Written by: Glendon, Techub News

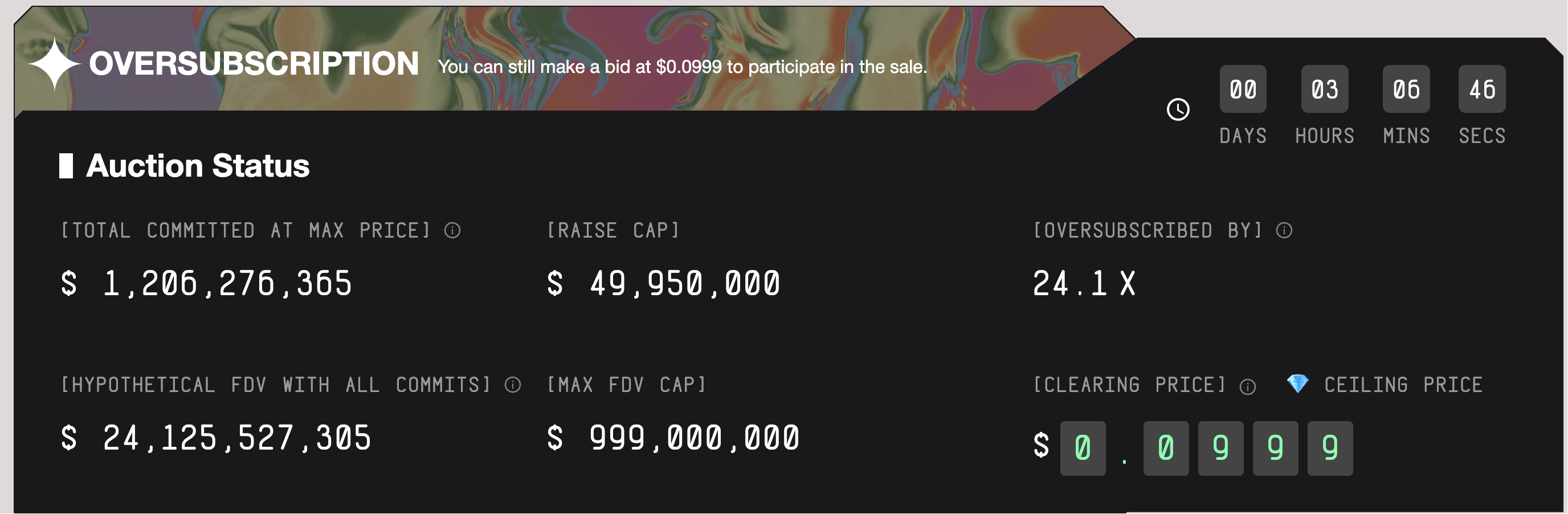

MegaETH has ignited the market's infinite enthusiasm, raising over $1.2 billion in public sales in less than 3 days. Official data shows that as of the time of writing, MegaETH has been oversubscribed by 24 times, and with 3 hours left until the public sale ends, this number continues to climb.

On October 27 at 21:00, MegaETH officially launched its public sale on the Sonar platform under Echo, marking the beginning of a wealth feast. A total of 500 million MEGA tokens were sold in this public sale, accounting for 5% of the total supply (10 billion tokens). According to the rules, MegaETH adopted a British auction model, allowing users to bid, with a minimum bid of $2,650 and a maximum bid of $186,282. The starting price was $0.0001, and the maximum price cap was $0.0999, corresponding to fully diluted valuations (FDV) of $1 million and $999 million, respectively.

