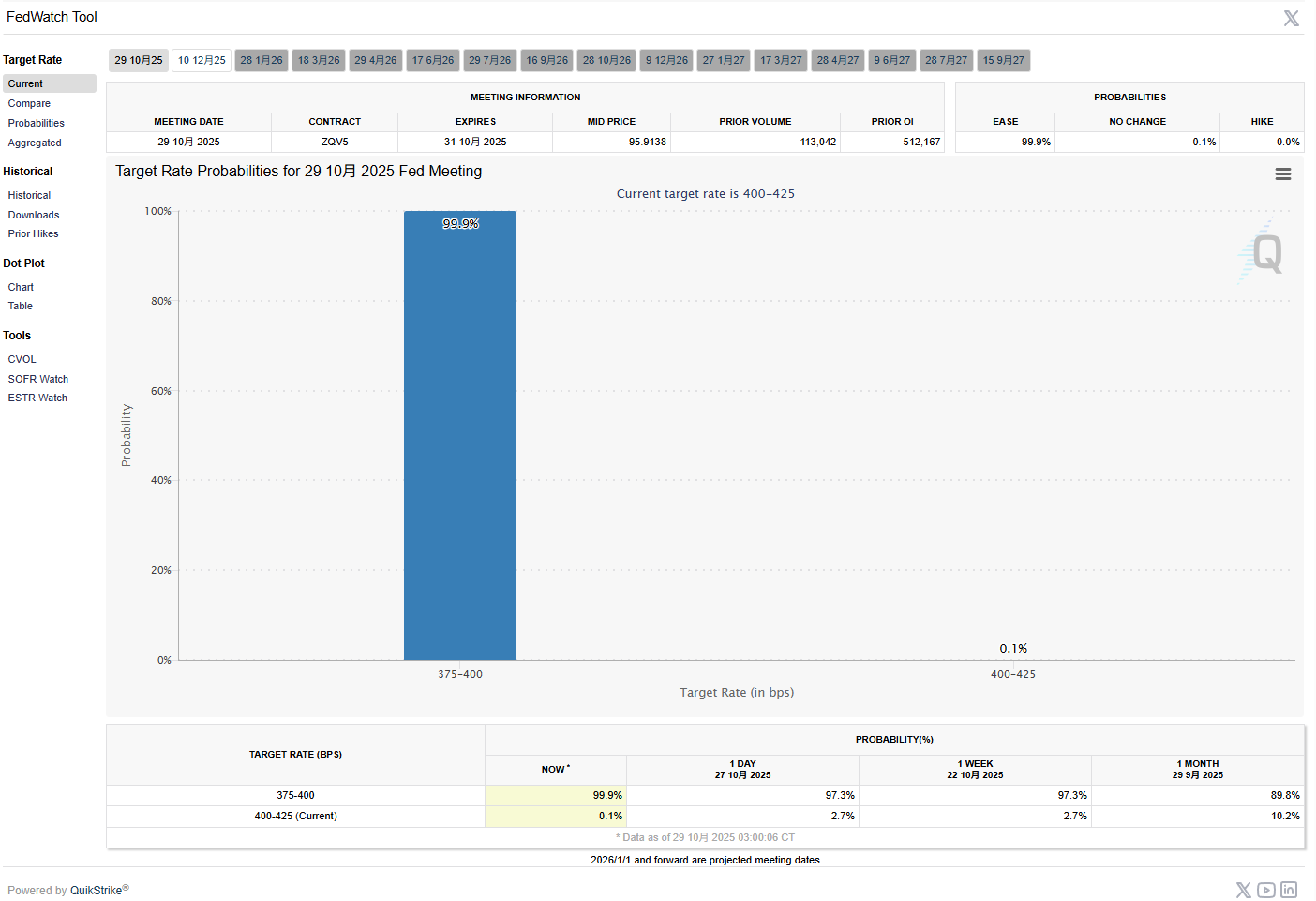

1. An Unquestionable Rate Cut

At 02:00 Singapore time on October 30, the Federal Reserve announced its interest rate decision. The market's expectation for a 25 basis point rate cut reached as high as 99.9%, making it almost a certainty. If implemented, the federal funds rate range will drop from 4.00%-4.25% to 3.75%-4.00%.

For cryptocurrency investors, the rate cut itself has long been priced in by the market. The real game lies in the press conference starting at 02:30—how Federal Reserve Chairman Powell balances the increasingly intense internal contradictions and sets the tone for future policy paths.

Economist Wang Lei pointed out: “Powell must avoid hawkish statements to maintain market confidence in a soft landing for the economy. However, being too dovish may raise concerns about asset bubbles; it’s a tightrope walk.”

