Daily market key data review and trend analysis, produced by PANews.

1. Market Observation

On the eve of the U.S. CPI data release tonight, market sentiment has significantly improved, coupled with signs of easing trade tensions, leading to a general rise in the three major U.S. stock indices. In terms of macro policy, China announced that the "14th Five-Year Plan" will focus on emerging industries such as quantum technology, biomanufacturing, and hydrogen energy, and will deepen the implementation of the "Artificial Intelligence+" initiative to recreate a high-tech industry in China. Meanwhile, the U.S. banking system's reserves have declined for the second consecutive week to $2.93 trillion, marking a new low since the beginning of the year, as the Federal Reserve faces a critical decision on whether to halt the reduction of its balance sheet. Both JPMorgan and Bank of America predict that, given the rise in money market rates, the Federal Reserve may pause its quantitative tightening policy that has lasted for more than two years this month. Against this backdrop, the yield on the 10-year U.S. Treasury bond has returned to 4%, and spot gold has hovered around $4,100 for three days after a sharp drop of 5% on October 21. Goldman Sachs and JPMorgan are both optimistic about gold's prospects, predicting it could reach $4,900 and $5,055, respectively, by the end of 2026.

In the gaming industry, a recent update to the classic shooting game Counter-Strike 2 (CS2) on October 23 triggered significant turmoil in its cosmetic market. The update allows players to synthesize previously rare golden items such as knives or gloves by consuming five relatively common red-quality skins. This change directly impacted the scarcity of high-end cosmetics, causing their market value to plummet. The market index dropped from 1,660 yesterday to 510 today, a nearly 70% decline. Well-known items like the "Butterfly Knife" fell from about 21,000 yuan to around 4,100 yuan, triggering panic selling among players and investors holding high-value items, even causing mainstream trading platforms to temporarily crash.

In the cryptocurrency space, after recent fluctuations, Bitcoin prices briefly returned to $111,000 but remain in a consolidation range between $104,000 and $112,000. Market opinions are mixed: Galaxy Digital CEO Mike Novogratz predicts Bitcoin will maintain a range of $120,000 to $125,000 by the end of the year; Bitwise CIO Matt Hougan believes that the rise in gold driven by central bank purchases shows a future path for Bitcoin, with prices expected to accelerate after selling pressure diminishes due to ongoing ETF and corporate demand. However, Standard Chartered's Geoff Kendrick warns that trade war concerns may cause a brief dip below $100,000, which would present a buying opportunity. On-chain analyst Murphy points out that a "defensive wall" of 2.92 million BTC has formed in the $104,000 to $112,000 range, but the selling from long-term holders and weakening demand from ETFs is still in play. Technically, analyst Rekt Capital believes the price is forming an ascending triangle, needing to stabilize above $110,800 to confirm a breakout. Options market data shows that open interest has reached a new high of $63 billion, with bullish positions mainly concentrated between $120,000 and $140,000, but the market still faces the challenge of $5.1 billion in options expiring in the short term, with the maximum pain point at $114,000.

Meanwhile, Ethereum is showing potential bullish structures. On-chain data indicates that "whale" addresses holding between 10,000 and 100,000 ETH are accelerating their accumulation, with their holdings nearing 28 million ETH, while smaller holders' balances are declining. Technically, Ethereum has formed a "triple bottom" pattern around $3,750 to $3,800, and if it can successfully break through the neckline resistance at $3,950 to $4,000, it could theoretically initiate a rebound towards a target price of $4,280.

Despite some analysts predicting that liquidity shifts will trigger an "altcoin season," various altcoin indices are currently still at bear market lows. A few coins like Solana are outperforming the market, but overall, there is a lack of broad upward momentum. The stablecoin project Stable faced widespread community skepticism today regarding its $825 million pre-deposit activity, as approximately $500 million in large deposits (with a single whale or institution accounting for 60.6%) occurred before the announcement, raising concerns of "insider trading." On-chain data tracking shows a connection between the related funds and Bitfinex. Additionally, last night, sources revealed that Trump announced a pardon for Binance founder Changpeng Zhao, citing sympathy for the "political persecution" he faced and ending the "war on cryptocurrency." Following this news, BNB's price surged, briefly breaking through $1,160, with a daily increase of nearly 6%.

2. Key Data (as of October 24, 13:00 HKT)

(Data source: Coinglass, Upbit, Coingecko, SoSoValue, Tomars)

Bitcoin: $111,262 (YTD +15.51%), daily spot trading volume $1.89 billion

Ethereum: $3,974 (YTD +15.68%), daily spot trading volume $1.907 billion

Fear and Greed Index: 32 (Fear)

