Author: Daniel Kim, Ryan Yoon, Jay Jo

Source: Tiger Research

This report, written by Tiger Research, proposes a target price of $200,000 for Bitcoin in the fourth quarter of 2025, based on factors such as institutional buying during volatility, expectations of Federal Reserve interest rate cuts, and the confirmation of an institution-led market structure following the October crash.

Key Points

Institutional investors continue to accumulate during volatility — Third-quarter ETF net inflows remained stable, with MSTR increasing its holdings by 388 Bitcoins in a single month, reinforcing long-term investment beliefs;

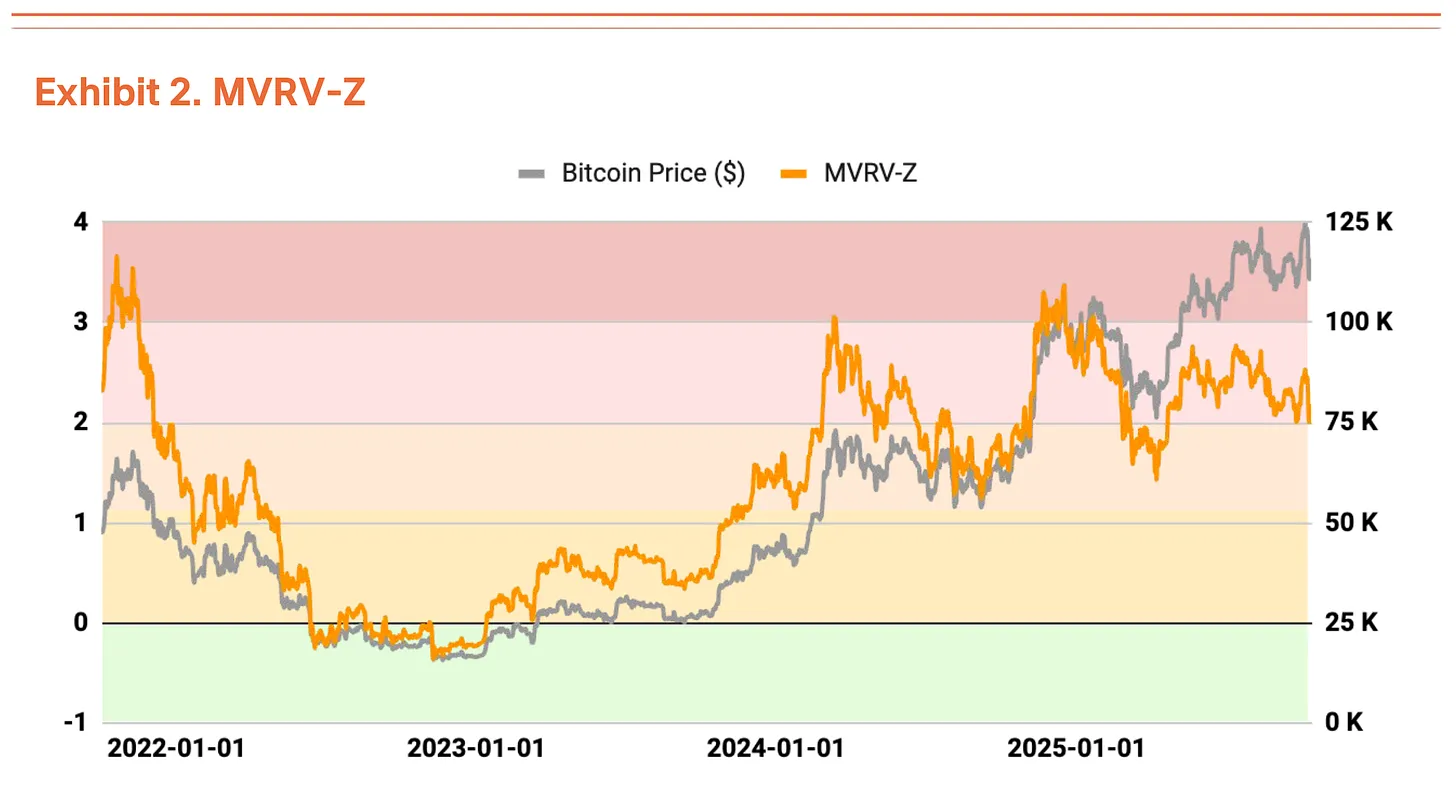

Overheated but not extreme — The MVRV-Z index stands at 2.31, indicating high valuation but not at extreme levels; the clearing of leveraged funds has removed short-term traders, creating space for the next wave of increases;

Global liquidity environment continues to improve — The broad money supply (M2) has surpassed $96 trillion, reaching a historical high, with expectations of further interest rate cuts from the Federal Reserve, anticipated to occur 1-2 times within the year.

