Today, the yields on U.S. Treasuries rose across the board, indicating that the market is redefining its expectations for the Federal Reserve's interest rate cuts. Previously, there was a belief that after halting the balance sheet reduction, there would be a continuous path of rate cuts, but this has now been largely denied by Powell. Long-term U.S. Treasury rates are rising, and investors are beginning to lower their expectations for continued rate cuts in 2025. Next, we should watch Trump's performance.

Especially within the Federal Reserve, apart from Milan, there seems to be no one else executing Trump's strategy of aggressive rate cuts. Let's see if Trump has any counterattacks. However, I personally believe this will not change the direction of U.S. monetary policy towards easing.

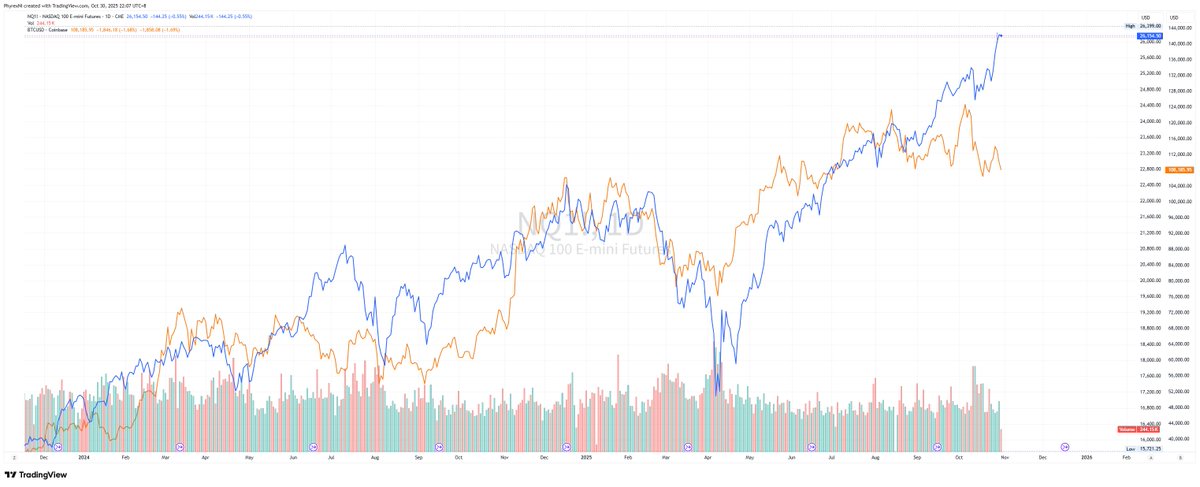

Moreover, I still think that when U.S. stocks, especially tech stocks, dominate, their movements are highly correlated with $BTC.

This article is sponsored by #Bitget | @Bitget_zh

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。