In October 2025, MrBeast submitted a trademark application named "MrBeast Financial" to the United States Patent and Trademark Office.

This 27-year-old, who can bury himself alive for video content in the real world and has 450 million fans in the virtual world, plans to expand his business empire from fast food and snacks to banking, investment, and even cryptocurrency trading platforms.

According to the application documents, what he wants to create is a SaaS platform that covers cryptocurrency payment processing, microloans, and investment management. MrBeast and his business empire, valued at $5 billion, are preparing to enter a field tightly locked by trust, risk, and regulation: finance.

This is not an unexpected crossover. He already owns the snack brand Feastables and the virtual restaurant chain MrBeast Burger. But financial services are entirely different; they touch on people's most sensitive nerves.

More subtly, just a year ago, he was thrust into the spotlight due to controversies surrounding cryptocurrency investments. Blockchain researchers accused him of using his influence to "scam" multiple projects, profiting over ten million dollars.

Now, this controversial traffic giant is set to lead his hundreds of millions of predominantly Gen Z fans into a strictly regulated financial world.

This is a gamble. The stakes are his reputation, and the chips are a generation's trust. The outcome of this gamble will redefine the relationship between traffic, finance, and trust.

The Exodus of Gen Z Banking

Traditional banks are losing their future.

Young people no longer walk into those halls built with marble and bulletproof glass. They switch banks two to three times more frequently than their parents, not for higher deposit rates, but for better digital experiences. Only 16% of Gen Z express "very high trust" in traditional banks, a figure nearly double that of millennials and almost three times that of baby boomers.

For them, who grew up in a world of algorithms and screens, a bank teller's suit is far less reliable than a smooth app interface.

Traditional banks took a century to build trust mechanisms; physical branches symbolize "accessibility," brand history represents "endurance," government backing means "no default," and marble counters and suited staff convey "professionalism" and "stability." These visual symbols and institutional arrangements were indeed effective in the past.

Bank of America | Source: Bloomberg

But for Gen Z, they live in a world of high-frequency interaction and instant feedback. What they need is not static, institutional proof of trust, but dynamic, perceptible trust experiences. Whether a bank has a century of history is far less important to them than whether the app's interface is user-friendly, customer service is responsive, and products can be customized to individual needs.

The deeper reason lies in Gen Z's deep-rooted dissatisfaction with the traditional financial system. They grew up after the 2008 financial crisis, witnessing how big banks were bailed out during the crisis while ordinary people bore the costs of unemployment and wealth shrinkage. They have seen financial institutions embroiled in data breach scandals and watched Wall Street elites abandon moral standards in the face of profit. These experiences have shaped their instinctive skepticism towards traditional finance.

The vast majority of Gen Z are influenced by financial influencers' recommendations; they discover new financial products through social media, learn investment knowledge on Xiaohongshu, and follow financial bloggers on Douyin. Behind these behavioral patterns is a collapse and reconstruction of trust foundations.

Gen Z is not looking for "better banks"; they are seeking something entirely different: an ecosystem that seamlessly integrates financial services, social experiences, and personal values. They want finance to no longer be a cold numerical game but a partner that understands, responds to, and even represents their values.

This is the opportunity MrBeast sees.

His relationship with his fans has long transcended the traditional brand-consumer relationship, becoming a quasi-social relationship. Social media researchers refer to this phenomenon as "para-social interaction," where audiences develop a one-sided but strong emotional connection through continuous engagement with a media figure, as if this person is a friend in their lives.

MrBeast understands this well.

The videos he releases weekly are carefully orchestrated performances of wealth redistribution. Whether it's challenging 100 kids to take on the world's strongest man, having strangers survive 100 days in a nuclear bunker to win $500,000, or burying himself alive for 50 hours, these extreme challenges are backed by continuous cash giveaways.

The cash, cars, and houses he gives away total tens of millions of dollars. These acts of giving are not mere marketing strategies; they are content in themselves, continuously fulfilling the trust contract between him and his fans.

MrBeast challenges himself to be buried alive for 50 hours | Source: Instagram

Each giveaway proves to fans that he means what he says, that his promises are real, and that he is willing to share the money he earns. This "visible generosity" is more persuasive to Gen Z than any brand declaration.

