Information asymmetry, insider trading, and front-running are particularly evident in Stable's recent event.

Written by: David, Deep Tide TechFlow

The biggest FOMO and criticism today comes from Stable's pre-deposit event.

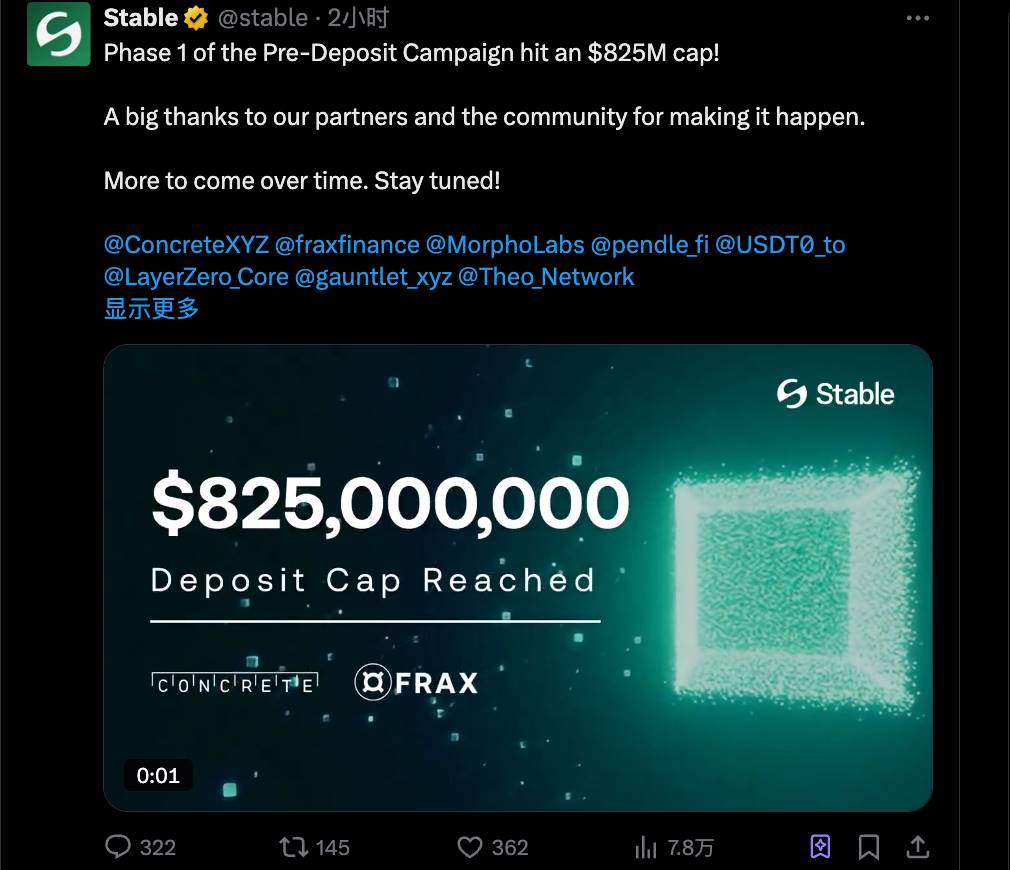

At 9:13 AM, the official Twitter of the stablecoin public chain project Stable announced the pre-deposit event. The $825 million quota was sold out in a very short time, making the event appear extremely popular and successful.

However, under Stable's own celebration post, the comments section is filled with various complaints and dissatisfaction, primarily because everyone has seen through one thing via on-chain data:

A large amount of funds had already been deposited before the event announcement, leaving very little quota and opportunity for others to deposit.

Specifically:

