Author: Eric, Foresight News

On the evening of the 19th Beijing time, Bankless co-founder David Hoffman posted on X to "mourn" the departure of Dankrad Feist, the longest-serving researcher at the Ethereum Foundation, who has chosen to leave Ethereum to join the stablecoin L1 Tempo.

David Hoffman believes that the issue of profit-driven companies appropriating talent cultivated by the Ethereum open-source community should not be underestimated, stating that these companies will not bring greater benefits to Ethereum as they claim. David Hoffman bluntly expressed, "In my view, the purpose of Tempo's existence is to intercept the trillions of dollars in stablecoins expected to flow in over the next decade and place them on their private blockchain. Of course, this will enlarge the pie, but Tempo still intends to take as much of that pie as possible." He believes that Tempo will be limited by compliance issues regardless, and even issuing tokens will not resolve this. While both Tempo and Ethereum will bring change to the world, only Ethereum is best suited to become a trusted, neutral global settlement layer, without shareholders and not bound by legal constraints.

The "disappointment" with Ethereum began when its price performance started lagging behind Bitcoin in this cycle, but over time, it has become apparent that the exodus of talented individuals from the Ethereum community seems to have become an irreversible trend. When dreams conflict with interests, many ultimately choose the latter, which is precisely what many in the industry have been concerned about…

Dankrad Feist is not the first, nor will he be the last

On the 17th of this month, Dankrad Feist announced on X that he would be joining Tempo while continuing to serve as a research advisor for three strategic plans of the Ethereum Foundation's protocol cluster (scaling L1, expanding Blob, and improving user experience). Dankrad Feist stated, "Ethereum has powerful values and technical choices that make it unique. Tempo will be a great complement, built on similar technologies and values, while being able to break boundaries in scale and speed. I believe this will greatly benefit Ethereum. Tempo's open-source technology can easily be reintegrated into Ethereum, benefiting the entire ecosystem."

According to LinkedIn, Dankrad Feist officially became an Ethereum researcher in 2019, primarily researching sharding technology to scale the Ethereum mainnet. The Danksharding, one of the core parts of Ethereum's scaling roadmap, is named after him. Danksharding is a key technical path for Ethereum to achieve high throughput and low-cost transactions, widely regarded by the community as the most important upgrade direction after "Ethereum 2.0."

Dankrad Feist promoted the precursor version of Danksharding, Proto-Danksharding (EIP-4844), which introduced a blob transaction type, providing a cheaper and more efficient data availability layer for Rollups, significantly reducing the data publishing costs for Rollups.

Additionally, he publicly debated the MEV issue with Geth development lead Péter Szilágyi, ultimately prompting Vitalik to step in and coordinate, raising the community's awareness of MEV mitigation mechanisms (such as PBS, Proposer-Builder Separation).

Tempo researcher Mallesh Pai introduced the members joining Tempo in September, including former OP Labs CEO and ETHGlobal co-founder Liam Horne.

Before Dankrad Feist, the industry was "surprised" by Danny Ryan, who co-founded Etherealize, which secured $40 million in funding. As a former core member of the Ethereum Foundation known as the "Chief Engineer of Ethereum 2.0," he announced an indefinite exit just six months after joining Etherealize in September 2024. However, given the similarity between Etherealize and ConsenSys, founded by Ethereum co-founder Joseph Lubin, who left due to commercialization disputes 11 years ago, Danny Ryan received understanding from most people.

What truly worries David Hoffman are companies like Tempo and Paradigm. Notable Ethereum developer Federico Carrone expressed similar views, retweeting David Hoffman's post about Dankrad Feist joining Tempo and stating that he has been saying for the past two years that Paradigm's influence within Ethereum could become a tail risk for the entire ecosystem.

Federico Carrone wrote that the sole goal of venture capital funds is to maximize returns for LPs, and Ethereum should not form a deep technical dependency on a venture capital firm that is playing with extremely high strategic stakes. After the FTX collapse, Paradigm almost erased all brand exposure related to cryptocurrencies and publicly shifted focus to AI. Carrone believes this is enough to prove his point.

