In the next two to three years, stablecoins will complete compliance model implementations across multiple jurisdictions, evolving from "offshore channel assets" to the "foundation of a global financial operating system," profoundly changing the pathways of currency transmission and the production methods of financial services.

Abstract

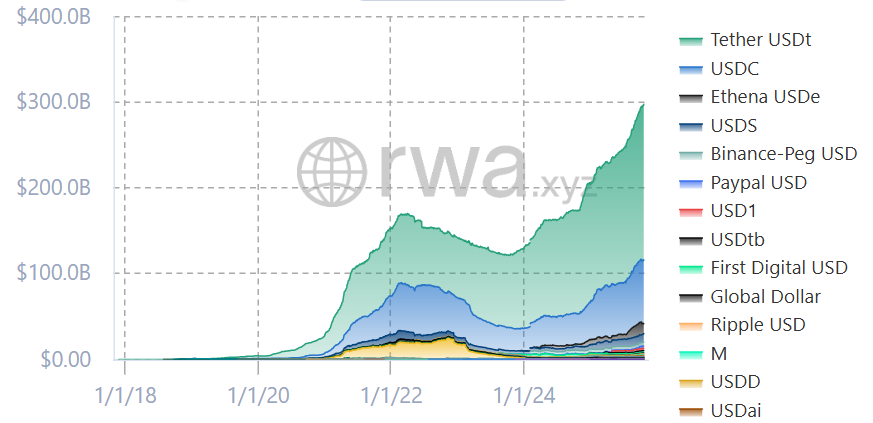

Stablecoins have evolved from "crypto-native settlement tokens" to the "infrastructure for global digital dollarization." Over the past two years, the total market capitalization of global stablecoins has surged from approximately $120 billion to a range of about $290 billion to $300 billion, setting a historical high; on-chain cross-border settlements and fund transfers have become the strongest real-world use cases, while the "currency substitution" demand in emerging markets provides a long-term structural tailwind. The United States has anchored a federal framework for stablecoins through the "GENIUS Act," creating a triangular resonance of "rules-supply-demand" with the expansion of dollar stablecoins; major economies such as the EU, Hong Kong, and Japan have also provided their own regulatory and industrialization pathways. Meanwhile, the structural concentration of "over-dollarization," the interest rate constraints of reserve assets and operational incentives, and the potential "crowding-out effect" of CBDCs (central bank digital currencies) constitute the core of the policy and business game in the next stage.