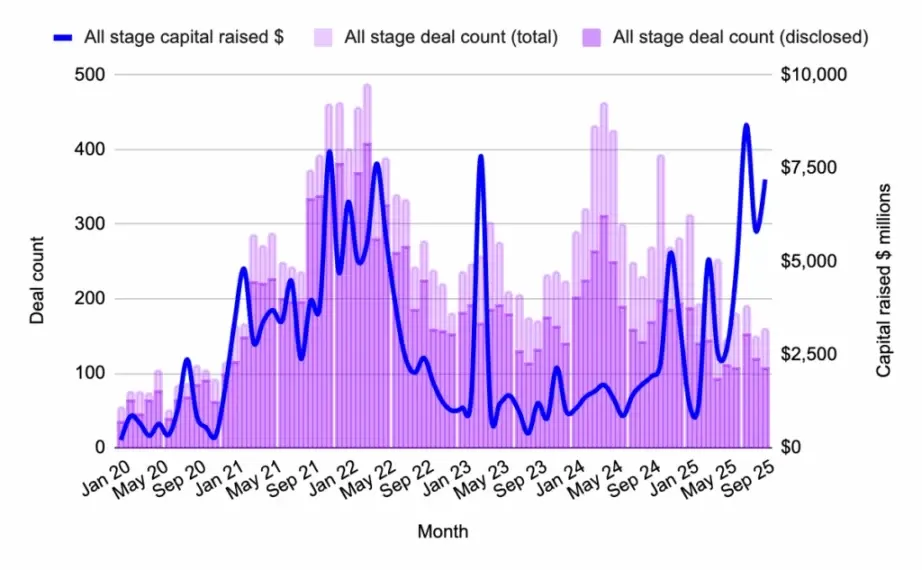

In fact, before the public sale began, MegaETH was already in the spotlight, with high levels of interest. On several trading platforms, the pre-sale futures trading price of MegaETH once broke $0.45, indicating that its FDV could exceed $4.5 billion. On October 10, Grayscale included MegaETH in its list of assets under consideration for future investment products.

So, why is the public sale of MegaETH so popular? What charm does it possess that attracts a large number of investors? This article will analyze from multiple dimensions, including the background of the MegaETH project, financing situation, and token economics.

MegaETH: The Path to "Real-Time Blockchain"

MegaETH is a high-performance Ethereum Layer 2 blockchain project founded by MegaLabs, with the core goal of addressing the limitations of current Ethereum Virtual Machine (EVM) compatible chains in terms of transaction throughput, support for complex applications, and block generation speed.

In an official statement, MegaETH claims to be the first fully Ethereum-compatible "real-time blockchain," aiming to achieve sub-millisecond latency (block times as low as 1-10 milliseconds) and ultra-high throughput of 100,000 TPS through an innovative heterogeneous blockchain architecture and "super-optimized" EVM execution environment, while maintaining Ethereum's security and decentralization, thus supporting on-chain high-frequency and DeFi trading applications.

The founding of MegaETH can be traced back to early 2023, when it was co-founded by Shuyao Kong, former global business development director at Consensys, and Yilong Li, a PhD in computer science from Stanford University. However, it was not well-known at that time. It wasn't until June 2024, when MegaETH developer MegaLabs announced a $20 million seed round financing led by Dragonfly, that it truly entered the public eye.

As an emerging project, MegaETH started ahead of other projects, attracting investments from companies such as Figment Capital, Robot Ventures, and Big Brain Holdings, as well as support from well-known angel investors like Ethereum co-founder Vitalik Buterin and ConsenSys founder Joseph Lubin. Shuyao Kong, co-founder and Chief Business Officer of MegaLabs, stated that this round of financing adopted a structure of equity plus token warrants, with MegaETH's fully diluted token valuation reaching at least $100 million at that time.

