A little over two weeks since bitcoin printed a fresh all-time high of $126K, analysts are already predicting a drop below six figures, a scenario that appeared increasingly likely on Wednesday, as the cryptocurrency followed stocks into the red, dipping 4% over 24 hours.

“I am now thinking a dip below 100k seems inevitable,” says Geoffrey Kendrick, head of digital assets research at London-based Standard Chartered Bank. “Although the dump may be short-lived,” he adds. Kendrick made the comments in a public newsletter circulated early Wednesday morning.

Bitcoin has consistently maintained a six-figure sticker price since May 2025, a period of five months. But ever since Trump threatened China with a “massive increase” in tariffs, triggering the largest liquidation event in crypto history, BTC has struggled to maintain a positive trajectory, dropping as low as $104K over the past week.

And now, at least according to Kendrick, it will likely fall below the $100K threshold, although he admits, it won’t stay there for long. “Spoiler alert – it will be a buying opportunity,” he says. Indeed, just a few days ago, Michael Saylor’s bitcoin treasury firm Strategy, snapped up 168 BTC at roughly $112,051 per coin. The company now holds 640,418 BTC, currently worth about $69 billion. If bitcoin rallies back to $126K, that same stash will be worth more than $80 billion.

“Stay nimble and ready to buy the dip below 100k if it comes,” Kendrick says. “It may be the last time Bitcoin is EVER below 100k.”

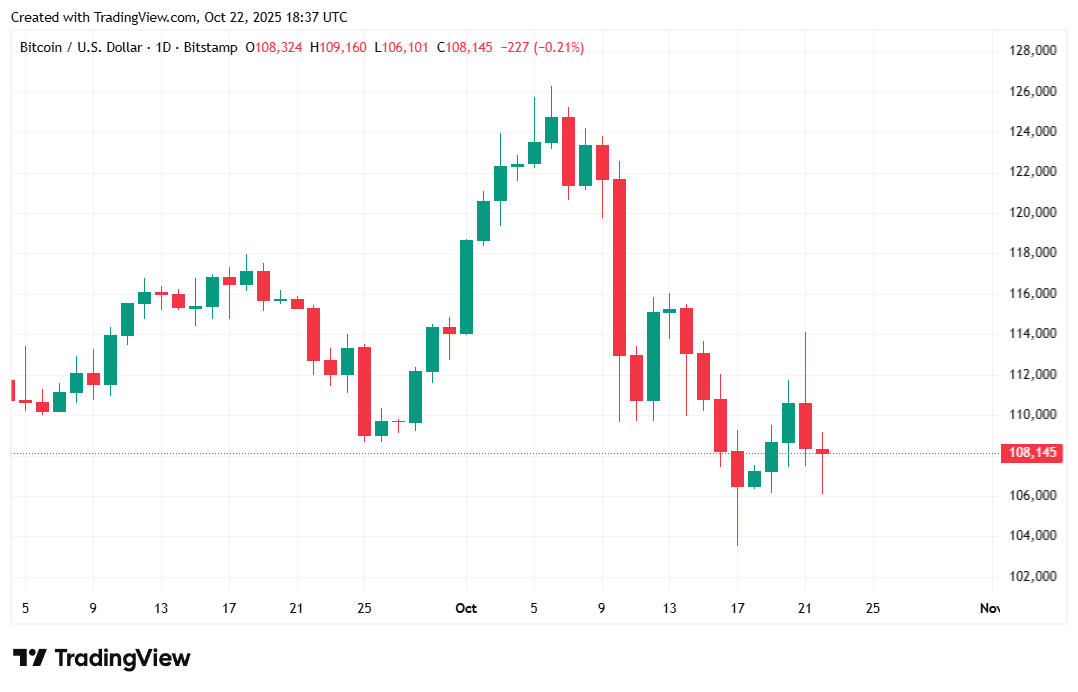

Bitcoin was trading at $107,996.08 at the time of writing, down 3.59% over 24 hours and lower by 3.07% for the week, according to Coinmarketcap data. Intraday fluctuations ranged from $106,960.11 to $112,230.76.

( BTC price / Trading View)

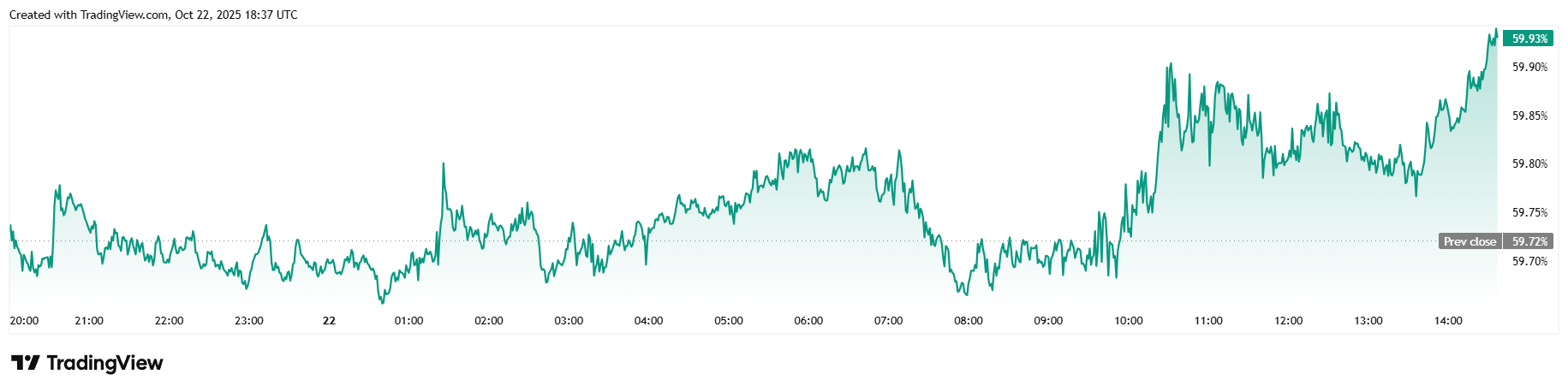

Twenty-four-hour trading volume eased 3.8% to $87.12 billion, and market capitalization tracked price, dropping 3.42% to $2.15 trillion. Bitcoin dominance climbed 0.33% since Tuesday, reaching 59.92% at the time of reporting.

( BTC dominance / Trading View)

Total futures open interest slipped to $68.55 billion, a 5.96% decrease over 24 hours, Coinglass data shows. Liquidations came in at $186.52 million for the day, dominated by losses from long investors to the tune of $155 million. Short sellers were mostly spared but still recorded a solid $31.51 million in liquidations.

- Why did Bitcoin fall to $108K?

Rising U.S.–China trade tensions and a broader market sell-off pushed both stocks and crypto into decline. - What are analysts saying about Bitcoin’s outlook?

Standard Chartered’s Geoffrey Kendrick predicts a temporary dip below $100K, calling it a prime buying opportunity. - How severe is the market pullback?

BTC is down about 3.6% in 24 hours with $186M in liquidations, mostly from long positions. - What’s next for investors?

Kendrick believes any dip under $100K could be bitcoin’s last before another rally.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。