Average GAS: BTC: 1 sat/vB, ETH: 0.1 Gwei

Market share: BTC 59.1%, ETH 12.8%

Upbit 24-hour trading volume ranking: ORDER, ETH, BTC, XRP, F

24-hour BTC long/short ratio: 48.59%/51.41%

Sector performance: AI sector up 17.85%, NFT sector up 5.4%

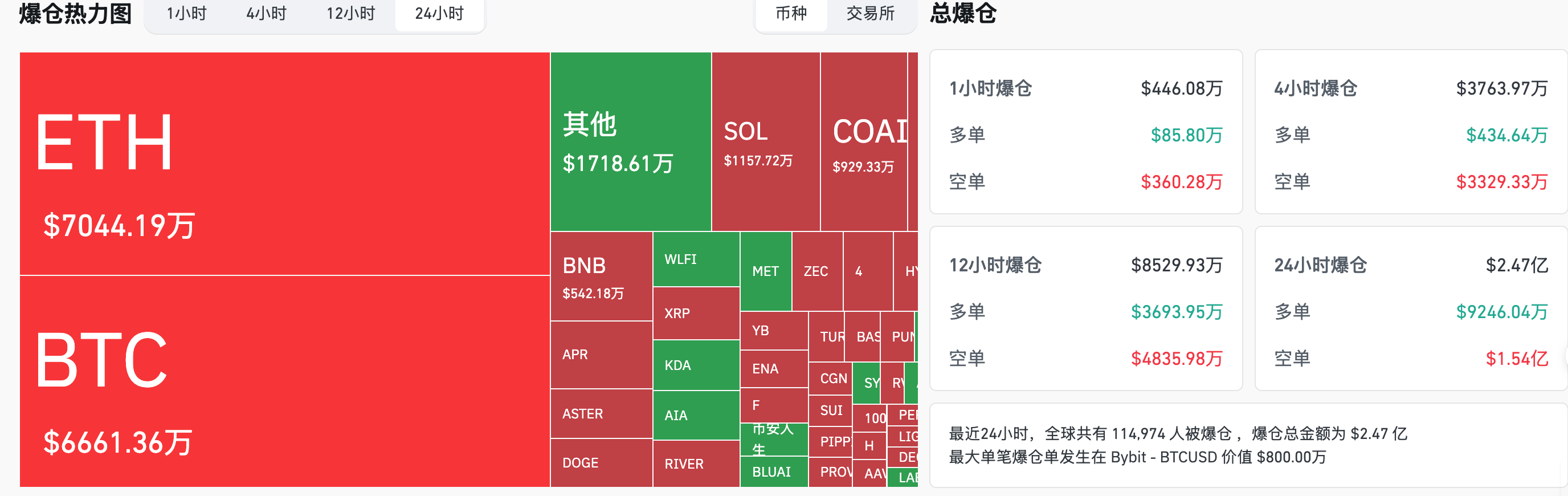

24-hour liquidation data: A total of 114,974 people were liquidated globally, with a total liquidation amount of $247 million, including $66.61 million in BTC, $70.44 million in ETH, and $5.42 million in BNB.

BTC medium to long-term trend channel: upper line ($111,805.35), lower line ($109,591.38)

ETH medium to long-term trend channel: upper line ($4,003.39), lower line ($3,924.11)

*Note: When the price is above the upper and lower lines, it indicates a medium to long-term bullish trend; conversely, it indicates a bearish trend. When the price is within the range or fluctuates through the cost range in the short term, it indicates a bottoming or topping state.

3. ETF Flows (as of October 23)

Bitcoin ETF: +$20.33 million

Ethereum ETF: -$128 million, with all nine ETFs showing no net inflow

4. Today's Outlook

Binance will support the Shentu (CTK) network upgrade and hard fork on October 24

Binance Alpha will launch APRO (AT) on October 24, Binance Alpha and contracts will launch Orochi (ON)

Binance will remove A/FDUSD, AXS/BNB, GALA/BTC, and PNUT/BRL spot trading on October 24

The U.S. Bureau of Labor Statistics will release the September CPI report: expected value 3.1%, previous value 2.9% (October 24, 20:30)

Plasma (XPL) will unlock approximately 88.89 million tokens on October 25 at 8 PM, accounting for 4.97% of the current circulation, valued at approximately $36.9 million;

Humanity (H) will unlock approximately 62.5 million tokens on October 25 at 8 AM, accounting for 3.01% of the current circulation, valued at approximately $7.3 million;

Venom (VENOM) will unlock approximately 59.26 million tokens on October 25 at 4 PM, accounting for 2.23% of the current circulation, valued at approximately $6.2 million.

Today's top gainers among the top 100 cryptocurrencies by market capitalization: ChainOpera AI up 77.2%, Aster up 13.9%, World Liberty Financial up 13.4%, ASI Alliance up 12.3%, Pump.fun up 11.1%.

5. Hot News

Only 274 addresses successfully participated in Stable's $825 million pre-deposit limit

Clanker joins the Farcaster ecosystem, launching a $CLANKER buyback and deflationary mechanism

Spark transfers $100 million in stablecoin reserves to the Superstate crypto arbitrage fund

A single entity is suspected to have claimed a $10 million MET airdrop

Three addresses related to the TRUMP team received a $4.2 million MET airdrop

The Wall Street Journal: President Trump pardoned the convicted founder of Binance

BNB continues to rise, breaking through $1,122, up 3.81% for the day

Arthur Hayes withdraws 2.16 million WILD from Kucoin and Gate, valued at $463,000

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。