⚡️I just love how Powell appears tough on the outside but soft on the inside—

When the FOMC statement was just released, Wall Street was eager to speculate on easing expectations, and the S&P and Nasdaq briefly surged.

But then Powell directly admonished Wall Street, stating that a rate cut in December is far from a certainty and shouldn't be taken for granted.

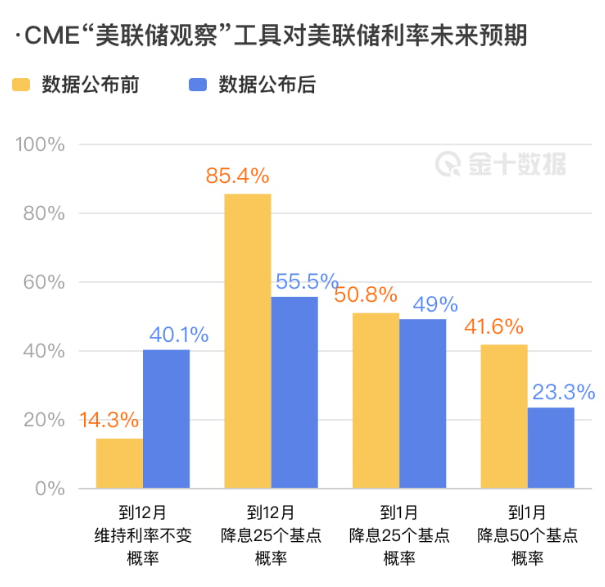

The market immediately hit the brakes—S&P fell back, Nasdaq's gains narrowed, and gold, U.S. stocks, and Bitcoin all plummeted. Wall Street's expectations for a December rate cut were slashed from 98% to 68%.

This starkly reflects that the current market is pinning its hopes on the Federal Reserve cutting rates.

However, the more Powell says this, the more I find it strange—

Because the Fed's current assessment of the economy is not providing confidence to the market:

On one hand, they say "job growth is slowing, the unemployment rate has slightly risen but remains low," while on the other hand, they acknowledge "the risks to employment are increasing."

They mention "moderate economic expansion," yet also state "inflation remains high."

It's like they're directly laying their cards on the table, but they can't just walk away from the table either; they can only do a little tightening to prevent the market from anticipating what they really want to do, taking it step by step.

This results in a hawkish tone verbally, while in practice, they are cutting rates and reducing the balance sheet, easing policies.

Ah, the more a man is inconsistent between words and actions, the more I feel there’s a story behind it!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。