Author | @simononchain

Compiled by | Odaily Planet Daily (@OdailyChina)

Translator | Dingdang (@XiaMiPP)

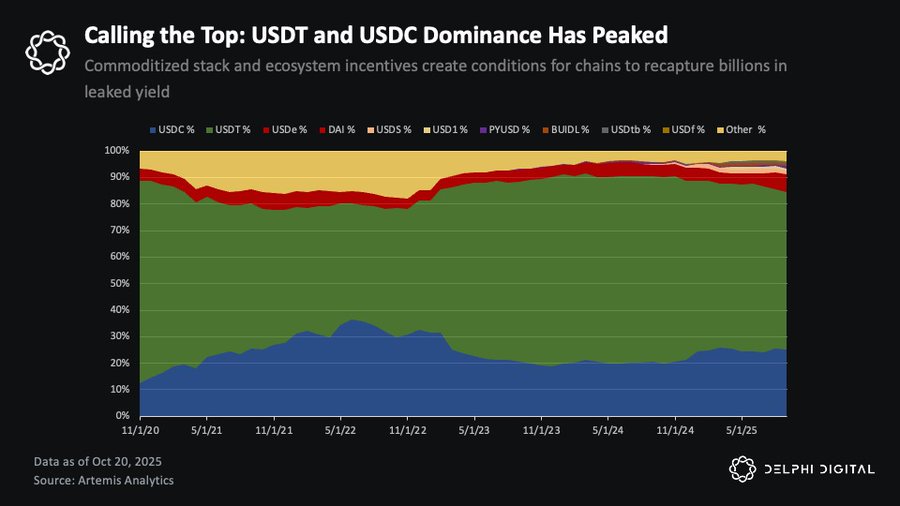

Tether and Circle's moat is being eroded: distribution channels surpass network effects. The market share of stablecoins held by Tether and Circle may have peaked in relative terms—even as the overall supply of stablecoins continues to grow. It is expected that by 2027, the total market capitalization of stablecoins will exceed $1 trillion, but the benefits of this expansion will not flow primarily to the existing giants as they did in the last cycle. Instead, an increasing share will go to "ecosystem-native stablecoins" and "white label issuance" strategies, as blockchains and applications begin to "internalize" the benefits and distribution channels.

Currently, Tether and Circle account for about 85% of the circulating stablecoin supply, totaling approximately $265 billion.

Background data is as follows: Tether is reportedly raising $20 billion at a valuation of $500 billion, with a circulating supply of about $185 billion; while Circle is valued at about $35 billion, with a circulating supply of about $80 billion.

The network effects that once supported their monopoly are weakening. Three forces are driving this change:

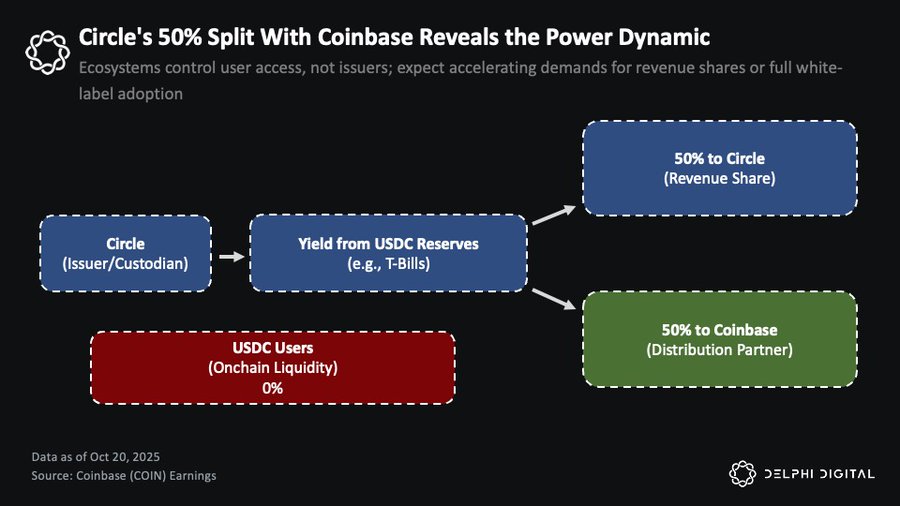

First, the importance of distribution channels has surpassed the so-called network effects. The relationship between Circle and Coinbase illustrates this well. Coinbase receives 50% of the residual yield from Circle's USDC reserves and monopolizes the yield from all USDC on its platform. In 2024, Circle's reserve yield is expected to be about $1.7 billion, of which approximately $908 million is paid to Coinbase. This shows that stablecoin distribution partners can capture most of the economic benefits—explaining why players with strong distribution capabilities are now more inclined to issue their own stablecoins rather than continue to let the issuers profit.