I. Basic Overview of the Stablecoin Sector

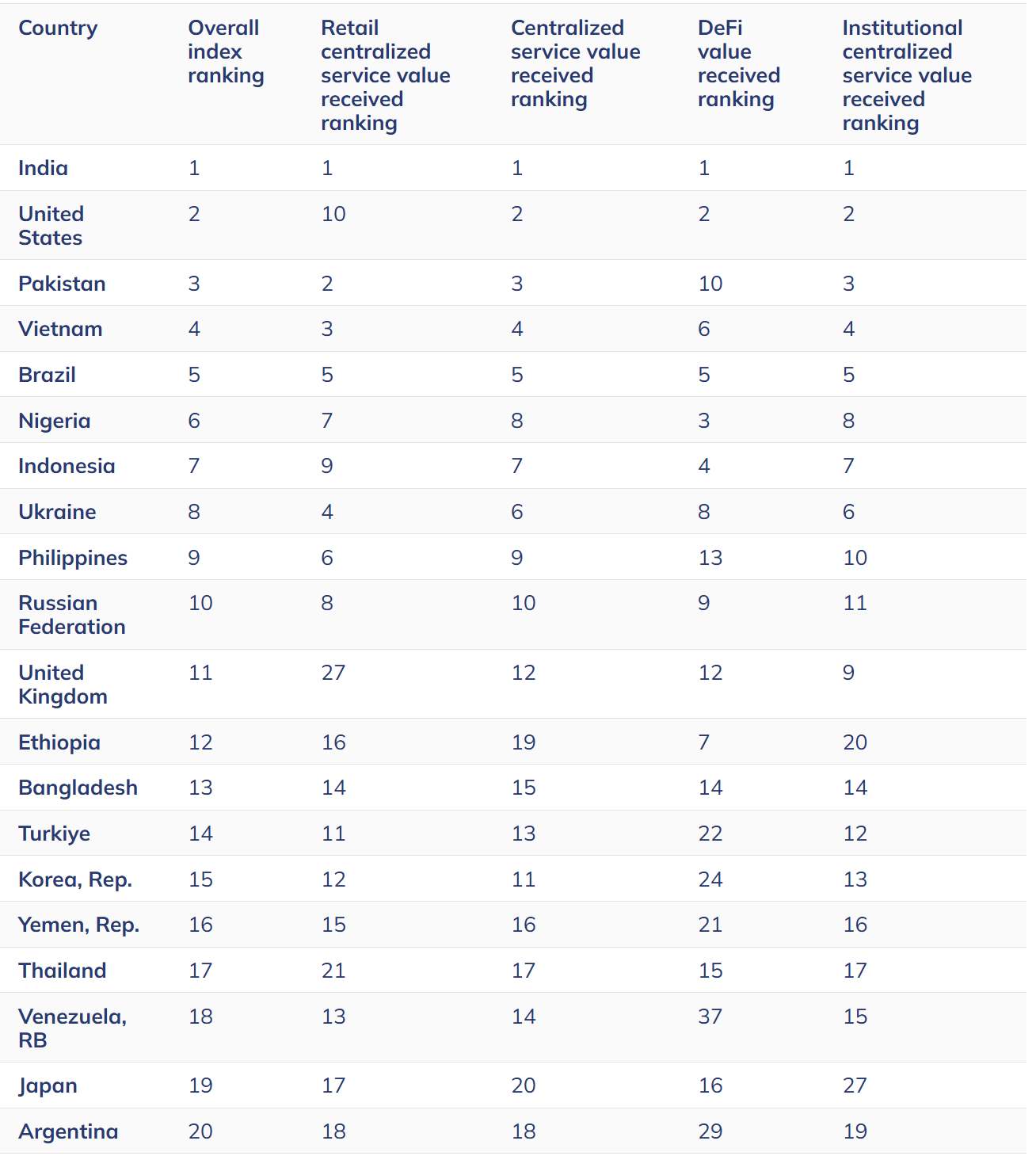

From the perspectives of scale and structure, stablecoins are experiencing a threefold inflection point of "volume-price-usage." First, in terms of "volume": since the third quarter of 2025, multiple authoritative and industry media outlets have almost simultaneously reported observations of "approaching/breaking through $300 billion," while the industry association AFME on the capital market side reported a more cautious anchor of $286 billion in September. This difference mainly stems from variations in statistical windows and inclusion criteria, but the direction of "returning to and refreshing historical highs" is undisputed. AFME further pointed out that the proportion of dollar-denominated stablecoins reached 99.5%, pushing the structural certainty of "unipolar dollarization" to a historical peak. At the same time, FN London, under the Financial Times, presented a dual oligopoly of USDT and USDC in terms of market share and liquidity, maintaining a combined share in the range of 70-80% across different metrics/time points, reinforcing the anchoring power of dollar stablecoins on on-chain funding curves and pricing systems. Second, in terms of "usage": cross-border settlements/remittances and B2B fund transfers have become the strongest engines of real-world adoption. Morgan Stanley Investment Management disclosed that the scale of cross-border stablecoin payments in Turkey alone will exceed $63 billion in 2024, while countries like India, Nigeria, and Indonesia have entered the ranks of high adoption nations. This demand is not a "circulation within the crypto circle," but a systematic alternative to traditional cross-border financial frictions and uncertainties. Furthermore, Visa's latest white paper extends the technical scope of stablecoins from "payments" to "cross-border credit/on-chain credit infrastructure," emphasizing that under the combination of programmable cash and smart contracts, global lending will usher in automation, low friction, and high verifiability throughout the entire lifecycle of "matching-signing-performance-settlement." This means that the marginal value of stablecoins will leap from "reducing cross-border payment costs" to "rewriting the cross-border credit production function." Third, in terms of "price" (i.e., efficiency and financial conditions): Ethereum L2 (such as Base) and high-performance public chains (such as Solana) have established lower latency and lower fee "last-mile" settlement networks, combined with compliant RWA and short-term treasury tokenized asset pools, allowing stablecoins to be not only "transferable dollars" but also "re-pledgeable and enterable into funding curves," thereby reducing the radius of capital turnover and increasing turnover efficiency per unit time. These threefold increases collectively drive a paradigm shift from cyclical rebounds to structural penetration: "thickening" market capitalization, "strengthening" dollar anchors, and "deepening" scenarios, upgrading stablecoins from "matching intermediaries" to "operating capital and credit generation foundations." On this curve, short-term public sentiment or individual case events (such as recent instances of certain stablecoins quickly rolling back after over-minting during internal transfer processes) serve more as "risk management and audit visualization" stress tests and do not alter the main trend: historical highs at the total level, extreme dollarization at the structural level, and the extension of usage from "payments" to "credit."

