This report is written by Tiger Research and analyzes how AI builds financial intelligence platforms using Edgen as an example.

Key Points Summary

- Retail investor participation is rapidly expanding, but investors lack the infrastructure to effectively interpret and utilize data. Institutional investors systematically manage the market through professional systems like Bloomberg Terminal, while individual investors still rely on fragmented information.

- Edgen bridges this gap with its AI-driven financial intelligence platform. The platform integrates analysis of stocks and cryptocurrencies, providing not just data but actionable insights.

- Edgen further advances by building hyper-personalized investment analysis. The platform tailors intelligent analysis to each investor's style and goals, transforming financial analysis capabilities that were once exclusive to Wall Street into tools accessible to everyone.

1. The Era of Retail Investing Needs New Intelligence

The lowering of barriers to entry in financial markets has rapidly expanded retail investor participation. Today, anyone can access global markets anytime and anywhere with just a smartphone. Everyone can easily obtain professional information, including company disclosures, financial statements, and analyst reports. Market access and information acquisition have never been easier.

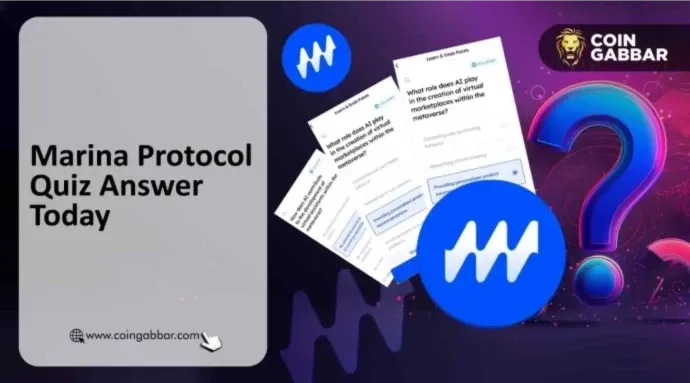

Source: JPMorganChase Institute

However, the improvement in accessibility, including market access and information access, has not provided sufficient infrastructure to effectively analyze and utilize data. The complex market environment and higher volatility increase the burden on retail investors. Investors must monitor vast amounts of data across multiple services to invest in various assets, including stock markets and cryptocurrencies. Nasdaq and the New York Stock Exchange plan to introduce a 24-hour trading system modeled after the cryptocurrency market. The investment environment will become even more fast-paced.

Retail investors lack adequate infrastructure to cope with this complexity. When investing is not their primary profession, they lack the time and resources to systematically analyze vast amounts of data. The complexity of financial data imposes a significant cognitive burden on understanding and utilization. Many retail investors acquire abundant information but fail to utilize it appropriately and timely. They rely on social media or fragmented news, apps, or homemade spreadsheets to make investment decisions.

Source: Bloomberg Terminal

Institutional investors traditionally cope with this complexity through professional systems like Bloomberg Terminal. Ultra-high-net-worth individuals receive personalized portfolio management and customized investment strategies through private bankers. Bloomberg Terminal can cost tens of thousands of dollars annually and requires professional training. Private banking services require a minimum asset threshold of several billion Korean won.

Most retail investors cannot access these professional tools. However, retail investors face the same market environment as institutional investors. The expansion of market participation forces retail investors to make quick and accurate decisions in a complex and rapidly changing market. Advancements in AI technology open up new possibilities for narrowing this information gap. Current services can analyze vast amounts of data in real-time like Bloomberg Terminal and provide personalized investment insights like private bankers. Edgen is a leading example of this possibility.

2. Edgen: The AI Version of Bloomberg Terminal for All Investors

Source: Edgen

Edgen is an AI-driven financial intelligence platform designed to be the AI version of Bloomberg Terminal for everyone. The platform enables retail investors to seamlessly monitor and analyze stock and cryptocurrency markets within a single interface.

