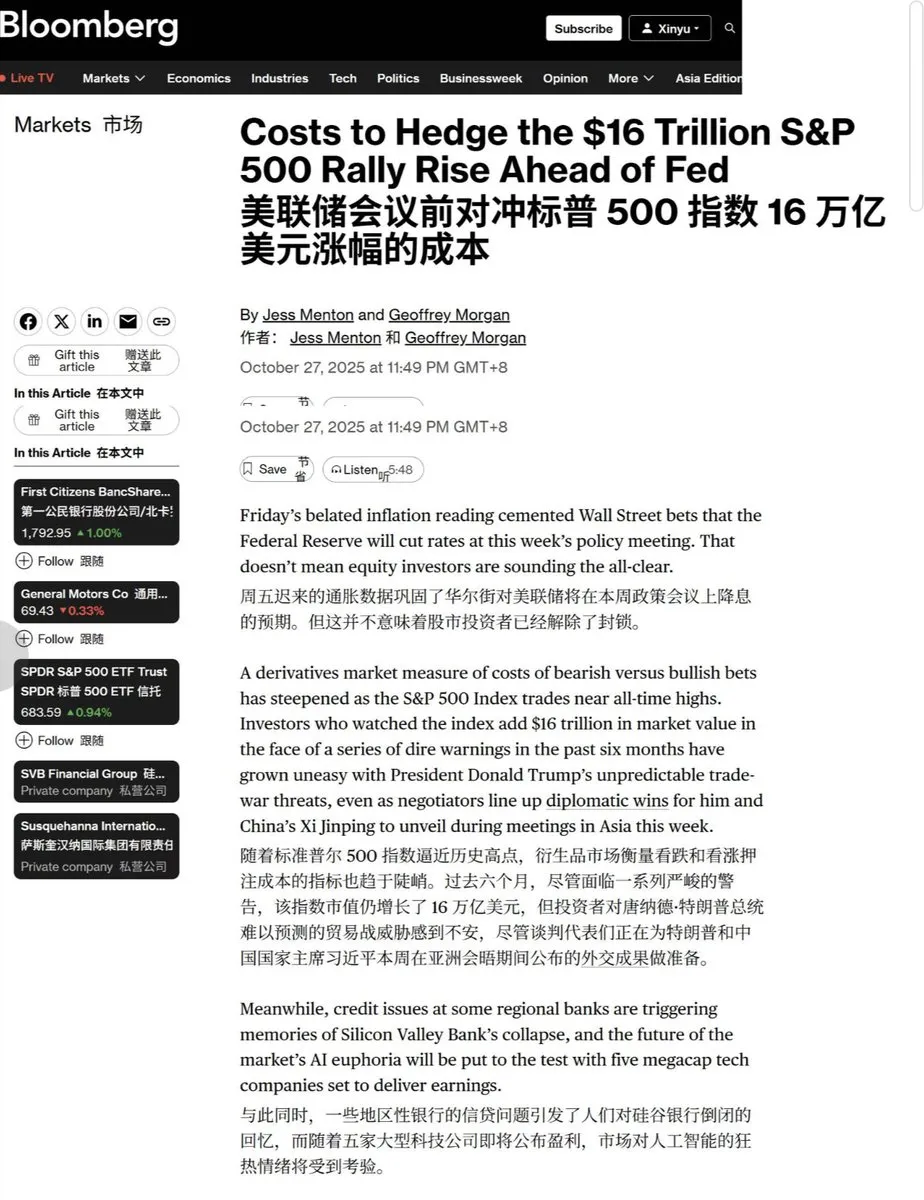

⚡️The probability of the Federal Reserve cutting interest rates by 25 basis points this month is as high as 96.7%——

The U.S. Department of Labor resumed operations a couple of days ago and released the September CPI data, which was overall lower than expected, clearing the way for further rate cuts in October.

The probability of a cumulative 50 basis point cut in December has reached 95.8%, and the market has almost priced in easing. This means:

1️⃣ Liquidity returns, but risks also revive

A rate cut is a signal for capital to start moving; it will push U.S. Treasury yields down, weaken the dollar, and drive asset prices up. However, if inflation resurges, the market will immediately question whether this rate cut was too early, leading to secondary volatility.

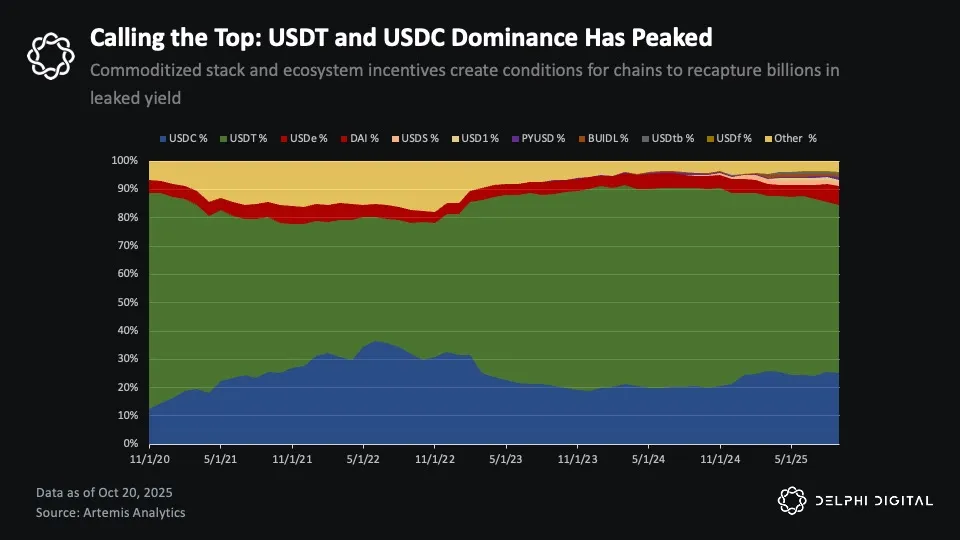

2️⃣ Seeking the sword in the boat: The cryptocurrency market will be the first place where liquidity seeps in

Historically, the early stages of rate cuts are often accompanied by a recovery in risk appetite—Bitcoin rose 7% in the week following the September rate cut, and Ethereum rose 18%.