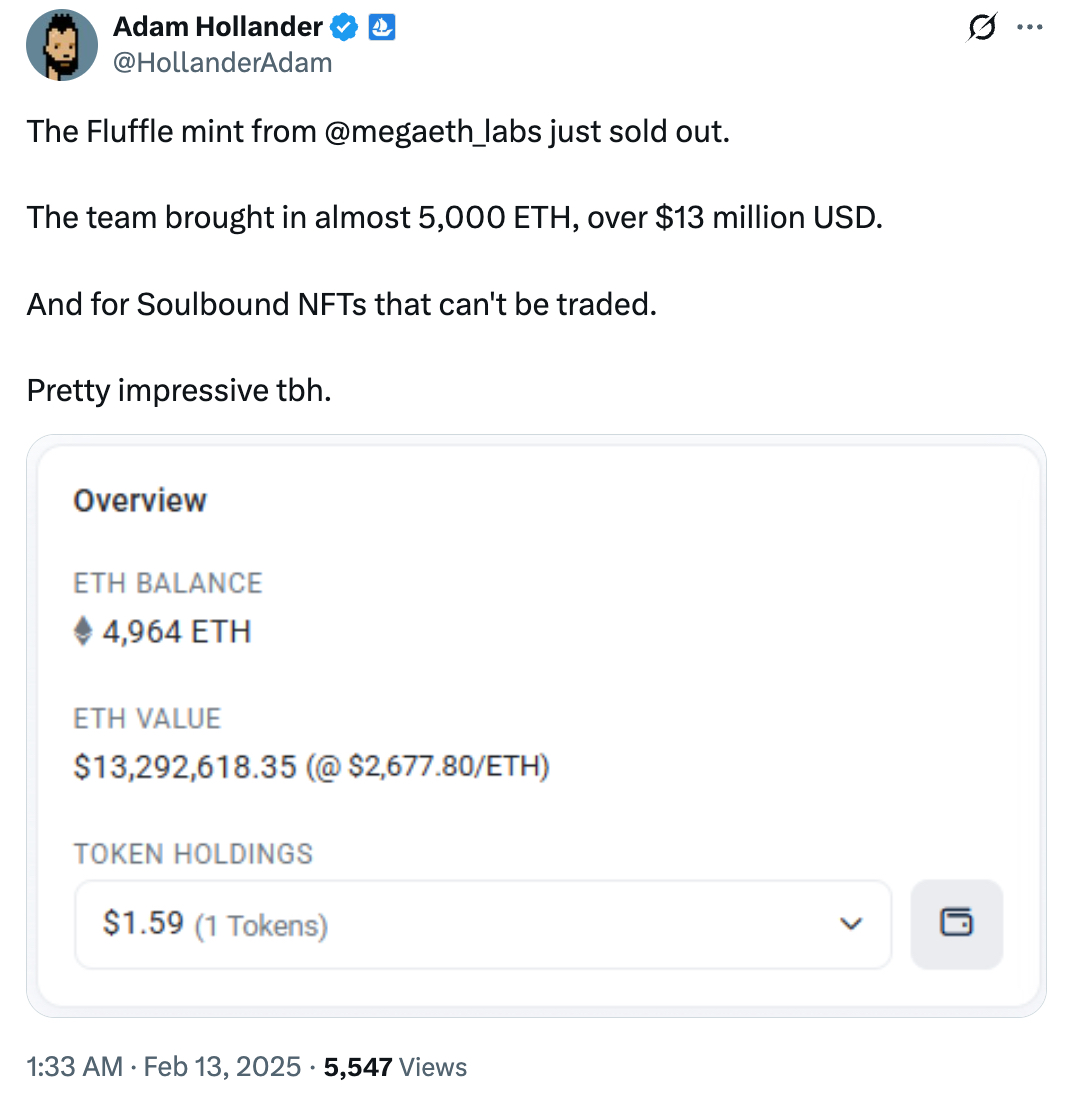

In December of the same year, MegaLabs made another move, completing a $10 million financing through the Echo platform using the "equity plus token warrants" method. At that time, the over-the-counter (OTC) market valuation of MegaLabs had already far exceeded $100 million. In February of this year, MegaETH launched community financing through the Soulbound NFT series The Fluffle, raising 4,964 Ethereum, valued at approximately $13.29 million at that time. It must be said that MegaETH's financing journey has been quite smooth.

Fast forward to March, amid the community's anticipation, MegaETH announced the launch of its public testnet. The testnet showcased powerful performance capabilities, supporting 20,000 TPS, 1.7 Gigas/s computing power, and 10 ms block times, and airdropped testnet ETH to over 190,000 wallets in just 15 seconds. Although there was a significant gap between this testnet and the claimed 100,000 TPS, it far exceeded mainstream L2 solutions, which was undoubtedly surprising. MegaETH stated that the network is based on Ethereum Rollup architecture and will introduce parallelization, JIT compilation, and optimized storage backends in the future to provide a true real-time on-chain experience.

So, how did MegaETH achieve these accomplishments? From a technical perspective, MegaETH employs a hybrid Rollup architecture, where key state updates are still settled through Ethereum, retaining Optimistic Rollup-style finality while enhancing verification efficiency with zero-knowledge proofs (ZK). During execution, it achieves instant transaction sorting through dedicated sorting nodes, breaking through the traditional EVM single-thread limitation by using multi-threaded cross-CPU core parallel processing, compressing block processing time to under 10 milliseconds.

Additionally, MegaETH utilizes EigenDA distributed storage, breaking down state proofs into data fragments distributed to EigenLayer nodes, reducing reliance on the Ethereum mainnet. Although MegaETH sacrifices some decentralization features in areas like sorter centralization, it gains significant improvements in speed and throughput, achieving performance levels comparable to Web2 platforms.

Currently, while the MegaETH mainnet has not yet launched (scheduled for official release at the end of this year), its ecosystem development is thriving. Through the accelerator program "MegaMafia," which supports native on-chain applications, MegaETH has successfully incubated several high-quality projects, such as the new stablecoin model Cap Money, the vertical trading platform GTE, and the capital market World Capital Markets.

Notably, in early September, MegaETH announced a partnership with the decentralized finance protocol Ethena Labs to launch the native stablecoin "USDm" on-chain, aimed at addressing the phenomenon of multiple Layer 2 networks generating revenue by inflating sorter fees. USDm will use stablecoin reserve earnings to replace traditional sorter margins to cover network operating costs, thereby keeping transaction fees low and stable for users and developers, thus coordinating on-chain and ecosystem incentives.