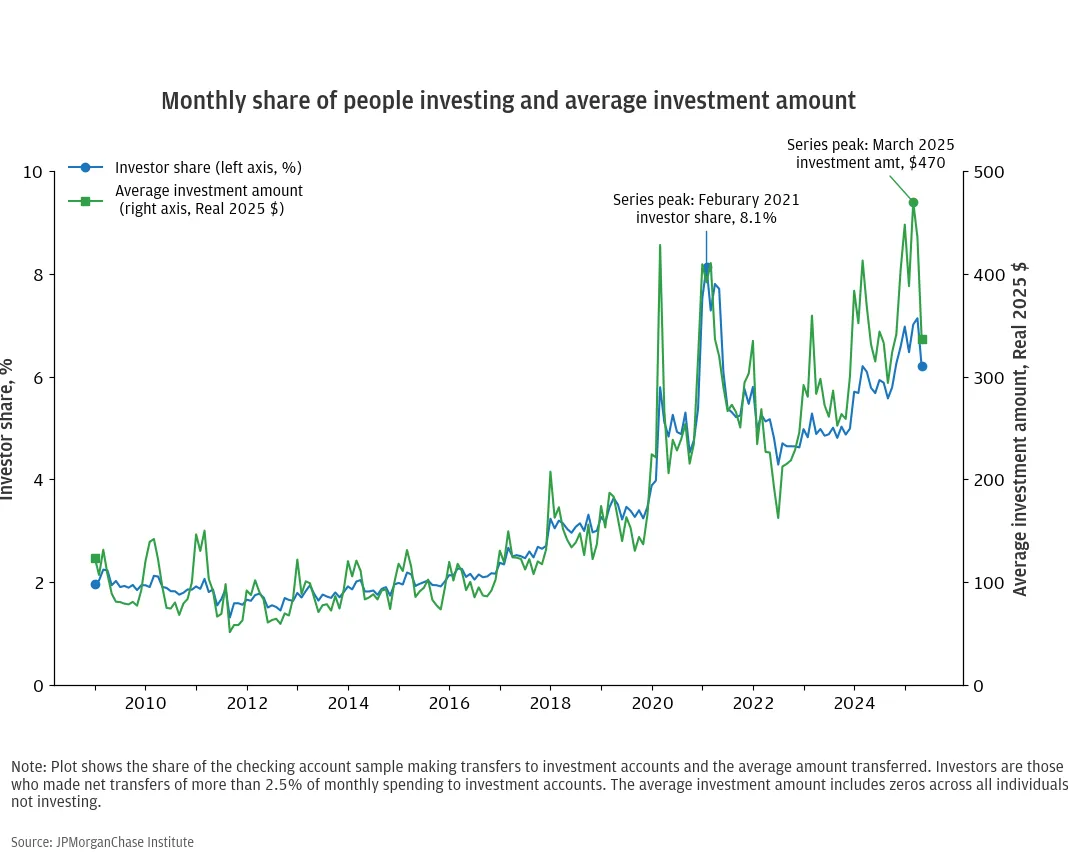

Source: Tiger Research

Edgen goes beyond data aggregation. The platform transforms fragmented data into actionable insights. Traditional financial information platforms provide raw data such as news, charts, and financial statements, while Edgen analyzes this data and presents investment insights in various formats, including conversational answers, visual charts, comprehensive reports, and customized quantitative scores for each investor.

Edgen further advances by building personalized analysis tailored to each investor's style and goals. The platform presents insights optimized for individuals rather than showing the same data to all users. This approach is similar to personalized social media feeds. Just as Facebook and Instagram show different content to each user, Edgen provides different dashboards for each investor. For example, under the same Bitcoin market conditions, a long-term investor might receive a prompt indicating that a local bottom has been reached and to consider adding to their position, while a short-term trader would see a personalized key point alert focusing on potential rebounds in an oversold area.

Source: Edgen

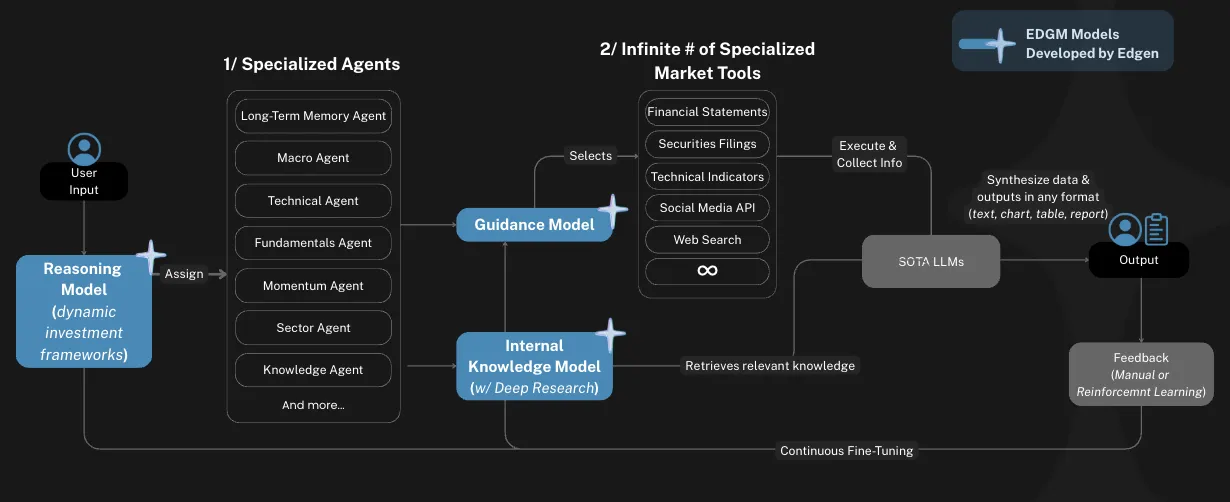

The Efficient Decision Guidance Model (EDGM) underpins this capability. EDGM orchestrates specialized agents and tools through a multi-agent system rather than operating as a single holistic model.

Unlike general large language models that only process language and text, this reasoning model interprets user queries and allocates them to specialized agents based on professional investment frameworks, such as macroeconomic analysis, technical analysis, fundamental analysis, and real-time market data. Each agent utilizes the guidance model and knowledge model to gather necessary data. This process integrates real-time market data, individual investors' search histories, portfolio compositions, and trading patterns. The system also references data from investors with similar investment profiles. The market tools and large language models then process and synthesize the collected data to present results in the form of conversational answers, charts, or reports.