In terms of driving forces, the demand and supply sides form a "real demand × regulatory dividend" dual curve overlay, reinforcing the aforementioned threefold increase. The demand side primarily stems from the "currency substitution" demand in emerging markets. Against a backdrop of high inflation and depreciation, the spontaneous adoption of on-chain dollars as "hard currency" and settlement media has become increasingly evident. Joint observations by Morgan Stanley and Chainalysis show that bottom-up cross-border payments/remittances have become the fastest penetration point for stablecoins, exhibiting typical counter-cyclical characteristics: "the more turbulent, the more volume." The demand side also comes from the operational capital efficiency constraints of global enterprises: cross-border e-commerce, foreign trade, overseas platforms, and developer economies all require T+0/minute-level arrival and low rejection certainty, making stablecoins a "second track to replace SWIFT/agent bank networks," continuously driving down "last-mile" costs under the technological dividends of multi-chain parallelism and L2 proliferation. Cross-border settlements/remittances, B2B payments, and fund pool turnover have become the primary strong scenarios of "real-world adoption." The supply side is mainly reflected in the regulatory dividend curve: the U.S. "GENIUS Act" was signed into law on July 18, 2025, establishing a unified regulatory baseline for stablecoins at the federal level, mandating 100% high liquidity reserves (such as dollars or short-term U.S. Treasury securities) and monthly reserve disclosures, while clarifying redemption, custody, supervision, and enforcement powers, effectively writing "safety-transparency-redeemability" into regulatory constraints. The Hong Kong "Stablecoin Ordinance" will take effect on August 1, 2025, establishing a licensing framework and activity boundaries, with the Monetary Authority having released supporting pages and guidelines to ensure the quality of reserves, redemption mechanisms, and risk control through transparent management. The EU's MiCA will gradually enter into effect starting at the end of 2024, with ESMA subsequently releasing secondary and tertiary regulatory technical standards and knowledge/competency guidelines, marking Europe's inclusion of stablecoins into a "financial infrastructure-level" prudential regulatory system. The clarity of regulation results in two outcomes: first, it significantly reduces the compliance uncertainty and cross-border compliance costs for issuers, clearing networks, and merchant acceptance endpoints, leading to a continuous decrease in the friction of "real-world adoption"; second, it alters the industry's "risk-return-scale" function, internalizing the externalities of reserve safety and information disclosure into compliance costs, thereby raising industry thresholds and accelerating the strong getting stronger. Coupled with the public chain technology curve (L2 proliferation/high TPS chains) and RWA funding curve (short-term debt tokenization/money market funds on-chain), stablecoins have completed the transition from "cross-border payment entry" to "cross-border credit and on-chain capital market foundation": Visa's latest white paper explicitly states that stablecoins will become the foundational layer of the "global credit ecosystem," with the automation capabilities of smart contracts in pre-loan matching, in-loan monitoring, and post-loan settlement and disposal, meaning that the generation, circulation, and pricing of credit will shift from being primarily "manual and credential-based" to being primarily "code and data-based." This also explains why, at a time when total volume is hitting historical highs and structural dollarization is extreme, the industrial logic has shifted from "cyclical rebounds" to "structural penetration." In this process, the simultaneous launch of the U.S. federal anchoring, Hong Kong licensing implementation, and EU MiCA rollout forms a cross-continental institutional synergy, upgrading the global expansion of stablecoins from a "commercial phenomenon" to a "systematic engineering of policy and financial infrastructure synergy," providing a credible, auditable, and combinable underlying cash and settlement layer for subsequent more complex trade finance modules such as cross-border credit, accounts receivable securitization, inventory financing, and factoring.