MEGA Token Economic Model and Listing Outlook

The development path of MegaETH has been smooth sailing, so how is the economic model of its native token MEGA designed?

According to official disclosures from MegaETH, the 500 million MEGA tokens sold in this public sale will be fully allocated to purchasers, with the issuer not retaining any crypto assets directly. The specific allocation plan for the remaining MEGA tokens is as follows:

Team and advisors: 950 million tokens (9.5%), these tokens have a 1-year lock-up period and will be gradually unlocked linearly over 3 years;

Foundation/ecosystem reserve: 750 million tokens (7.5%), primarily used for ecosystem development, establishing strategic partnerships, and maintaining the sustainability of the protocol;

Key performance indicator (KPI) staking rewards: 5.33 billion tokens (53.3%), which will be distributed based on network metrics over time, providing performance-based staking rewards to incentivize users to actively participate in network development.

In summary, the MegaETH ecosystem will retain up to 7.03 billion MEGA tokens. The remaining tokens will be allocated to third-party investors and sale participants, with the specific distribution as follows: venture capital firms (VC) will receive 1.47 billion tokens, Echo investors will receive 500 million tokens, Fluffle purchasers will get 250 million tokens, and the Sonar reward pool will receive 250 million tokens, totaling 2.47 billion tokens.

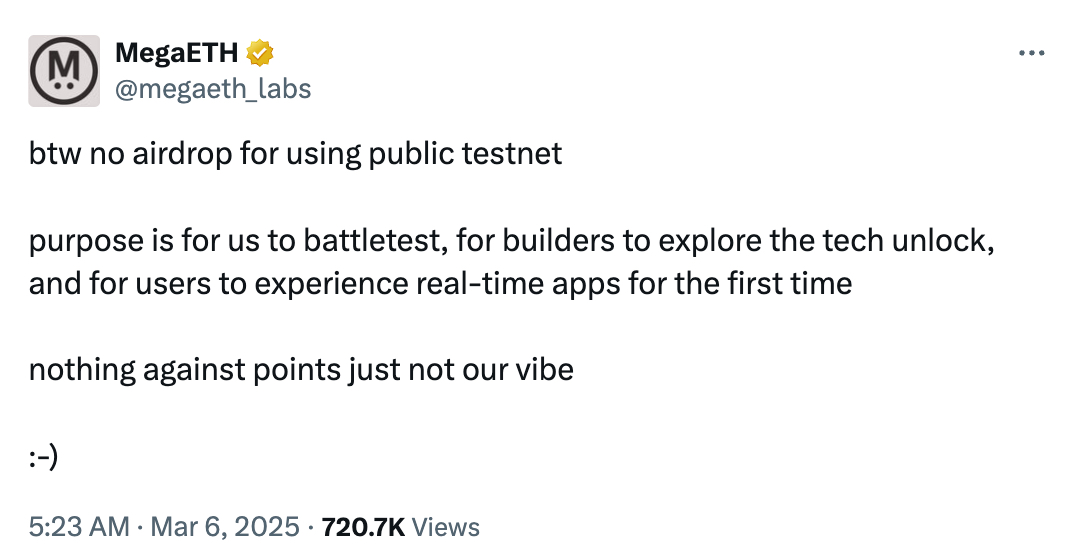

From the above token economic model, it is not difficult to see that MegaETH has not explicitly mentioned a large-scale community airdrop plan for early users and testnet users. In fact, as early as the public testnet launch in March, MegaETH clearly stated that it would not provide airdrop rewards for users participating in the testnet. It stated that the main mission of the public testnet is to conduct technical stress testing, allowing developers to explore new technological breakthroughs in depth while giving users their first experience of real-time applications. Although they do not reject a points incentive model, this does not align with the project's core philosophy.

In other words, unless they are Fluffle holders or Echo investors, other early participants cannot ensure they will receive an airdrop. While this situation has disappointed many community members, some view it as good news. Given that MegaETH values long-term participation and performance-based incentives, not conducting large-scale airdrops may help avoid damage to the MegaETH project itself while reducing sell-off pressure caused by airdrops.

From the current oversubscription multiple of MegaETH's public sale and the speed of fundraising, its public sale performance, even if not "head and shoulders above," has already far exceeded most similar projects. In this context, what kind of performance will MEGA exhibit after its official listing?