Coinbase receives 50% of the yield from Circle's USDC reserves and monopolizes the yield from USDC held on its platform.

Second, cross-chain infrastructure has made stablecoins interchangeable. Official bridge upgrades for mainstream Layer 2s, the universal messaging protocol launched by LayerZero and Chainlink, and the maturity of smart routing aggregators have made stablecoin exchanges both on-chain and cross-chain nearly costless and provide a native user experience. Today, which stablecoin you use is no longer important, as you can quickly switch based on liquidity needs. Not long ago, this was still a cumbersome process.

Third, regulatory clarity is eliminating entry barriers. Legislation such as the GENIUS Act has established a unified framework for domestic stablecoins in the U.S., reducing the risks for infrastructure providers holding coins. Meanwhile, more and more white label issuers are driving down fixed issuance costs, while treasury yields provide strong incentives for "float monetization." The result is that the stablecoin stack is being commoditized and increasingly homogenized.

This commoditization erases the structural advantages of the giants. Now, any platform with effective distribution capabilities can choose to "internalize" the stablecoin economy—rather than paying profits to others. The earliest actors include fintech wallets, centralized exchanges, and an increasing number of DeFi protocols.

DeFi is where this trend is most evident and has the most far-reaching implications.

From "leakage" to "yield": A new script for stablecoins in DeFi

This shift has already begun to take shape in the on-chain economy. Compared to Circle and Tether, many public chains and applications with stronger network effects (based on metrics such as product-market fit, user stickiness, and distribution efficiency) are starting to adopt white label stablecoin solutions to fully leverage their existing user base and capture the yields that traditionally belonged to established issuers. This change is creating new opportunities for on-chain investors who have long ignored stablecoins.

Hyperliquid: The first "defection" within DeFi

This trend first appeared in Hyperliquid. At that time, about $5.5 billion of USDC was held on the platform—meaning that approximately $220 million in additional yield was flowing to Circle and Coinbase each year, rather than remaining with Hyperliquid itself.

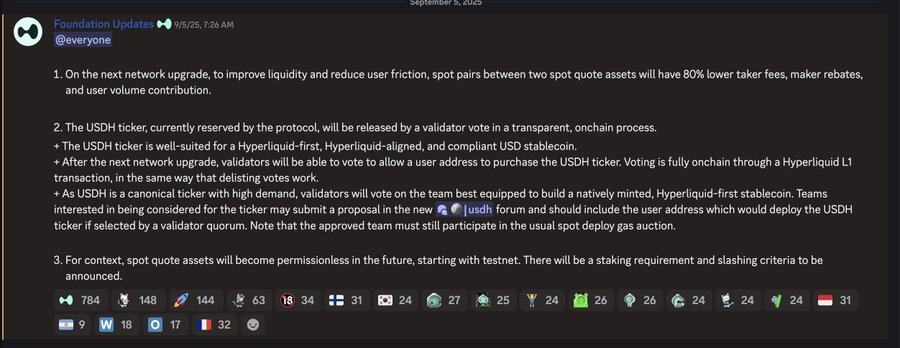

Before the validator vote determined the ownership of the USDH code, Hyperliquid announced it would launch a natively issued stablecoin centered around itself.

For Circle, becoming the main trading pair in Hyperliquid's core markets brought considerable revenue. They directly benefited from the explosive growth of the exchange but contributed almost no value back to the ecosystem itself. For Hyperliquid, this meant a significant loss of value to a third party that contributed little, which severely contradicted its community-first and ecosystem-synergy philosophy.