After Trump returned to the White House, Paradigm re-entered the Web3 space, aggressively recruiting top researchers from the community and funding key open-source libraries for Ethereum, as well as supporting Stripe's launch of Tempo. Carrone believes that while Paradigm claims everything they do benefits Ethereum—more funding, more tools, more testing grounds, and new ideas that can feed back into Ethereum—these are indeed potential benefits, but when companies have excessive visibility and influence over open-source projects, priorities can shift from the community's long-term vision to corporate interests.

Ethereum's technical debt is accumulating

The simple loss of talent from the Ethereum open-source community may not raise widespread concern, but if the loss of talent is accompanied by the accumulation of technical debt, it warrants high vigilance.

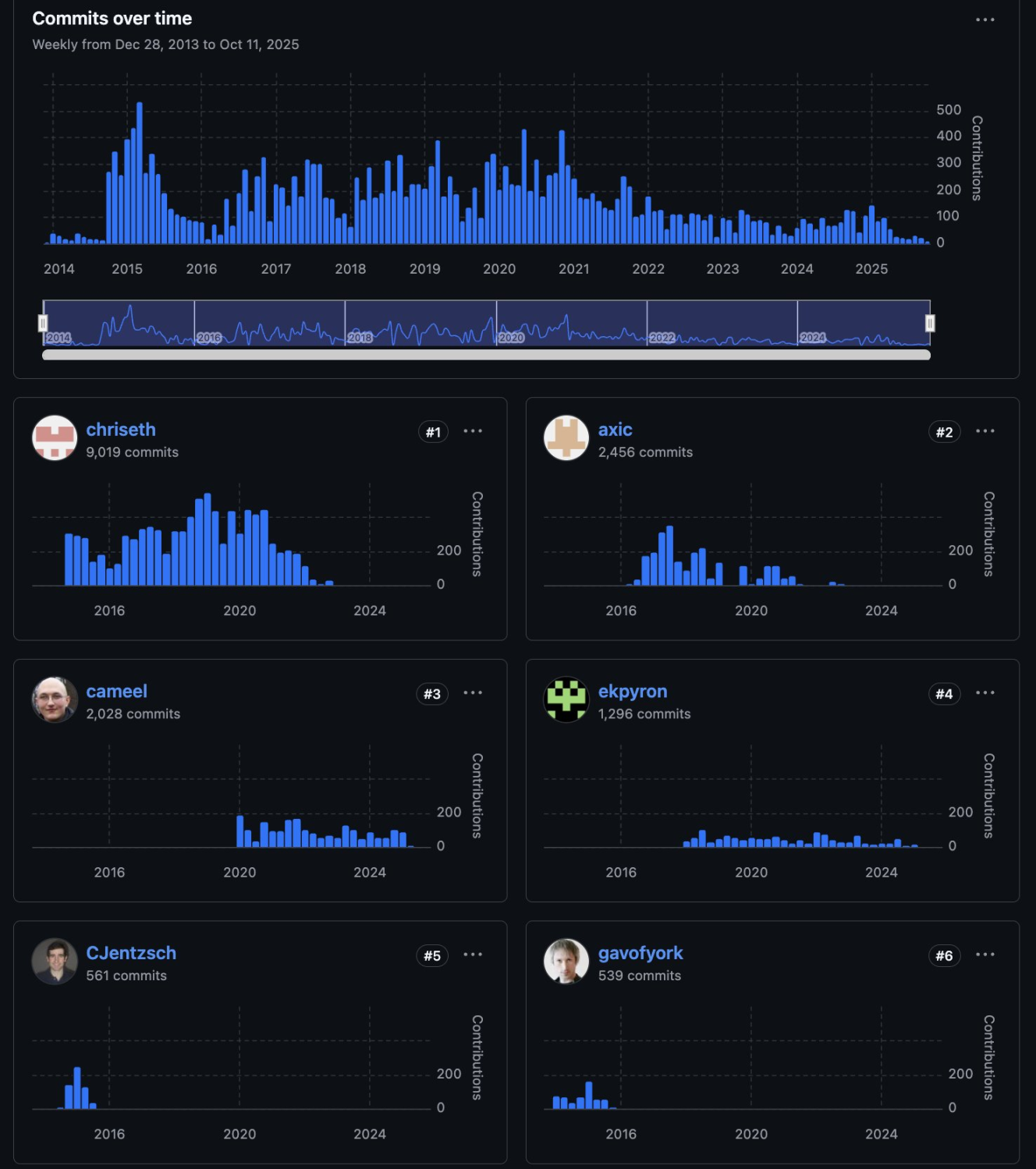

A week ago, a community user shared a screenshot on X, stating that top contributors to the Solidity language are almost no longer continuing development. Only Cameel is still actively raising new issues and advancing technical progress, but it seems to be merely in maintenance mode. He believes the community needs to invest more resources to support this programming language.

In the comments, some users questioned why energy should be spent on continuing to improve and upgrade Solidity rather than just maintaining it to ensure stability and security. The user who posted explained that even changing the Solidity compiler would not alter any deployed contracts, but it could enhance security, improve the development experience, or support the use of new contracts. From the above image, it can be seen that the activity level of development began to sharply decline from the beginning of the last bull market.

Federico Carrone also expressed his views, stating that what worries him most is that a large number of core tools and libraries built around Solidity may not receive long-term maintenance at all. Even the latest Solidity compiler currently relies on only a handful of developers for support. Additionally, companies related to L2 and ZK technology are scaling back, meaning that the iteration of cutting-edge technology may rely on only a few companies; as the Gas Limit increases, many execution clients have not made substantial improvements in performance, and from the perspective of libraries, it seems that the development teams of these clients are unable to keep up.

Federico Carrone stated, "Ethereum's technical debt is continuously accumulating, not only because the protocol itself must continue to evolve, but also because a large number of dependent libraries and surrounding repositories are in a state of stagnation. The entire ecosystem continues to expand, guarding hundreds of billions of dollars in assets, while parts of its foundation are quietly eroding."