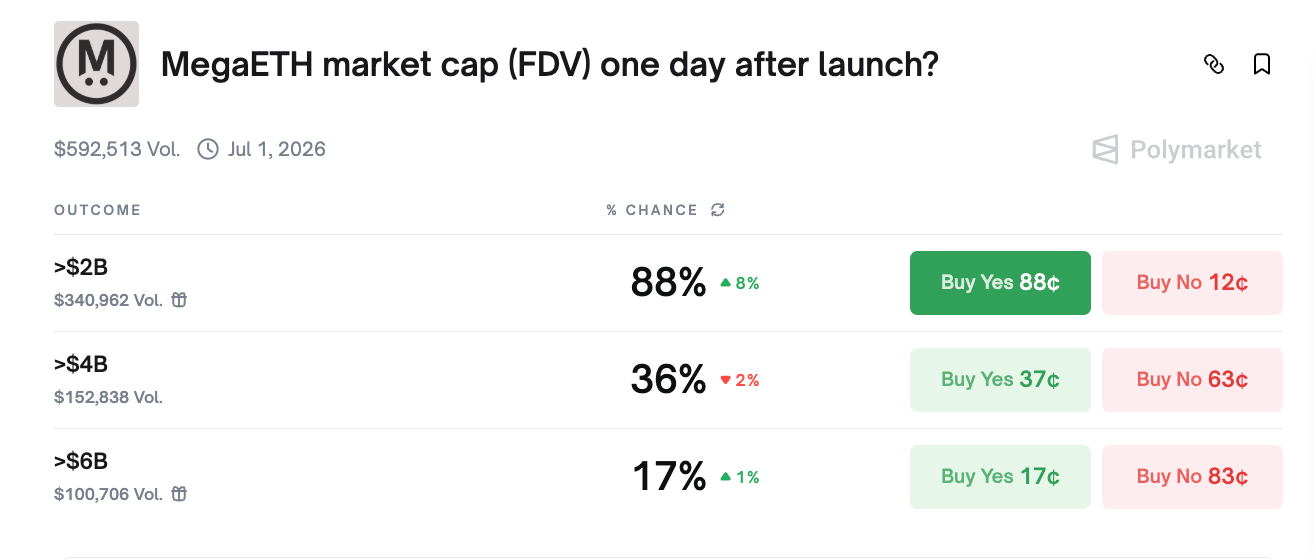

There is no doubt that market expectations for MegaETH are high. According to the Polymarket prediction page, the probability of MEGA exceeding a fully diluted valuation (FDV) of $2 billion within 24 hours of issuance is as high as 88%, and the probability of exceeding $4 billion is also 36%. This clearly indicates that the market is highly optimistic about the issuance price and valuation of the MEGA token, and this sentiment is likely to drive the early trading price of the token in the secondary market to rise rapidly, potentially even leading to short-term speculative premiums.

From a long-term perspective, the value of MegaETH and its token MEGA still depends on the actual application and promotion of the MegaETH network. If MegaETH can successfully achieve its technical goals (sub-millisecond latency and 100,000 TPS) while attracting real-time applications such as high-frequency trading and gaming, then the demand for the token will inevitably increase as the ecosystem grows.

In this critical aspect, MegaETH's planning also demonstrates a clear long-term vision. In mid-October, MegaETH repurchased approximately 4.75% of the company's equity and token warrants from early Pre-Seed investors. Co-founder Shuyao Kong explained that this "atypical buyback" was completed before the mainnet and token launch, aiming to optimize the equity structure and token supply, maintaining consistency in long-term incentives. From a positive perspective, this move helps reduce potential selling pressure on MEGA in the future, making the token supply more concentrated and stable, thus laying a foundation for the long-term stability of the token price.

However, MEGA will also face similar "profit-taking" risks as other project tokens. Especially with the high enthusiasm for this public sale, if MEGA launches at several times the auction price, early participants may choose to cash out, which could likely lead to price fluctuations in the short term.

Finally, when we broaden our view to the entire Ethereum ecosystem, if MegaETH succeeds, its importance will be akin to gears in a machine, and its impact should not be underestimated. MegaETH's EVM compatibility and monolithic design can significantly reduce migration costs for developers, attracting more DApp deployments and enriching Ethereum's application scenarios. Moreover, based on its core positioning as a "Layer-2 scaling solution," MegaETH's high throughput will help alleviate congestion on the Ethereum mainnet, reduce gas fees, and comprehensively enhance user experience.

Therefore, whether MegaETH can establish a foothold in the crypto market not only concerns its own success or failure but will also have far-reaching implications for Ethereum. So, could MegaETH become the new "myth of sudden wealth"?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。