The pace of inflation was slower than what many economists predicted according to the latest CPI report published by the U.S. Bureau of Labor Statistics (BLS) on Friday morning. The announcement buoyed markets as the cooler-than-expected inflation data sets up an even more compelling case for an interest rate cut by the Federal Reserve at the end of the month. Bitcoin briefly climbed past $111K following the report’s publication, jumping 2.27% before easing back to $110K.

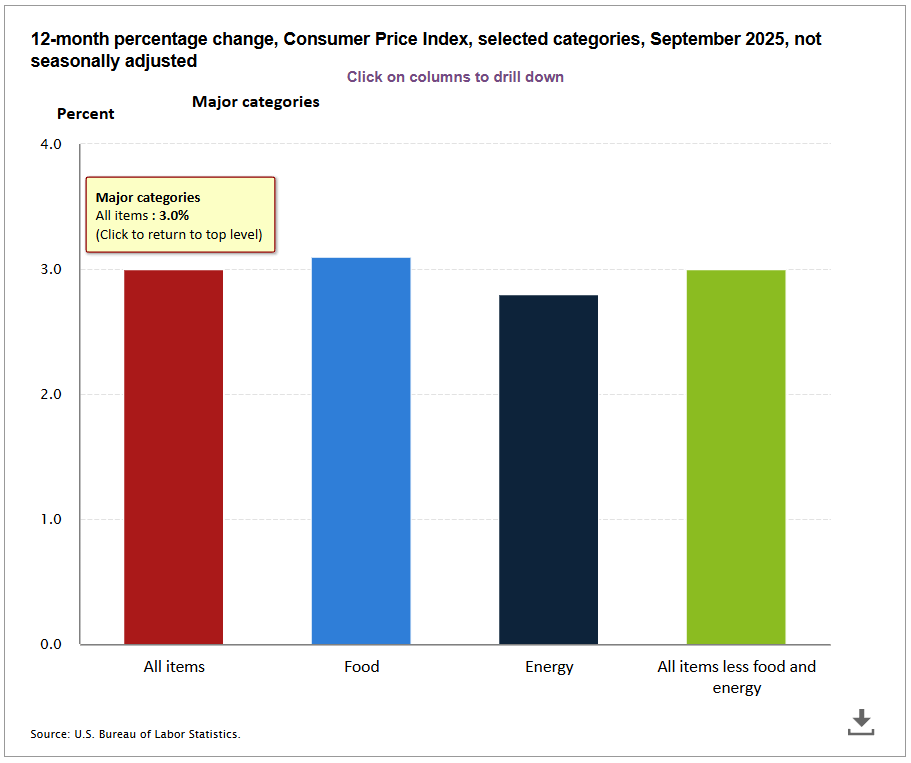

September’s CPI increased by only 0.3%, nudging the annual rate of inflation to 3%. Experts had projected a 0.4% increase, which would have pushed the annual inflation rate to 3.1%. Core inflation, which strips out the more volatile categories of food and energy, rose 0.2% but also ended up at 3% on an annual basis. Economists were expecting slightly higher numbers of 0.3% and 3.1% respectively.

(September’s inflation was lower than expected at an annual rate of 3%. / U.S. Bureau of Labor Statistics)

Other official economic reports have been suspended as the U.S. government shutdown enters its 24th day. An exception was made for the CPI data, which had initially been scheduled for October 15. The Fed will use the report to guide its rate decision next week. All predictions point to a lowering of the policy rate, with the CME Fed Tool showing a 96.7% likelihood of a rate cut. Both crypto and stock markets were reacting positively at the time of writing, with the broader crypto market up 1.74% and all major stock indices in the green.

But others are questioning the accuracy of the CPI data and are even wary of the widespread dovish sentiment behind an expected rate reduction.

“Even if you measure annual price increases by the CPI, which understates the magnitude of the rise by design, the index rose 3% YoY in Sept., 50% above the Fed’s 2% target,” writes gold investor Peter Schiff. “Despite this, the Fed intends to cut interest rates again, throwing gasoline on the inflation fire it lit.”

