In the rapidly evolving digital asset industry of 2025, Hong Kong's position as a global Web3 hub is becoming increasingly prominent. On October 30, the "Digital Asset Analyst Elite Forum" live stream, hosted by Uweb, Techub News (exclusive content strategic cooperation media), and the Hong Kong Registered Digital Asset Analysts Association (HKCDAA), held its 7th session themed "Exploring Hong Kong Web3.0 Brokerages:卓锐证券 (Zhuorui Securities)," attracting hundreds of industry professionals. The host, Romeo Wang Hongbin—executive secretary general of the association—collaborated with guest Phil Kang (康帅), CEO of卓锐金融集团有限公司 (Zhuorui Financial Group), to deliver a content-rich sharing session covering the public segment "How Zhuorui Securities Understands the Web3 Trend" and the analyst-exclusive segment "Interpretation of Hong Kong Web3 Regulatory Policies." From the perspective of an atypical finance professional transitioning from engineering to finance, to practical insights from a compliant brokerage, this live stream not only analyzed the macro context of Web3 but also provided practitioners with clear entry paths. The following distills the core content from a media perspective, presenting the highlights of this sharing.

Public Segment: The Dual Drive of Compliance + Technology for Brokerages under the Web3 Trend

At the beginning of the live stream, Romeo used the "golden era" of Hong Kong's brokerage sector as a starting point, highlighting the phenomenal case of Guotai Junan soaring due to its license, leading to the unique positioning of Zhuorui Securities. Phil Kang's self-introduction resembled an inspirational legend of "engineering to finance": he studied mathematics in college, entered game development after graduation, and participated in the development of the mobile game "Tianlong Babu," reaching the top of the App Store's popular list at its peak. After the gaming industry transformed in 2014, he switched to a U.S. listed internet brokerage, starting as an engineer while learning finance on the job. After leaving in 2019, he co-founded a fintech company "Random Walk," focusing on SaaS services to provide securities derivatives solutions for global brokerages. Since 2020, the news of Hong Kong OSL obtaining a license ignited enthusiasm for Web3, and the company gradually explored virtual asset businesses, assisting a Hong Kong brokerage in completing its Web3 transformation in 2024. At the end of last year, Phil joined Zhuorui Securities as CEO, aiming to "create a globally influential traditional brokerage + Web3 brokerage."

Zhuorui Financial Group was established in 2017, initially focusing on wealth management in Singapore, and entered Hong Kong in 2019, holding licenses 1, 2, 4, 5, and 9, and providing crypto asset services approved by the Securities and Futures Commission (SFC). Why is there a firm belief in the Web3 track? Phil candidly stated that it stems from a profound insight into the cyclical nature of the financial industry. "Finance always has strong cyclicality; throughout human history, every economic cycle has birthed new stars, such as Charles Schwab and Robinhood." He analyzed the rise of Robinhood: after the 2008 financial crisis, the institutional market (with institutions accounting for 80-90%) was disrupted by millennial retail investors, with technology amplifying the voices of retail investors. Similarly, without blockchain, traditional finance would not have developed so rapidly. "We do not see Web3 as a stagnant pool, but as a dynamic track."

The key turning point lies in "the path of compliance." Phil emphasized that the greatest advantage of traditional institutions is their reverence for compliance—SOPs and risk control have been internalized into their DNA. However, compliance alone is not enough; a strong R&D background is also needed to keep up with technological innovation. Zhuorui's entry point lies here: while communicating with offshore exchanges and stablecoin issuers, he discovered a significant "gap" in global institutions' compliance with Hong Kong regulations. "Hong Kong compliance is not a shackle, but a bridge, allowing Web3 to move from the margins to the mainstream." The company's strategy focuses on attracting talent and precise direction, with expectations of achieving good results in a limited time. Romeo added that this is a "two-way effort": traditional institutions seek "crypto native" talent, while grassroots players pursue certification upgrades. The larger the institution, the harder the transformation; emerging brokerages may emerge as dark horses through product development and user insights.