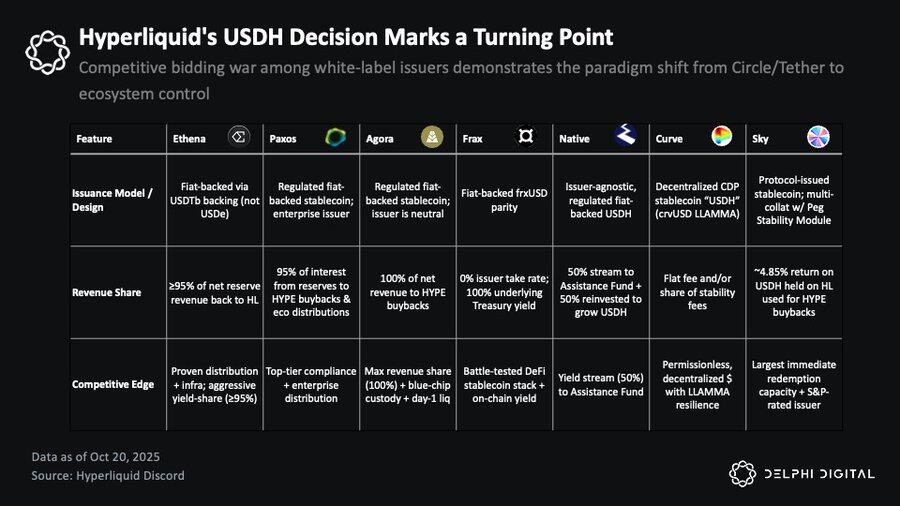

In the bidding process for USDH, almost all major white label stablecoin issuers participated, including Native Markets, Paxos, Frax, Agora, MakerDAO (Sky), Curve Finance, and Ethena Labs. This marks the first large-scale competition in the stablecoin economy at the application layer, indicating that the value of "distribution rights" is being redefined.

Ultimately, Native won the issuance rights for USDH—its proposal was more aligned with Hyperliquid's ecosystem incentives. This model features issuer neutrality and compliance, with reserve assets managed offline by BlackRock and the on-chain portion supported by Superstate. The key point is that 50% of the reserve yield will be directly injected into Hyperliquid's aid fund, while the remaining 50% will be used to expand USDH liquidity.

Although USDH will not replace USDC in the short term, this decision reflects a deeper power shift: in the DeFi space, moats and yields are gradually shifting to applications and ecosystems with stable user bases and strong distribution capabilities, rather than traditional issuers like Circle and Tether.

The spread of white label stablecoins: The rise of the SaaS model

In recent months, an increasing number of ecosystems have adopted the "white label stablecoin" model. Ethena Labs' proposed "Stablecoin-as-a-Service" solution is at the center of this wave—on-chain projects like Sui, MegaETH, and Jupiter are using or planning to issue their own stablecoins through Ethena's infrastructure.

Ethena's appeal lies in its protocol, which directly returns yields to holders. The yield from USDe comes from basis trading. Although the yield has compressed to about 5.5% as total supply exceeds $12.5 billion, it is still higher than U.S. treasury yields (around 4%) and far better than the zero-yield status of USDT and USDC.

However, as other issuers begin to directly pass treasury yields to users, Ethena's relative advantage is declining—treasury-backed stablecoins are more attractive in terms of risk and return. If the interest rate cut cycle continues, the basis trading spread will widen again, thereby enhancing the appeal of such "yield-based models."

You may wonder if this violates the GENIUS Act, which prohibits stablecoin issuers from directly paying yields to users? In fact, this restriction may not be as strict as imagined. The act does not explicitly prohibit third-party platforms or intermediaries from distributing rewards to stablecoin holders—as long as the funding source is provided by the issuer. This gray area has not been fully clarified, but many believe this "loophole" still exists.

Regardless of how regulation evolves, DeFi has always operated in a permissionless, fringe state and is likely to continue doing so in the future. More important than legal texts are the underlying economic realities.