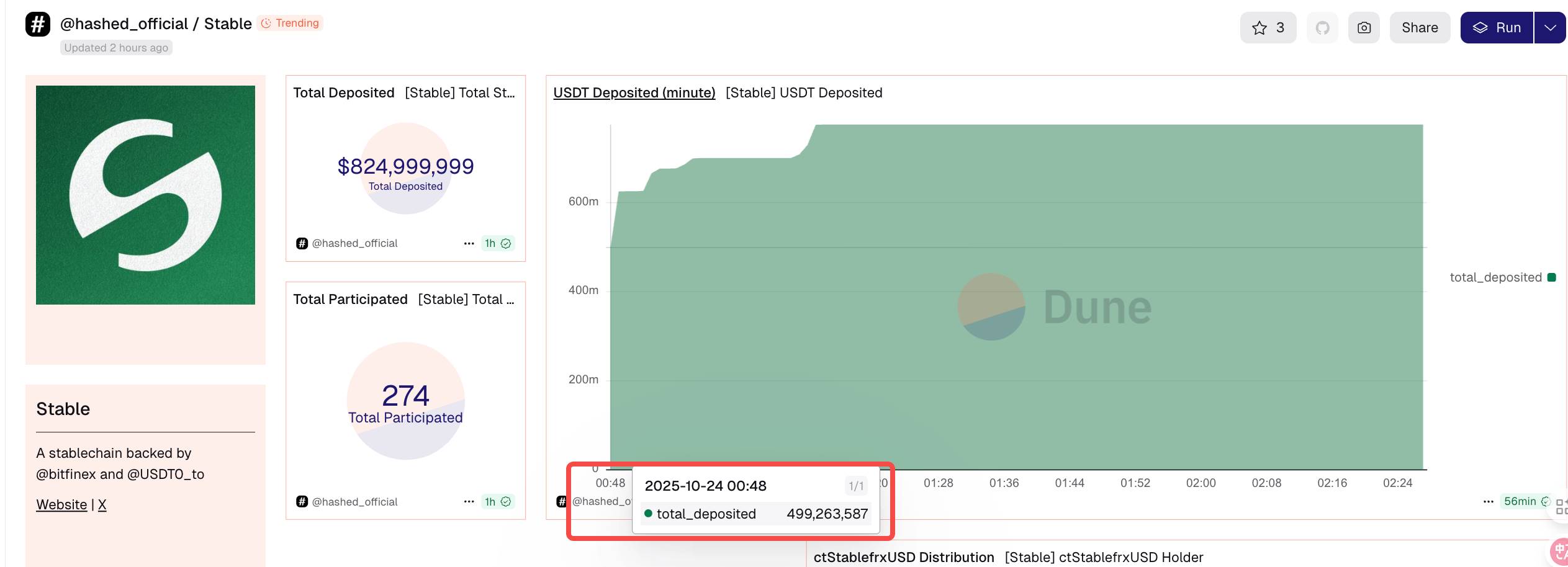

In the 15-20 minutes before the announcement, 90% of the $825 million deposit quota had already been filled; 20 addresses had already filled $700 million of the quota.

After the announcement, only 192 addresses successfully participated, and they collectively only divided up $70 million of the quota;

Before the announcement, the largest deposit address had deposited $100 million by a single individual.

Information asymmetry, insider trading, and front-running are particularly evident in Stable's event. After digging deeper into on-chain data, the community also discovered that the controller of Stable's official deposit contract was also in on the action.

By integrating various scattered data, reviewing the complete timeline of Stable's deposit event, it is easy to see that this was a victory for front-running and insider trading.

Pre-sale, now presented as a front-run

Let's look at a comparison:

October 24, 8:48:47: The first large deposit of 50 million USDT entered the deposit vault.

October 24, 9:13:00 UTC+8: Stable officially announced on Twitter that the event "officially begins."

The time difference is about 24 minutes.

What happened in those 24 minutes? On-chain data shows that over 70% of the final deposit quota had already been pre-booked.

After the official announcement, in reality, less than 30% of the quota was available for ordinary users to compete for. And this 30% was quickly consumed within 26 minutes, leaving most users who only saw the announcement empty-handed.

From the Dune dashboard regarding this event, it is even more intuitive; after 8:48, the deposit quota skyrocketed, and the opportunity had mostly ended before it even began.

When tracking the sources of these large pre-informed deposits, a key player emerged: BTSE exchange.