In terms of driving forces, the demand and supply sides form a "real demand × regulatory dividend" dual curve overlay, reinforcing the aforementioned threefold increase. The demand side primarily stems from the "currency substitution" demand in emerging markets. Against a backdrop of high inflation and depreciation, the spontaneous adoption of on-chain dollars as "hard currency" and settlement media has become increasingly evident. Joint observations by Morgan Stanley and Chainalysis show that bottom-up cross-border payments/remittances have become the fastest penetration point for stablecoins, exhibiting typical counter-cyclical characteristics: "the more turbulent, the more volume." The demand side also comes from the operational capital efficiency constraints of global enterprises: cross-border e-commerce, foreign trade, overseas platforms, and developer economies all require T+0/minute-level arrival and low rejection certainty, making stablecoins a "second track to replace SWIFT/agent bank networks," continuously driving down "last-mile" costs under the technological dividends of multi-chain parallelism and L2 proliferation. Cross-border settlements/remittances, B2B payments, and fund pool turnover have become the primary strong scenarios of "real-world adoption." The supply side is mainly reflected in the regulatory dividend curve: the U.S. "GENIUS Act" was signed into law on July 18, 2025, establishing a unified regulatory baseline for stablecoins at the federal level, mandating 100% high liquidity reserves (such as dollars or short-term U.S. Treasury securities) and monthly reserve disclosures, while clarifying redemption, custody, supervision, and enforcement powers, effectively writing "safety-transparency-redeemability" into regulatory constraints. The Hong Kong "Stablecoin Ordinance" will take effect on August 1, 2025, establishing a licensing framework and activity boundaries, with the Monetary Authority having released supporting pages and guidelines to ensure the quality of reserves, redemption mechanisms, and risk control through transparent management. The EU's MiCA will gradually enter into effect starting at the end of 2024, with ESMA subsequently releasing secondary and tertiary regulatory technical standards and knowledge/competency guidelines, marking Europe's inclusion of stablecoins into a "financial infrastructure-level" prudential regulatory system. The clarity of regulation results in two outcomes: first, it significantly reduces the compliance uncertainty and cross-border compliance costs for issuers, clearing networks, and merchant acceptance endpoints, leading to a continuous decrease in the friction of "real-world adoption"; second, it alters the industry's "risk-return-scale" function, internalizing the externalities of reserve safety and information disclosure into compliance costs, thereby raising industry thresholds and accelerating the strong getting stronger. Coupled with the public chain technology curve (L2 proliferation/high TPS chains) and RWA funding curve (short-term debt tokenization/money market funds on-chain), stablecoins have completed the transition from "cross-border payment entry" to "cross-border credit and on-chain capital market foundation": Visa's latest white paper explicitly states that stablecoins will become the foundational layer of the "global credit ecosystem," with the automation capabilities of smart contracts in pre-loan matching, in-loan monitoring, and post-loan settlement and disposal, meaning that the generation, circulation, and pricing of credit will shift from being primarily "manual and credential-based" to being primarily "code and data-based." This also explains why, at a time when total volume is hitting historical highs and structural dollarization is extreme, the industrial logic has shifted from "cyclical rebounds" to "structural penetration." In this process, the simultaneous launch of the U.S. federal anchoring, Hong Kong licensing implementation, and EU MiCA rollout forms a cross-continental institutional synergy, upgrading the global expansion of stablecoins from a "commercial phenomenon" to a "systematic engineering of policy and financial infrastructure synergy," providing a credible, auditable, and combinable underlying cash and settlement layer for subsequent more complex trade finance modules such as cross-border credit, accounts receivable securitization, inventory financing, and factoring.

II. Trends and Analysis of Dollar Stablecoins

In the global stablecoin landscape, U.S. dollar stablecoins are not just a market product but a key pivot deeply embedded in national interests and geopolitical financial strategies. The underlying logic can be understood from three dimensions: maintaining dollar hegemony, alleviating fiscal pressure, and leading global rule-making. First, dollar stablecoins have become a new tool for maintaining the international status of the dollar. Traditionally, dollar hegemony relies on its status as a reserve currency, the SWIFT system, and the petrodollar mechanism. However, over the past decade, the global trend of "de-dollarization," although slow, has been gradually eroding the dollar's settlement share and reserve weight. Against this backdrop, the expansion of dollar stablecoins provides an asymmetric path, bypassing sovereign currency systems and capital controls to directly transmit the "dollar value proposition" to end users. Whether in high-inflation economies like Venezuela and Argentina or in cross-border trade scenarios in Africa and Southeast Asia, stablecoins have essentially become the "on-chain dollars" that residents and businesses actively choose, penetrating local financial systems in a low-cost, low-friction manner. This penetration does not require military or geopolitical tools but is achieved through market-driven behavior, resulting in "digital dollarization" that expands the coverage radius of the dollar ecosystem. As JPMorgan's latest research points out, by 2027, the expansion of stablecoins could bring an additional $1.4 trillion in structural demand for the dollar, effectively offsetting some of the "de-dollarization" trend, meaning that the U.S. has achieved a low-cost extension of monetary hegemony through stablecoins.