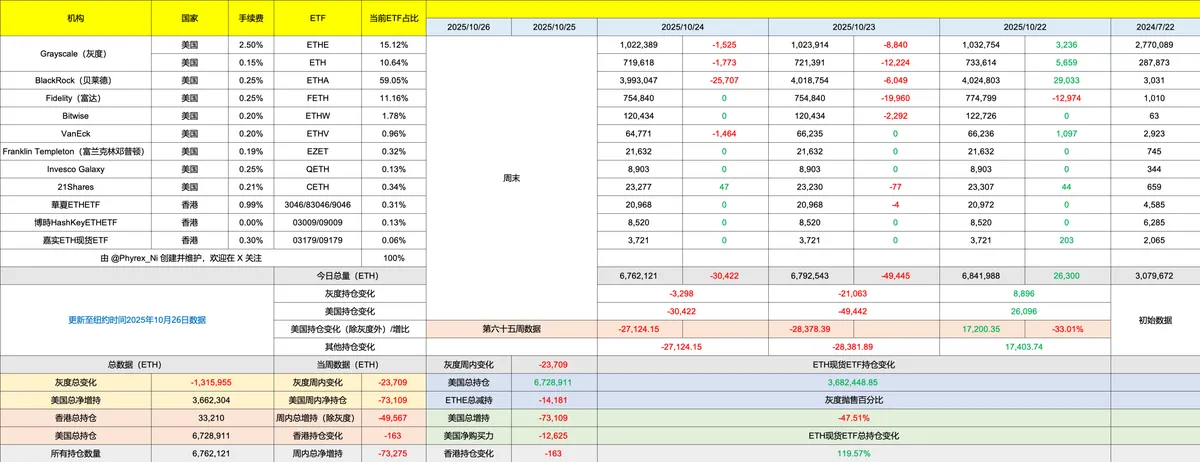

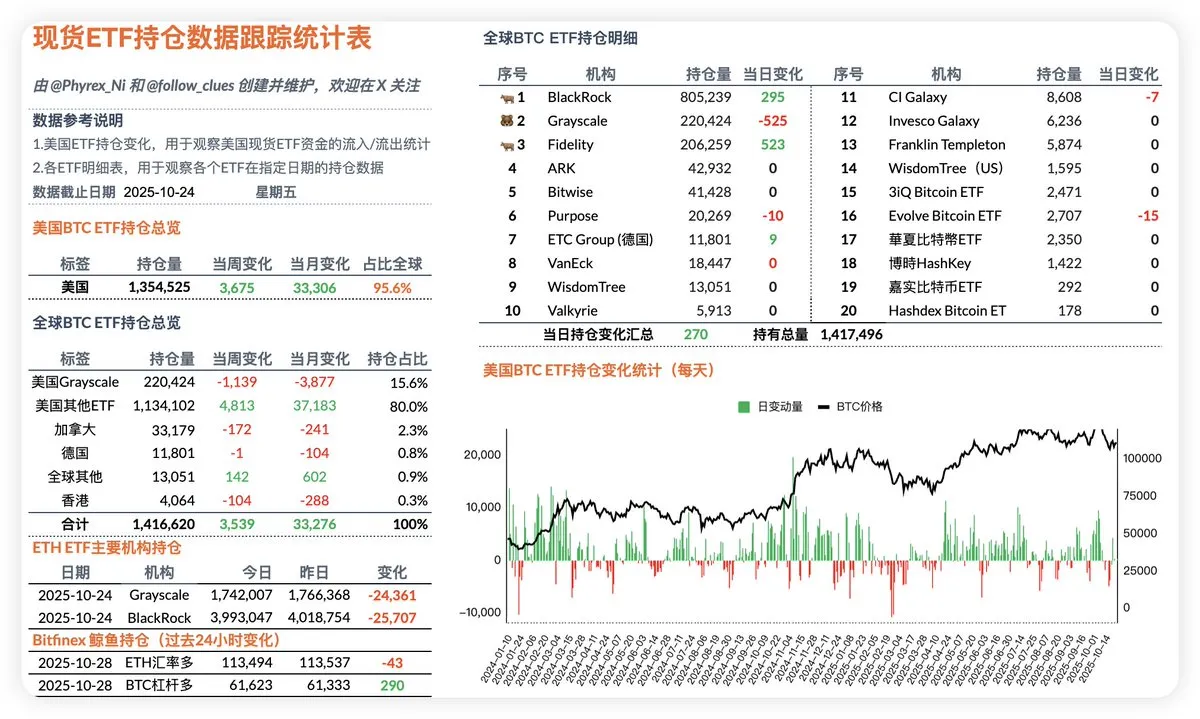

ETF funds have seen a net inflow of $62 billion over five consecutive days, indicating that institutions have not exited the market; they are just waiting for confirmation signals—such as the official implementation of the rate cut.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。