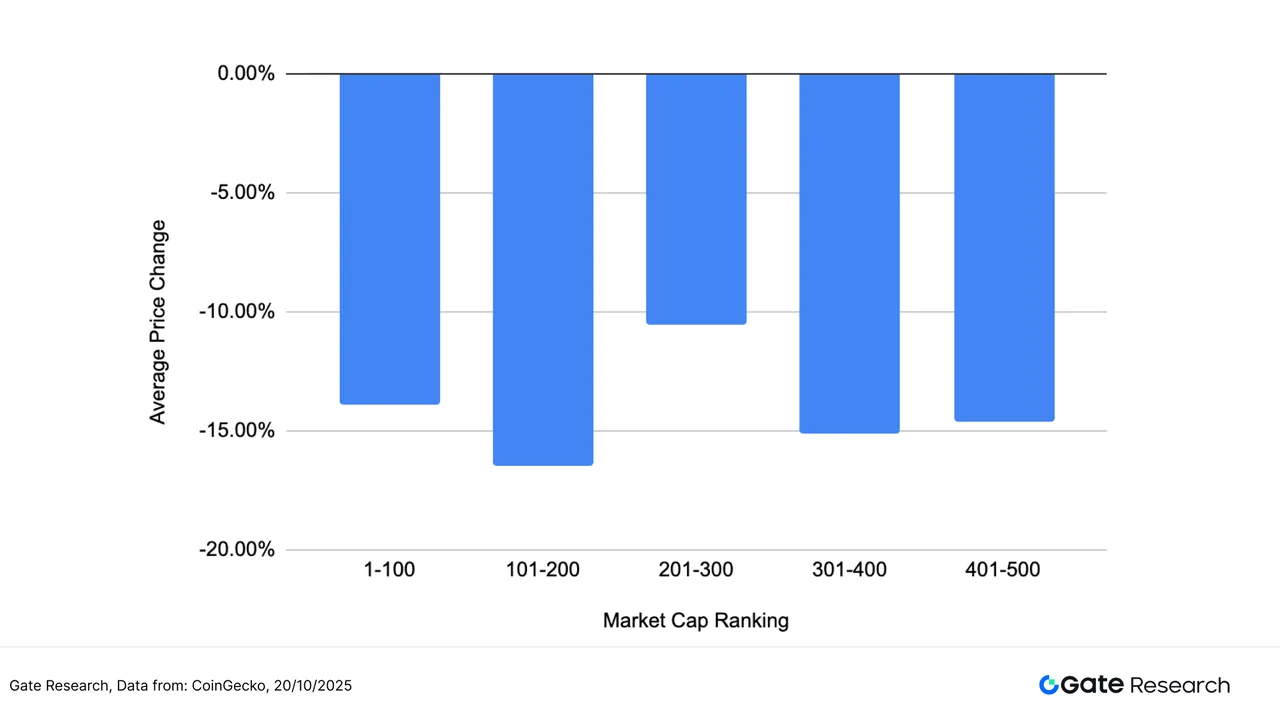

When discussing market judgments, Phil avoided the "four-year cycle" trap. "By the end of 2024, many exchanges will obtain DIM licenses but will encounter a bear market; the current financing iteration lacks the anxiety of the past." He believes that the crypto cycle is integrating into the traditional financial market, with giants like BlackRock laying out through ETFs and derivatives, introducing an "X factor" that disrupts the rhythm. "Winter theories for Q3-Q4 2025? I cannot verify; I will not adjust strategies based on expectations." It depends on perspective: traders chase signals, while long-term investors believe BTC will reach a million dollars, ignoring short-term fluctuations. Phil predicts that this year is unlikely to decline; the biggest change from 2024 to 2025 will be "adoption"—from niche to mainstream, with an explosion of application scenarios and market normalization. The future narrative connects the traditional and the virtual: RWA, ETFs, DeFi, etc., will "move traditional products onto the chain." "This is an inevitable trend that enhances popularization."

Romeo shared observations from Silicon Valley: after the trade war in April, retail market share in U.S. stocks exceeded 40%, as institutions halted due to agreements, and Web3 grants more freedom to the "stock god dream." Emerging institutions have opportunities in discovering demand, such as Robinhood's low-profile headquarters (avoiding banners). Mainland regulatory "window guidance" curbs the overheating of stablecoins, which Phil sees as a double-edged sword: on one hand, overheating; on the other, public participation—at the Shenzhen port, two shop owners passionately discussed stablecoins, akin to casual conversations on A-shares buses. Romeo called for long-termism: "The optimistic atmosphere on Wall Street exceeds expectations; visiting institutions in New York received strong feedback. After overheating, quality projects will prevail."

Analyst Exclusive Segment: Hong Kong Web3 Regulatory Policies, License Upgrades, and Talent Gaps

The internal session shifted to a "private" mode, focusing on regulatory interpretation. Phil provided an overview of the Hong Kong framework: the HKMA regulates stablecoins and banks; the SFC regulates brokerages and exchanges. There is no exclusive "virtual asset license," but rather upgrades of the existing 13 licenses. Brokerages typically hold licenses 1 (securities trading), 4 (investment advisory), 2/5 (futures), and 9 (asset management), and Zhuorui has them all. License 7 is upgraded to VATP (Virtual Asset Trading Platform), emphasizing security.

