On October 31, 2025, the "coin-stock linkage" effect between the cryptocurrency market and traditional stock markets was once again highlighted. Despite Bitcoin's price recording its worst monthly performance in a decade in October, falling below $108,000, several listed companies continued to ramp up their Bitcoin treasury strategies, demonstrating institutional confidence in the long-term value of digital assets. Meanwhile, crypto-related stocks in the U.S. faced a widespread "bloodbath," with major players like Coinbase (COIN) seeing their stock prices plummet over 5%. This week (October 30-31), from Strategy's $2.8 billion Q3 profit to SEGG Media's $300 million digital asset plan, the wave of corporate Bitcoin reserve expansion shows no signs of slowing, while short-term market fluctuations test investors' resilience. The following analysis combines recent dynamics to dissect the multifaceted mirror of coin-stock linkage.

Corporate Bitcoin Treasury Expansion: From Strategy to SEGG, Institutional "Hoarding" Enthusiasm Remains Strong

The narrative of Bitcoin as "digital gold" is becoming increasingly entrenched in the treasuries of listed companies. On October 30, U.S. Bitcoin giant Strategy (formerly MicroStrategy) released its Q3 financial report, boasting a net profit of $2.8 billion, a quarterly record. The company added approximately 43,000 Bitcoins this quarter, bringing its total holdings to 640,808 Bitcoins, valued at over $68 billion. Executive Chairman Michael Saylor reiterated his ambitions for Bitcoin: a target price of $150,000 by the end of 2025, and $1 million within 4-8 years. Strategy's "Bitcoin-first" strategy not only financed $2 billion in Bitcoin purchases through bond and stock issuance but also views Bitcoin as a core asset, which helped its stock price rebound temporarily after the earnings report.

Following Strategy, on October 30, Chinese electric vehicle retailer Jiuzi Holdings (NASDAQ: JZXN) announced a partnership with the SOLV Foundation to launch a Bitcoin treasury plan of up to $1 billion. This plan aims to inject a portion of digital asset income into Bitcoin reserves, marking a deep integration of traditional industries into the crypto space. Jiuzi emphasized that this move will hedge against inflation risk through the long-term appreciation of Bitcoin and explore NFT and DeFi applications.

On October 31, this wave continued. The U.S. listed company SEGG Media announced plans to establish a $300 million digital asset program, with 80% of the funds allocated to a multi-asset crypto reserve. Bitcoin will be the primary target initially, providing a "stable foundation," while also including assets like Ethereum (ETH), Solana (SOL), and ZIGChain (ZIG), enhancing returns through validator operations (staking). This plan highlights a trend towards diversification: not just hoarding BTC, but also pursuing passive income. CryptoBriefing analyzed that this move may inspire more media and entertainment companies to follow suit, promoting the Web3 content ecosystem.

Korean listed company Bitplanet also joined the "hoarding" ranks. According to BitcoinTreasuries.NET data, the company increased its holdings by 9 Bitcoins on October 31, bringing its total to 119.67 Bitcoins. As a representative of the integration of mining and technology in Asia, Bitplanet's actions reflect regional institutions' ongoing commitment to Bitcoin. Overall, by 2025, the scale of corporate Bitcoin treasuries has exceeded expectations: 131,000 new BTC were added in Q2, an 18% increase from the previous year. As of September, over 200 companies have adopted digital asset treasury strategies, with 190 focusing on BTC. This phenomenon has expanded from Strategy's "Bitcoin Empire" to emerging players, with coin-stock linkage shifting from mere hoarding to ecosystem building.

U.S. Crypto Stocks "Bloodbath": October Ends Under Pressure, Mining Stocks Defy the Trend

Despite the confidence boost from corporate treasury expansion, short-term market sentiment remains low. On October 31, the three major U.S. stock indices all fell: the Dow Jones dropped 0.23%, the S&P 500 fell 0.99%, and the Nasdaq declined 1.57%. The crypto stock sector was hit hardest, with Coinbase (COIN) closing down 5.77%, Circle (CRCL) down 6.85%, and Strategy (MSTR) down 7.55%. Other stocks like Bullish (BLSH) fell 4.98%, Bitmine (BMNR) dropped 10.47%, SharpLink Gaming (SBET) decreased 6.17%, and BTCS fell 4.77%, all showing "deep red." Newly listed SOL treasury stock Helius (HSDT) plummeted 11.8%, BTC treasury stock Kindly MD (NAKA) fell 9.98%, and new stock Figure (FIGR) dropped 4.46%.