This implementation merges comprehensive market analysis from Bloomberg Terminal with personalized strategy formulation from private banking services into a single platform. Retail investors can now access financial intelligence that was previously monopolized by institutional investors and ultra-high-net-worth individuals.

3. How Edgen Supports the Entire Investment Journey

3.1. Market Discovery: Uncovering Investment Opportunities

Finding valuable investment opportunities in today's complex market is a challenge even for experienced investors. Investors must review and analyze vast amounts of data, including countless news articles, charts, financial statements, and social media signals. Edgen simplifies this process through various methods.

Source: Edgen

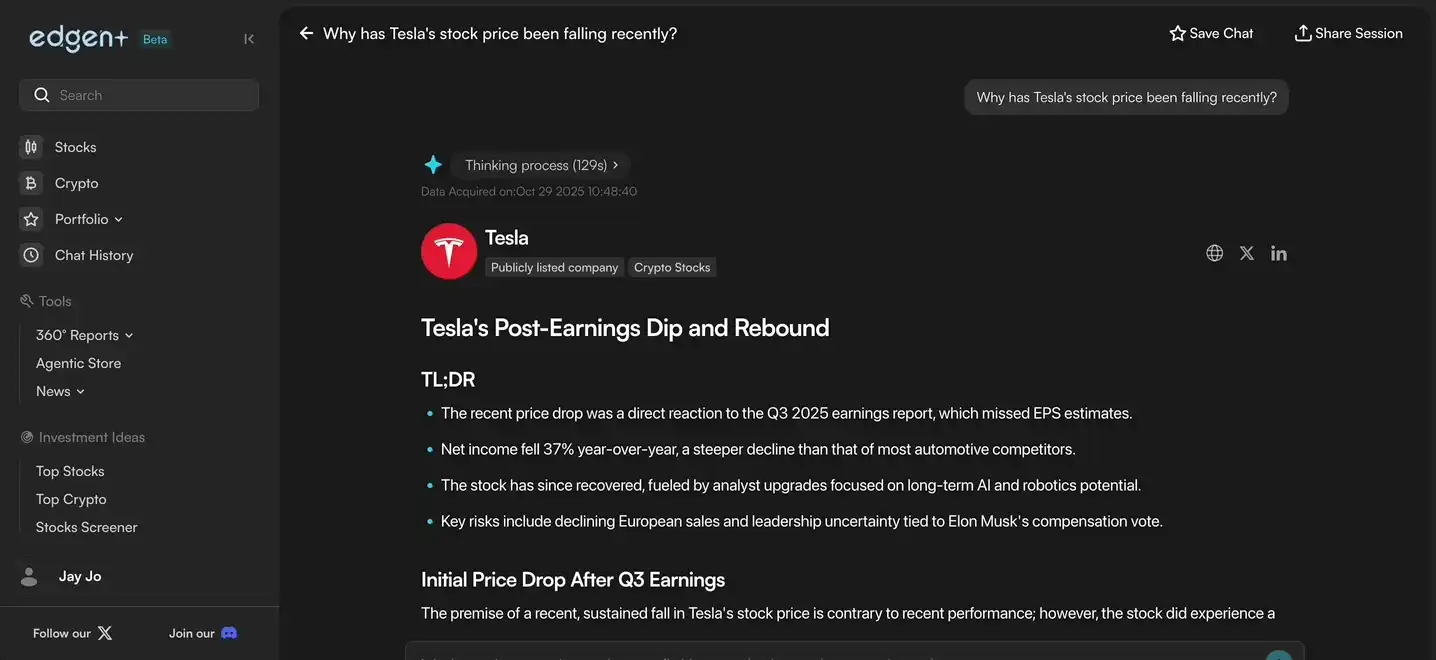

Edgen's search function allows investors to explore the market conversationally without directly analyzing complex financial data. For example, when an investor asks why Tesla's stock price has recently fallen, Edgen simultaneously analyzes the company's news, financial condition, technical indicators, and market sentiment to provide a comprehensive answer. Personalization features also play a role here. Edgen learns from users' search histories, identifying the themes, sectors, and indicators each investor values, and gradually customizes search results and investment suggestions for that specific user.

