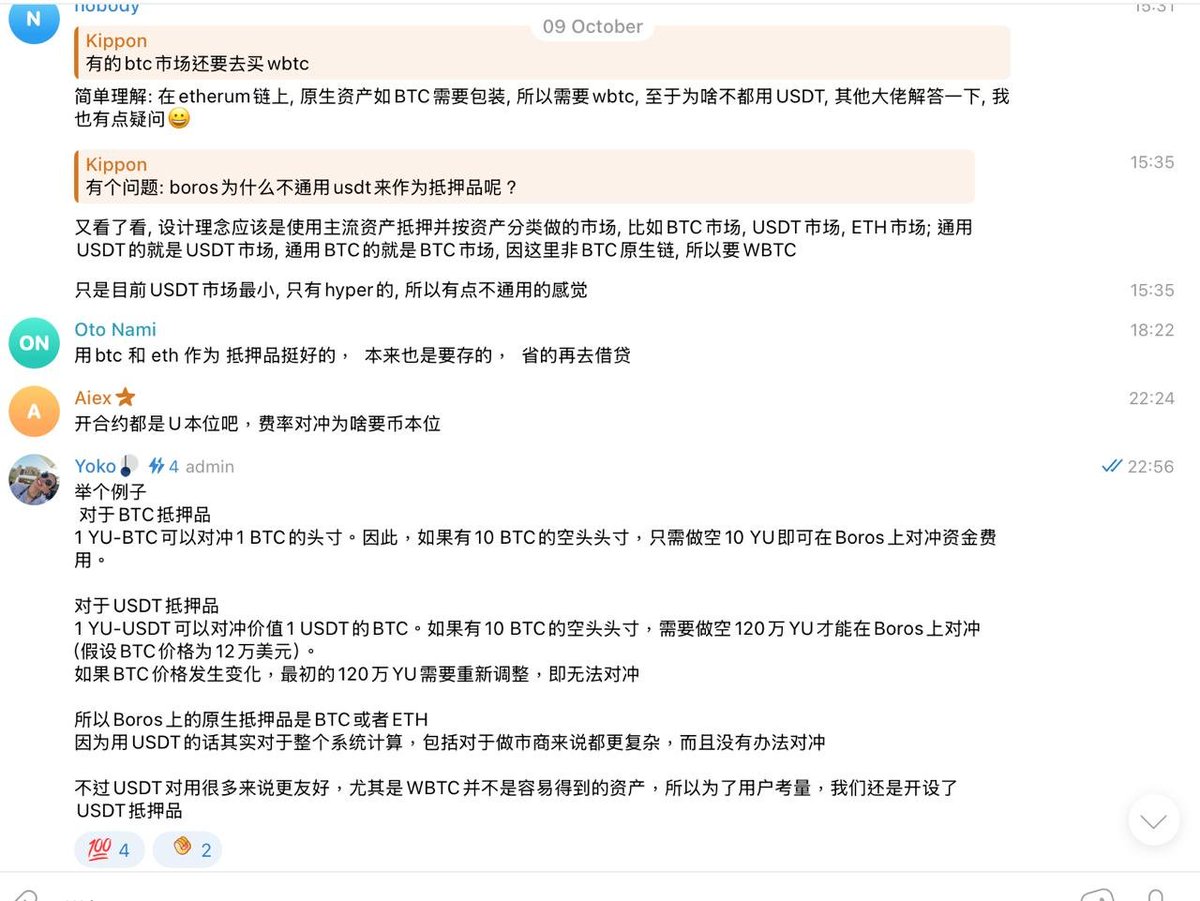

📌 I saw someone in the group asking about Boros collateral, which should also be a point of confusion for some Boros users:

@boros_fi Since it is a funding rate market, why can't we use USDT as collateral to open positions like in common contracts?

Based on Grandma @pendle_grandma's reply, I would like to add a few points of my understanding—

1️⃣ Funding rate market ≠ Ordinary lending market

The logic of traditional DeFi lending protocols is that the liquidity pool has unified collateral; as long as the assets are safe and have low volatility, they can generally be used as collateral.

However, Boros's design philosophy is different; it requires that the collateral assets for each market must be consistent with the pricing assets of the trades.

The reason is simple: 👉 To prevent cross-asset liquidation risk.

For example—

If you open a long position of 10 BTC (worth 1.1 million USDT) on an exchange, to hedge the funding rate, you only need to short 10 YU-BTC on Boros.

⚙️ At this point, the hedging relationship is "BTC against BTC," with consistent pricing units, and the profit/loss changes on Boros directly correspond to the funding rate fluctuations on the exchange, making the risk model simple.

If you use USDT as collateral, the problem becomes much more complicated—

The same long position of 10 BTC would require a corresponding position of 1.1 million YU-USDT to hedge the funding rate, which brings three issues:

1) The hedging calculation becomes more complex, requiring constant conversion of BTC prices.

2) The volatility of the collateral and the volatility of the funding rate are not on the same dimension, making the risk model difficult to establish.

3) User experience becomes more chaotic, and liquidation and risk control become less intuitive.

In the event of a sudden drop in BTC prices, the value of USDT would not change, but the collateral ratio would instantly become unbalanced, forcing the system to either liquidate or require complex re-collateralization logic.

Therefore, from the perspective of risk efficiency, the vast majority of users playing in the coin-based market on Boros will find better cost-effectiveness.

The native asset collateral market of Boros can provide higher leverage because the risk control model is more predictable.

2️⃣ Why does only Hyperliquid's funding rate support USDT collateral?

Some people may not have noticed that on October 3rd, Boros launched a dedicated USDT market for Hyperliquid, and the team must have made a lot of considerations:

If you look at the funding rate curve of Hyperliquid, you will find that it is one of the most volatile in the entire market. It can flip several times in a single day, and traders update their positions very frequently.

This frequent interest rate fluctuation is precisely the raw material that the funding rate market needs the most—

The more volatile it is, the larger the trading space, the higher the trading density, and the stronger the hedging demand, the more trading value it has, which aligns with Boros's appetite.

Boros chose to first implement USDT collateral on Hyperliquid, which I feel is a small-scale test:

Using the fastest-reacting market to test the sensitivity, depth, and participation of the funding rate market. Once this runs smoothly, it may just be a matter of time before more markets are onboarded.

After analyzing the above, I feel that the @pendle_fi team is doing a very meticulous job in the operation of Boros, balancing safety, matching, and user experience. This is the level of detail that a mature protocol should have, and it deserves a thumbs up!

Additionally, Boros launched a new term funding rate market yesterday (expiring on November 28, 2025), providing a longer hedging window. It would be good to observe if there are any pricing differences between long and short-term contracts, as there may be opportunities for cross-term arbitrage.

📍 I previously wrote a series of tutorials on Boros; interested friends can refer to them!

https://x.com/Bitwux/status/1961620194620854732

https://x.com/Bitwux/status/1964521312657018928

https://x.com/Bitwux/status/1956237907574055261

https://x.com/Bitwux/status/1954004619627225302

In the new Boros communication channel opened by Pendle, I discovered many hidden experts who provided a lot of strategic insights. I recommend joining; you can really learn something! 👉 https://t.me/PendleFinance_CN

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。