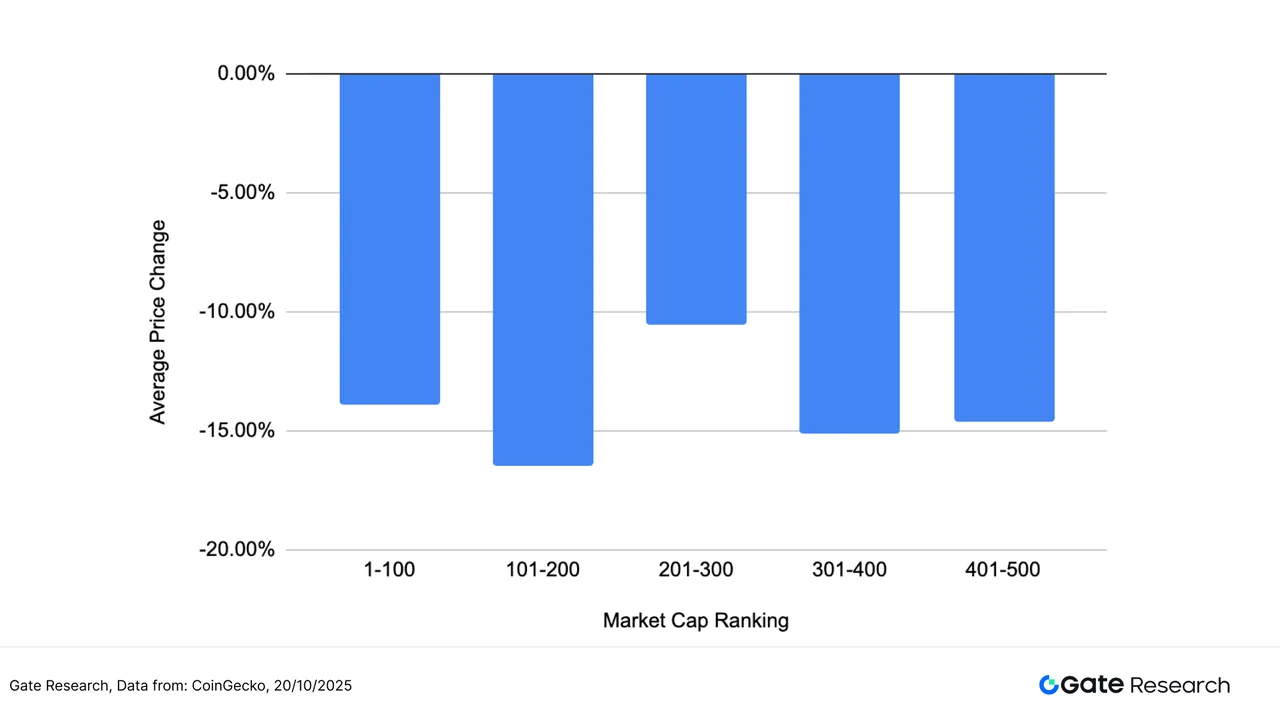

This round of declines stemmed from Bitcoin's "disappointing close" in October: the price slid over 15% from the month's high, marking the worst monthly return in a decade. On October 30, Bitcoin had fallen below $108,000, dragging crypto stocks down collectively. BitMine Chairman Tom Lee bluntly stated, "The digital asset treasury bubble has burst," with many companies' stock prices falling below their net asset value (NAV). Analysts pointed out that profit-taking at the beginning of Q4 and macro uncertainties (such as slowing expectations for Federal Reserve rate cuts) exacerbated volatility. Although Strategy's earnings report on October 30 was impressive, the mNAV premium compressed to a historical low, and the stock price failed to reverse the downward trend.

However, it was not a complete rout. On October 31, crypto mining stocks rose against the trend, with the sector's market value increasing more than threefold this year, far exceeding Bitcoin itself. This "leverage effect" stems from the transformation of AI infrastructure: mining companies are shifting towards high-performance computing (HPC), with the computing power leasing businesses of Riot Platforms and Marathon Digital booming. The Block reported that mining stocks have become a "magnifying glass" for Bitcoin, providing excess returns amid volatility. Additionally, Coinbase's Q3 accumulation data boosted morale: in addition to 2,772 BTC, it also added 11,933 ETH and pledged to "continue accumulating." Base co-founder Jesse Pollak emphasized on X that this move reflects institutional "resilience confidence" in BTC.

Market Outlook: Regulation and Innovation Drive Coin-Stock Linkage Towards Improvement

Looking back at October 30-31, the "ice and fire" of coin-stock linkage reflects signs of market maturity: corporate treasury expansion provides long-term anchoring, while short-term fluctuations test risk management. The repayment of 34,000 Bitcoins from Mt. Gox was postponed to October 31 (Japan time), which, while triggering panic selling, also injected liquidity into the market. At the same time, the Bitwise SOL ETF saw nearly $70 million in net inflows on its first day, combined with the Federal Reserve's renewed rate cuts, boosting the altcoin ETF ecosystem.

Looking ahead to Q4, experts are optimistic about the deepening of coin-stock linkage. A DLA Piper report pointed out that digital asset treasuries have become a key trend in capital markets, with over 190 companies focusing on BTC. Hyperscale Data's Bitcoin treasury has reached $13.25 million, with the payment date set for October 31. PR Newswire analyzed that by 2025, crypto assets will be embedded in e-commerce and retail frameworks, with institutional adoption rates further climbing. For investors, Strategy's Saylor model may serve as a template: amplifying BTC exposure through debt financing, but caution is needed regarding NAV discount risks.

Coin-stock linkage is shifting from "concept hype" to "value anchoring." With Strategy, SEGG, and Coinbase leading the way, the wave of corporate treasuries may reshape the stock market landscape. Although October ended on a bleak note, a rebound window has emerged in Q4—if Bitcoin can hold the $100,000 support, crypto stocks may see a "V-shaped" reversal. Investors should adopt a long-term perspective and embrace this new era of digital finance.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。