Second, dollar stablecoins have become an important new buyer supporting the U.S. Treasury market at the fiscal and financial level. Currently, global demand for U.S. Treasuries remains strong, but the continuous expansion of the fiscal deficit and fluctuations in interest rates put long-term pressure on the U.S. government in terms of financing. The issuance mechanism of stablecoins is naturally tied to the demand for high liquidity reserves, and under the clear requirements of the "GENIUS Act," these reserves must primarily consist of short-term U.S. Treasuries or cash equivalents. This means that as the market capitalization of stablecoins expands from hundreds of billions to potentially trillions of dollars, the underlying reserve assets will become a stable and continuously growing buying force in the U.S. Treasury market, acting similarly to "quasi-central bank buyers." This not only improves the maturity structure of U.S. Treasuries but may also lower overall financing costs, providing a new "structural pivot" for U.S. fiscal policy. Multiple research institutions have modeled that by 2030, the potential scale of stablecoins could reach $1.6 trillion, with incremental demand for U.S. Treasuries reaching hundreds of billions of dollars. Finally, the U.S. has achieved a strategic shift in rule-making from "suppression" to "incorporation." Early regulatory attitudes were not friendly towards stablecoins, as legislators feared they posed threats to monetary policy and financial stability. However, as the market scale continued to expand, the U.S. quickly realized that it could not stifle this trend through suppression and instead adopted a model of "rights confirmation-regulation-incorporation." The "GENIUS Act," as a milestone piece of legislation, officially took effect in July 2025, establishing a unified regulatory framework at the federal level. This law not only imposes mandatory requirements on reserve quality, liquidity, and transparency but also clarifies the parallel legality of banking and non-banking issuance channels, while incorporating AML/KYC, redemption mechanisms, and custody responsibilities into compliance hard constraints, ensuring that the operation of stablecoins remains within controllable boundaries. More critically, this law allows the U.S. to gain a first-mover advantage in international standard-setting, enabling the U.S. to export its stablecoin regulatory logic in future multilateral platforms such as the G20, IMF, and BIS, making dollar stablecoins not only dominant in the market but also the "default standard" institutionally.

In summary, the strategic logic of the United States regarding dollar stablecoins has achieved a threefold convergence: at the international monetary level, stablecoins are an extension of digital dollarization, maintaining and expanding dollar hegemony at a low cost; at the fiscal and financial level, stablecoins create new long-term buying power for the U.S. Treasury market, alleviating fiscal pressure; and at the regulatory and institutional level, the U.S. has completed the rights confirmation and incorporation of stablecoins through the "GENIUS Act," ensuring its dominant voice in the future global digital financial order. These three strategic pivots not only complement each other but also resonate in practice: as the market capitalization of dollar stablecoins expands to trillions of dollars, it will strengthen the international monetary status of the dollar, support the sustainability of domestic fiscal financing, and establish global standards at the legal and regulatory levels. This overlay effect of "institutional priority" and "network first-mover advantage" makes dollar stablecoins not just market products but also important tools for U.S. national interests. In the future global competition landscape for stablecoins, this moat will persist over the long term, while non-dollar stablecoins, although they may have some development space in regional markets, will find it difficult to shake the core position of dollar stablecoins in the short term. In other words, the future of stablecoins is not only a market choice in digital finance but also a monetary strategy under great power competition, and the U.S. has clearly occupied the high ground in this game.

