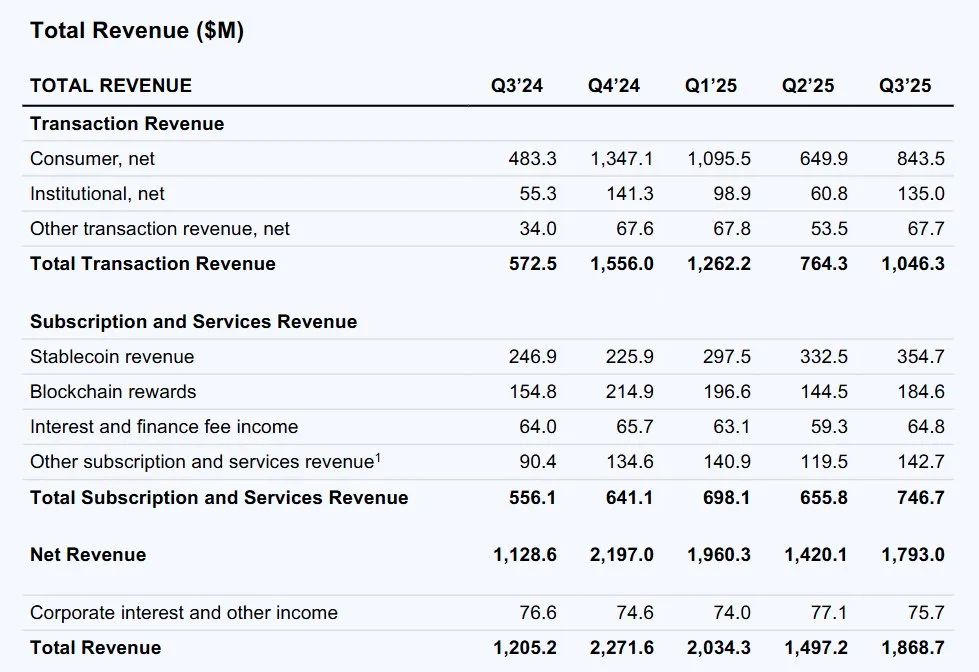

Accidentally finishing the $MSTR earnings report, the day has brightened up. I was specifically waiting to see the earnings reports for MSTR and $Coin; I haven't looked at Coin's yet, so I'll talk about that later. Today's homework isn't too difficult; mainly, it's about Powell's expectations for no interest rate cuts in December combined with the reactions to U.S. stock earnings reports. In the short term, the market sentiment is indeed quite poor. However, after the U.S. stock market closes today, the new round of earnings reports looks promising, even though there was a significant drop yesterday, and pre-market trading today has already started to rise.

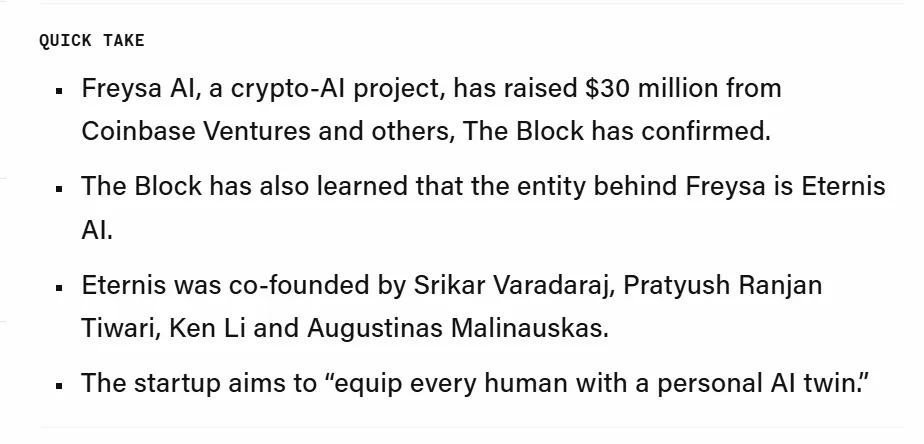

Currently, $BTC and tech stocks still maintain a strong correlation. At least for now, I haven't seen any risk of BTC and tech stocks decoupling. The biggest issue right now is that the overall cryptocurrency space lacks its own narrative. Aside from the latest few spot ETFs, there are almost no independent narratives. Trump hasn't mentioned the BTC strategic reserve in a long time either.