Source: Edgen

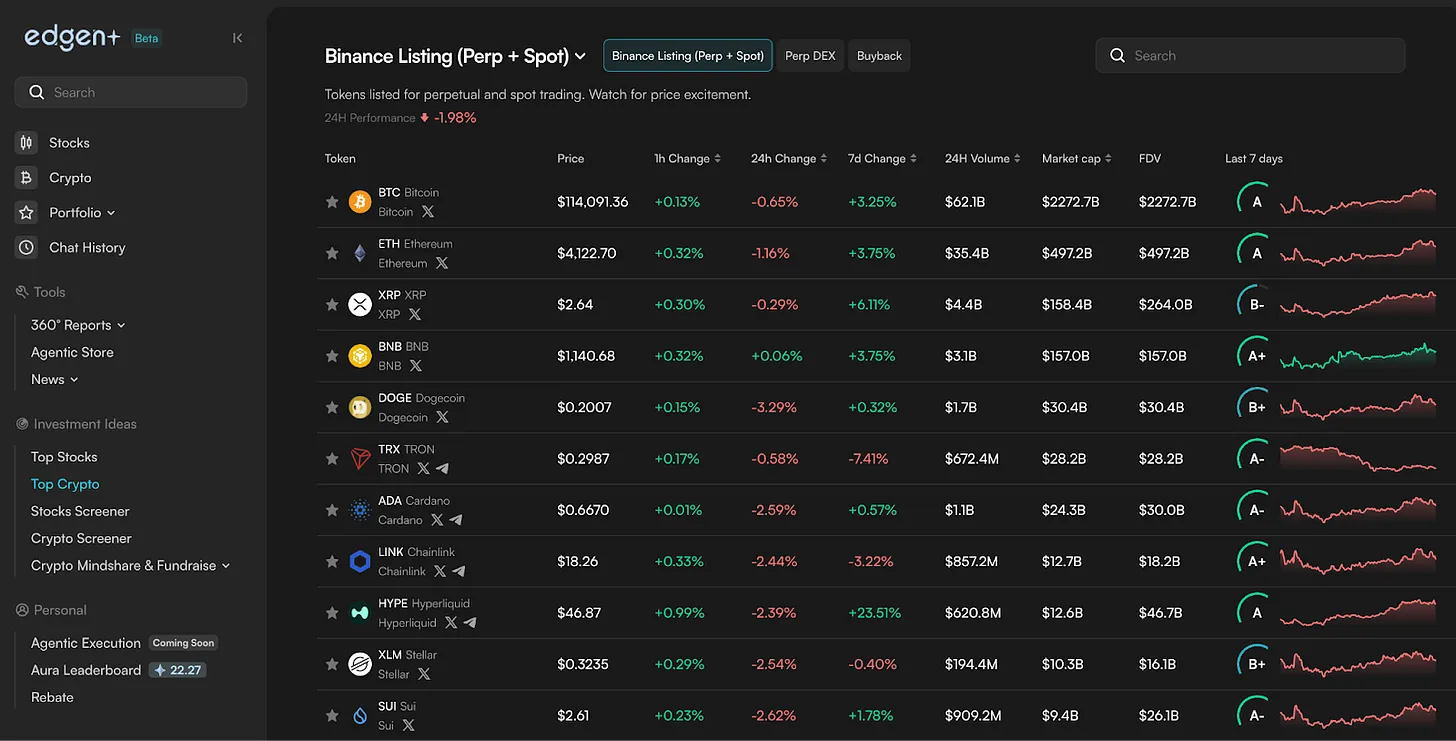

The investment ideas feature systematically uncovers market opportunities worth attention by theme. Popular stocks and cryptocurrencies highlight assets with strong market momentum. Stock and cryptocurrency screeners allow investors to create customized asset lists by setting conditions such as market capitalization, trading volume, and price changes. The cryptocurrency sentiment index captures unique signals in the cryptocurrency market. The cryptocurrency sentiment index tracks the popularity of tokens on social media in real-time through X, the former Twitter's heat index. The recently funded section provides information on projects that have recently secured funding, including the amount raised and participating investors. The decentralized exchange tracker analyzes on-chain transactions, revealing the capital flows of professional investors.

