The last piece of the puzzle for financial freedom has always been hidden in the shadows.

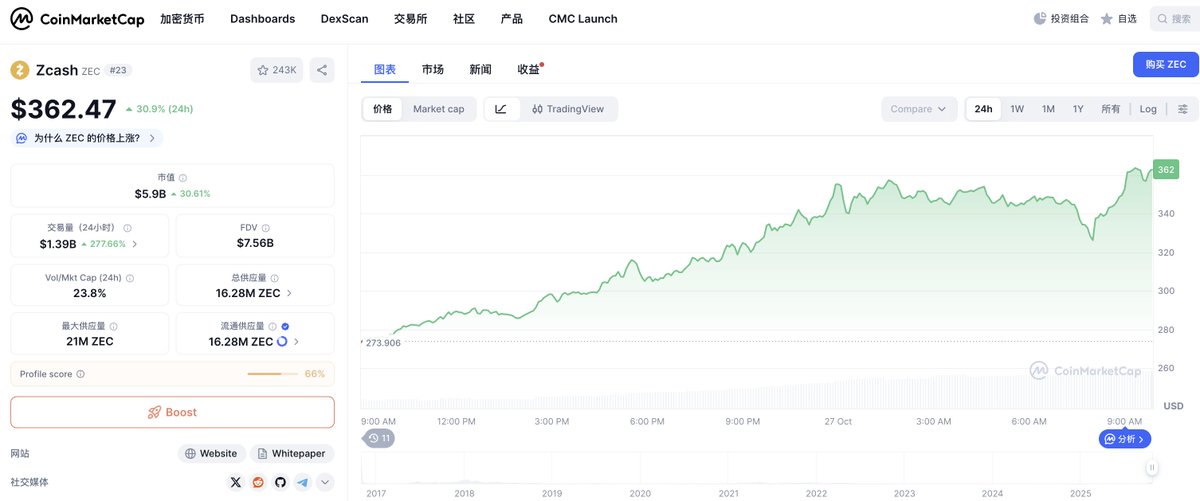

$ZEC has been called out for two weeks and has increased more than three times!

Where is the logic behind the explosion in the privacy track? How should we position ourselves for similar opportunities in the future?

In an era where regulation is becoming increasingly detailed and on-chain activities are almost fully monitored, it is the anonymous assets that are leading the charge.

This is not a coincidence, but a signal.

1️⃣ Regulatory loosening ≠ Laissez-faire, but rather a redistribution of power~!

The U.S. is relaxing restrictions on privacy coins, and Japan is re-discussing the legality of crypto payments,

This indicates a core trend:

Regulators are no longer fantasizing about "complete control,"

but are beginning to default to "unable to completely prevent."

Privacy is being tamed by the system, rather than being eradicated.

When power cannot eliminate a technology, it learns to coexist.

ZEC represents not an evasion of regulation, but the gray area in the new financial order.

2️⃣ Social Motivation: The anti-surveillance impulse in the era of AI awakening

2021 was the awakening of DAO's self-organization,

2023 is the awakening of AI's intelligence,

and 2025 is the awakening of privacy's anti-surveillance.

AI makes humans transparent, and all behaviors can be "quantified" by algorithms;

while privacy coins provide the final line of human sovereignty.

You don't need to become an anarchist,

but you need to maintain an economic boundary that cannot be read by algorithms.

3️⃣ Market Logic: The resonance of old narratives + new liquidity

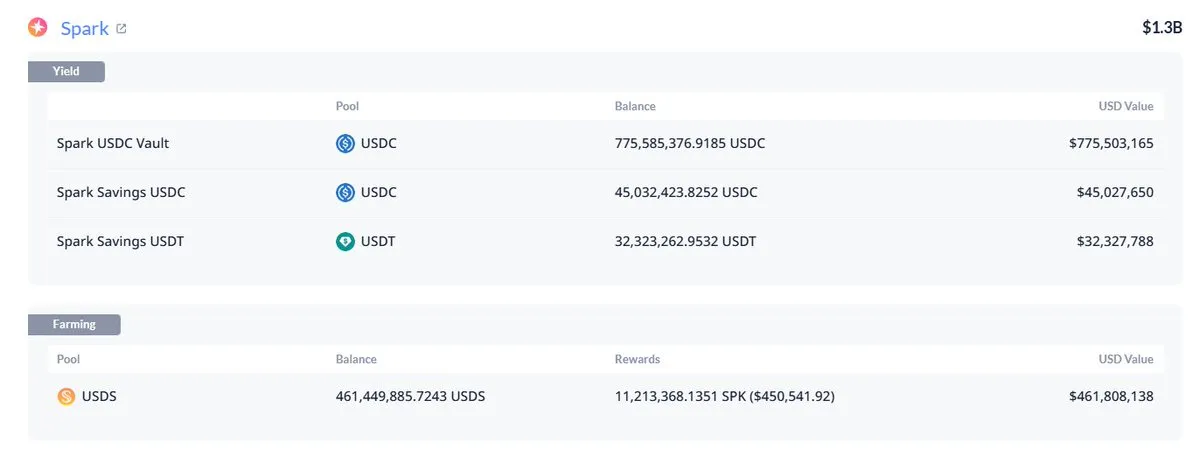

The logic behind ZEC's rise is not just speculation.

Limited supply, early holdings dispersed, no VC pressure,

ZK technology naturally connects to new narratives (AI privacy computing, DePIN, cross-chain signatures) and when combined with "regulatory loosening + stories easily understood by retail investors," it naturally becomes the cleanest explosion point.

This is a classic narrative reactivation.

4️⃣ Insight: How to position ourselves for this narrative in advance?

This is the most important point; we cannot just know that it has risen, but rather how can we position ourselves better for the next opportunity?

We must!

Because the explosion in many tracks does not rely on early news, but rather on the sensitivity of narrative cycle resonance.

To capture similar market movements in the future, look for three points:

1) Regulatory rebound cycle: A signal when policies shift from repression to ambiguity.

2) Narrative displacement: When new narratives (AI, RWA) need old concepts for support.

3) Emotional temperature difference: When the mainstream market is numb, and peripheral sectors suddenly become active.

Funds always flow first into "forgotten places," which are the entry points for narrative reboots.

Summary—

After every cycle peak, funds will ask themselves one question:

"If even the money I spend can be seen, does this game of freedom still have meaning?"

So from this perspective, ZEC's rise is not retro, but a rehearsal.

Every round presents an opportunity, every round!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。