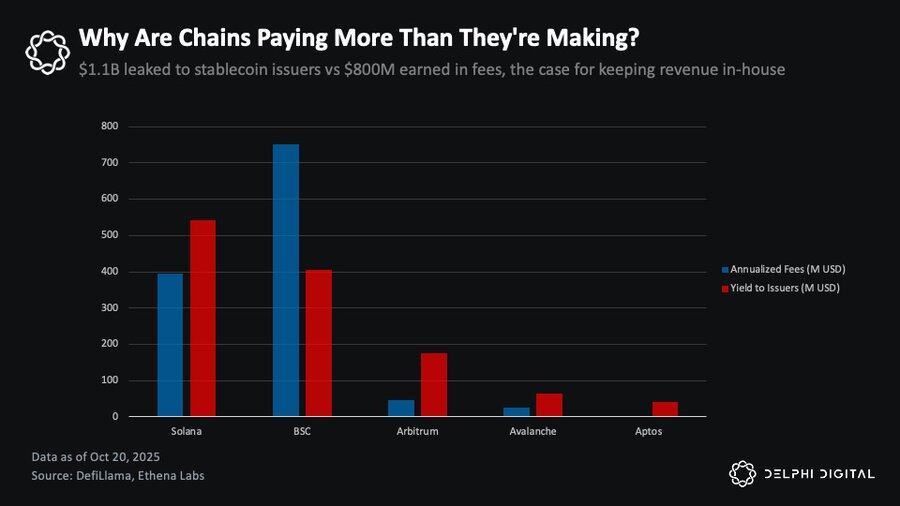

Stablecoin tax: The loss of revenue for mainstream public chains

Currently, approximately $30 billion of USDC and USDT are sitting idle on Solana, BSC, Arbitrum, Avalanche, and Aptos. At a 4% reserve yield, this could generate about $1.1 billion in interest income for Circle and Tether each year. This figure is about 40% higher than the total transaction fee revenue of these public chains. This highlights a reality: stablecoins are becoming the largest yet under-monetized value landscape within L1, L2, and various applications.

Taking Solana, BSC, Arbitrum, Avalanche, and Aptos as examples, Circle and Tether earn about $1.1 billion annually, while these ecosystems only earn $800 million in transaction fees.

In simple terms, these ecosystems are losing hundreds of millions of dollars in stablecoin yields each year. Even capturing a small portion of this on-chain would be enough to reshape their economic structure—providing public chains with a more robust and counter-cyclical revenue base than transaction fees.

What is stopping them from reclaiming these profits? The answer is: nothing. In fact, there are many paths to take. They can negotiate revenue sharing with Circle and Tether (as Coinbase has done); they can initiate competitive bidding for white label issuers like Hyperliquid; or they can launch native stablecoins using platforms like Ethena's "Stablecoin-as-a-Service."

Of course, each path has its trade-offs: collaborating with traditional issuers can maintain the familiarity, liquidity, and stability of USDC or USDT, which have withstood multiple market cycles and maintained trust under extreme stress tests; issuing native stablecoins increases control and yields but faces cold start issues. Both methods have corresponding infrastructures, and each chain can choose its path based on its priorities.

Redefining Public Chain Economics: Stablecoins as New Revenue Engines

Stablecoins have the potential to become the largest source of revenue for certain public chains and applications. Today, when the blockchain economy relies solely on transaction fees, growth faces structural limits—network revenue can only increase when users "pay more fees," which contradicts the goal of "lowering the barriers to use."

The USDm project from MegaETH is a response to this. It issues the white label stablecoin USDm in collaboration with Ethena, using BlackRock's on-chain treasury product BUIDL as reserve assets. By internalizing USDm yields, MegaETH can operate its sequencer at cost and reinvest the profits into community programs. This model provides the ecosystem with a sustainable, low-cost, innovation-oriented economic structure.

The leading DEX aggregator on Solana, Jupiter, is implementing a similar strategy with JupUSD. It plans to deeply integrate JupUSD into its product ecosystem—from the collateral assets of Jupiter Perps (where approximately $750 million of stablecoin reserves will be gradually replaced) to the liquidity pools of Jupiter Lend. Jupiter aims to redirect this portion of stablecoin revenue back to its own ecosystem rather than to external issuers. Whether these profits are used for user rewards, token buybacks, or funding incentive programs, the value accumulation they bring far exceeds simply handing over all profits to external stablecoin issuers.

This is the core shift happening now: the profits that were once passively flowing to old issuers are being actively reclaimed by applications and public chains.

Valuation Mismatch Between Applications and Public Chains

As all of this unfolds, I believe that both public chains and applications are on a credible path to generating more sustainable revenue, which will gradually detach from the cyclical fluctuations of "internet capital markets" and on-chain speculation. If this is true, they may finally find justification for the high valuations that are often questioned as "disconnected from reality."

