Original Title: Life lessons from trading

Original Author: thiccy, cofounder of scimitar capital

Translated by: SpecialistXBT, BlockBeats

Editor’s Note: Trading is a mirror that reflects the relationship between people and reality. This article superficially discusses how to survive in the market, but in essence, it explores a more universal life question: how to recognize one’s strengths, how to calibrate one’s understanding of the world, how to make decisions in uncertainty, and how to maintain humanity in a zero-sum game. The author states, "In a sense, everyone is a trader," as we all bet on the future with incomplete information, the only difference being the form of the chips.

1) Traders make money by guessing the flow of funds.

2) There are many ways to win in the guessing game:

Some people can quickly read new information.

Some people can quickly complete guesses.

Some people can accurately process new information.

Some people can quickly identify patterns.

Some people can see patterns that others cannot.

Some people can accurately interpret others' predictions.

Some people have networks that can gossip about fund movements.

Some people can chase funds that others cannot, are unwilling to, or do not know how to chase.

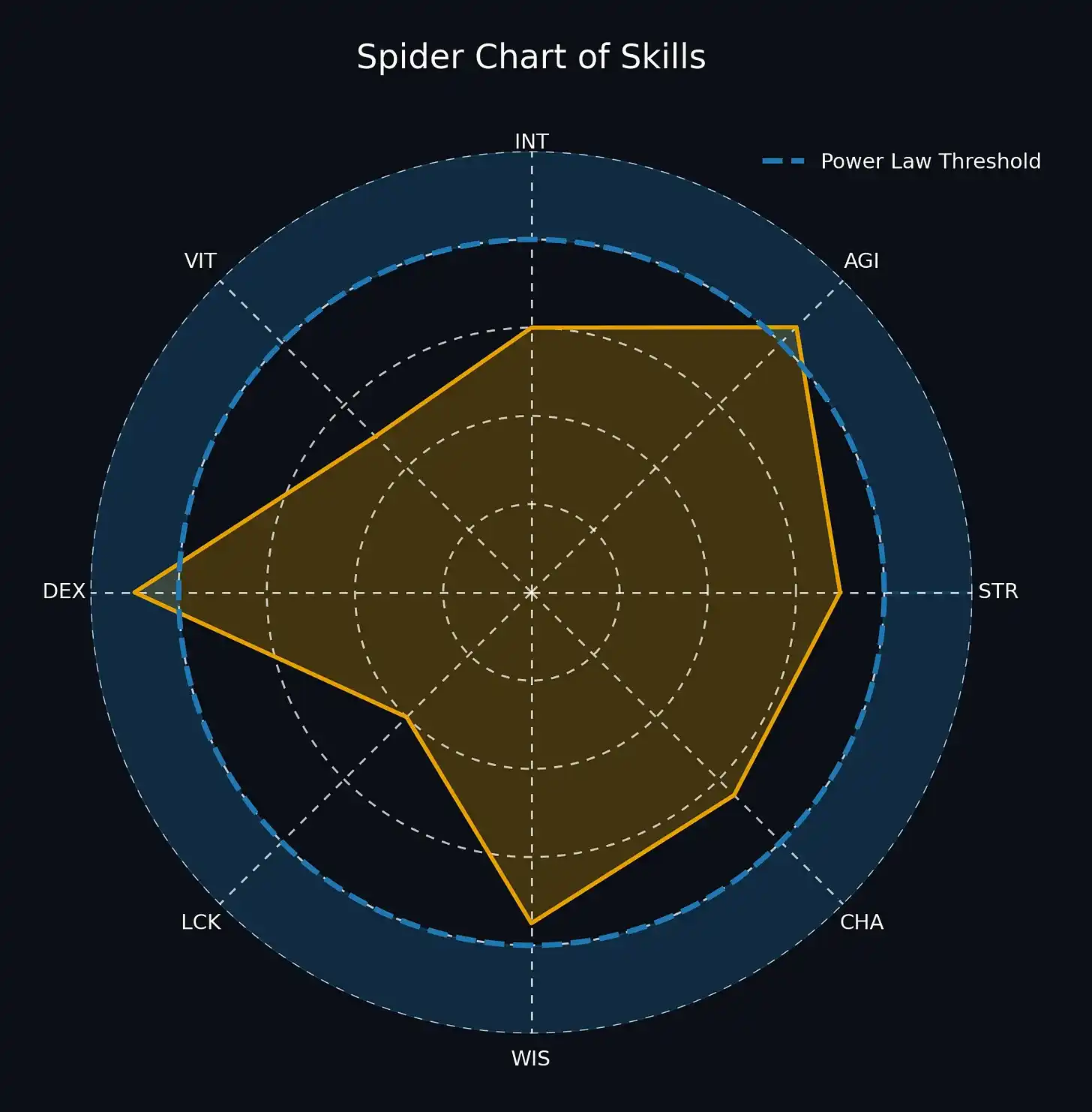

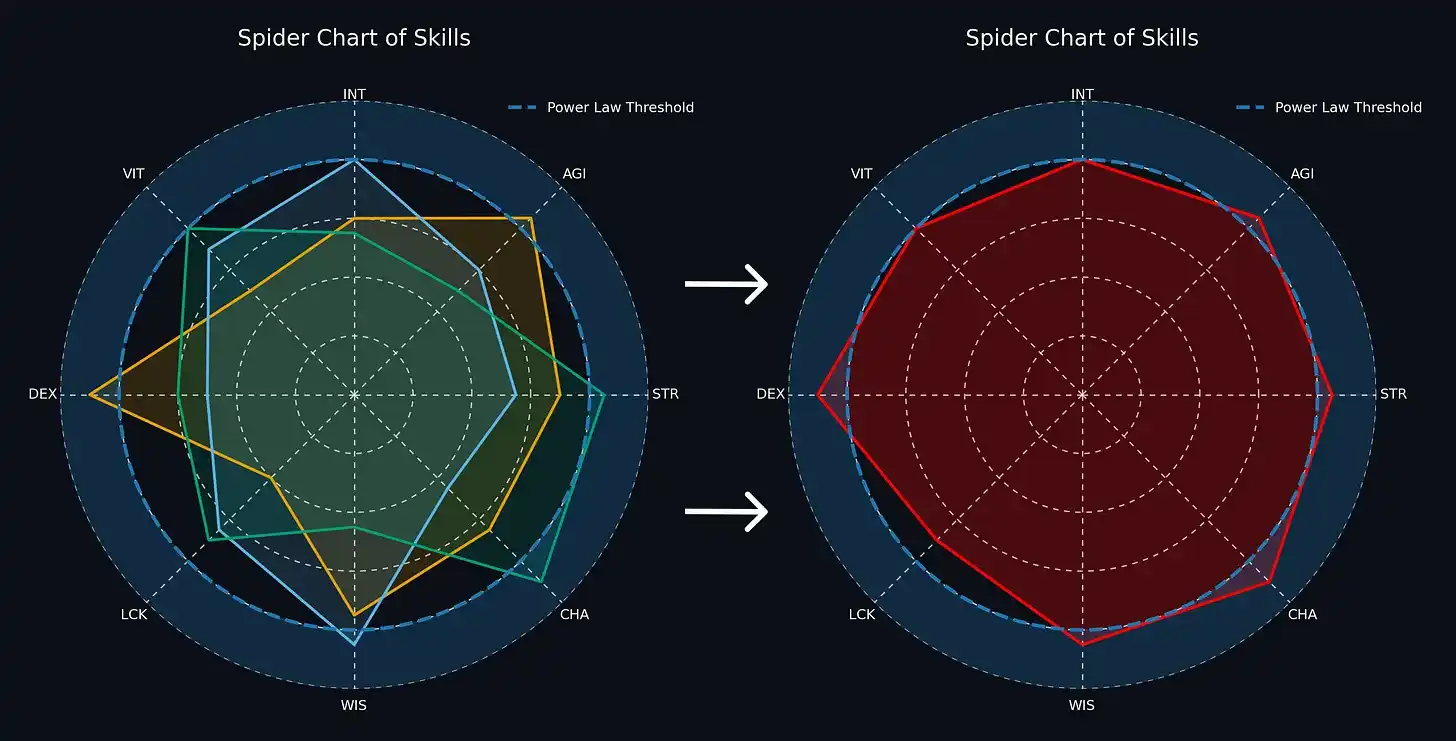

3) Each skill is referred to as an "edge," and you can think of each skill as an attribute value in the game.

4) This game is winner-takes-all. If you want to keep making money, you need to fill your attribute circles and cross the power law threshold.

5) Team hunting is easier. Combining everyone's best skills can cross more thresholds. A great trading team is a positive-sum game. The whole is greater than the sum of its parts.