Institutional Investors Buy Amid US-China Trade Uncertainty

In the third quarter of 2025, the Bitcoin market slowed from a strong growth of 28% in the second quarter to a volatile sideways phase, with a marginal increase of 1%.

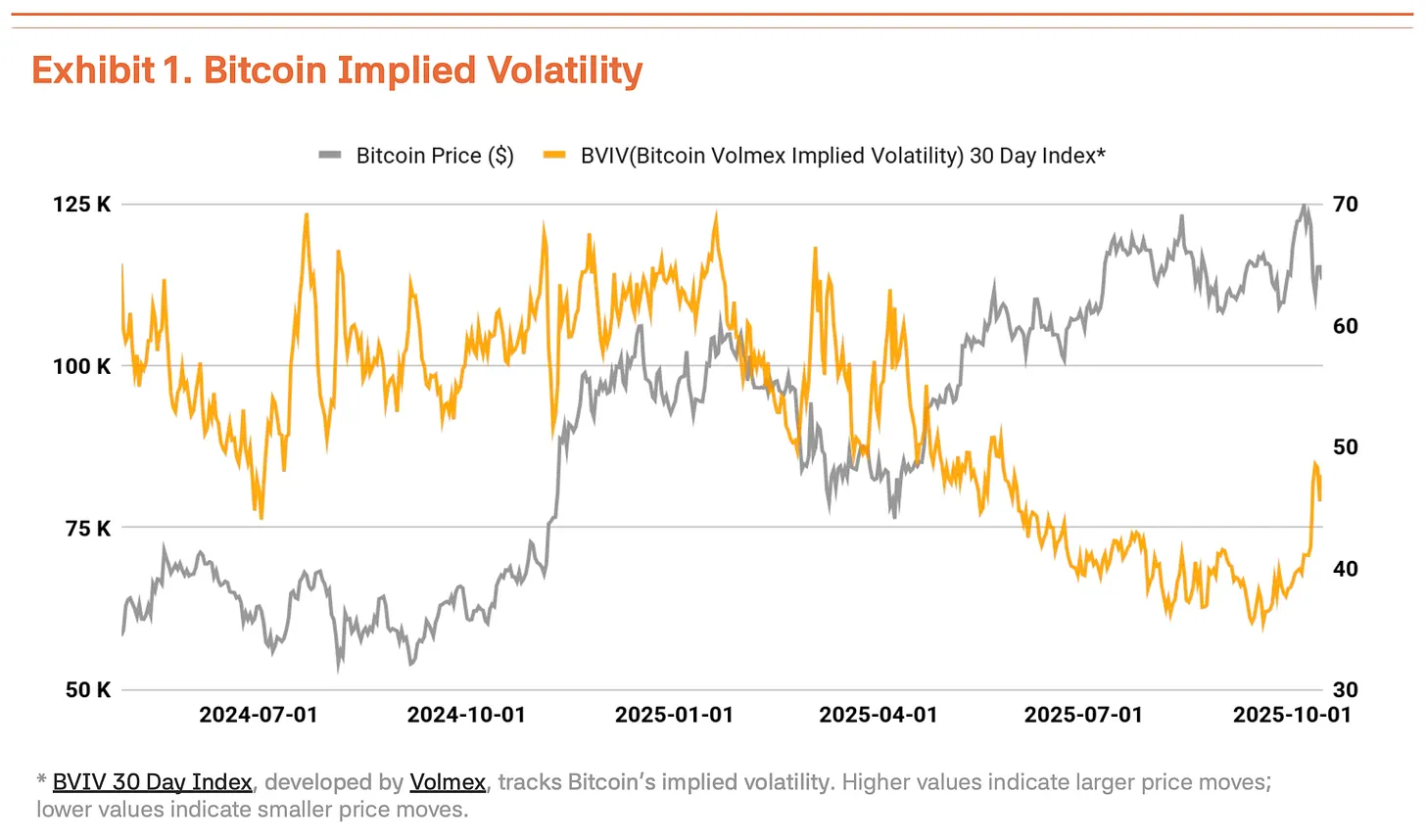

On October 6, Bitcoin reached an all-time high of $126,210, but the Trump administration's renewed trade pressure on China led to an 18% price correction to $104,000, significantly increasing volatility. According to Volmex Finance's Bitcoin Volatility Index (BVIV), Bitcoin's volatility narrowed from March to September as institutional investors steadily accumulated, but surged by 41% after September, exacerbating market uncertainty (Chart 1).

Driven by the resurgence of US-China trade frictions and Trump's tough rhetoric, this correction appears temporary. The strategic accumulation by institutions, led by Strategy Inc. (MSTR), is actually accelerating. The macro environment has also played a supportive role. The global broad money supply (M2) has surpassed $96 trillion, reaching a historical high, while the Federal Reserve lowered interest rates by 25 basis points to 4.00%-4.25% on September 17. The Fed hinted at 1-2 more rate cuts this year, with a stable labor market and economic recovery creating favorable conditions for risk assets.

Institutional capital inflows remain strong. In the third quarter, Bitcoin spot ETF net inflows reached $7.8 billion. Although this is lower than the $12.4 billion in the second quarter, the net inflow throughout the third quarter confirms the steady buying by institutional investors. This momentum continued into the fourth quarter — in just the first week of October, $3.2 billion was recorded, setting a new weekly inflow record for 2025. This indicates that institutional investors view price corrections as strategic entry opportunities. Strategy continued to buy during the market correction, purchasing 220 Bitcoins on October 13 and 168 Bitcoins on October 20, totaling 388 Bitcoins within a week. This shows that regardless of short-term volatility, institutional investors firmly believe in Bitcoin's long-term value.

On-Chain Data Signals Overheating, Fundamentals Unchanged

On-chain analysis reveals some signs of overheating, but valuations are not yet concerning. The MVRV-Z metric (market cap to realized value ratio) is currently in the overheated zone at 2.31, but has stabilized compared to the extreme valuation range approached in July-August (Chart 2).

