FTX News: SBF Defends FTX Collapse as Liquidity Crisis, Not Insolvency

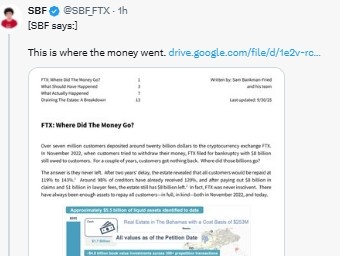

Did Sam Bankman-Fried really just say FTX was never broke? In his latest report titled “ FTX: Where Did the Money Go ?” , the former FTX CEO claims the company’s collapse wasn’t because of insolvency, but because of a short-term liquidity crunch.

Source: X (formerly Twitter)

This recent FTX News update brings a surprising twist, suggesting that the exchange still holds billions even after paying off most creditors.

Exchange Faced a Liquidity Crisis, Not Bankruptcy

According to SBF, the organisation always had enough money to repay its customers. He says the real problem was timing too many withdrawals came in too quickly, creating a temporary liquidity crisis. The report claims that the $8B exchange owed to users when it filed for bankruptcy never actually left the exchange.

SBF adds that all customers will eventually receive between 119% and 143% of their original balances. So far, about 98% of creditors have already been paid around 120% of what they were owed, making this one of the most unusual bankruptcy cases in recent history.

FTX’s Massive Asset Holdings

The report also reveals how large its remaining assets are.

The company’s holdings on the day it filed for bankruptcy were worth an estimated $136 billion.

These include $14.3 billion in Anthropic shares, $7.6 billion in Robinhood stock, $1.2B in Genesis Digital Assets, and $600 million in SpaceX.

It also lists 58 million SOL tokens worth about $12.4B, 890 million SUI tokens valued at $2.9 billion, 205,000 BTC worth $2.3 billion, and $345 million in stablecoins.

After paying $8 billion in customer claims and $1 billion in legal fees, FTX’s bankruptcy estate still has around $8 billion left.

Creditors Receiving Strong Repayments

In the latest FTX News update, the exchange confirmed a new $1.6 billion payout to creditors under its bankruptcy plan.

This brings total recovery rates close to 95% far higher than the usual 20–40% that creditors receive in most bankruptcies.

Large creditors who were owed over $50,000 are now recovering nearly 84% of their funds.

Meanwhile, smaller claimants with less than $50,000 are being repaid an impressive 120.5% of their original claims. In other words, many small investors are actually getting back more money than they lost.

However, not all groups are seeing the same results. U.S.-based account holders have so far recovered only around 40% due to legal and jurisdictional issues. Still, compared to most bankruptcy outcomes, it’s repayment progress remains remarkable.

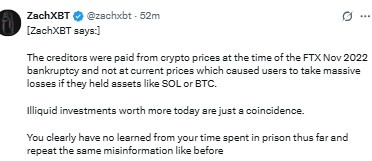

Although, not everyone agrees with SBF’s version of events. On-chain investigator ZachXBT pointed out that creditors were repaid based on crypto prices from organisation’s 2022 bankruptcy, not today’s higher values meaning many users still faced huge losses on assets like SOL and BTC.

Source: X (formerly Twitter)

What It Means for Crypto

This News report changes how people might see the FTX collapse. If SBF’s claims are true, it suggests that the organisation didn’t go bankrupt; it just couldn’t meet withdrawals fast enough. That paints a very different picture of what happened in 2022.

It also raises questions about how the bankruptcy team handled the case, and whether delays and mismanagement caused unnecessary losses. SBF’s claims may be controversial, but the repayment numbers speak for themselves.

Final Thoughts

While many still doubt Sam Bankman-Fried’s version of events, there’s no denying that FTX’s recovery is one of the most successful in history. Nearly all creditors are getting their money back, some even with extra.

Whether it was truly a liquidity crisis or deeper mismanagement, one thing is clear: this story is far from over. And as more facts come out, this update will remain one of the most talked-about topics in crypto.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。