6) Trust is built through continuously upgraded trust tests. It is important to calibrate the scale of trust tests. Too large can lead to being taken advantage of, while too small can hinder the compounding growth of relationships. Generosity is very useful. Most people in trading feel lonely, so making the process enjoyable is a valuable skill.

7) If you want to win, you must be willing to sacrifice everything. Most people do not actually desire success that much, and that’s okay.

8) Only play games that you can learn to win repeatedly. Honestly calibrate your abilities and the real level of your abilities in the world. Achieving world-class status in any game requires intense focus, courage, and often rare talents shaped from childhood. Most importantly, find games that suit your specific strengths. Playing a game that is not suitable for you is the most common tragedy in this industry. Trading has consumed and spat out millions, wasting their golden years and scattering their stories in the wind.

9) The guessing game always becomes harder over time because it is an adaptive Darwinian system. People learn, knowledge spreads, advantages decay, winners grow, and losers die.

10) Adverse selection is everywhere. Always ask yourself why people who are smarter, better connected, or faster than you did not seize the opportunity before you.

11) Most market participants are just flipping coins against each other. Occasionally, someone will flip twenty heads in a row, appearing to be a genius, which then triggers a crowd to blindly follow and imitate.

12) Your best trades will succeed quickly and violently.

13) Trading exposes your deepest insecurities about yourself and the world. It is a way to quickly recognize reality and your place within it. In a sense, everyone is a trader. We make calculated decisions with incomplete knowledge, manage drawdowns to avoid bankruptcy, and convert our natural advantages into returns. Almost everything boils down to calibrating your understanding of yourself with your understanding of the world. Many people underestimate their most powerful unique traits and take too few risks when building a life around those traits.

14) Jealousy is the most intense emotion in the internet age. If handled well, it can allow you to quickly replicate effective things from the best people. If handled poorly, it can lead to scarcity-driven anxiety and burnout.

15) As trading time increases, you will realize that ultimately you need to find a foundation for your identity based on something stable. An identity based on talent or "niche perspectives" will soon be challenged. An identity based on the thought process of problem-solving is more sustainable, even if it sacrifices novelty and excitement.

16) Only the paranoid survive. Panic ahead of others. Always have an exit plan. Avoid deep drawdowns. Stay humble and leave room for the unknown unknowns. Be aware of when you are selling tail risks. Maintain liquidity. Respect counterparty risks. Respect path dependence.

17) People often build artificial heavens around the goals they pursue and artificial hells around the anxieties they escape. This framework can spark brief bursts of motivation, but it is not a sustainable way to live long-term. A sense of scarcity and anxiety distorts decision-making, making you susceptible to ideological capture.

18) Trading is a zero-sum game within a larger positive-sum game. While every trade has a winner and a corresponding loser, the market as a whole allocates resources over space and time, aiding the development of civilization. The emergent goals of complex systems are often only clear in hindsight. If you are too cynical about the futility of what you are doing, you will mentally self-destruct and exhaust yourself.

19) It is difficult to observe the big picture clearly. You are an individual ant trying to understand the behavior of the entire ant colony. Prices and price movements are low-dimensional projections of a vast machine. The market fluctuates for various reasons, but we simplify views and compress them into a single coherent story.

20) Money can change a lot, but not everything. When you understand what truly changes and what remains constant, you will experience the pain of growth.

21) Making a profit in trading means your view of the world is closer to reality than the average level of market funds. However, seeing through the essence in one market does not mean you can see through it in another. The higher-order abilities that can transfer across markets include discovering and realizing advantages, understanding adverse selection, and judging where the power law critical points are.

22) People who make a living from trading often age quickly. The mental stress is costly. Make a conscious effort to take care of yourself. Without health, money means little.

23) Winning streaks often mask bad habits that will backfire over time. Losing streaks will make you question the entire process. Do not get excited at peaks, nor disheartened at troughs.

24) The world is in a constant state of decay. Reality is constantly changing, and everyone’s models will become outdated and inaccurate. This is why there is always room for young people, those eager for success, and those who are passionate to make money. People are like the moving averages of their lives. Short windows capture new trends first, even if the parts they capture are noise.

25) The market trains you to find self-reinforcing and self-correcting loops where you see them.

26) Most excess opportunities in modern markets ultimately stem from people trying to fill the void of meaning in life.

27) I am grateful to play this game with friends and be rewarded for it. Life is truly beautiful.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。