3.2. Intelligent Portfolio Management: Evaluating and Managing Assets

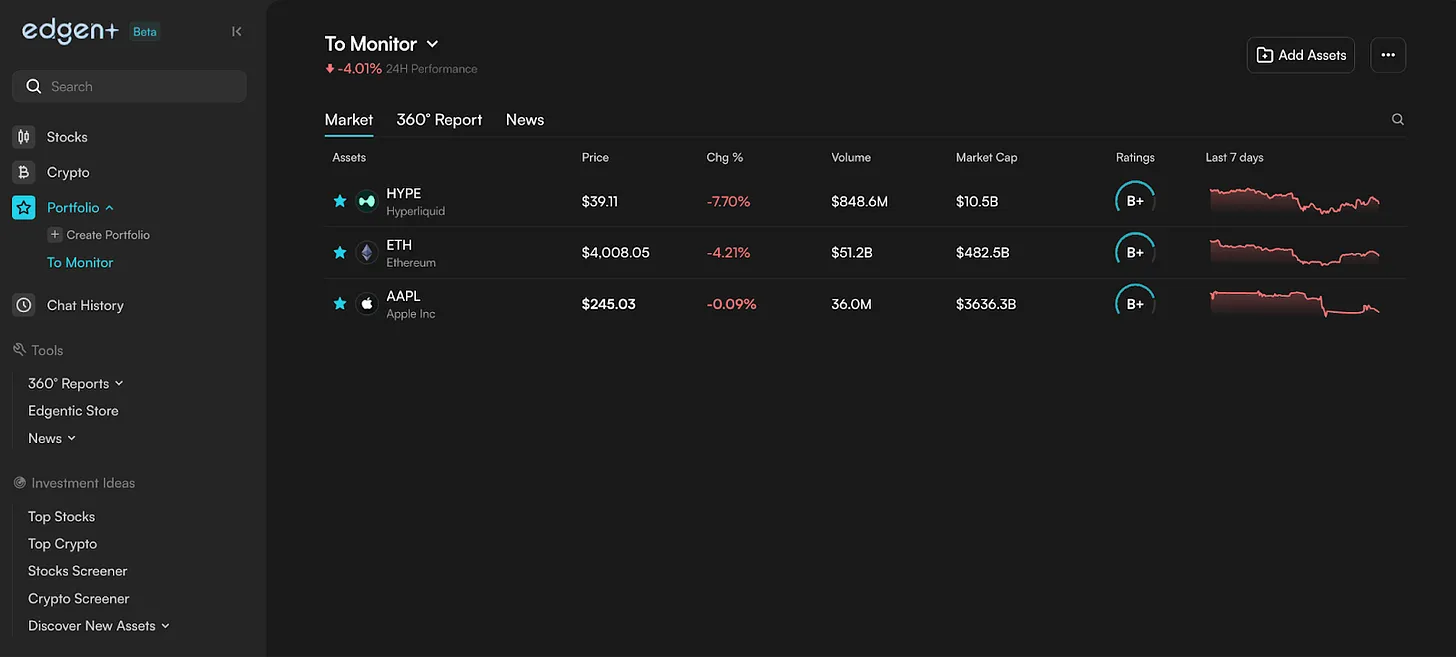

Source: Edgen

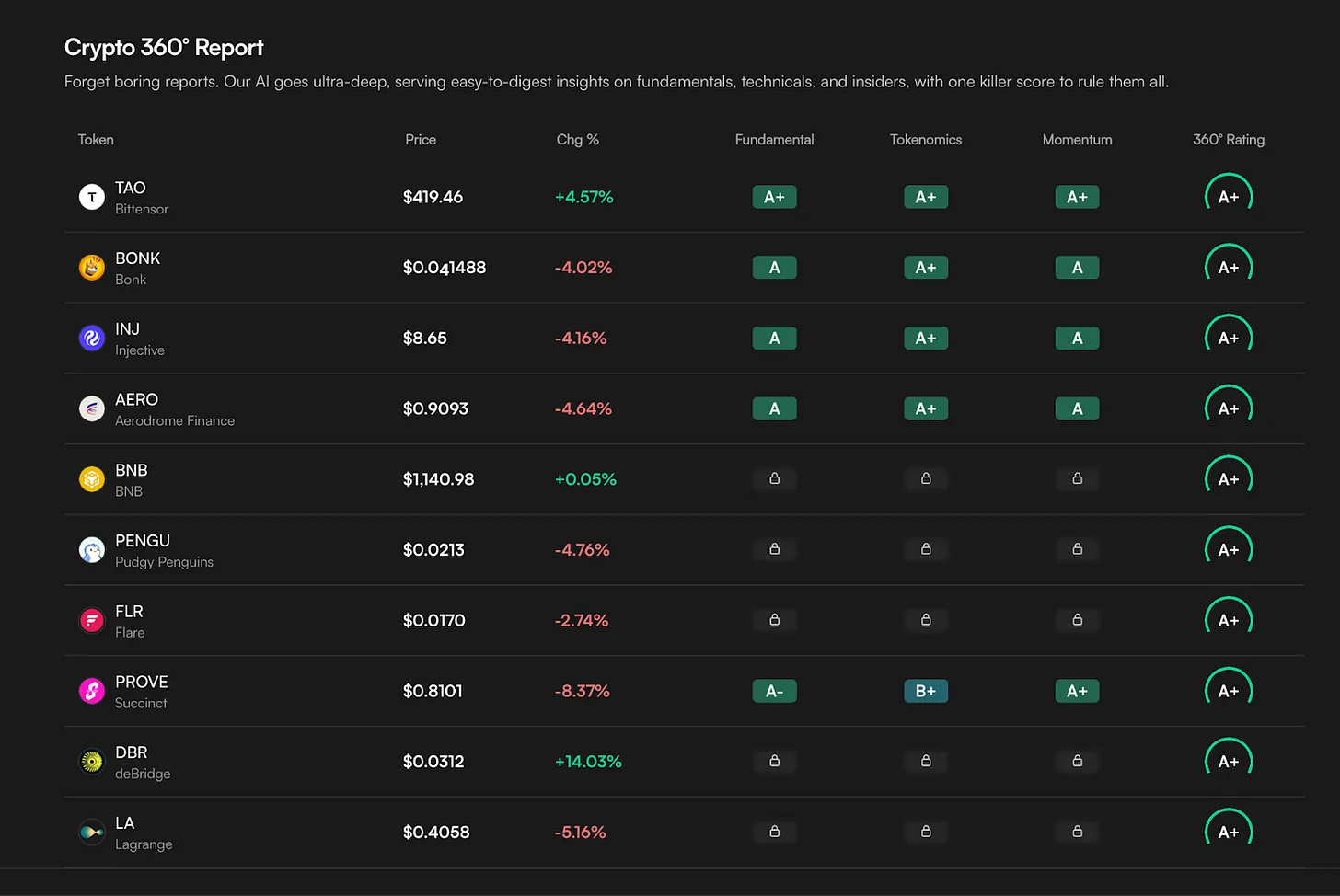

After uncovering investment opportunities, investors need tools to conduct in-depth analysis of assets and continuously monitor them. The 360-degree report feature automatically generates comprehensive analyses for individual assets. The system evaluates stocks from the perspectives of valuation, growth, profitability, and momentum, and assesses cryptocurrencies from the angles of fundamentals, token economics, and momentum. Edgen's specialized agents analyze each category and provide ratings ranging from A+ to D-. The platform transparently discloses the analysis process, making it easy for investors to verify how each agent arrived at their judgments.

