ETHzilla Corporation (Nasdaq: ETHZ) said Monday it sold about $40 million of its ETH holdings to finance share repurchases under its $250 million board-approved buyback program. Since Oct. 24, the decentralized finance (DeFi) firm has repurchased approximately 600,000 shares for around $12 million, buying back stock it says trades at a “significant discount” to net asset value (NAV).

“We are leveraging the strength of our balance sheet, including reducing our ETH holdings, to execute share repurchases,” said McAndrew Rudisill, ETHzilla’s chairman and CEO. He added the company expects the buybacks to be “immediately accretive,” boosting NAV per share while reducing availability for stock loan and borrow activity.

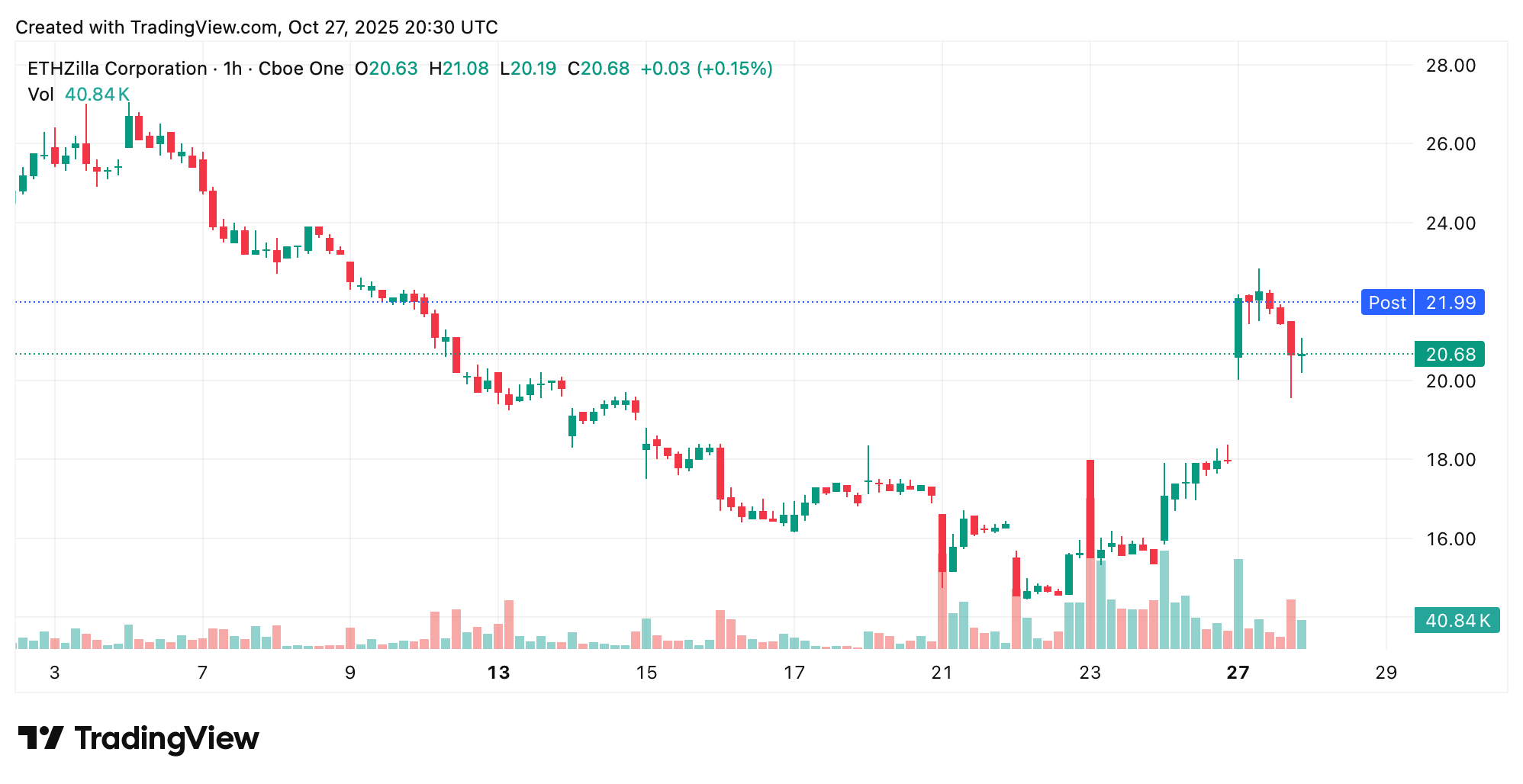

ETHZ shares are up 32% this week and jumped 14% higher today.

Despite the sale, ETHzilla still holds roughly $400 million in ETH to support future strategic initiatives. Some of the funds are staked. The company said it plans to continue selling portions of its holdings for repurchases until the discount to NAV “normalizes.” ETHzilla’s stock slipped over the past week after the company unveiled plans for a 1-for-10 reverse split.

The move, however, didn’t go unnoticed among retail investors on social media. Several traders mocked the firm’s decision. “⭢ $40M dump ⭢ Stock buybacks ⭢ ETHZILLA goes full Wall Street. Decentralized … kinda,” one person poked. It’s not every day you see a digital asset treasury (DAT) outfit cashing in its own crypto stash, but ETHzilla just broke tradition — and possibly a few jaws — by doing it.

ETHzilla says it still positions itself as a bridge between traditional finance (TradFi) and decentralized finance (DeFi), offering tokenization, blockchain analytics, and Ethereum-based infrastructure services. Following the sale, the company continues to tout its balance-sheet strength and DeFi ambitions.

- What did ETHzilla announce?

The company sold roughly $40 million in ETH to finance share buybacks under its $250 million repurchase program. - How many shares has ETHzilla repurchased?

It has bought back about 600,000 shares for $12 million since Oct. 24, 2025. - What will ETHzilla do with the remaining ETH proceeds?

The company plans to continue using the funds for share repurchases until its stock discount to NAV normalizes. - How much ETH does ETHzilla still hold?

ETHZilla retains roughly $400 million in ETH to support future strategic initiatives and DeFi operations.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。