Author: J.A.E

Recently, the decentralized social protocol Farcaster announced the acquisition of Clanker, a leading token issuance platform on the Base chain. Following the completion of the transaction, Farcaster immediately announced that Clanker would initiate a buyback and deflationary plan, using two-thirds of the protocol's long-term revenue to repurchase CLANKER tokens.

After the news was released, the price of CLANKER tokens surged significantly. As of now, the weekly increase has exceeded four times. On the surface, this acquisition appears to be Farcaster's ecological plan to build a value capture mechanism through Clanker, but it may also signal the next trend in the decentralized social space is about to emerge.

Clanker One-Click AI Token Issuance Empowers Farcaster

Clanker was able to attract the strategic acquisition by the decentralized social protocol Farcaster, possibly due to its AI-powered innovative business model and considerable revenue-generating capability.

Clanker is a token issuance platform deployed on the Base chain, and its unique value lies in its one-click generation feature driven by AI Agents, allowing users to easily issue ERC-20 tokens without any complex programming knowledge. This innovation significantly simplifies the token creation process, lowering the technical barrier to the minimum.

It is worth mentioning that Clanker allows users to create tokens directly on Farcaster using social tagging (tagging @clanker), which creates a new paradigm for SocialFi. AI Agents are no longer limited to chat tools but have become a high-frequency, efficient, and profitable Web3 financial infrastructure. This combines AI automation with the immediacy and community-driven nature of social media, transforming social sentiment into on-chain financial actions and significantly reducing the friction cost for users transitioning from "social interaction" to "on-chain transactions."

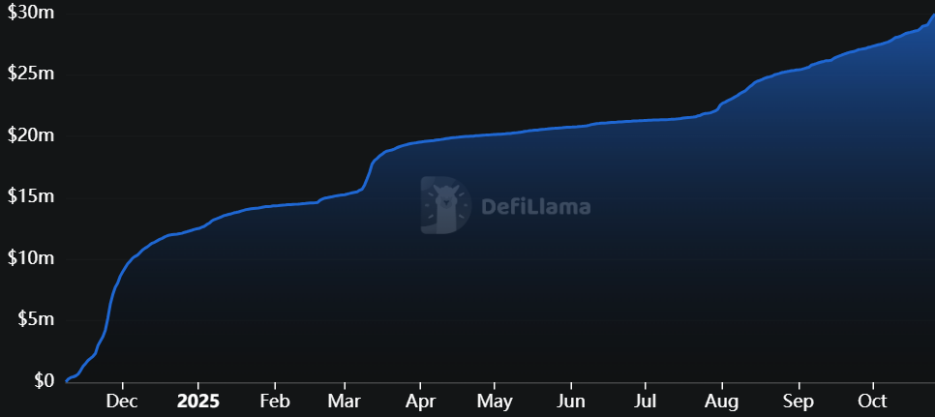

Additionally, Clanker has a strong revenue-generating capability. According to data from clanker.world, since its launch in November last year, Clanker has generated nearly $30 million in cumulative fees.

The protocol's profit source comes from a 1% transaction fee charged on every trade of tokens issued by Clanker on Uniswap V3. Of this, 60% of the fees belong to the protocol, while 40% is allocated to the token creators. Clanker's anonymous co-founder revealed that the protocol has been profitable since its first day of launch, with a small team and low operating costs, allowing most of its revenue to be considered net profit, making it one of the most profitable projects in the Base ecosystem.

The Integration Trend of "Social Graph + Financialization" in the Decentralized Social Space

Farcaster's acquisition of Clanker may signify that the decentralized social space will surpass traditional social graph competition and shift towards embedded financialization and direct value capture.

At the same time as Clanker was acquired, its token deployment tool will also be directly integrated into Farcaster's social graph. This integration represents a deep fusion of artificial intelligence (AI) and social finance (SocialFi), forming a unified and highly operable ecosystem. With this move, Farcaster may become a "one-stop center" for community token creation.

This acquisition also marks Farcaster's upgrade from a purely decentralized social protocol to a comprehensive ecosystem that integrates social, creative, and issuance functions. Decentralized social protocols like Lens focus on data ownership, while Farcaster intends to achieve a "monetization" effect through Clanker. The addition of Clanker will help Farcaster provide users with the shortest path from "idea" (posting) to "financial product" (issuing tokens), further solidifying its position as the decentralized social center on the Base chain and creating strong network effects and competitive barriers.

In fact, before Clanker was successfully acquired, it had also undergone a fierce acquisition battle that attracted widespread market attention. According to a tweet from Clanker's founder Jack Dishman, the crypto wallet provider Rainbow had approached Clanker in August to initiate acquisition discussions, planning to acquire Clanker for 4% of its upcoming RNBW token's total supply to integrate its token launch functionality. However, Clanker deemed the acquisition by Rainbow an unsuitable choice and rejected the proposal. After receiving the response, Rainbow threatened Clanker that it would publicly disclose the proposal letter if the deal was not accepted. Although Clanker reiterated its refusal, Rainbow still released the acquisition terms without Clanker's consent, further exacerbating Clanker's dissatisfaction with their communication methods and misconduct.

In contrast, Farcaster's acquisition proposal appears to be a better fit, as both parties will generate strong strategic synergies and share an ecosystem. Jack Dishman emphasized that "Clanker's success is inseparable from Farcaster," as it is "rooted in the open social graph's lines and the thriving ecosystem," indicating that Clanker is more strategically aligned with Farcaster's social functions. Furthermore, Farcaster's offer is cooperative, proposing acquisition terms while considering Clanker's independence and community interests. First, Farcaster retains Clanker's original token system and commits to using two-thirds of the protocol's revenue for repurchasing CLANKER tokens. Second, Farcaster has also destroyed the early protocol fee pool and locked 7% of the total supply in a unilateral liquidity position, thereby reducing the circulating supply and maximizing the interests of token holders.

Clanker Places Greater Emphasis on Creator Incentives Compared to Pump.fun

Clanker's success is not merely a replication; its business model significantly differs from the Meme coin launch platform Pump.fun on Solana.

The main difference between Clanker and Pump.fun lies in their incentive mechanisms. Clanker adopts a creator economy model based on the long-tail effect and continuous incentives. Tokens issued through Clanker traded on Uniswap V3 allow token creators to receive ongoing revenue sharing (40% of the transaction fees). This mechanism may encourage creators on Farcaster to view Meme coins as a sustainable source of income, closely linking their interests with the long-term liquidity and trading volume of the tokens, which aligns better with Farcaster's decentralized social spirit.

In contrast, Pump.fun's mechanism focuses more on incentivizing early users and price discovery through bonding curves, transitioning to DEX after reaching a certain market cap. While this model benefits short-term speculation and fair launch culture, it does not provide the same level of ongoing income security for creators as Clanker's revenue-sharing model.

In terms of liquidity management and trading mechanisms, the two have also chosen different strategies. Clanker employs a long-term 1% Uni V3 trading fee mechanism, focusing on sustainable liquidity supply and fee generation. The advantage of this model is that liquidity remains on Uni V3, which is transparent and controllable, ensuring the depth and credibility of liquidity, thus attracting more traders.

On the other hand, Pump.fun uses bonding curves to determine prices and only goes live on DEX after the tokens reach a certain market cap. While this model somewhat delays internal selling pressure, it may lack the depth of integration with mature DeFi infrastructure that Clanker possesses in liquidity management.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。