In 2024, MrBeast partnered with fintech company MoneyLion to launch a campaign giving away $4.2 million. Young users willingly downloaded the MoneyLion app because they trusted MrBeast. They were not choosing a financial product; they were following someone they trusted.

The success of this campaign opened MrBeast's eyes to a larger possibility: if he could directly convert traffic into financial services, cutting out the middleman, the monetization efficiency would reach unprecedented heights.

Traditional banks say, "We have a 100-year history; we have weathered the Great Depression and financial crises; we have government backing."

MrBeast says, "I just gave 100 people $100,000 each."

The former's trust is based on past accumulation, while the latter's trust is based on present performance. The former requires institutional endorsement, while the latter needs algorithmic amplification. The former is static and abstract, while the latter is dynamic and visible.

But the paradox is that Gen Z's distrust of traditional finance stems precisely from the latter's flaws in transparency and ethics. The global trust level in the financial services industry has long ranked low among all sectors, and young people's dissatisfaction with financial institutions largely comes from their moral failures in the face of profit.

So, how can MrBeast, a celebrity who has left a "stain" in the cryptocurrency world, become their financial savior?

The Distance Between "Scalper" and "House"

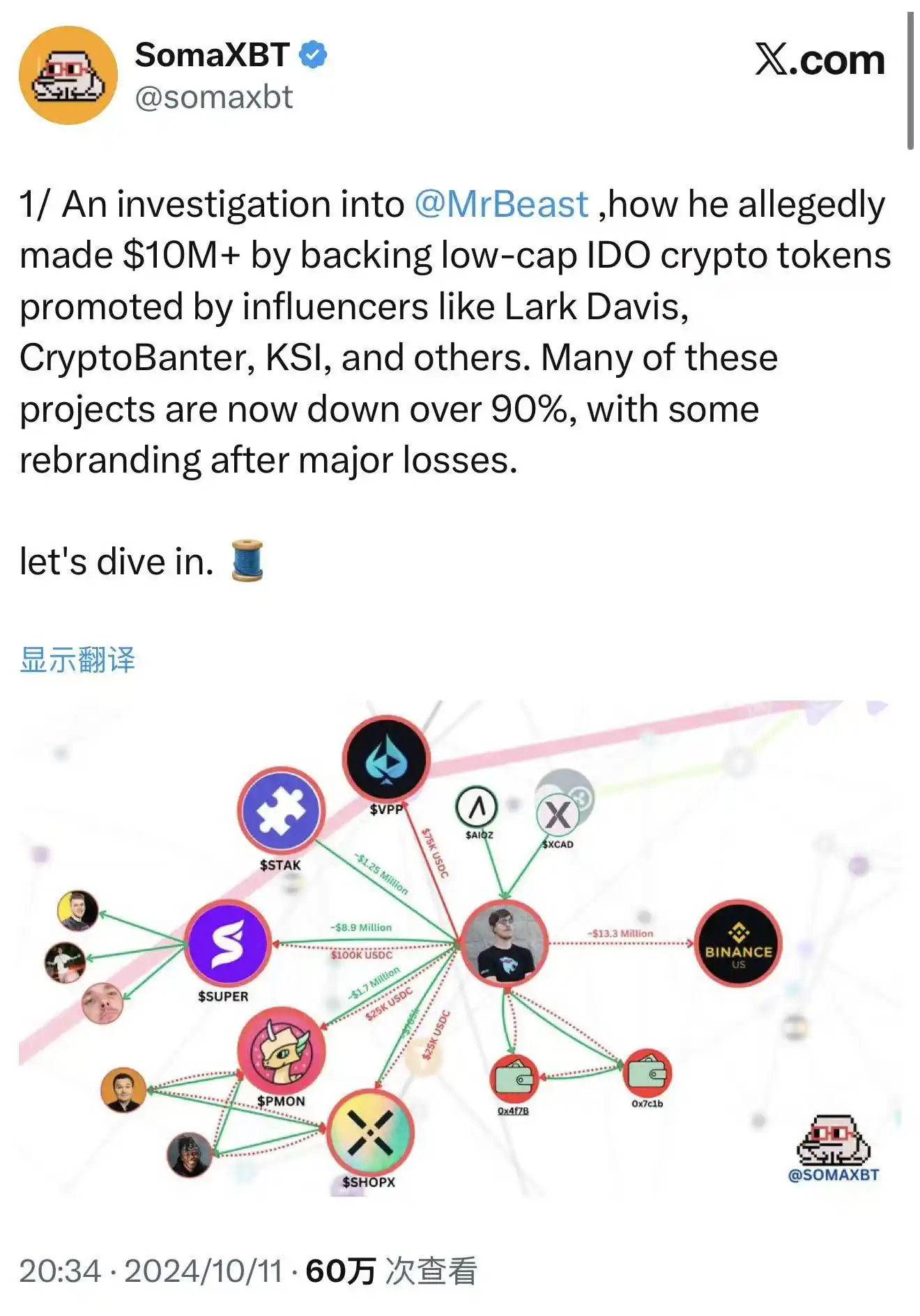

In October 2024, blockchain detective SomaXBT published a detailed report on social platform X, dissecting MrBeast's other side in the crypto world like a scalpel.

The report tracked wallet addresses associated with MrBeast, accusing him of participating in multiple "scam" projects. These accusations are not baseless but are based on publicly transparent transaction records on the blockchain. In a decentralized world, every transaction is permanently recorded, unerasable, and undeniable.

SomaXBT's exposure of MrBeast | Source: X

The most typical case is SuperFarmDAO. MrBeast invested $100,000 during the project's presale phase, receiving 1 million SUPER tokens. He then used his unparalleled influence to promote the project. The token price soared, and market sentiment was ignited. Then, he began to sell.

Ultimately, this $100,000 investment brought him millions in profit. Behind this staggering figure are countless retail investors' losses. They saw MrBeast involved in the project and thought it was a reliable investment opportunity, rushing to buy in. But when he started selling, the token price quickly collapsed, leaving retail investors as the last ones holding the bag.

