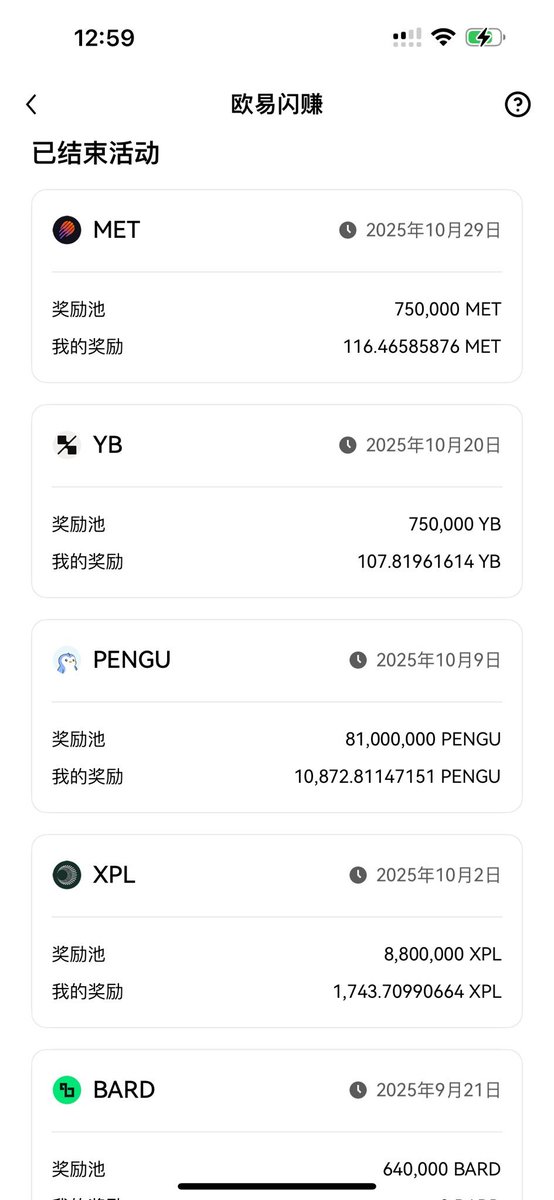

Yesterday, the harvest on #OKX was also collected. This time, the profit pool consists of 200 $OKB and 20,000 USDT, with a total duration of 7 days, all filled up at the first opportunity. A total of 116.47 $MET was obtained. Based on the price of MET, the total income is $55, and the total investment is calculated at $50,000, resulting in an annualized return of 5.9%.

How should I put it? The data seems okay, after all, the current lending rate for OKB on OKX is about 1%. However, if calculated in USDT, it feels a bit pitiful, and the yield based on USDT is indeed too low. I mentioned during the last YB project that it might be better to cancel the USDT yield and allocate it all to OKB, making the returns on OKB look better.

The total profit from the last YB and this MET is just a little over $100, but the capital occupation still requires USDT, which feels a bit unworthy. If it were only OKB, could we consider directly transferring from the OKB in the financial management? It adds an extra step and more operations, which is quite troublesome.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。