Tesla's third-quarter earnings report fell short of expectations, causing tension in the U.S. stock market. Coupled with Trump's consideration of restrictions on software exports to China, this has increased pessimism in the market. The biggest challenge may arise after the CME opens in the morning, as well as whether the Chinese government will take more aggressive countermeasures.

Currently, the U.S. stock market and $BTC remain highly correlated, which means that a decline in the U.S. stock market will also affect Bitcoin's price movement, even though BTC itself does not have any negative news.

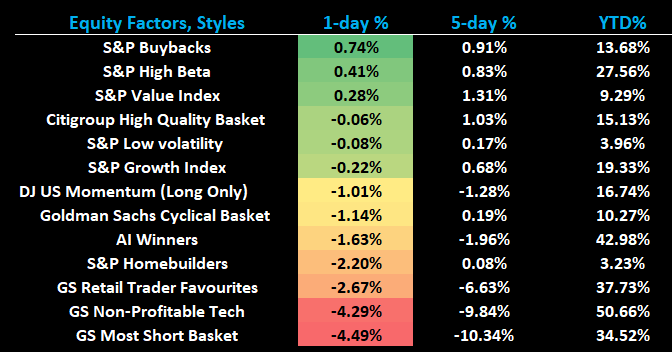

In terms of style attributes, Bitcoin is more akin to high β + momentum assets (High Beta + Momentum Trade). This means that when High Beta, AI Winners, Non-Profitable Tech, Retail Favorites, and Most Short Basket decline, BTC will also face pressure.

BTC is one of the first assets to rise and the first to be liquidated during risk appetite cycles. This is the fundamental reason why BTC has recently fallen in sync with AI Winners and Non-Profitable Tech stocks.

In simple terms, BTC is still highly correlated with tech stocks. If tech stocks face setbacks and decline, BTC cannot escape that fate. (The weekly report pinned at the top explains this clearly.)

This article is sponsored by #Bitget | @Bitget_zh

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。