Original Title: "Cryptocurrency Mining Electricity Cost Management: Where Are the Cheapest Electricity Prices in the World?"

Original Author: Dr. Chai Talks Crypto

In the world of cryptocurrency, electricity is gold. You may know how much cryptocurrency a mining machine can mine, but what truly determines a miner's profit or loss is often not the hash rate, but rather — the electricity cost.

Many newcomers initially focus only on "how many bitcoins can be mined daily," neglecting that electricity costs are the biggest burden on profits. Today, Dr. Chai will systematically break down the components of mining electricity costs, the global distribution of electricity prices, and how ordinary miners can find the optimal solution.

01 Electricity Costs: The First Lifeline for Miners

According to the Cambridge Bitcoin Electricity Consumption Index, the total electricity consumption of the Bitcoin network exceeds 120 TWh annually, nearly equivalent to the entire national electricity consumption of Greece.

What does this mean for miners? It means that for every $0.01/kWh increase in electricity prices, the payback period could be extended by several months. Electricity prices determine whether miners can survive in a bear market and also dictate who can earn more during a bull market.

In countries with high electricity costs (such as Germany and Japan), large-scale mining operations are almost nonexistent; whereas regions with electricity prices as low as $0.03/kWh — such as Texas in the USA, Kazakhstan, Argentina, the UAE, and certain hydropower areas in Laos — are hotspots for global mining operations.

Everyday Analogy

Electricity costs are like the "fuel costs" for mining gold; the mining machine is the vehicle, and the lower the fuel price, the farther it can run and the more it can earn.

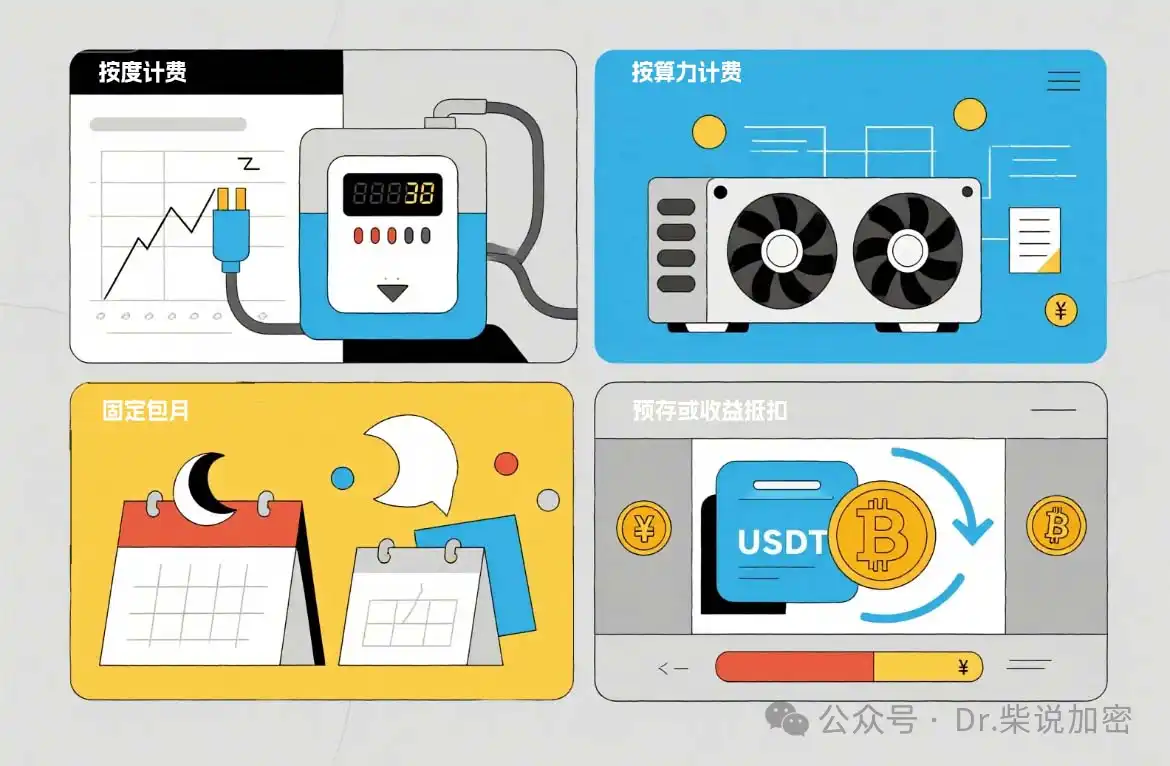

02 Four Models of Electricity Payment for Miners

Self-built Mining Farms: Lowest Electricity Prices, Highest Barriers

Large miners or institutional players often choose to build their own mining farms. They sign contracts directly with electricity companies, with metering and transparent settlement.