Detailed explanation of Zhuorui's business: after the upgrade of license 1, it engages in VA Trading—buying and selling BTC/ETH/USDT, etc., with fiat currency (HKD/USD), institution to institution, not C2C, ensuring high security, especially for large allocations. Off-ramp (crypto monetization) also falls under license 1. License 4 upgrade provides investment advice and Copy Trade. IWA distribution operates under license 1; stablecoins are independent of HKMA. Requirements include asset protection, AML/KYC, and security (such as vaults, multi-signature, 98% cold wallet storage, 13-person co-signature for withdrawals), and insurance coverage (initially 97%, now reduced to 50%). Romeo promoted the association's certification: Level 1 is suitable for distribution, while Level 3 is for RO (responsible officer).

External Q: With the country strengthening regulation, does Hong Kong's opportunity decrease?

Phil replied: "Hong Kong is a channel between the mainland and overseas; under strict legal compliance, Web3 projects that cannot be conducted in the mainland can be in Hong Kong. Policies continue to move forward: the first VATP in two years, with subsequent acceleration; the world's first physical ETF (BTC subscription). Macroscopically, revitalizing Hong Kong's financial core, Web3 is indispensable." Romeo added: "Lack of regulation is scary; chaos can easily collapse; regulation encourages institutions to enter, leading to growth in scale."

In-depth internal discussion: Hong Kong vs. U.S. RWA paths? Phil pointed out that the U.S. is ahead (e.g., Robinhood's rough RWA is based on the EU's MiCA), but Hong Kong has the attribute of a circulation hub, influenced by non-local factors. The stablecoin focus is on offshore RMB, not U.S. Treasury bonds. Hong Kong lacks talent: without the internet era, innovation is weak; however, IPOs are booming, making it suitable for deep exploration of traditional + Web3. Opportunities lie in cross-disciplinary talent: those who understand traditional finance + on-chain (e.g., settlement, clearing, cross-border). The talent gap in Hong Kong is enormous; compliant Web3 is only in its early stages and is not limited. Practitioners from the mainland: production and research are okay, but operations/compliance must transition to Hong Kong. There is much internal promotion.

Q: Offshore exchanges (like Binance) refuse mainland/Hong Kong users? Phil explained: Offshore holds licenses from Singapore/Dubai; Chinese law does not protect losses, and it is not encouraged. Hong Kong refuses mainland users to protect investors, as the SFC strictly prohibits it. Compliance is stringent: process review, face-to-face testing, insurance. The collapse of FTX/GPX serves as a warning; high-asset individuals seek stability, not reckless gambling. Romeo pointed out the gray area: for example, buying Hong Kong insurance from the mainland is legal but non-compliant; early bird opportunities exist in the healthy process. Recommendation: participate early, be at the table to win.

As the live stream concluded, Romeo encouraged: the first batch of Level 2 will hold early next year; join the industry as soon as possible. Thanks to Phil, and arrangements for offline communication. CC promotion: contact the QR code to register and connect with the community.

This sharing was like timely rain: amidst the clouds of a bull market, Zhuorui Securities' confidence stems from the dual wings of compliance and technology, while regulatory policies safeguard the industry. Web3 is not a zero-sum game but a future of inclusivity. HKCDAA supports those transitioning from engineering/finance through certification and live streaming. Want to get involved? Start from Level 1; Hong Kong is waiting for you. Elite Forum, see you next time!

Digital Asset Analyst (HKCDAA) Qualification Certification Exam Introduction

The Digital Asset Analyst (HKCDAA) qualification certification exam launched by the Hong Kong Registered Digital Asset Analysts Association aims to provide authoritative certification for professionals in the digital asset field. The exam covers areas such as the basic theory of digital assets, blockchain technology, investment analysis, trading tools, risk management, regulatory laws and regulations, and professional ethics, cultivating and certifying professionals with a global perspective in digital assets.

The exam has now been officially incorporated into the professional/vocational examination system recognized by the Hong Kong Examinations and Assessment Authority (listed on the Authority's official website) and is administered by the Hong Kong Examinations and Assessment Authority, alongside internationally recognized exams such as HKDSE, CFA, and FRM, under a unified management system. This marks the exam's official authoritative recognition by the Hong Kong Examination Authority, establishing its irreplaceable authoritative status in the digital asset industry and laying the foundation for the standardization and professionalization of talent in the digital asset field, which will inject more reliable professional strength into the Web3.0 industry.

The career development path after obtaining the certification is broad, including directions such as financial institutions and investment companies, digital asset exchanges and Web3.0 enterprises, regulatory agencies and compliance departments, digital asset investment and wealth management, and educational and research institutions. The target audience includes practitioners in financial institutions, digital asset professionals, digital asset investors, regulatory agencies and compliance personnel, as well as students and beginners.

The fourth phase of registration offers a special price of 9,000 HKD, with a full waiver of the registration fee (a discount of 300 HKD). Those who complete registration by September 12 will also receive a "High-Frequency Exam Point Online Course" (valued at 15,000 HKD). Registration is open until September 30, 2025, with the exam date set for December 20, 2025.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。