Similar operational patterns have been repeated in multiple projects, including Polychain Monsters, STAK, VPP, and SHOPX. SomaXBT estimates that MrBeast profited over $10 million from these projects.

From a legal perspective, these operations may not have violated any regulations. MrBeast did not explicitly promise to hold these tokens long-term, nor did he violate any clear securities laws. The cryptocurrency market at that time was still in a regulatory gray area, and many rules from traditional financial markets did not fully apply. In traditional stock markets, such behavior could constitute market manipulation and face severe legal penalties. But in the crypto world, there were no such rules.

However, from a moral perspective, these actions sparked considerable controversy. Many in the cryptocurrency community believe that using influence to drive up token prices and then selling is essentially profiting from fans' trust. This not only destroys the long-term value of the projects but also damages the credibility of the entire industry. When major KOLs exploit information asymmetry and influence to profit from retail investors, the market becomes another version of the Wall Street game.

MrBeast's team responded by denying direct involvement, claiming that these investments were managed by third parties and that he was unaware. But this defense seems weak. Even if investment decisions were made by others, his name and influence remain central to attracting retail investors to these projects.

When he mentions a project on social media or features elements of a project in his videos, fans naturally assume it is an endorsement. Regardless of who pulls the trigger, the bullet is marked with his name.

Now, it's October 2025. Less than a year after SomaXBT first publicly released its findings, MrBeast submitted the trademark application for "MrBeast Financial." More intriguingly, the services he plans to offer include "cryptocurrency exchange" and "decentralized exchange operations," precisely the areas that previously sparked controversy.

He seems to want to tell the world that the former "scalper" is now transforming into a compliant "house."

Behind this are two possible business logics that are not mutually exclusive.

The first is a commercial "whitewashing." By establishing a compliant financial platform, he attempts to cover his past speculative history and repackage himself as a responsible financial service provider. This strategy is not uncommon in business history. Many former speculators have transitioned from "barbarians" to "establishment" by establishing legitimate institutions. The founder of JPMorgan was also a radical speculator in his early years but ultimately became one of Wall Street's most respected bankers.