The valuation framework that most people still use primarily views these two layers from the perspective of "the total economic activity occurring on them." In this model, on-chain transaction fees represent the total costs borne by users, while the chain's revenue is the portion of these fees that flows to the protocol itself or token holders (for example, through mechanisms like burning or treasury inflows). However, this model has been flawed from the start—it assumes that as long as activity occurs, public chains will inevitably capture value, even if the actual economic benefits have long since flowed elsewhere.

Now, this model is beginning to shift—and leading the way is the application layer. The most intuitive examples are the two star projects of this cycle: Pump.fun and Hyperliquid. Both applications use almost 100% of their revenue (note, not transaction fees) for buying back their own tokens, while their valuation multiples are far lower than those of major infrastructure layers. In other words, these applications are generating real and transparent cash flows, rather than imaginary implied yields.

In contrast, the price-to-sales ratios of most mainstream public chains remain in the hundreds or even thousands, while leading applications create higher revenues at lower valuations.

Taking Solana as an example, over the past year, the total transaction fees for the chain were about $632 million, with revenues around $1.3 billion and a market capitalization of about $105 billion, leading to a fully diluted valuation (FDV) of about $118.5 billion. This means Solana's market cap-to-transaction fee ratio is about 166 times, and its market cap-to-revenue ratio is about 80 times—this is already a relatively conservative valuation among large L1s. Many other public chains have FDV valuation multiples that reach into the thousands.

In comparison, Hyperliquid generated $667 million in revenue, with an FDV of $38 billion, corresponding to a multiple of 57 times; based on circulating market cap, it is only 19 times. Pump.fun's revenue is $724 million, with an FDV multiple of only 5.6 times, and a market cap multiple of just 2 times. Both demonstrate that applications with strong product-market fit and distribution capabilities are creating substantial revenue at multiples far lower than the foundational layer.

This is a power shift that is currently underway. The valuation of the application layer is increasingly dependent on the real revenue it generates and returns to the ecosystem, while the public chain layer is still struggling to find justification for its valuation. The continuously weakening L1 premium is the clearest signal.

Unless public chains can find ways to "internalize" more value within their ecosystems, these inflated valuations will continue to be compressed. "White label stablecoins" may be the first step for public chains to attempt to reclaim some value—transforming the previously passive "currency channels" into active revenue layers.

Coordination Issues: Why Some Public Chains Move Faster

The shift towards "stablecoins aligned with ecosystem interests" is already happening; the pace of advancement varies significantly between different public chains, depending on their coordination capabilities and execution urgency.

For example, Sui—despite its ecosystem being far less mature than Solana's—has acted very quickly. Sui is collaborating with Ethena to introduce both sUSDe and USDi stablecoins simultaneously (the latter is similar to the BUIDL-supported stablecoin mechanism being explored by Jupiter and MegaETH). This is not a spontaneous action from the application layer but a strategic decision from the public chain layer: to "internalize" the stablecoin economy as early as possible before path dependence forms. Although these products are expected to officially launch in Q4, Sui is the first mainstream public chain to actively pursue this strategy.

In contrast, Solana faces a more complex and painful situation. Currently, about $15 billion in stablecoin assets are on the Solana chain, with over $10 billion being USDC. These funds generate about $500 million in interest income for Circle each year, a significant portion of which flows back to Coinbase through revenue-sharing agreements.

Where does Coinbase use these profits?—to subsidize Base, one of Solana's direct competitors. The liquidity incentives, developer funding, and ecosystem investments for Base partially come from that $10 billion of USDC on Solana. In other words, Solana is not only losing revenue but is even providing financial support to its competitors.

This issue has already drawn strong attention within the Solana community. For example, Helius founder @0xMert_ has called for Solana to launch stablecoins tied to ecosystem interests and suggested using 50% of the profits for SOL buybacks and burns. Some senior figures from stablecoin issuers (like Agora) have proposed similar plans, but compared to Sui's proactive approach, Solana's official response has been relatively lukewarm.

The reason is not complicated: as regulatory frameworks like the GENIUS Act become clearer, stablecoins are increasingly becoming "commoditized." Users do not care whether they hold USDC, JupUSD, or any other compliant stablecoin—as long as the price is stable and liquidity is sufficient. So, if that’s the case, why continue to default to a stablecoin that is profiting a competitor?