This has led to a decline in traditional investors' sentiment towards cryptocurrency investments. The data from spot ETFs shows that recent buying power is indeed weak; there is only some buying volume when there are significant positive developments in tech stocks or macroeconomic factors. At other times, the situation doesn't look good, which is the biggest dilemma currently facing Bitcoin and cryptocurrencies. But I still believe that BTC is fortunate to have the same group of investors as tech stocks.

Looking back at Bitcoin's data, the fear index has significantly increased in the last 24 hours, mainly due to the Federal Reserve's influence. However, the fact that the U.S. is moving towards monetary easing is undeniable; the balance sheet reduction has already stopped, and there's also Trump lurking in the background. Therefore, my personal view is that even if there are no interest rate cuts in December, it won't change Trump's determination to adjust interest rates by 2026.

I am still holding my long positions; I made a few short trades but overall started from $106,000, taking profits a few times and then reopening positions at lower levels. We'll discuss it together when reviewing the trades. If this price leads to my liquidation, I will start buying spot.

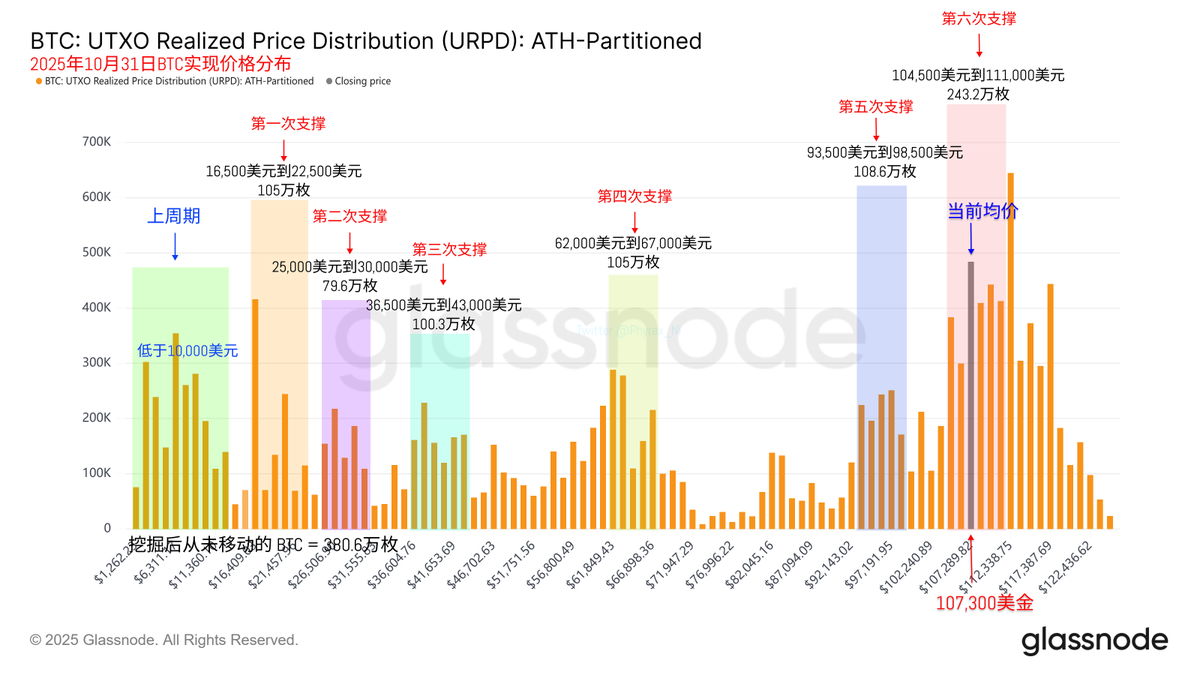

From the perspective of the chip structure, I haven't found any significant risks; more buying volume is gathering, and I haven't seen any signs of investor panic yet.

This article is sponsored by #Bitget | @Bitget_zh

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。