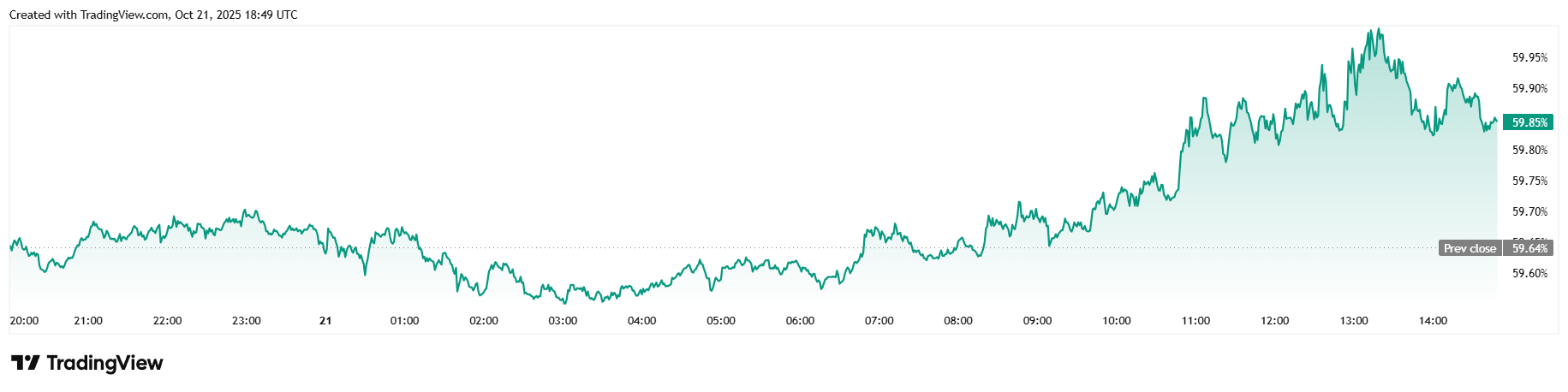

Twenty-four-hour trading volume jumped 44.13% to $90.33 billion and market capitalization rose roughly 1% to $2.22 trillion. Bitcoin dominance was also up, gaining 0.35% to reach 59.85%.

( BTC dominance / Trading View)

Total futures open interest inched up 0.90% to reach $72.90 billion according to Coinglass data. Liquidations climbed to $232.45 million for the day, almost doubling yesterday’s total. Most of that came from the $142.75 million in short liquidations, with the remainder consisting of $89.70 million in losses from long investors.

- Why did Bitcoin rise to $113K?

Bitcoin rebounded after the U.S. and Australia signed an $8.5 billion rare earths deal seen as a counter to China. - What’s the purpose of the agreement?

The deal aims to reduce U.S. dependence on China, which currently controls about 90% of global rare earth production. - How did the market react?

Crypto traders viewed the pact as a de-risking win, pushing bitcoin and sentiment higher after recent volatility. - Who announced the partnership?

U.S. President Donald Trump and Australian Prime Minister Anthony Albanese unveiled the agreement at the White House.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。