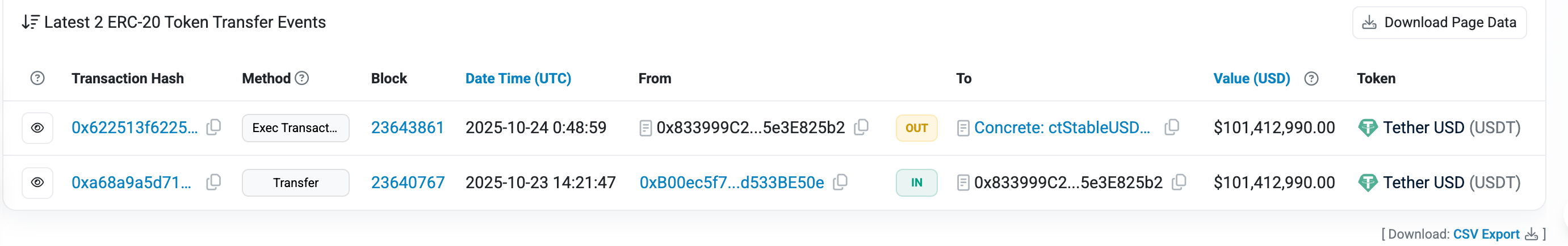

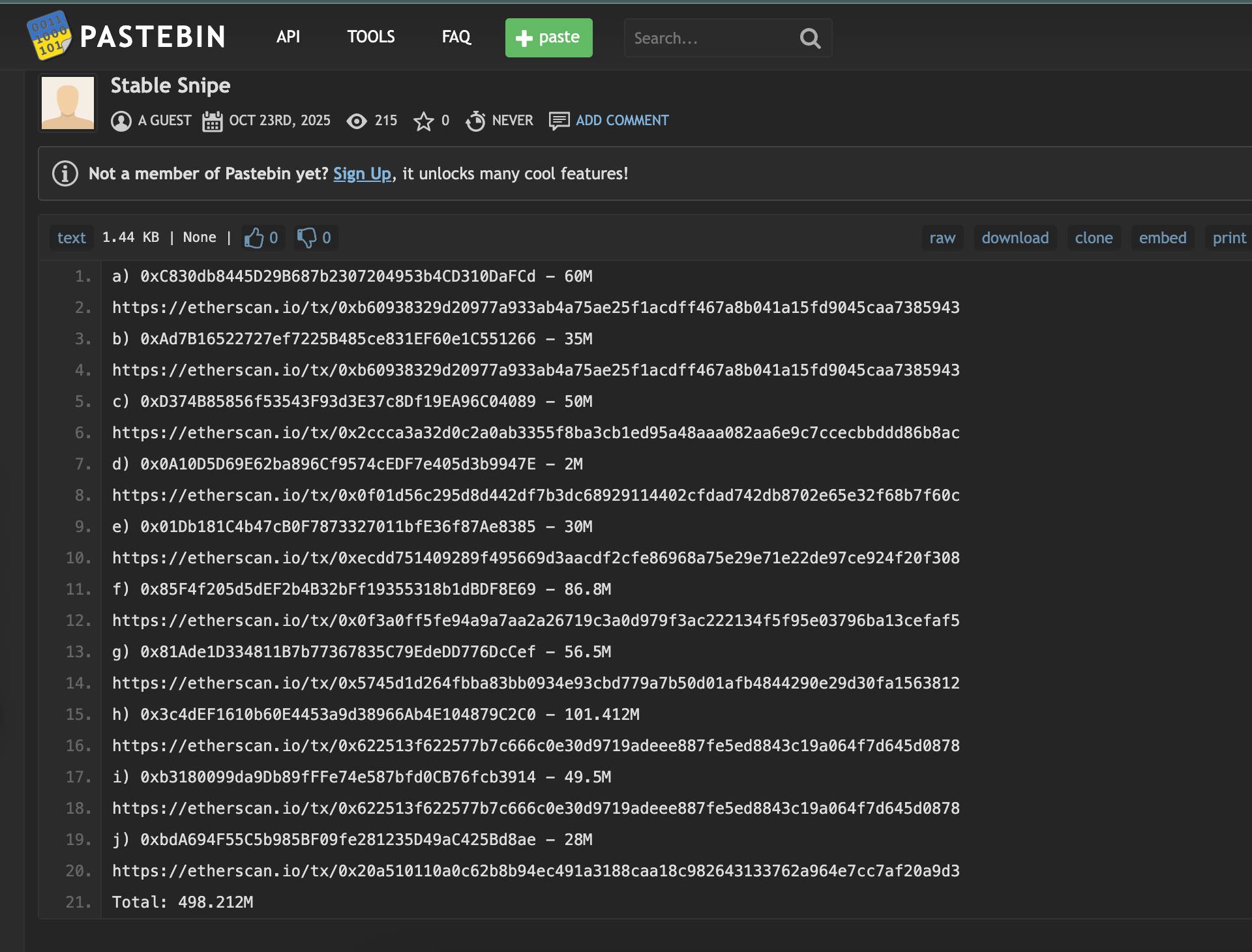

Largest deposit address: 0x833999c2fe99e388c100fab7680a1e45e3e825b2

Deposit amount: 101,400,000 USDT

Source of funds: Transferred from BTSE exchange address 0xbb4d1dc5c1abec4ea11166ec97e714862863ad1d on October 23 at 14:21 UTC