The open-source community cannot simply "run on love"

For an open-source community like Ethereum, which carries a significant amount of quantifiable value, balancing "running on love" and economic incentives is a problem with no reference cases. This should be a matter of great concern for the Ethereum Foundation, but it seems to have been overlooked.

Péter Szilágyi, who joined the Ethereum Foundation in 2015 and is responsible for Geth development and maintenance, clearly pointed out three of his biggest disappointments in a letter to the leadership of the Ethereum Foundation a year and a half ago: being portrayed as a leader externally but marginalized internally; income being severely disproportionate to Ethereum's market value growth; and Vitalik and a small group around him having too much influence over the Ethereum ecosystem.

At the end of 2024, Péter Szilágyi discovered that the Ethereum Foundation was secretly incubating an independent Geth fork team, and later was dismissed due to disputes with the Ethereum Foundation, having repeatedly refused rehire offers. Subsequently, the Ethereum Foundation even proposed to pay Péter Szilágyi $5 million to make Geth independent from the foundation, but he refused. Currently, Péter Szilágyi is still maintaining the Geth codebase as an independent contributor.

Rumors of internal corruption within the Ethereum Foundation have been rampant, but this is actually a problem that should have been anticipated since the foundation's establishment. As the saying goes, "where there are people, there are conflicts." We cannot eliminate human greed, but we also cannot allow Ethereum to gradually lose its core values due to commercialization.

Ethereum's market value of hundreds of billions of dollars and its years of carrying trillions of dollars in value transfer on-chain are based on infrastructure built by professional technical teams, centered on a permissionless open-source spirit, and brought about by the commercialization of numerous enterprises. However, maintaining such a massive system requires a large number of personnel, and as we have said, these people are leaving due to disappointment or choosing to join other projects for economic benefits.

The Ethereum Foundation has undergone significant reforms this year, but so far, it does not seem to have produced any remarkable results. Ethereum can still be called a world computer, and its potential for commercial applications is still being explored by brilliant teams. However, as the foundation of all this, Ethereum cannot continue to dishearten those who are still persevering for their ideals.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。