III. Trends and Analysis of Non-Dollar Stablecoins

The overall landscape of non-dollar stablecoins is showing a typical characteristic of "weak overall, strong locally." Looking back to 2018, their market share once approached 49%, almost achieving parity with dollar stablecoins. However, in just a few years, this share has plummeted to less than 1%, with industry data platform RWA.xyz even estimating an extreme low of 0.18%. The euro stablecoin has become the only visible presence in absolute scale, with a total market capitalization of approximately $456 million, occupying the vast majority of the non-dollar stablecoin space, while stablecoins for other currencies in Asia, Australia, and elsewhere are still in the initial or pilot stages. Meanwhile, the EU capital markets industry association AFME noted in its September report that the share of dollar stablecoins has reached as high as 99.5%, indicating that global on-chain liquidity is almost entirely tied to the dollar. This excessive concentration poses structural risks; should extreme regulatory, technological, or credit shocks occur in the U.S., the spillover effects will rapidly transmit to global markets through the settlement layer. Therefore, promoting non-dollar stablecoins is not merely a matter of commercial competition but a strategic necessity for maintaining systemic resilience and monetary sovereignty.

Among the non-dollar camp, the Eurozone is leading the way. The implementation of the EU's MiCA legislation has provided unprecedented legal certainty for the issuance and circulation of stablecoins. Circle announced that its USDC/EURC products fully comply with MiCA requirements and is actively advancing a multi-chain deployment strategy. Driven by this, the market capitalization of euro stablecoins achieved triple-digit growth in 2025, with EURC alone rising by 155%, from $117 million at the beginning of the year to $298 million. Although the absolute scale is still far smaller than that of dollar stablecoins, the growth momentum is clearly visible. The European Parliament, along with ESMA and the ECB, is intensively launching technical standards and regulatory rules, imposing strict requirements on issuance, redemption, and reserves, gradually building a compliant cold-start ecosystem. Australia's path differs from that of the Eurozone, leaning more towards a top-down experiment dominated by traditional banks. Among the four major banks, ANZ and NAB have launched A$DC and AUDN, respectively, while the retail market is filled by the licensed payment company AUDD, primarily targeting cross-border payments and efficiency optimization. However, overall development remains at the pilot stage with a limited number of institutions and scenarios, failing to form large-scale retail applications. The biggest uncertainty lies in the absence of a nationwide unified legal framework, while the Reserve Bank of Australia (RBA) is actively researching a digital Australian dollar (CBDC), which, if officially issued, could potentially replace or even squeeze existing private stablecoins. If regulation opens up in the future, leveraging the dual advantages of bank endorsement and retail payment scenarios, Australian dollar stablecoins have the potential for rapid replication, but their relationship with CBDCs as substitutes or complements remains unresolved. The South Korean market presents a paradox: despite the country's high overall acceptance of crypto assets, the development of stablecoins has almost stagnated. The key issue is that legislation is severely lagging, with the earliest expected effectiveness not until 2027, leading conglomerates and large internet platforms to collectively adopt a wait-and-see approach. Additionally, the regulatory body tends to promote "controllable private chains," and the scarcity and low yield of the domestic short-term treasury market impose dual constraints on issuers regarding profitability models and commercialization incentives. Hong Kong is one of the few cases where "regulation is ahead." In May 2025, the Hong Kong Legislative Council passed the "Stablecoin Ordinance," which officially took effect on August 1, becoming the first major financial center in the world to launch a comprehensive regulatory framework for stablecoins. The Hong Kong Monetary Authority subsequently released implementation details, clarifying the compliance boundaries for Hong Kong dollar anchoring and domestic issuance. However, alongside the proactive regulation, the market has experienced "localized cooling." Some Chinese-funded institutions have chosen to proceed cautiously or delay applications under the prudent regulatory attitude in the mainland, leading to a decline in market enthusiasm. It is expected that by the end of 2025 or early 2026, regulatory authorities will issue a very limited number of initial licenses, conducting rolling pilots in a "prudent rhythm—gradual opening" manner. This means that while Hong Kong has the advantages of being an international financial hub and having proactive regulations, its development pace is constrained by the mainland's cross-border capital controls and risk isolation considerations, leaving the breadth and speed of market expansion uncertain. Japan has taken a unique path in institutional design, becoming an innovative model of "trust-based strong regulation." Through the "Amendment to the Fund Settlement Act," Japan has established a regulatory model of "trust custody + licensed financial institution dominance," ensuring that stablecoins operate entirely within a compliant framework. In the fall of 2025, JPYC was approved as the first compliant yen stablecoin, issued by the Progmat Coin platform of Mitsubishi UFJ Trust, with plans to issue a total of 1 trillion yen over three years. The reserve assets are anchored in deposits and government bonds (JGBs) from the Bank of Japan, targeting cross-border remittances, corporate settlements, and the DeFi ecosystem.