Preparation time: Funds were prepared 18 hours in advance

Second largest deposit address: 0xfca49ab538972876d79aa0082b265b6b049f0b21

Deposit amount: 86,850,000 USDT

Source of funds: Also from internal allocation within the BTSE system

Operation mode: Distributed through multiple intermediary addresses, but ultimately all pointed to BTSE

Third largest deposit address: 0x4e1f6753640f87854b377c36efb2af0d0e19a5d2

Deposit amount: 60,000,000 USDT

Operation mode: BTSE → intermediary address → deposit address

From this flow of funds, it can be seen that these large deposits did not come from retail investors or ordinary institutions, but were coordinated operations conducted through the BTSE exchange system. The three largest deposit addresses collectively controlled 248 million USDT, accounting for 30% of the total quota.

Interestingly, there is evidence regarding gas fees. All large deposits used an unusually high gas fee of 50 Gwei, while the average gas fee across the network was around 1.14 Gwei.

This cost-ignoring high gas fee strategy seems to have only one purpose: to ensure that transactions are packaged by miners at the first opportunity, avoiding any possible delays or failures.

Front-running is an inside job

If the front-running in the 24 minutes before the official announcement was outrageous enough, the subsequent discovery completely tore off the veil of this event.

The Twitter account @aggrnews, through on-chain data mining, restored a longer timeline: the layout of this insider trading began 20 days ago.

Moreover, the controller of the Stable deposit contract may have directly participated in insider trading, using their privileged access to facilitate profit transfer.

Let's rewind to October 4:

October 4, funding connections established. Address 0x1fa1c… transferred ETH to the owner address of the Stable deposit contract (0x1407c35Ad0ed3f9e143Ee6b99CF2da920606e760), which has contract management authority. Notably, this owner address is actually a 5-person multi-signature Safe wallet that controls the entire deposit contract.