Source: Edgen

In addition to analyzing individual assets, investors must manage multiple assets holistically. Edgen offers intelligent portfolio features. Investors can manage their collection of stocks and cryptocurrencies on a single screen. The portfolio provides three views. The market view displays real-time prices and asset ratings. The 360-degree report view summarizes in-depth analyses of each asset. The news view filters and provides news related to the portfolio.

Edgen plans to further upgrade its intelligent portfolio features. The platform will provide an overall score for the entire portfolio, not just individual asset ratings, and will offer specific action plans to achieve higher ratings.

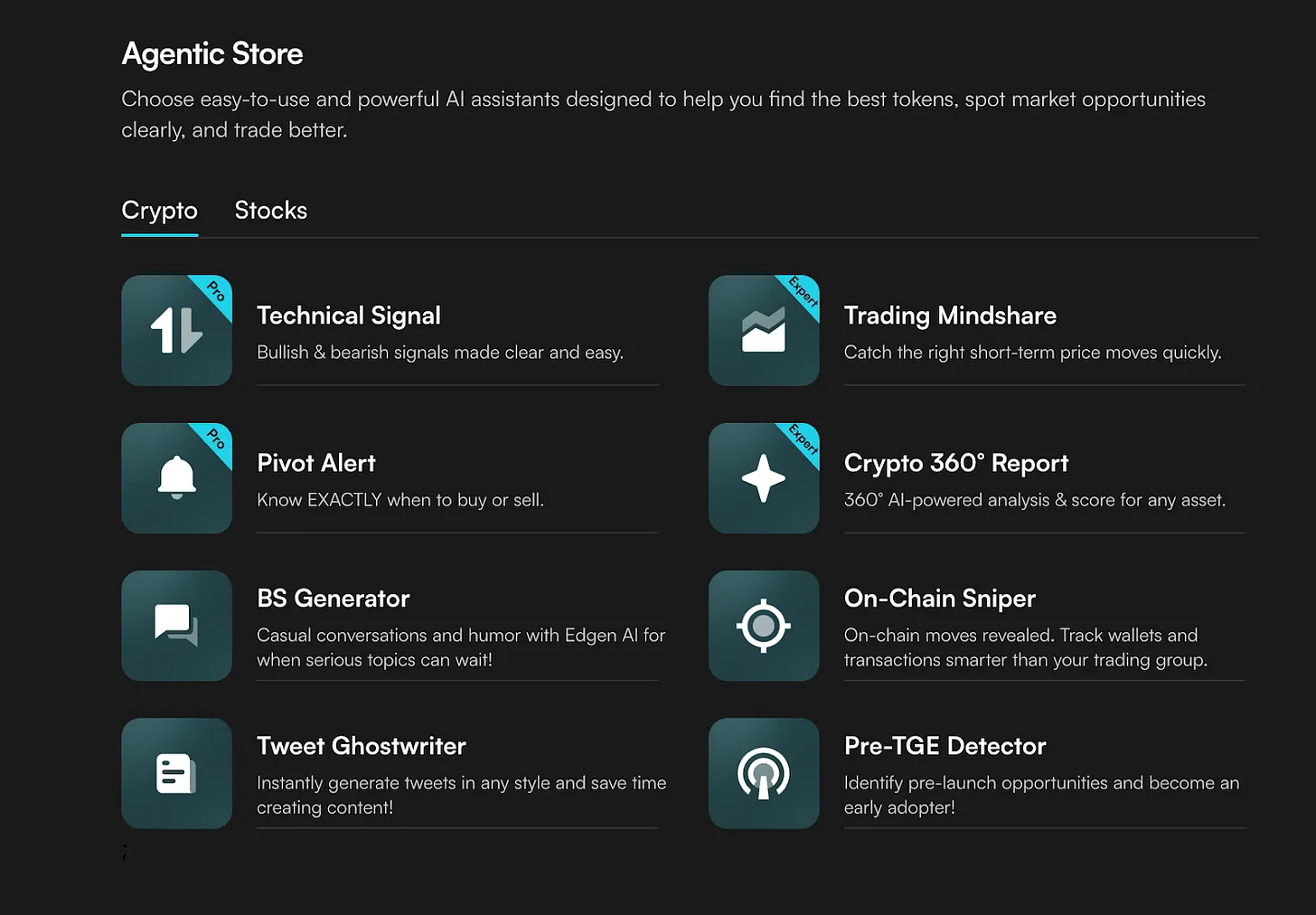

3.3. Customizable Tools: Build Your Own Investment Strategy

Edgen offers an agent marketplace for investors who need more specialized analysis. This marketplace provides a range of AI assistants focused on specific investment perspectives. Investors can directly select and deploy agents that match their investment style and goals.

Source: Edgen

For example, the technical signals agent automatically calculates indicators such as RSI, MACD, and moving averages, then provides bullish or bearish judgments along with a comprehensive three-star rating. The key point alert agent detects when assets are approaching local highs or lows, helping investors time their trades accurately at critical turning points. Other agents offer various capabilities, including on-chain activity analysis and opportunity discovery before token generation events. Investors choose and deploy the agents they need based on specific goals.