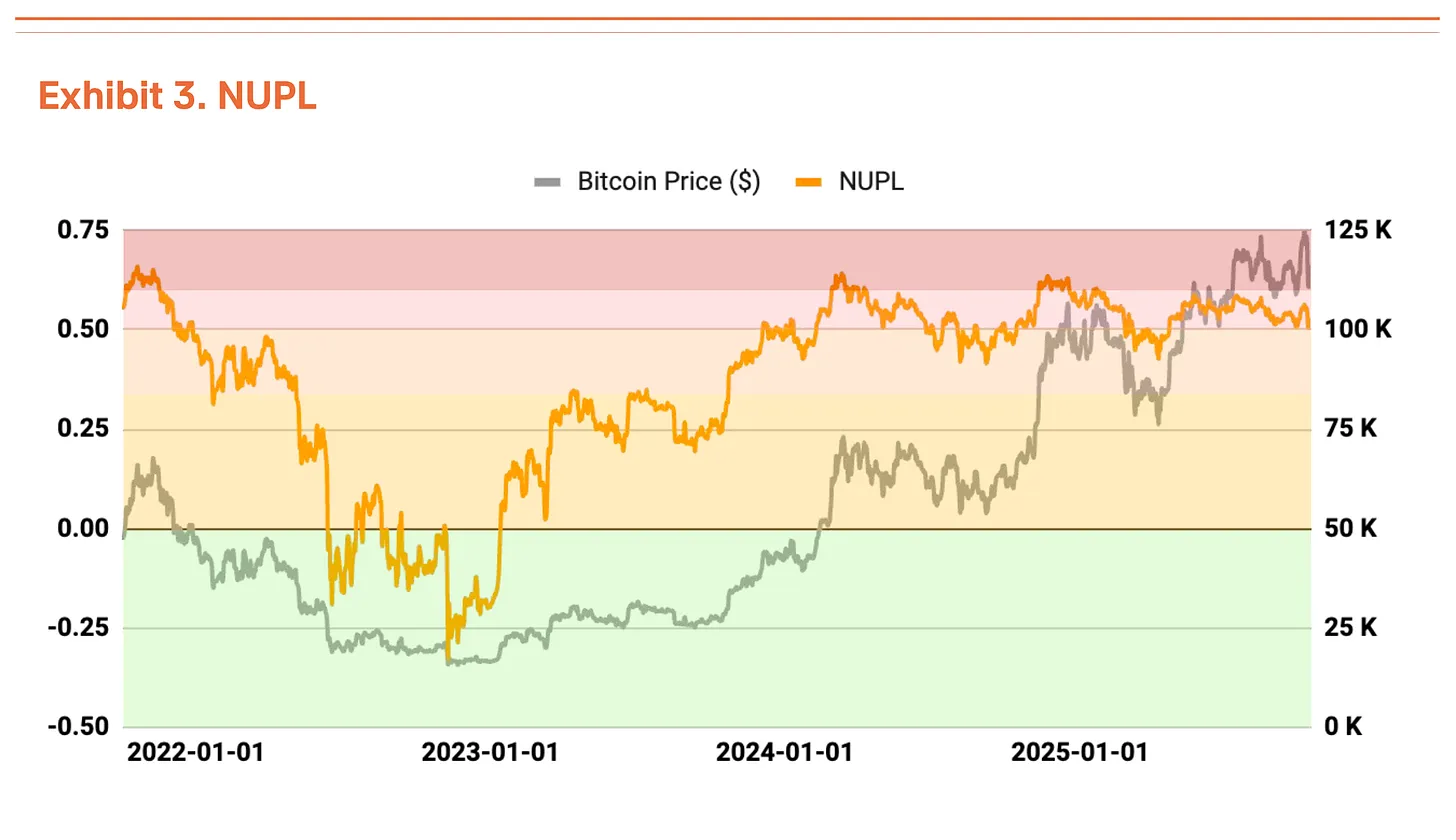

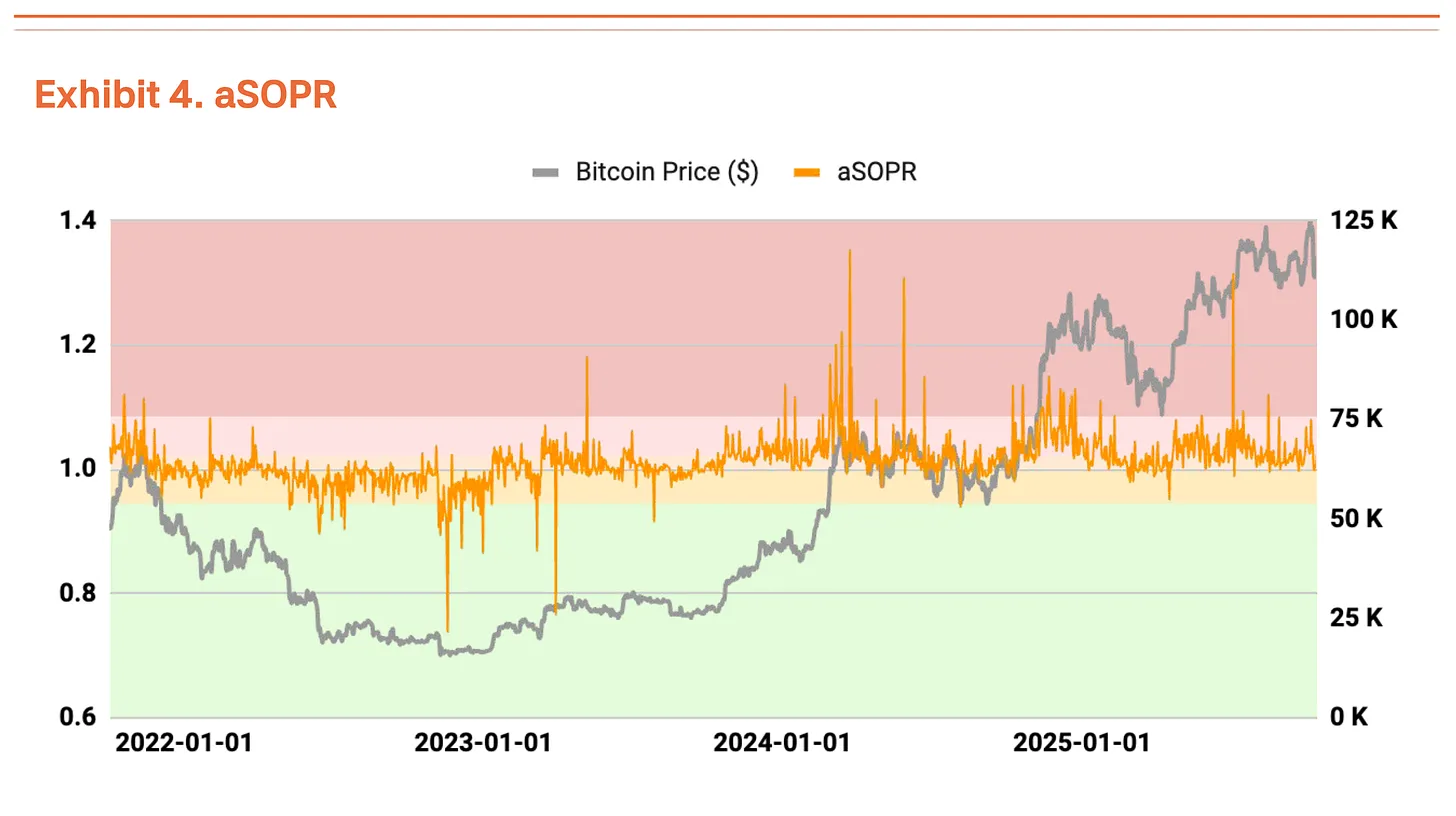

The Net Unrealized Profit and Loss (NUPL) also shows signs of overheating, but has eased from the high unrealized profit conditions of the second quarter (Chart 3). The Adjusted Spent Output Profit Ratio (aSOPR) reflects the realized profit and loss of investors, and this ratio is very close to the equilibrium value of 1.03, indicating no cause for concern (Chart 4).