Overall, the current development status of non-dollar stablecoins can be summarized as "overall dilemma, local differentiation." On a global scale, the extreme concentration of dollar stablecoins has compressed the space for other currencies, leading to a significant collapse in the share of non-dollar stablecoins. However, at the regional level, the euro and yen represent a long-term route of "sovereignty and compliance certainty," likely to form differentiated competitiveness in cross-border payments and trade finance; Hong Kong maintains a unique position with its advantages as a financial hub and proactive regulations; Australia and South Korea remain in exploratory and wait-and-see stages, with the ability to break through quickly depending on legal frameworks and CBDC positioning. In the future stablecoin system, non-dollar stablecoins may not be able to challenge the dominance of the dollar, but their existence itself holds strategic significance: they can serve as a buffer against systemic risks and a backup plan, as well as help countries maintain monetary sovereignty in the digital age.

IV. Investment Prospects and Risks

The investment logic of stablecoins is undergoing a profound paradigm shift, transitioning from the past "coin-centric" thinking focused on token prices and market share to a "cash flow and rule-centric" framework based on cash flow, institutions, and regulations. This shift is not only an upgrade in investment perspective but also an inevitable requirement for the entire industry to move from a crypto-native stage to financial infrastructure. From the perspective of the layered industry chain, the most direct beneficiaries are undoubtedly on the issuance side. Stablecoin issuers, custodians, auditing firms, and reserve managers have gained clear compliance pathways and institutional guarantees with the implementation of the "GENIUS Act" in the U.S. and the MiCA and Hong Kong Stablecoin Ordinance. Mandatory reserve and monthly information disclosure requirements, while increasing operational costs, have also raised the industry entry threshold, accelerating the concentration of the industry and strengthening the scale advantages of leading issuers. This means that leading institutions can achieve stable cash flow through interest income from reserve assets, allocation of reserves, and compliance dividends, forming a "stronger gets stronger" pattern.

In addition to issuers, the settlement and merchant acceptance networks will be the next important investment direction. Whoever can first integrate stablecoins on a large scale into enterprise ERP systems and cross-border payment networks will be able to build sustainable cash flow from payment commissions, settlement fees, and operational capital management financial services. The potential of stablecoins goes beyond on-chain exchanges; it lies in whether they can become "everyday monetary tools" in the business operations of enterprises. Once this embedding is realized, it will release long-term, predictable cash flow, similar to the moats established by payment network companies. Another area worth paying attention to is RWA (real-world assets) and short-term debt tokenization. As the scale of stablecoins expands, the allocation of reserve funds will inevitably need to seek returns; tokenization of short-term treasuries and money market funds not only meets reserve compliance requirements but also builds an efficient bridge between stablecoins and traditional financial markets. Ultimately, a closed loop of stablecoins—short-term debt tokens—funding markets is expected to form, making the entire on-chain dollar liquidity curve more mature. Additionally, compliance technology and on-chain identity management are also areas worth investing in. The U.S. "GENIUS Act," EU MiCA, and Hong Kong regulations collectively emphasize the importance of KYC, AML, and blacklist management, indicating that "regulatable open public chains" have become an industry consensus. Technology companies providing on-chain identity and compliance modules will play an important role in the future stablecoin ecosystem. From a regional comparison, the U.S. is undoubtedly the market with the largest scale dividend. The first-mover advantage of the dollar and the clarity of federal legislation mean that banks, payment giants, and even tech companies may deeply engage in the stablecoin sector. Investment targets include both issuers and builders of financial infrastructure. The opportunity in the EU lies in institutional-level B2B settlements and the euro-denominated DeFi ecosystem, with the MiCA compliance framework and expectations for a digital euro shaping a market space centered on "stability + compliance." Hong Kong, with its regulatory advantages and international resources, is expected to become a bridgehead for offshore renminbi, Hong Kong dollars, and cross-border asset allocation, especially against the backdrop of Chinese-funded institutions proceeding cautiously, where foreign and local financial institutions may gain faster access. Japan, through its "trust-based strong regulation" model, has created a highly secure template; if JPYC and its subsequent products can reach a trillion yen issuance scale, it could change the supply-demand structure of certain maturity segments of JGBs. Australia and South Korea remain in exploratory stages, with investment opportunities more reflected in small-scale pilots and the window period after policy dividends are released. In terms of valuation and pricing frameworks, the income model of issuers can be simplified to reserve asset interest income multiplied by AUM, adjusted according to profit-sharing ratios and incentive costs. Scale, interest rate spreads, redemption rates, and compliance costs are key factors determining profitability. The income from settlement and acceptance networks mainly comes from payment commissions, settlement fees, and financial value-added services, with core variables being merchant density, ERP integration depth, and compliance loss rates. The income from on-chain funding markets is directly related to net interest margins, programmable credit stock, and risk-adjusted capital returns, with the key being the stability of asset sources and the efficiency of default resolution.

