Breaking: 4 Major Outcomes Expected From Trump Speech Today At 3PM ET

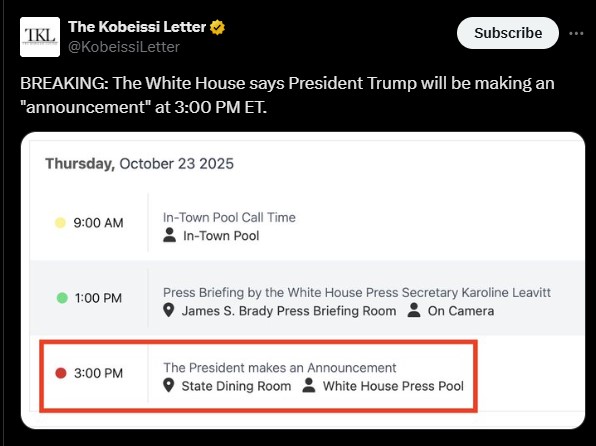

Something big is about to happen in Washington — and the world is watching closely. The White House has confirmed that the U.S. President will speak today at 3:00 PM ET, and nobody really knows what’s coming next.

Could the Trump Speech Today be about new sanctions on Russia? Or a bold plan to fix the $38 trillion U.S. debt? Maybe even a hint about the next Fed rate cut.

Source: The Kobeissi Letter X Account

Whatever it is, one thing’s clear — this isn’t just another political speech. It might decide how investors move their money in the coming days. Everyone’s asking the same question: what will Trump announce today — and how will it hit crypto?

White House Alert: All Eyes on Trump Speech Today At 3PM ET

The White House press conference scheduled for 3:00 PM ET has caught global attention as the Donald's announcement could shake the cryptocurrency marketplace.

Investors, analysts, and traders worldwide are waiting to hear what this Trump speech today could reveal. With the U.S. national debt touching $38 trillion, market participants expect strong words on fiscal policy, inflation, or even foreign strategy.

The timing is striking—just days before the next Federal Reserve decision on October 29 2025. A dovish confirmation from Washington could inject fresh liquidity into risk assets such as cryptocurrencies.

Experts are eyeing 4 major Donald Trump speech outcome criteria that he might address today, let’s know what they are.

4 Donald’s Posts Signal Global Tension Ahead of His Announcement

Over the past 24 hours, the U.S. President has fired off multiple posts on Truth Social, giving clues about the issues that might dominate his remarks.

-

As per the latest Trump news , he announced the new U.S. Treasury companies on Russian oil sanctions, calling on Moscow to “immediately agree to a ceasefire.”

-

He labeled a Wall Street Journal report on the U.S. approving Ukrainian long-range strikes inside Russia as “fake news.”

-

In another news, he drew attention to America’s record-breaking $38 trillion national debt, warning it’s time for a “strong economic reset.”

-

Market expectations point to a potential Fed rate cut October 2025 to 3.75 – 4.00 percent, according to the CME FedWatch tool, with a 98.9 percent probability.

Each point connects directly to global markets and could ripple into the digital-asset space. Traders believe what Donald will announce today may range from new sanctions to an economic reform plan.

But if he focuses on controlling inflation or tightening fiscal policies, it might strengthen the U.S. Dollar temporarily—causing short-term pressure on crypto prices.

Fear Sentiment: Crypto Market Reacts With Measured Caution

The total crypto market cap currently stands at $3.67 trillion, up roughly 1 percent in 24 hours—a modest gain showing that traders are cautious.

The Crypto Fear and Greed Index sits at 27 Fear , a level that reflects anxiety over the Trump speech today. Bitcoin and Ethereum are trading with neutral sentiment.

Market analysts say that the fear is less about fundamentals and more about uncertainty. Whenever a White House addresses something, crypto reacts instantly.

Possible Outcomes: What Traders Should Watch For Next

If the Trump speech today confirms further sanctions or stronger global positioning, volatility could spike across assets. A surprise mention of blockchain or crypto adoption—even indirectly—could unleash a new speculative wave.

Experts suggest traders monitor three key elements:

-

Tone of the speech: Aggressive = risk off; conciliatory = risk on.

-

Fed Signal: If he supports monetary easing, expect liquidity boosts.

-

Market reaction: Watch Bitcoin’s $110 K resistance as a sentiment barometer.

Final Thoughts

With the Trump speech today drawing near, the crypto world stands at a crossroads. A single phrase about debt, sanctions, or economic policy could tilt market momentum overnight.

Regardless of the outcome, one thing is certain: The upcoming outcome has already become a defining moment for global finance, blending politics, macroeconomics, and digital assets into a single stage.

Disclaimer: This article is for informational purposes only and should not be treated as financial advice.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。