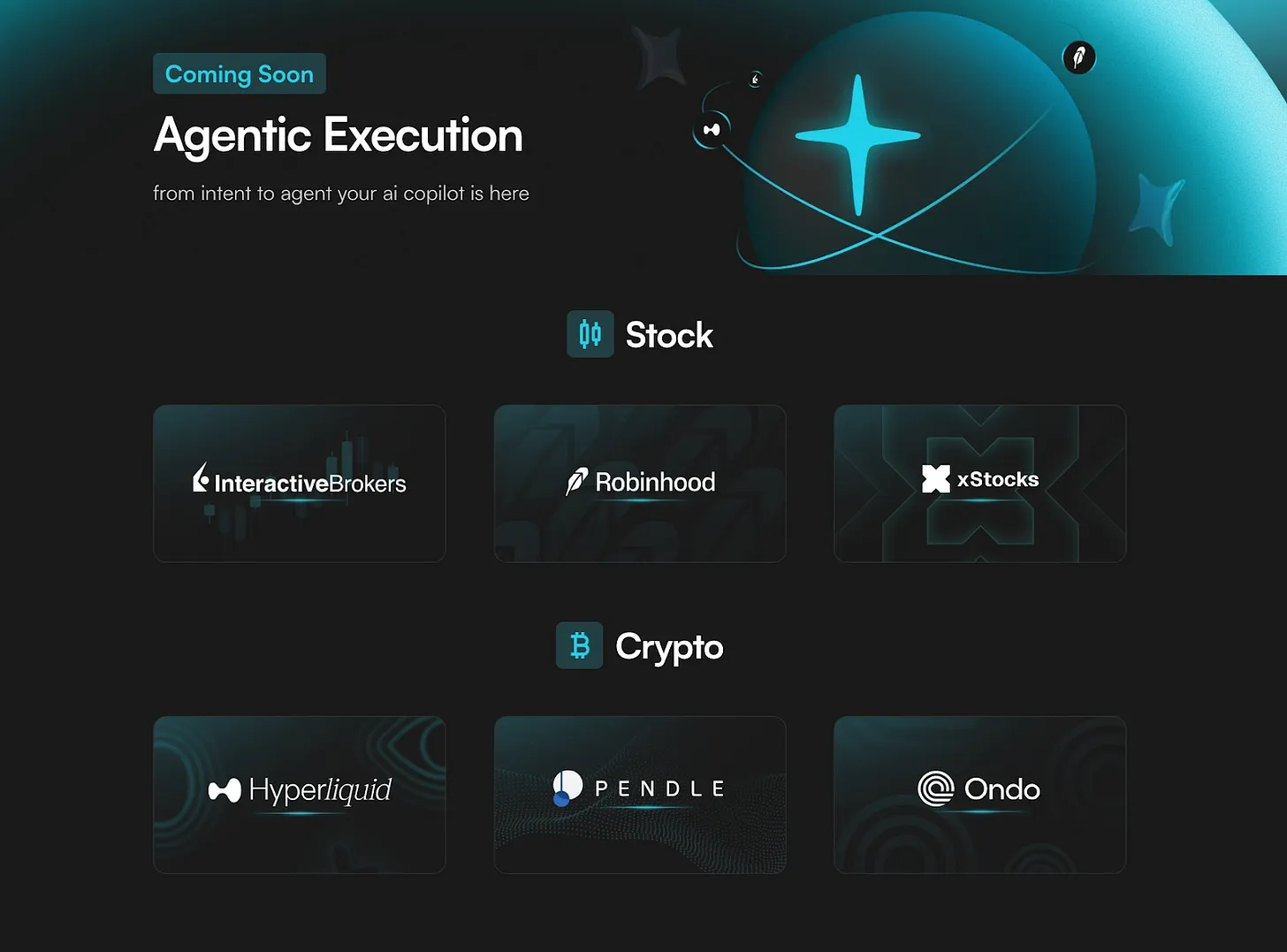

Source: Edgen

Additionally, Edgen is set to launch agent execution features that can automatically execute investors' requests as trades. For stocks, the platform connects to services like Robinhood and XStocks. For cryptocurrencies, it integrates with protocols like Hyperliquid and Pendle. The AI co-pilot understands investor intentions and executes trades directly. With this capability, Edgen evolves from an intelligent platform to a comprehensive investment operations platform.