Solana's hesitation on this issue partly stems from its desire to maintain "credible neutrality." This is particularly important as the foundation strives for institutional-level legitimacy—after all, the only assets that have truly gained recognition in this regard are Bitcoin and Ethereum. To attract heavyweight issuers like BlackRock—whose "institutional endorsement" can bring real capital inflows and confer a "commoditized" status to assets in the eyes of traditional finance—Solana must maintain a certain distance from ecosystem politics. Once it publicly supports a specific stablecoin, even if it is "ecosystem-friendly," it could land Solana in trouble on its path to this level, potentially being seen as favoring certain ecosystem participants.

At the same time, the scale and diversity of the Solana ecosystem complicate matters further. Hundreds of protocols, thousands of developers, and billions of dollars in total value locked (TVL). At this scale, coordinating the entire ecosystem to "abandon USDC" becomes exponentially more difficult. But this complexity is ultimately a characteristic that reflects the maturity of the network and the depth of its ecosystem. The real issue is: inaction also has a cost, and that cost will continue to grow.

Path dependence accumulates daily. Every new user defaulting to USDC raises future switching costs. Every protocol optimizing liquidity around USDC makes alternatives harder to launch. From a technical perspective, the existing infrastructure allows migration to be completed almost overnight—the real challenge lies in coordination.

Currently, within Solana, Jupiter is taking the lead by launching JupUSD and promising to redirect profits back to the Solana ecosystem, deeply integrating it into its product system. The question now is: Will other leading applications follow suit? Will platforms like Pump.fun also adopt similar strategies to internalize stablecoin profits? When will Solana have no choice but to intervene from the top down, or will it simply let the applications built on its layer collect these profits themselves? From the perspective of public chains, if applications can retain stablecoin economic profits, while not the ideal outcome, it is certainly better than those profits flowing off-chain or even to rival camps.

Ultimately, from the perspective of public chains or the broader ecosystem, this game requires collective action: protocols need to direct their liquidity towards a consistent stablecoin, treasuries must make thoughtful allocation decisions, developers should change the default user experience, and users need to "vote" with their own funds. The $500 million subsidy that Solana provides to Base each year will not disappear due to a statement from the foundation; it will only truly vanish the moment ecosystem participants "refuse to continue funding competitors."

Conclusion: The Power Shift from Issuers to Ecosystems

The dominance of the next round of stablecoin economics will no longer depend on who issues the tokens, but rather on who controls the distribution channels and who can coordinate resources and capture the market more quickly.

Circle and Tether have been able to build massive business empires based on "first-mover advantage" and "liquidity establishment." However, as the stablecoin stack gradually commoditizes, their moats are being weakened. Cross-chain infrastructure allows for almost interchangeable stablecoins; clearer regulations lower the barriers to entry; and white label issuers reduce issuance costs. Most importantly, platforms with the strongest distribution capabilities, high user stickiness, and mature monetization models have begun to internalize their profits—no longer paying interest and profits to third parties.

This shift is already underway. Hyperliquid is reclaiming the $220 million in annual revenue that originally flowed to Circle and Coinbase by switching to USDH; Jupiter is deeply integrating JupUSD into its entire product ecosystem; MegaETH is using stablecoin revenue to run its sequencer at near-cost; and Sui is collaborating with Ethena to launch ecosystem-aligned stablecoins before path dependence forms. These are just the pioneers. Now, every public chain that "bleeds" hundreds of millions of dollars annually to Circle and Tether has a template to follow.

For investors, this trend offers a new perspective on ecosystem evaluation. The key question is no longer: "How much activity is there on this chain?" but rather: "Can it overcome coordination challenges, monetize its capital pool, and capture stablecoin revenue at scale?" As public chains and applications begin to "incorporate" hundreds of millions in annualized revenue into their systems for token buybacks, ecosystem incentives, or protocol income, market participants can directly "capture" these cash flows through the native tokens of these platforms. Protocols and applications that can internalize this revenue will have more robust economic models, lower user costs, and interests more aligned with the community; while those that cannot will continue to pay the "stablecoin tax," watching their valuations get compressed.

The most interesting opportunities in the future lie not in holding equity in Circle, nor in betting on those high FDV issuer tokens. The real value lies in identifying which chains and applications can complete this transition, transforming "passive financial pipelines" into "active revenue engines." Distribution is the new moat. Those who control the "flow of funds," rather than merely laying down "funding channels," will define the landscape of the next stage of stablecoin economics.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。