The advantage is the lowest electricity prices, with some areas as low as $0.025–0.035/kWh;

The disadvantage is the high barrier to entry, requiring considerations for land, heat dissipation, transformers, compliance, and maintenance.

For example, some mining farms in Texas successfully reduce costs by utilizing wind energy and stranded electricity resources, achieving electricity prices over 40% lower than traditional energy sources.

Hosted Mining: Worry-Free but Not Cheap

Miners without the conditions to build their own farms often choose hosted mining — handing over their mining machines to professional institutions for operation and maintenance, paying monthly electricity and management fees.

The advantage is that it is hassle-free;

The disadvantage is that electricity prices are relatively high (about $0.05–$0.08/kWh) and subject to policy risks.

For instance, after the Kazakh government tightened energy regulations in 2023, hosted electricity prices generally increased by 20%–30%.

Cloud Mining: A Light Asset Model with "Bundled" Electricity Costs

Cloud mining is the entry point for ordinary investors. Platforms virtualize and sell computing power, allowing users to participate in mining by purchasing shares of computing power, with electricity costs generally included in the contract or settled based on computing power.

Advantages: Low barrier to entry, no maintenance required.

Disadvantages: Electricity prices are higher than actual electricity costs, and users cannot independently turn machines on or off.

For example, the KuMining platform launched by KuCoin allows users to obtain real BTC, DOGE, and LTC combined computing power with a single click, while enjoying low-cost energy and real-time profit settlement, significantly lowering the barriers to mining.

Home Mining: More About Interest Than Profit

Some miners choose to plug in their mining machines directly at home. Electricity costs are calculated at residential rates (about $0.16–$0.20/kWh in the USA), nearly three times that of industrial electricity.

The advantage of home mining is flexibility and control, with the ability to turn machines on and off at will; however, due to the high electricity prices, it is more like a way to experience the fun of mining rather than a stable profit model.

03 Electricity Cost Settlement Methods and Cycles

· Metered Billing ($0.0x/kWh): The most transparent and fair method, suitable for self-built or large hosted operations.

· Hash Rate Billing ($/TH/day): A common model in cloud mining, convenient but with higher electricity costs.

· Fixed Monthly Package: Simplifies settlement, but full payment is required even during downtime.

· Prepayment or Profit Deduction: A popular practice on cloud mining platforms, convenient but requires attention to balance and profit fluctuations.

Settlement cycles are usually monthly or prepaid, with some platforms supporting the use of USDT or BTC to offset electricity costs, achieving currency-based management.

04 How Electricity Price Differences Change Miner Strategies

· Metered Billing Miners: Tend to use electricity during off-peak hours at night, flexibly turning machines on and off;

· Hosted and Cloud Mining Miners: Passively bear electricity price fluctuations;

· Fixed Monthly Miners: Pursue 24-hour full-load operation to lower costs.

Smart electricity management platforms even support dynamic scheduling — automatically shutting down when electricity prices are too high to protect profit margins. Such solutions are becoming standard for large mining farms.

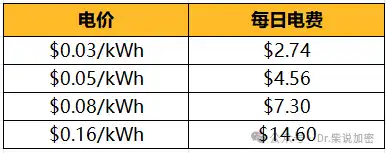

Simple Calculation: The Price Difference

Taking a mining machine with a power consumption of 3,800W as an example:

Under the same revenue, the profits of home miners may be directly consumed. This is why "finding cheap electricity resources" is almost the ultimate task for every miner.

05 Distribution of the Cheapest Electricity Prices Globally

Based on data from the International Energy Agency (IEA) and various mining farms:

06 Beyond Hash Rate, Electricity Prices Reign Supreme

The essence of mining is the competition between computing power and electricity. The more concentrated the computing power, the fiercer the energy competition. In the future, the focus of mining competition will no longer be "who has more mining machines," but rather who can obtain cheaper, more stable, and cleaner electricity.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。