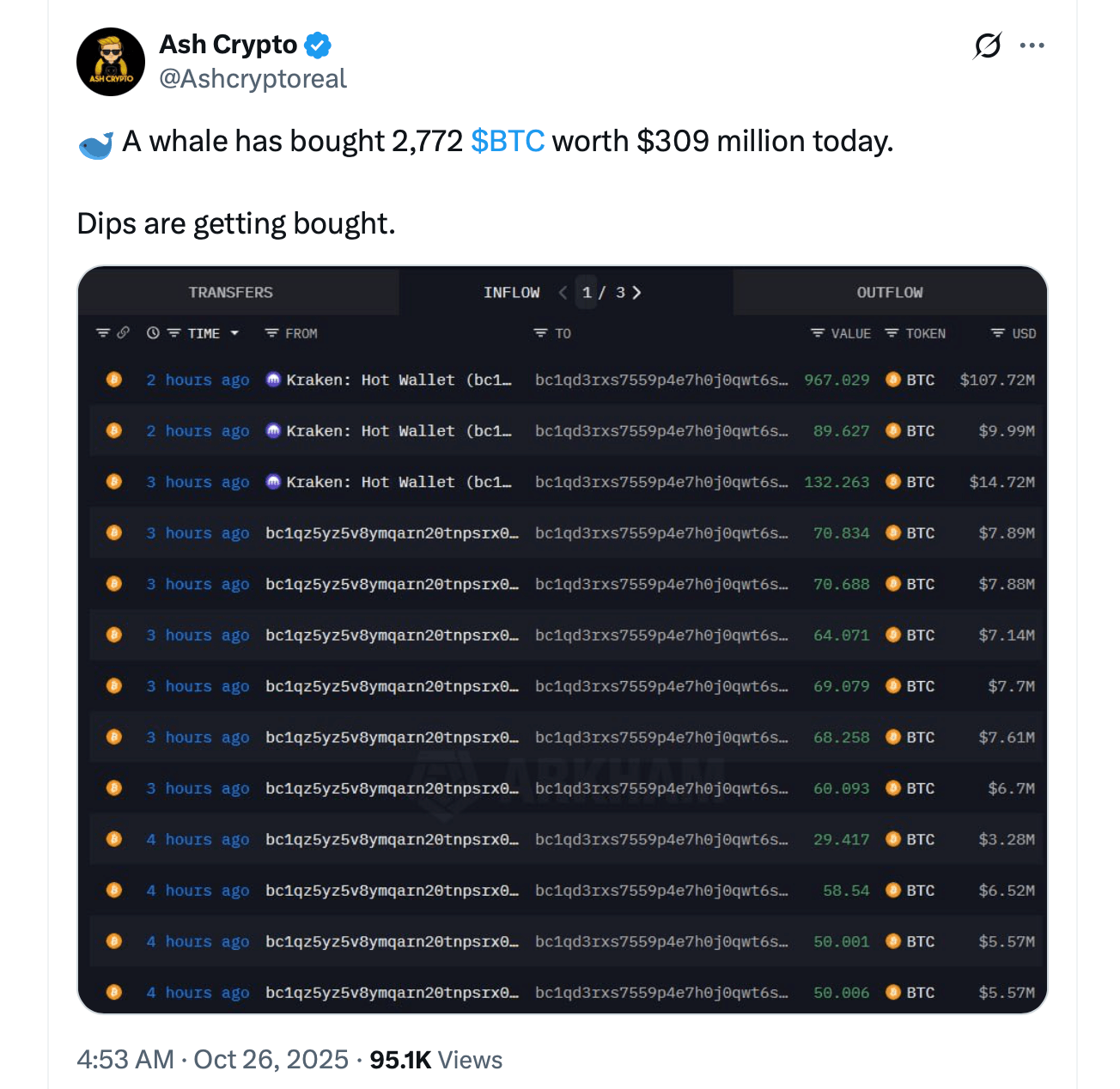

In the early hours of Oct. 26, 2025, bitcoin’s price climbed nearly 2% against the dollar, just as an “unidentified whale” began making waves on X—and even caught Grok’s attention as a trending topic.

The twist? Grok’s take was way off. The artificial intelligence (AI) model claimed the whale deposited 2,772 BTC—worth about $309 million—into Kraken, suggesting “preparations for trading or selling.” In reality, Arkham Intelligence and mempool.space data shows it was Kraken’s own hot wallet moving 2,772 BTC out to an unknown address, flipping the narrative entirely.

While overly-hyped, social media receipts make it crystal clear, and the onchain trail of this address stands out like a neon sign. As of 11 a.m. Eastern time on Oct. 26, the wallet’s balance has dipped below the initial 2,772 BTC, now sitting at 748.67374794 BTC—roughly $85 million.

So far, the address has welcomed 5,669.74569975 BTC in total deposits ($643M) and logged about eight UTXOs along the way. The wallet is not flagged on Arkham as any specific entity. Between 9:30 p.m. on Oct. 25, 2025, and 5:50 a.m. Eastern time the next day, the transaction log shows a calculated storm of outbound transfers—each one neat, deliberate, and oddly satisfying in its precision.

Every transaction pulled in one or two hefty inputs from the same address and split them into several outputs, most landing in fresh, unidentified bc1q-prefixed Segwit wallets. The kicker? Nearly all those outputs are perfectly even to the satoshi, hinting not at human hands but a finely tuned automated script doing the heavy lifting.

This kind of movement doesn’t match the behavior of a typical exchange hot wallet or someone simply shuffling around personal holdings. Instead, it screams large-scale custody operation—think an institutional player executing precise redistributions. Over-the-counter (OTC) desks and prime brokers often spread coins across counterparties or settlement vaults in clean, round batches—50 BTC here, 100 BTC there.

The timing, volume, and surgical precision all point to a corporate-style batch distribution. Every clue—the UTXO count, transaction rhythm, standardized lot sizes, and meticulous Segwit management—fits the profile of a major cold-storage allocator or fund administrator re-sharding its holdings with machine-like accuracy.

In short, this wasn’t your average whale flexing its fins—it looked more like institutional choreography executed with mathematical precision. Whether it’s a bitcoin fund administrator, OTC desk, or deep-pocketed custodian, one thing’s clear: these moves were planned, polished, and anything but random.

- What happened with the bitcoin whale transfer?

A large holder moved 2,772 BTC, worth about $309 million, from Kraken’s hot wallet to an unknown address. - When did the bitcoin whale activity occur?

The transactions took place between late Oct. 25 and early Oct. 26, 2025. - How much bitcoin does the whale wallet currently hold?

As of 11 a.m. Eastern time on Oct. 26, the wallet holds around 748.67 BTC, valued near $85 million. - What does the transaction pattern suggest?

Onchain data points to an institutional-style redistribution, likely by a large custodial or fund management entity.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。