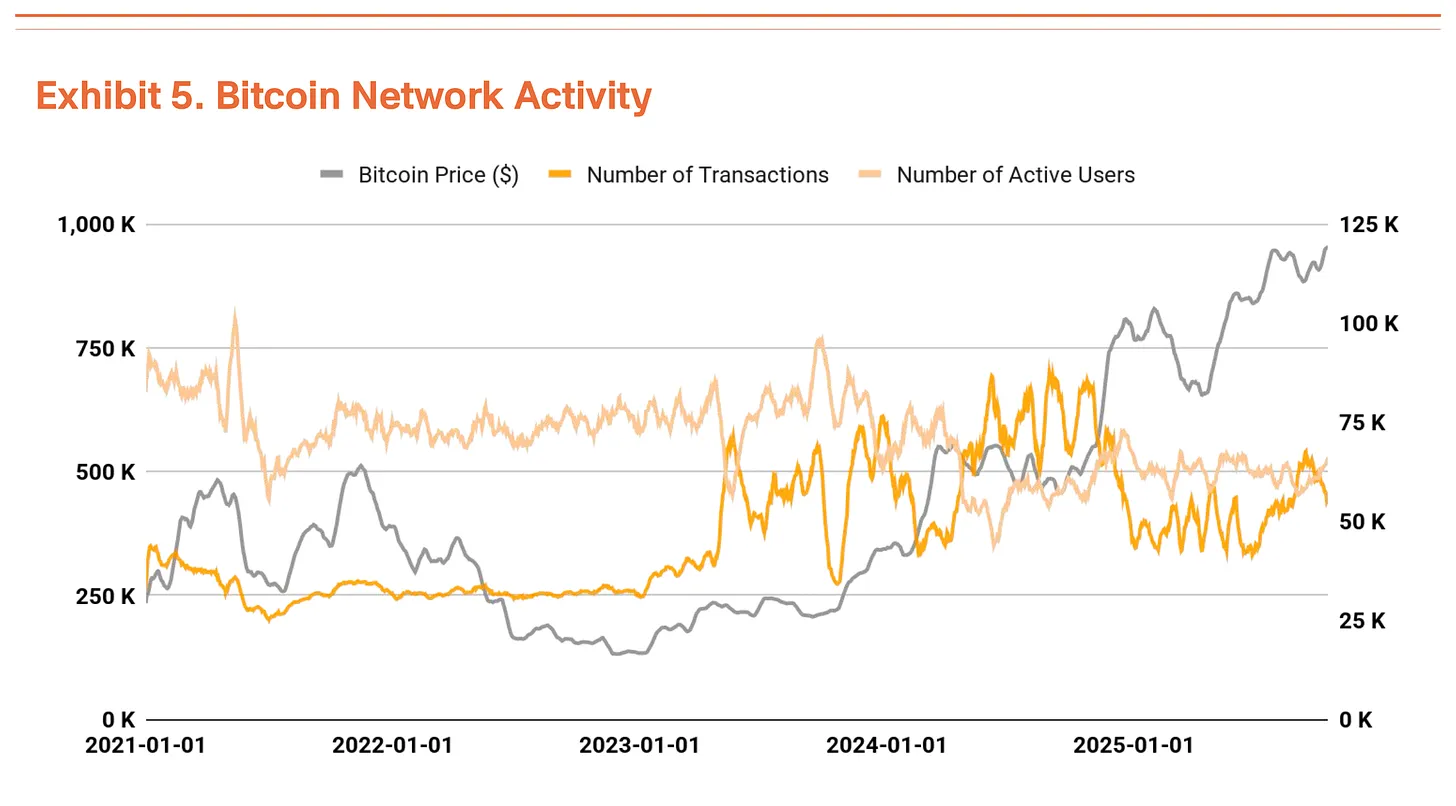

The number of Bitcoin transactions and active users remains at similar levels to the previous quarter, indicating a temporary slowdown in network growth momentum (Chart 5). Meanwhile, total transaction volume is on the rise. A decrease in transaction count but an increase in transaction volume means that larger amounts are being transferred in fewer transactions, indicating an increase in large capital flows.

