Native token of oracle network Chainlink plunged through critical support levels on Thursday as institutional selling dominated the session.

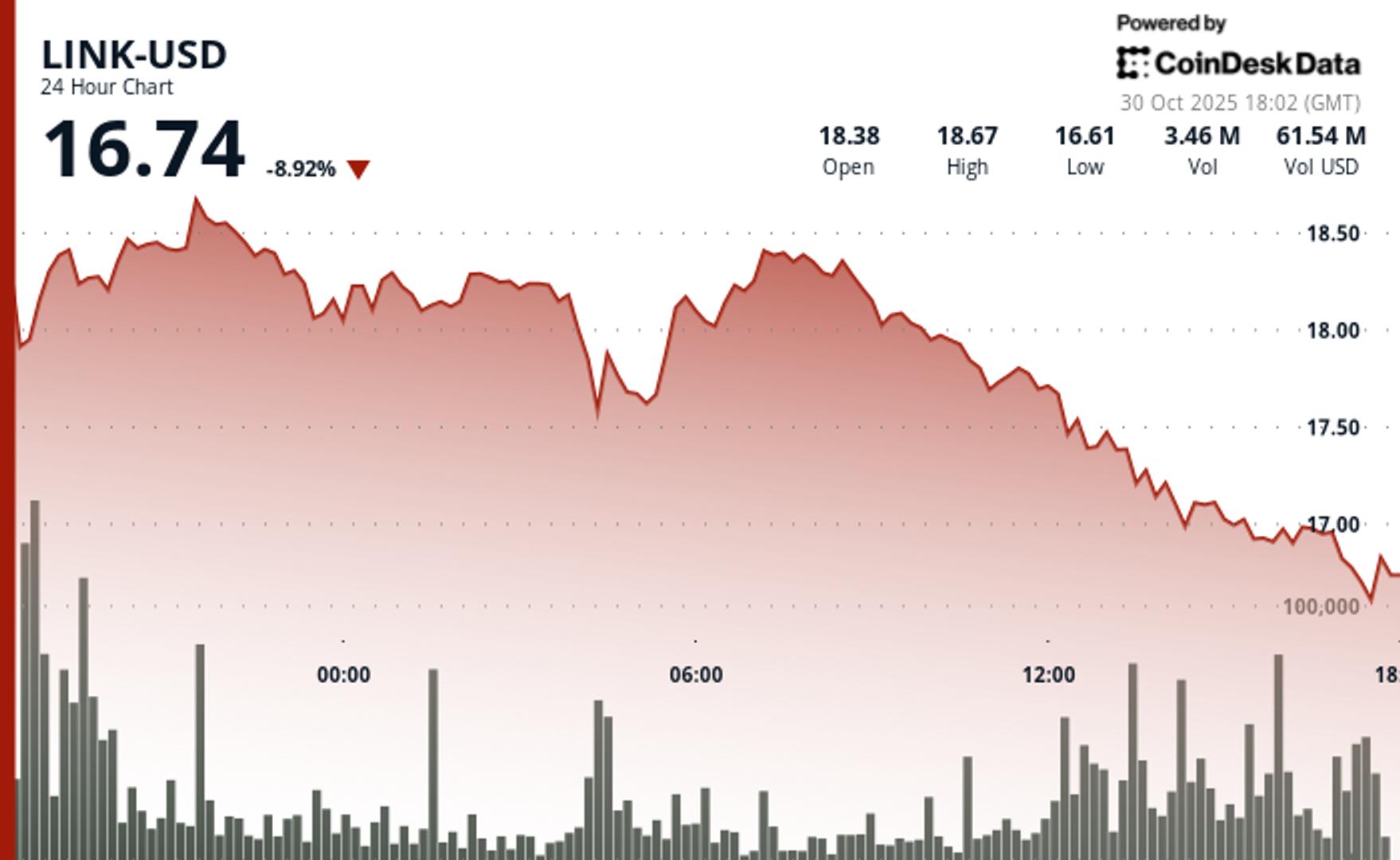

The token declined 8% from $18.39 to $16.92 over the past 24 hours, falling below a descending trendline that contained recent price action, CoinDesk research's market insight tool showed. Trading volume surged to 3.94 million units during the initial breakdown, nearly double the average.

Recent hourly data shows LINK trapped below $17 in a narrow consolidation range. Multiple attempts to reclaim the $17 psychological level failed as trading activity dropped 58% below session peaks. The compression suggests institutional buyers remain absent despite oversold technical conditions developing.

On the news front, real-world asset protocol Ondo Finance named Chainlink the provider of price feeds for over 100 tokenized stocks and ETFs. The service includes streaming data about corporate actions like dividend payments to ensure accurate valuations across multiple blockchains. The partnership also involves Chainlink's Cross-Chain Interoperability Protocol (CCIP) and collaborations through the Ondo Global Market Alliance.

The Chainlink Reserve, which uses protocol revenue from partnerships and services to purchase tokens on the open market, added another 64,445 LINK to its stash on Thursday. That's the largest nominal acquisition since early August, when the reserve started. It now holds $11 million worth of LINK.

What traders should watch:

- Support/Resistance: Immediate resistance at $17.00 psychological level, stronger resistance at $18.20 from failed recovery attempt.

- Volume Analysis: Exceptional 3.94 million unit volume during breakdown confirmed institutional selling.

- Chart Patterns: Descending trendline break triggered accelerated selling through multiple support zones.

- Targets & Risk: Next support target $16.50 zone, potential deeper correction toward $16.00 if consolidation fails.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk's full AI Policy.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。