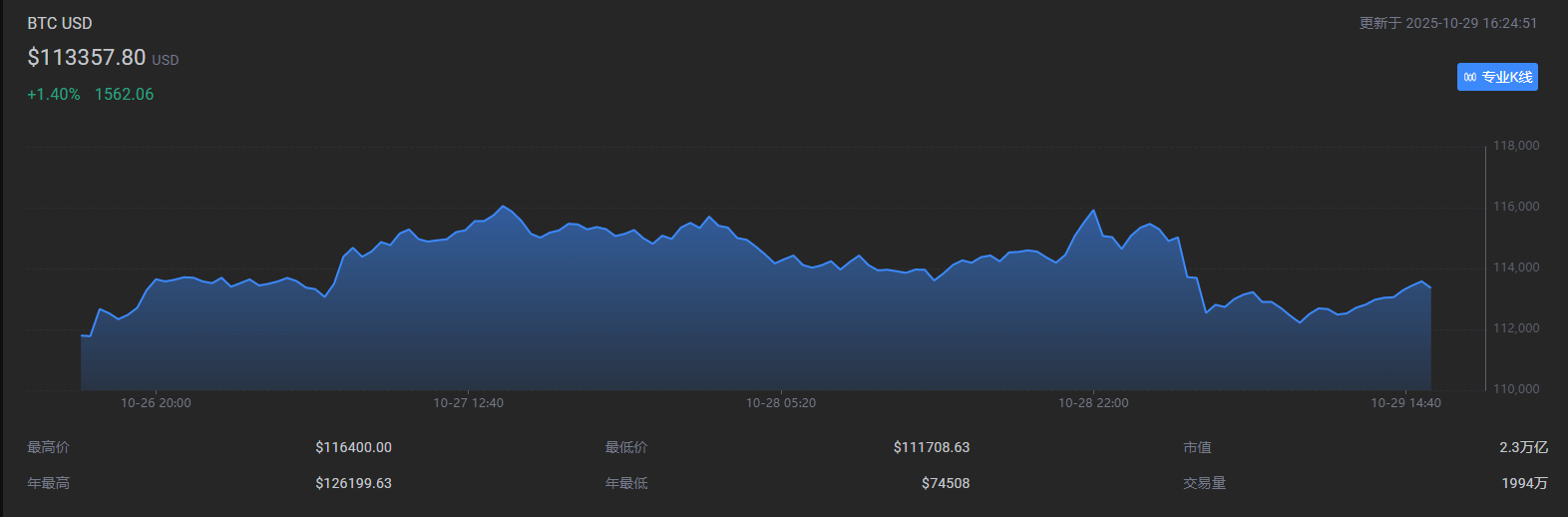

2. Where Will the Crypto Market Go After the Rate Cut?

1. Four Scenario Simulations and Crypto Market Reactions

| Scenario | Policy Features | Short-term Bitcoin Trend | Altcoin Risks | |------------------|-----------------------------------------|--------------------------|------------------------| | Dovish Rate Cut | Rate cut + hint of future easing | Break above $115K, targeting $118K | General rise, MEME coins active | | Hawkish Rate Cut | Rate cut + emphasis on inflation concerns | $112K-$114.5K fluctuations | Significant pullback | | Super Dovish | 50 basis point cut + end of QT signal | Violent surge to $130K | Full explosion | | Maintain Rates | Unexpectedly hold steady | Flash crash below $100K | Bloodbath |

2. On-chain Data Reveals Mainstream Movements

Stablecoin ammunition is ample: As of October 29, the total market cap of stablecoins surpassed $308 billion, with a net increase of 1.2% over the past 30 days, indicating potential buying power accumulation.

Continuous outflow of BTC from exchanges: In the past week, the balance of Bitcoin on exchanges decreased by 18,200 coins, indicating a strong reluctance to sell among long-term holders.

DeFi interest rates under pressure: After the rate cut in September, the USDC deposit rate on the Aave platform fell from 4.8% to 4.3%. If another cut occurs, it may further compress yields.

3. Market Divergence Hidden in the Details

“Cautious Faction” Representative: U.S. consumer spending remains strong, and sticky inflation may force the Fed to keep the terminal rate above 3.5%, with easing likely to be less than market expectations.

“Data Faction” Representative: What’s truly worth betting on tonight is whether to continue a 50 basis point cut in December and the timing of ending QT. These two points will determine whether funds dare to rush to the end of the risk curve.

“Optimistic Faction” Representative: Federal funds futures show that the market prices a probability of over 90% for consecutive rate cuts in the remaining two meetings this year. If inflation rebounds, there may be an additional 2-3 cuts next year.

4. Three Knives Hidden Behind the Rate Cut

Risk 1: Policy “Expectation Gap” Slaughters Leverage

The current crypto fear and greed index is at 38 (fear zone), but the perpetual contract funding rate for Bitcoin remains positive, indicating that long positions have not fully exited. If Powell signals “just this once,” it may trigger a wave of liquidations similar to that after the September rate cut.

Risk 2: Liquidity Trap Quietly Approaches

Although the Fed may cut rates, the timeline for ending quantitative tightening (QT) remains unclear. Barclays analysis suggests that the Fed may delay providing clear guidance until December. During this period, data gaps caused by the U.S. government shutdown will make the market feel like “blind men touching an elephant,” amplifying noise trading.

Risk 3: Regulatory Sword Suddenly Unsheathed

Recent statements from Fed governors claim they will “actively embrace payment innovation,” but the “streamlined main account” plan has yet to be implemented. If Powell expresses caution regarding cryptocurrency regulation after the meeting, it may dampen market expectations for traditional capital inflows.

5. Keep an Eye on These Two Key Dynamics

- Powell's “Lip Service” (after 02:30 on the 30th), focus on whether he mentions:

- “Data dependency” (hawkish)

- “Labor market risks” (dovish)

- “Inflation progress disappointing” (extremely hawkish)

- Signs of Ending QT (next week)

If the Fed includes a statement like “approaching discussions to end balance sheet reduction” in its announcement, it will ignite market expectations for the return of liquidity, becoming a catalyst for Bitcoin to break through previous highs.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX Benefits Group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance Benefits Group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。