Last time I mentioned that the cash reserves of global fund managers have decreased to 3.8%. On one hand, this indicates that these fund managers are optimistic about the market, but on the other hand, it also shows that there isn't enough cash to continue driving the market up in the short term. Of course, this is all about the short term, as clearly stated in the referenced article.

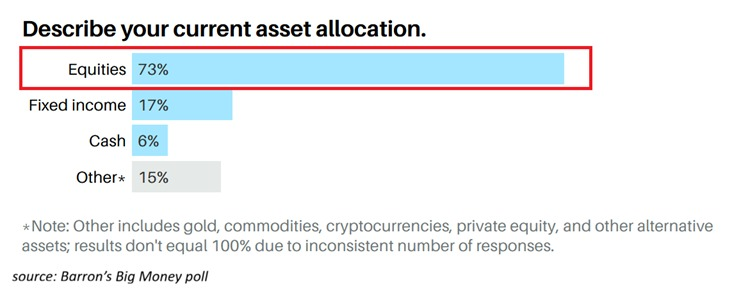

Today, I saw new data regarding investors' asset allocation. A positive aspect for the market is that 73% of assets are allocated to stocks, indicating a strong risk appetite, while the cash proportion is very low at only 6%, suggesting that most funds in the market are still in operation, with no obvious signs of risk aversion.

However, the negative aspect is also quite clear. With 73% of assets in stocks and 17% in bonds, it indicates that most funds have already been invested in the market, and there may not be much "ammunition" left for further buying, leading to limited marginal buying power.

Cash (6%) is a potential source of future buying power. When the cash proportion is too low, it means there isn't much available for bottom-fishing or increasing positions. The short-term market may be in a high zone, and this allocation structure is common during optimistic or even overheated market phases, as institutions are reluctant to miss out on profits and have increased their stock allocations.

But it also means that if the market experiences volatility or a pullback, the ability to replenish funds is weak, and the volatility of risk assets may be greater.

This article is sponsored by #Bitget | @Bitget_zh

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。