The second is a deeper business logic. He sees a more efficient path to directly convert traffic into financial assets. Rather than earning one-time speculative profits through third-party platforms for investment and trading, it is better to build his own platform and control the entire ecosystem. In this way, he can not only profit from content creation but also take a commission from every financial transaction made by fans, earn interest from every loan, and share profits from every investment.

This is the ultimate form of monetization in the creator economy, transitioning from content monetization to financial monetization, from influence to capital, from fans to customers. If successful, MrBeast will pioneer a brand new business model, becoming the first true "influencer banker."

However, regardless of the logic, he must confront the same issue. The core of finance is trust, and once trust is broken, the cost of rebuilding it is exponential. He needs to convince regulators that someone who once profited from retail investors in the crypto market is now capable, willing, and systematically prepared to protect consumer interests.

Moreover, the sword of Damocles of regulation hangs over his head.

Dancing on the Edge of Regulation

In 2025, cryptocurrency regulation in the United States is undergoing a subtle shift.

On July 31, SEC Chairman Paul Atkins announced the launch of "Project Crypto," aimed at reforming securities laws to promote crypto innovation. This is an important signal. In recent years, the SEC has taken a harsh stance against the cryptocurrency industry, filing lawsuits against several exchanges like Coinbase and Binance, attempting to bring most crypto assets under the securities regulatory framework. But in 2025, the winds have changed.

On September 29, the SEC and CFTC held a historic joint roundtable to discuss the regulatory framework for crypto spot trading. This marks the first time the two major regulatory agencies have jointly discussed crypto regulation, signaling a new phase in U.S. cryptocurrency regulation, shifting from "harsh crackdowns" to "clear rules."

SEC and CFTC Roundtable | Source: YouTube

For companies looking to enter the crypto finance space, this is a rare regulatory window. Regulators are sending friendly signals, trying to find a balance between protecting consumers and promoting innovation. According to the timeline from the U.S. Patent and Trademark Office, the trademark application for "MrBeast Financial" will undergo its first review in mid-2026, with final approval or rejection expected by the end of 2026. This means that even if everything goes smoothly, the platform won't officially operate until 2027.

But a window of opportunity does not equal a pass. "MrBeast Financial" will face multi-layered and comprehensive regulatory challenges.

At the federal level, the SEC will review whether it involves securities issuance. If the investment products offered by the platform are deemed securities, it must register as a broker or investment advisor and comply with strict regulations. The CFTC will oversee its derivatives and commodity trading, ensuring the platform does not engage in market manipulation or fraud. FinCEN (Financial Crimes Enforcement Network) will require compliance with anti-money laundering (AML) and know your customer (KYC) protocols, meaning the platform must establish a robust identity verification system, monitor suspicious transactions, and report unusual activities to regulators.

If the platform promotes crypto payments and trading, it is likely to be classified as a money services business (MSB), which means stricter compliance requirements, including registration, regular reporting, and audits. Each requirement demands significant human, material, and financial resources.

At the state level, the challenges become even more complex. The U.S. financial regulatory system operates on a dual federal and state basis, requiring dozens of different state money transmitter licenses (MTL) to operate a crypto exchange or mobile banking in various states. Each state has different licensing requirements, and the application process is time-consuming and costly.

MrBeast's direct targeting of young retail investors will place his business under a regulatory microscope. Regulators will ask a core question: does a creator whose brand is built on extreme content possess the "prudence" to manage consumer deposits and investments?

This involves not only compliance but also reputational risk. When evaluating financial license applications, regulators look not only at technical capabilities and capital strength but also at "risk culture" and "governance capabilities." They will review the company's track record, assess the integrity and professionalism of the management team, and determine whether the company can protect consumer interests in the long term.

Just weeks before the trademark application, MrBeast's video "Would You Risk Your Life for $500,000?" sparked significant controversy. In the video, a professional stunt performer escapes from a simulated fire in a building to win a prize. MrBeast defended that safety measures were "stricter than anyone could imagine," with professional stunt and pyrotechnic teams present, and all risks were within a controllable range.