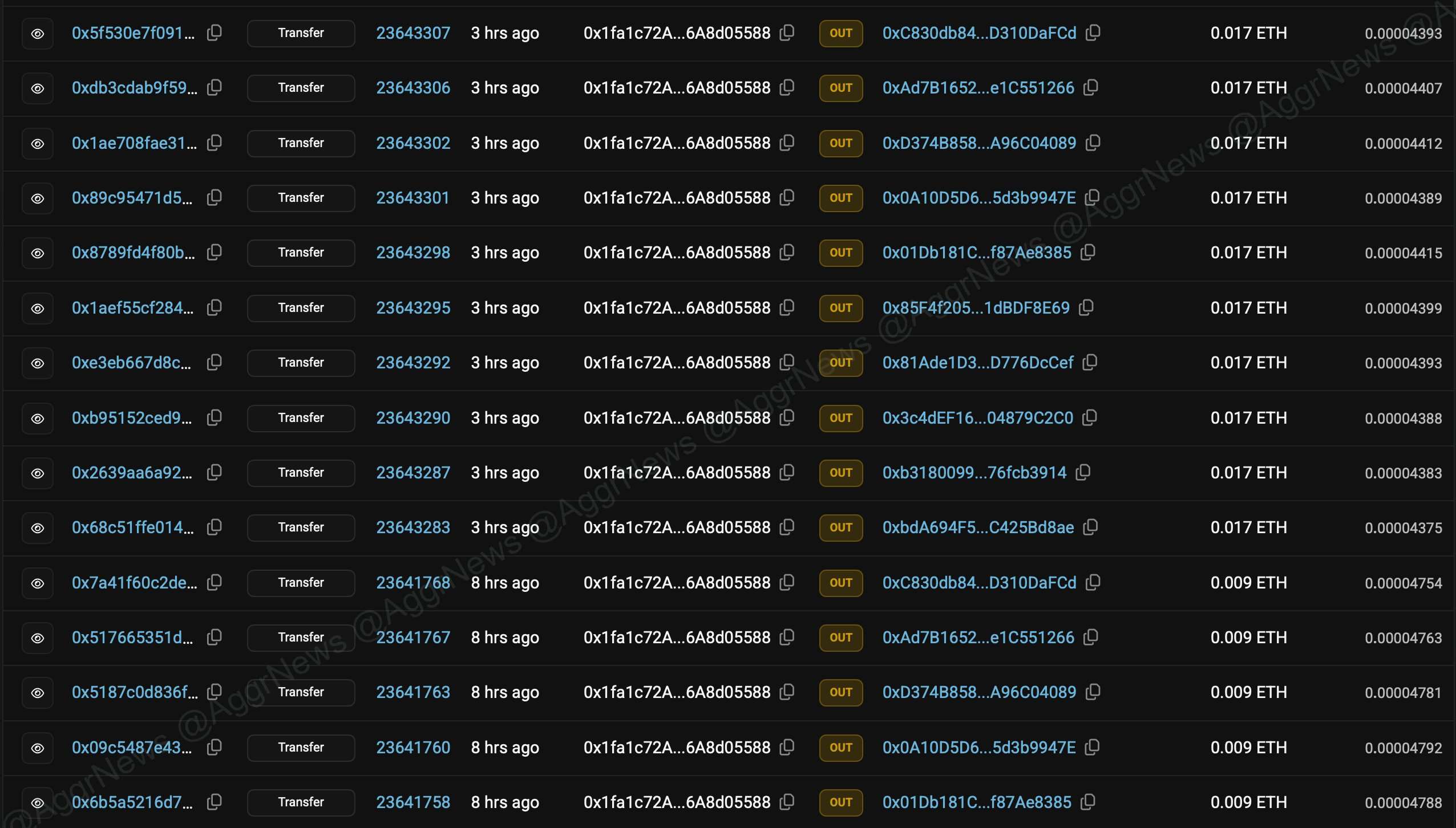

October 24, deployment of the sniper matrix. The same 0x1fa1c… address suddenly became active, precisely distributing 0.017 ETH as gas fees to 10 independent addresses. These 10 addresses had no prior connections and seemed to be specially prepared "shells" for the deposit event.

Subsequently, these 10 addresses acted almost simultaneously, completing deposits during the golden time window before the official announcement, totaling nearly $500 million, accounting for over 60% of the total quota.

What is even more intriguing is that the operational methods of these 10 addresses were highly consistent: uniform gas fee amounts, similar deposit times, and neat deposit amounts. Such near-military precision in operation would be nearly impossible without internal information support.

While we cannot determine whether the 5 signers of the multi-signature wallet directly participated in this insider trading, the connections are sufficient to indicate that at least one address close to the core circle had prior knowledge of the exact event time and contract address.

Ironically, as the owner of the deposit contract, this address theoretically has the authority to pause/resume the contract and view all deposit data.

The referee and the athlete are wearing the same pants; this race to see who deposits faster was doomed from the start. Those who rushed in after seeing the official tweet at 9:13 were merely spectators in this already choreographed performance, perhaps having bought tickets but unable to see the show.

Where is my opportunity?

Now, various pre-sales and new project activities in the crypto space have increasingly turned into a feast for insiders and privileged individuals, making it extremely difficult for ordinary users to fairly share in the spoils.

Looking back at Stable's first pre-deposit event, how can you increase your certainty of obtaining an opportunity? The answer may lie in the following two options.

First, become a part of the insider circle. You are part of the project's core circle, knowing the news in advance, but this is clearly very difficult to achieve.

Second, monitor on-chain data for front-running. Hard work can make up for shortcomings; more frequent monitoring of various on-chain data, along with a certain level of data analysis capability.

For example, when the insider big shots began depositing, different monitoring tools had already reacted. The $100 million stablecoin transfer would often be marked as "super large" in monitoring tools;

Almost simultaneously, multiple other addresses also transferred funds to this $100 million receiving address, with amounts all above $50 million. At this point, if you happen to be a research-driven individual accustomed to setting various alerts, you should have sensed something unusual.

However, this still does not guarantee that you will obtain a deposit opportunity; further analysis of the address receiving multiple deposits is needed, including creation time, creator associations, contract descriptions, and various other information, to have a certain probability of discovering "this is Stable's deposit vault."

Additionally, you need to make decisions and execute transactions in an extremely short time frame, paying gas fees far above market rates to ensure transaction success… this entire process may only have a few minutes of window, requiring strong on-chain analytical skills and execution ability.

Therefore, it is hard to say that this is an opportunity that an ordinary crypto player can possess.

Ultimately, in a market with extreme information asymmetry, ordinary investors are always at a disadvantage. Fairness has never been the rule of the crypto game; information gaps and rent-seeking are.

Rather than fantasizing about fairness, it is better to accept reality and adapt to the rules.

Either strive to enhance your information acquisition capabilities and technical skills, climbing up the food chain; or adjust your mindset and strategy, seeking opportunities with higher certainty within your capabilities.

Stable is certainly not the first, nor will it be the last. Front-running will continue, insider trading will continue, but the market will also continue.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。