However, the risks in the stablecoin sector cannot be ignored. The most critical risk lies in systemic concentration. Currently, dollar stablecoins account for as much as 99.5%, and global on-chain liquidity almost entirely relies on the dollar. Should there be a significant legislative reversal, regulatory tightening, or technical event in the U.S., it could trigger a global deleveraging chain reaction. The risk of regulatory repricing also exists; even with the "GENIUS Act," its implementation details and inter-agency coordination may still alter the cost curve and boundaries for non-bank issuers. The strong constraints of the EU's MiCA could force some overseas issuers to "Brexit" or switch to a restricted model; the high compliance costs, strict custody, and supplementary clauses in Hong Kong and Japan raise the financial and technical thresholds. The potential "crowding out effect" of CBDCs cannot be overlooked either; once the digital euro and digital Australian dollar are put into use, they may create institutional biases in scenarios such as public services, tax collection, and welfare distribution, thereby compressing the space for private stablecoins in local currency-denominated scenarios. Operational risks are also evident, as some issuers have recently experienced incidents of over-minting, which, although quickly reversible, highlight the need for real-time audits of reserve reconciliation and minting-destroying mechanisms. Interest rate and maturity mismatches present another potential risk; if issuers chase yields while mismatching assets and redemption obligations, it could lead to runs and market turmoil. Finally, the risks associated with geopolitical and sanctions compliance are also increasing. As an extension of the dollar, stablecoins will face higher compliance pressures and blacklist management challenges in specific scenarios. Overall, the future prospects for stablecoin investment are immense, but it is no longer a story of merely "betting on scale"; it is a complex game of cash flow, rules, and institutional certainty. Investors need to focus on which entities can establish stable cash flow models within a compliance framework, which regions can release structural opportunities amid evolving rules, and which sectors can generate long-term value through the extension of compliance technology and on-chain credit. At the same time, there must be a heightened awareness of the potential impacts of systemic concentration and regulatory repricing, especially against the backdrop of dollar dominance and the accelerated advancement of various countries' CBDCs.

V. Conclusion

The evolution of stablecoins has reached a qualitative turning point; it is no longer just a story of "how much market value can rise," but a leap from dollar tokens to a global financial operating system. Initially, it serves as an asset, carrying the basic functions of market neutrality and on-chain transactions; subsequently, through network effects, it enters the realm of small, high-frequency settlements in global B2B and B2C transactions; ultimately, bolstered by both rules and code, it develops into a programmable cash layer capable of supporting complex financial services such as credit, collateral, notes, and inventory financing. Under the combined force of monetary, fiscal, and regulatory lines, the U.S. has shaped dollar stablecoins into tools for the institutional export of digital dollarization: expanding the global penetration of the dollar, stabilizing demand for U.S. Treasuries, and securing international discourse power. Although non-dollar stablecoins are inherently disadvantaged in network effects and interest spreads, their existence supports regional financial sovereignty and systemic resilience, with the EU, Japan, and Hong Kong constructing their own survival spaces through proactive compliance or institutional design. For investors, the key is to complete the framework switch: moving from imagining price and market share to validating business models based on cash flow, rules, and compliance technology. In the next two to three years, stablecoins will achieve compliance model implementation across multiple jurisdictions, evolving from "over-the-counter channel assets" to the "foundation of a global financial operating system," profoundly changing the pathways of monetary transmission and the production methods of financial services.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。