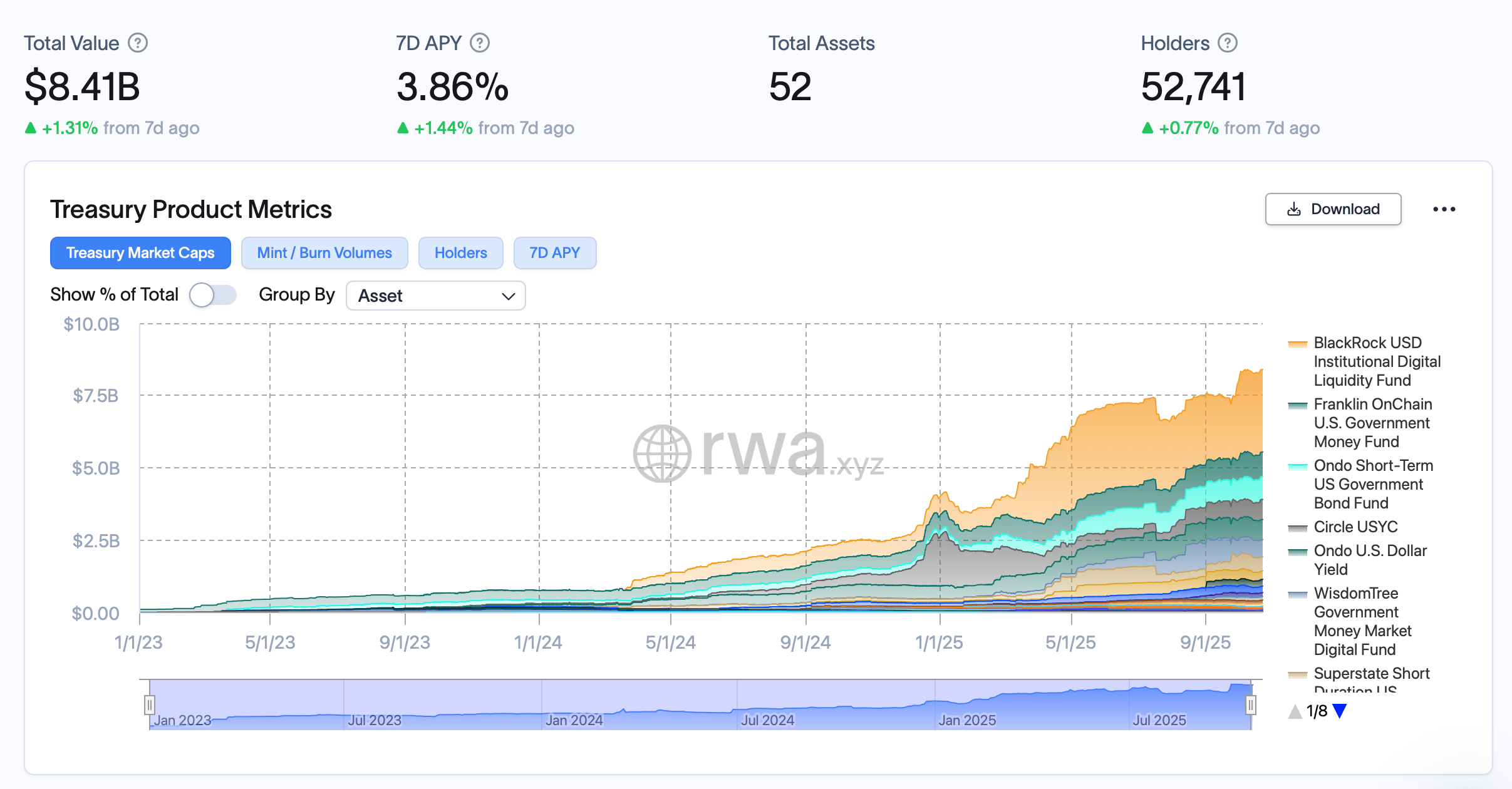

Blackrock’s USD Institutional Digital Liquidity Fund (BUIDL) held court at the top with a hefty $2.85 billion, running across seven chains via Securitize’s platform. It remains the heavyweight anchor of the space, outpacing Franklin Templeton’s BENJI fund at $851.6 million and Ondo’s OUSG at $788.3 million.

Steady Inflows and a Subtle Yield Boost

Rwa.xyz stats show the overall market saw a 1.31% increase, adding roughly $110 million in total value over the seven-day run. Average yields nudged higher to 3.86%, while holder counts ticked up 0.77% to 52,741, signaling that even minor rate movements continue to attract blockchain-savvy treasurers.

Tokenized U.S. Treasury funds according to rwa.xyz stats.

Platform Power Plays

Securitize continues to dominate the scene with 35.03% market share, buoyed by BUIDL’s expansion. Ondo retains second place with 17.58%, while Franklin Templeton and Circle trail with 10.13% and 8.28%, respectively. Superstate’s USTB fund added a respectable 31.8% over 30 days, hinting at a growing appetite for shorter-duration tokenized paper.

Chain Diversity Shows Muscle

Ethereum remains the liquidity nucleus with $4.3 billion in tokenized treasuries, followed by Avalanche at $638 million and Stellar at $609.8 million. The multi-chain march continues as issuers hedge network risk and chase cross-chain investors.

Yield Hunters Keep the Flows Coming

The top gainer, BUIDL, raked in $749 million in net inflows over 30 days, while Circle’s USYC and Superstate’s USTB saw $119 million and $160 million, respectively. Ondo’s OUSG added $59 million, reinforcing its role as a steady yield magnet. Other moves came from Wisdomtree’s 7.55% rise (WTGXX) and Fidelity‘s 13.39% gain (FDIT).

Fee Games and Access Models

Fee structures varied from Franklin Templeton’s tidy 0.15% to Circle’s 0% management fee model offset by a 10% performance cut, showing how tokenized products are experimenting with investor incentives.

With 52 products hosted on rwa.xyz spanning everything from Ethereum to XRP Ledger, the tokenized treasuries sector is evolving into a global liquidity bridge between traditional finance (TradFi) and decentralized finance (DeFi). Despite a modest weekly gain, its continued inflows and diversification signal that tokenized real-world assets aren’t a passing trend—they’re becoming financial infrastructure.

- What’s the total value of tokenized U.S. treasuries this week?

The market rose to $8.41 billion, up 1.31% from the previous week. - Which platform leads the tokenized treasuries market?

Securitize leads with 35% share, powered by Blackrock’s BUIDL fund. - Which blockchain hosts the most tokenized treasuries?

Ethereum dominates with $4.3 billion in tokenized treasuries. - How many holders now own tokenized treasuries?

More than 52,700 holders, reflecting steady institutional and DeFi interest.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。