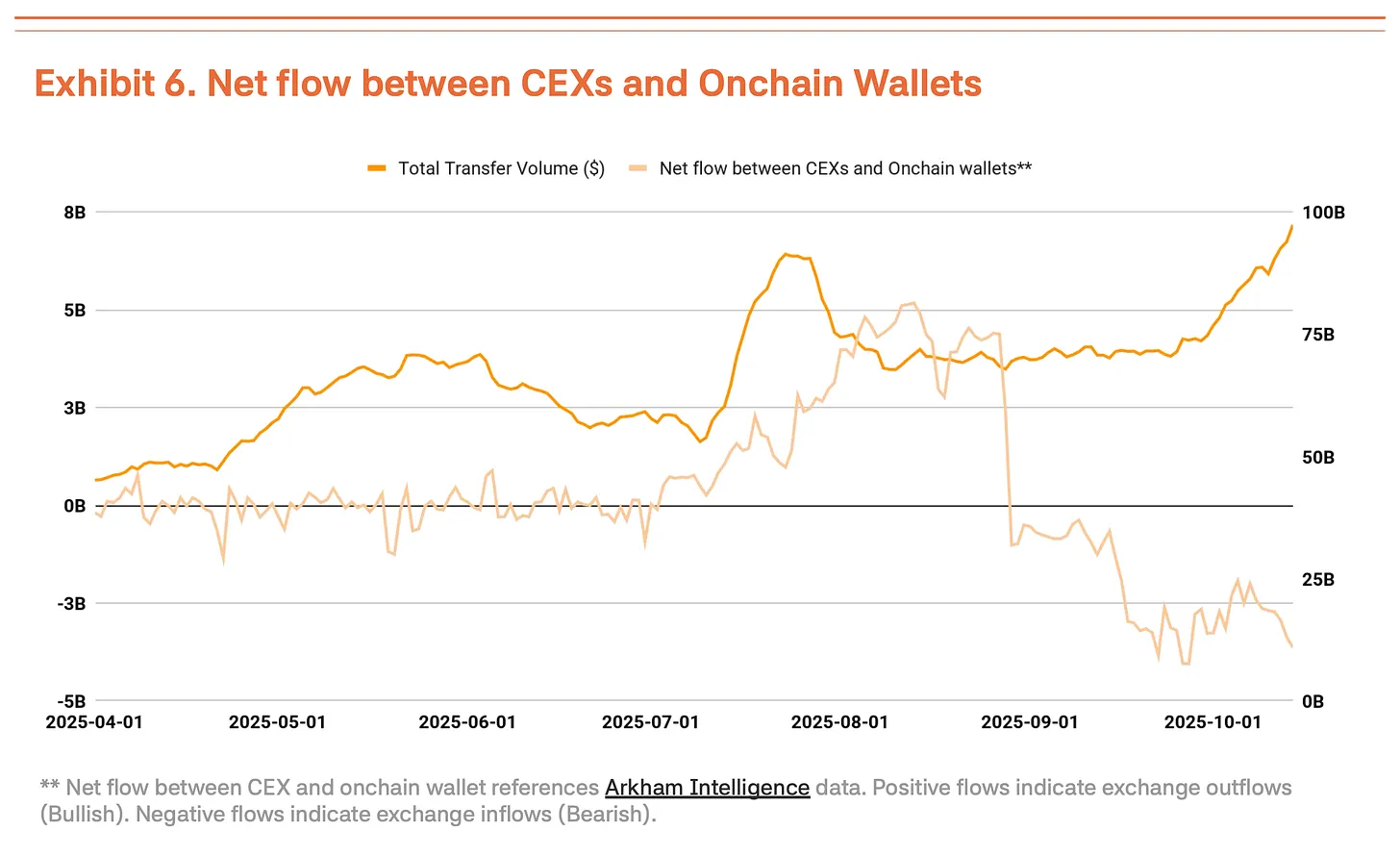

However, we cannot simply view the increase in transaction volume as a positive signal. Recently, there has been an increase in funds flowing into centralized exchanges, which typically indicates that holders are preparing to sell (Chart 6). In the absence of improvements in fundamental indicators such as transaction count and active users, the rise in transaction volume more reflects short-term capital flows and selling pressure in a high-volatility environment rather than a genuine expansion of demand.

October 11 Crash Proves Market Has Shifted to Institutional Dominance

The crash on centralized exchanges on October 11 (down 14%) proves that the Bitcoin market has shifted from being retail-dominated to institutionally dominated.

The key point is that the market reaction is markedly different from before. In a similar environment at the end of 2021, panic among retail investors spread, leading to a crash. This time, the correction was limited. After large-scale liquidations, institutional investors continued to buy, indicating that they are firmly defending the market's downside. Furthermore, institutions seem to view this as a healthy consolidation that helps eliminate excessive speculative demand.

In the short term, the chain reaction of selling may lower the average purchase price for retail investors and increase psychological pressure, potentially exacerbating volatility due to market sentiment being affected. However, if institutional investors continue to enter during the sideways consolidation, this correction may lay the groundwork for the next round of increases.

Target Price Raised to $200,000

Using our TVM method for third-quarter analysis, we derive a neutral benchmark price of $154,000, up 14% from the second quarter's $135,000. Based on this, we applied a -2% fundamental adjustment and a +35% macro adjustment, resulting in a target price of $200,000.

The -2% fundamental adjustment reflects a temporary slowdown in network activity and an increase in deposits to centralized exchanges, indicating short-term weakness. The macro adjustment remains at 35%. The global liquidity expansion and continued institutional capital inflows, along with the Federal Reserve's dovish stance, provide a strong catalyst for increases in the fourth quarter.

The short-term correction may stem from overheating signs, but this represents a healthy consolidation rather than a trend or shift in market perception. The sustained increase in the benchmark price indicates a steady rise in Bitcoin's intrinsic value. Despite temporary weakness, the medium to long-term upward outlook remains solid.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。