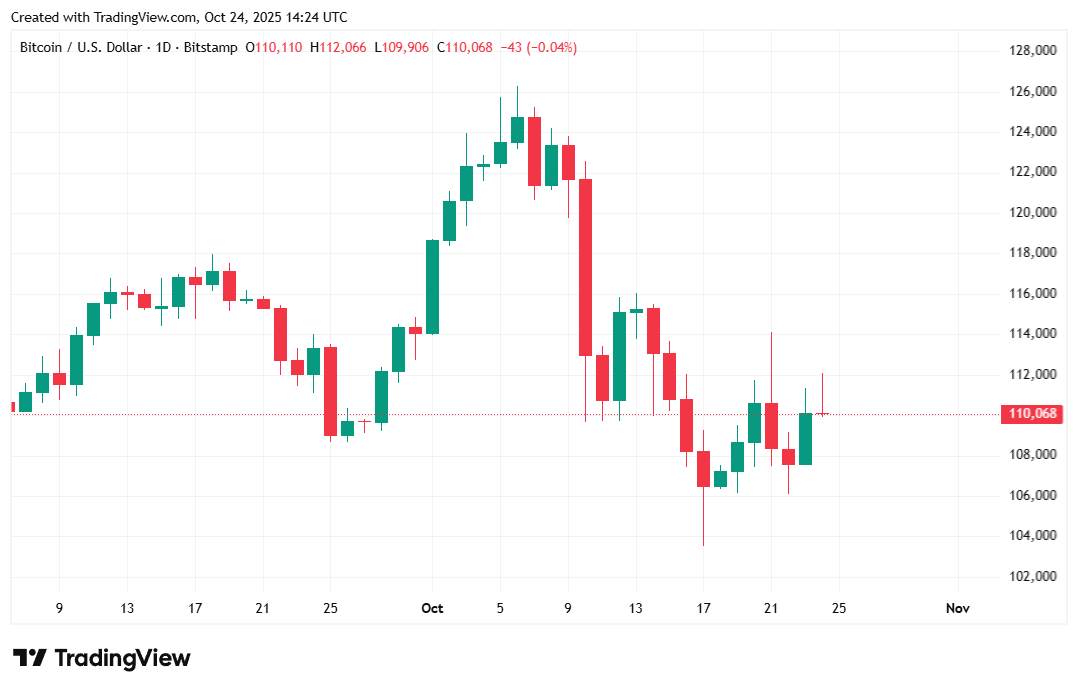

Bitcoin was trading at $110,083 at the time of reporting, an increase of 0.69% for the day and 4.57% for the week, according to Coinmarketcap data. The cryptocurrency’s price ranged from $108,802.83 to $111,842.53.

( BTC price / Trading View)

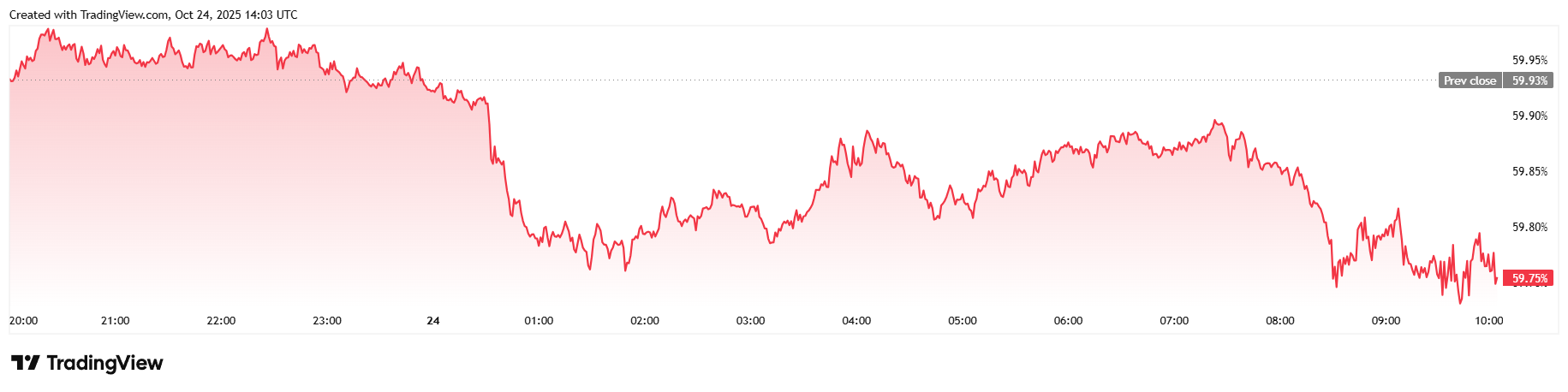

Twenty-four-hour trading volume eased 22.59% to $53.07 billion, but market capitalization rose 1.07% to $2.2 trillion. Bitcoin dominance shed 0.29% since Thursday, dipping to 59.75%.

( BTC dominance / Trading View)

Total value of open futures contracts climbed 2.92% to $71.50 billion over 24 hours according to Coinglass data. Liquidations echoed yesterday’s levels, totaling $66.05 million. Short sellers dominated that figure, losing $49.81 million in margin while long investors lost the remaining $16.24 million.

- Why did Bitcoin surge past $111K?

Cooler-than-expected inflation data boosted hopes of a Federal Reserve rate cut later this month. - What did the latest CPI report show?

September CPI rose just 0.3%, putting annual inflation at 3%, below economists’ forecasts. - How are markets reacting?

Crypto and stock markets rallied, with bitcoin up over 2% and the broader crypto market gaining 2.16%. - What happens next?

With a 96.7% chance of a rate cut priced in, traders expect bitcoin to stay strong as monetary policy loosens.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。