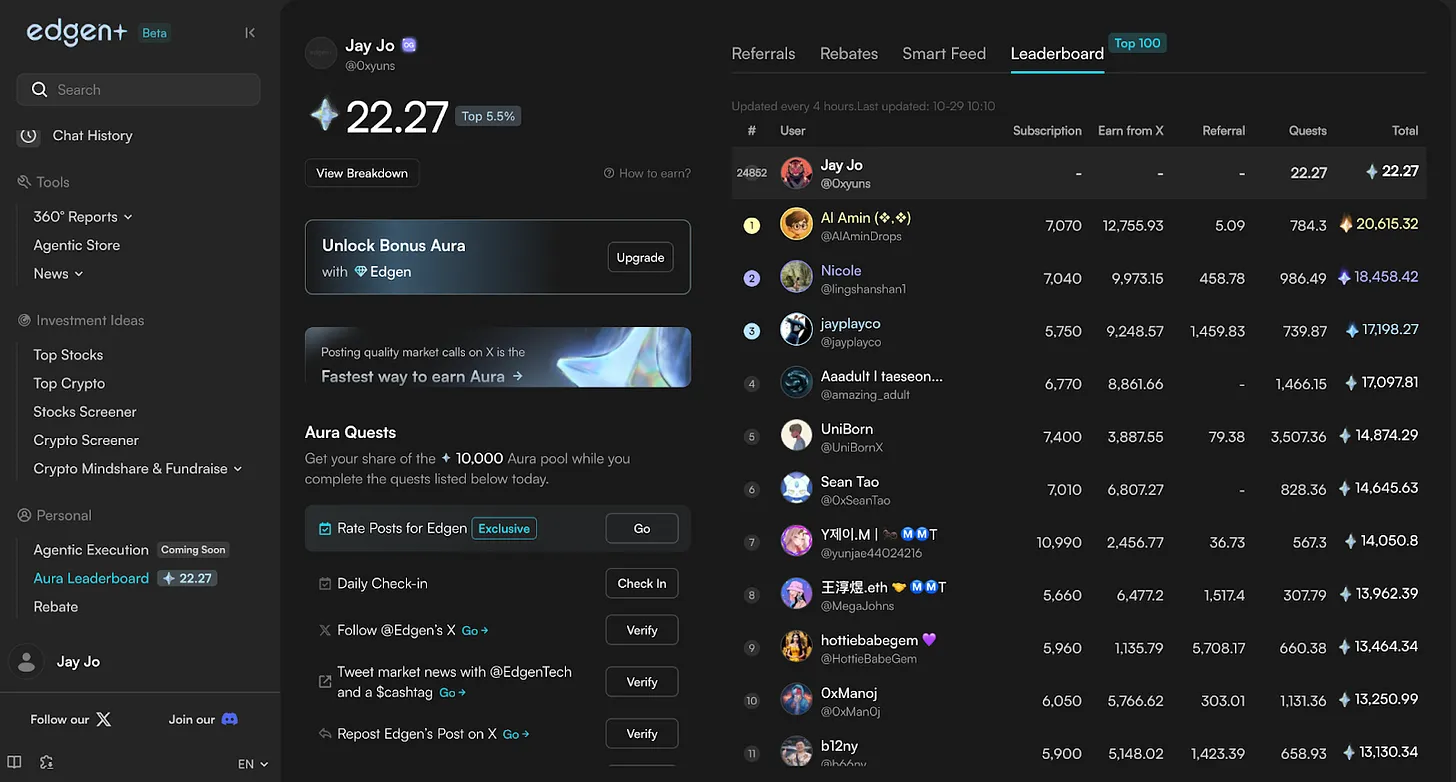

4. Open Intelligence: Evolving Through Participation

Edgen not only provides information but also builds an open intelligence ecosystem where users can directly participate and contribute. The Aura system is the cornerstone of this ecosystem. Aura serves as a non-transferable reputation metric that combines users' insight contributions, prediction accuracy, and social media influence into a comprehensive score.

Source: Edgen

Users earn Aura by posting market analyses or insights on the platform or sharing content on social media. The reward pool allocates 30% to dissemination activities and 70% to AI training contributions. The platform evaluates all contributions through AI scoring, community assessments, and expert validation. Users can view their Aura scores through the platform's leaderboard and a browser extension on X, formerly Twitter. The system categorizes scores into three levels: Aura, Super Aura, and Ultra Aura. The platform transparently records who provided which analyses and when.

User-provided insights are used to train the AI. User contributions improve the AI, and the improved AI then provides higher-quality analyses back to users, creating a virtuous cycle. Through this participatory structure, Edgen evolves into a platform that learns and progresses alongside its community.

5. From Wall Street to Personalized Financial Intelligence

Bloomberg Terminal and private banking services have long served institutional investors and ultra-high-net-worth individuals. These entities maintain overwhelming competitive advantages in the market through exclusive information acquisition channels and analytical tools. Meanwhile, retail investors must make investment decisions amid incomplete information, fragmented data, and limited tools.

The increasingly complex market further widens this gap. The variables investors must consider are growing exponentially, including on-chain data analysis, social media signal tracking, and global market trend identification. Individual investors find it nearly impossible to extract meaningful insights and make timely investment decisions amid this overwhelming flood of information.

Edgen addresses this information gap. The platform automates complex analytical tasks through a multi-agent system and integrates stock and cryptocurrency analysis within a single interface. Investors can now effortlessly access institutional-grade analytical tools without having to gather and cross-reference information across multiple platforms.

Edgen further advances toward personalized financial intelligence. The platform provides analyses and strategies optimized for each investor's style, risk preferences, and goals. This approach goes beyond simply providing institutional tools to retail investors. Edgen effectively equips everyone with a customized private banker.

Retail investing is rapidly moving toward democratization. Edgen transforms Wall Street privileges into opportunities for all. Financial intelligence, once reserved for a select few, is now accessible to all investors. The investment landscape is set for a fundamental shift.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。