However, critics argue that such high-risk, high-drama content conveys a dangerous value system that links human life safety with monetary rewards. Even if the actual risk is low, this presentation suggests that "it's okay to risk your life for money." For young viewers, this could create a negative modeling effect.

For companies seeking financial licenses, such controversies could become negative evidence. Regulators may view it as a reflection of "risk culture." A creator willing to let people risk their lives for a prize may also adopt similar risk-taking behavior in financial product design. Will he design high-risk, high-reward products that are actually detrimental to consumers just to attract attention?

These concerns are not unfounded. The design of financial products requires extreme caution; any elements that encourage risk-taking or speculation could lead to significant losses for consumers. The celebrity halo is fragile in the face of compliance and ethical scrutiny of financial products.

MrBeast's challenge is even more complex. He must not only prove the compliance and fairness of his products but also rebuild his moral image in the shadow of cryptocurrency controversies. He must perform a delicate balancing act within the regulatory window, maintaining his "Beast" persona to attract young users while demonstrating sufficient "prudence" to persuade regulators.

This is a dance on the edge of a knife. One misstep could plunge the entire plan into the abyss. But if successful, he will create a brand new business model, directly converting the trust of 445 million fans into financial capital.

An Ultimate Experiment on Trust

MrBeast's financial gamble is less a business adventure and more an ultimate experiment on the essence of "trust" in our era.

It is the product of three converging waves: the financialization of influencer economy, Gen Z's rebellion against traditional finance, and the compliance process of cryptocurrency.

These three forces converge at this moment in 2025, creating a unique window of opportunity while also bringing unprecedented risks.

If he succeeds, it will prove that the mechanism for generating trust has undergone a paradigm shift. It no longer necessarily arises from the sedimentation of time and institutional endorsement but can be rapidly cultivated through personal charisma and algorithmic amplification. Traditional financial institutions will be forced to acknowledge that their century-old foundations may indeed be fragile in the eyes of Gen Z.

This will compel traditional banks to reassess their strategies for young users, rethinking how to build trust in a world dominated by algorithms and screens. They may need to lower their guard, learn the language of influencers, embrace the logic of social media, and even collaborate with influencers to reach young users through their influence.

It will also open a new monetization path for other influencers. The creator economy will enter a new phase where content creators are no longer just sellers of ads and products; they can become providers of financial services. We may see more "influencer banks," "influencer funds," and "influencer insurance." The boundaries of traffic and trust will be redefined.

But if he fails, it will once again validate an old lesson: traffic can create spectacles but cannot conjure trust out of thin air. Especially in finance, moral flaws and compliance risks can consume any size of fan base. Influence can attract attention but cannot directly translate into the most valuable asset in the financial world: responsibility.

It will remind regulators that influencer-driven financial innovation requires stricter scrutiny and clearer rules. When financial services deeply integrate with content creation and fan economies, traditional regulatory frameworks may no longer apply. Regulators need to consider whether an influencer with hundreds of millions of fans becoming a financial service provider poses a systemic risk. When fan relationships transform into financial relationships, how can consumer rights be protected?

MrBeast's brand is built on "spectacle" and "extremes," with content centered around breaking conventions and creating surprises, such as being buried alive, nuclear bunkers, and extreme challenges.

But financial services require "stability" and "prudence," demanding predictability, safety, and long-term viability.

Can he establish a credible financial brand while maintaining entertainment value? This is not just a business question but a challenge related to identity. When a creator known for "madness" tries to persuade you to entrust him with your hard-earned money, is he expanding the boundaries of his brand or diluting its core values?

This paradox has no simple answer. Perhaps MrBeast will create a new form of financial brand that retains entertainment while possessing professionalism. Or perhaps he will discover that the two are fundamentally incompatible and ultimately have to choose between them.

Regardless of the outcome, this gamble has begun. It will force all of us to rethink who we should trust in an era where everyone can be a media figure. Should we trust those in suits speaking jargon we don't understand, or the influencer who brings us joy and dreams on screen?

When the first user completes their first transaction on MrBeast Financial, whether they hit "buy" or "sell," they cast a vote, providing their answer to the trust dilemma of this era. And hundreds of millions of young people will use their real money to collectively write the conclusion of this experiment.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。