Author: Yokiiiya

Let's analyze the fundamental reasons/real choices/underlying motivations for the inevitable emergence of stablecoins and why they are referred to as the blood of the DeFi ecosystem.

1. Fundamental Reason: Any Financial Activity Requires a Stable Equivalent

In traditional finance, stable equivalents (such as the US dollar and euro) are inherently present. The entire system is built on this stable foundation to construct complex structures like credit and derivatives:

We use USD / CNY / EUR for payments, settlements, and value storage;

This is the "blood" of the entire economic system, determining the accounting unit for all transactions.

But in the DeFi world:

You cannot directly settle with fiat currencies like the US dollar (the banking system does not directly connect to the blockchain);

Therefore, a "fiat currency on-chain" is needed to perform the same functions.

2. Real Choices: Native Cryptocurrencies (like ETH) Have Too Much Volatility

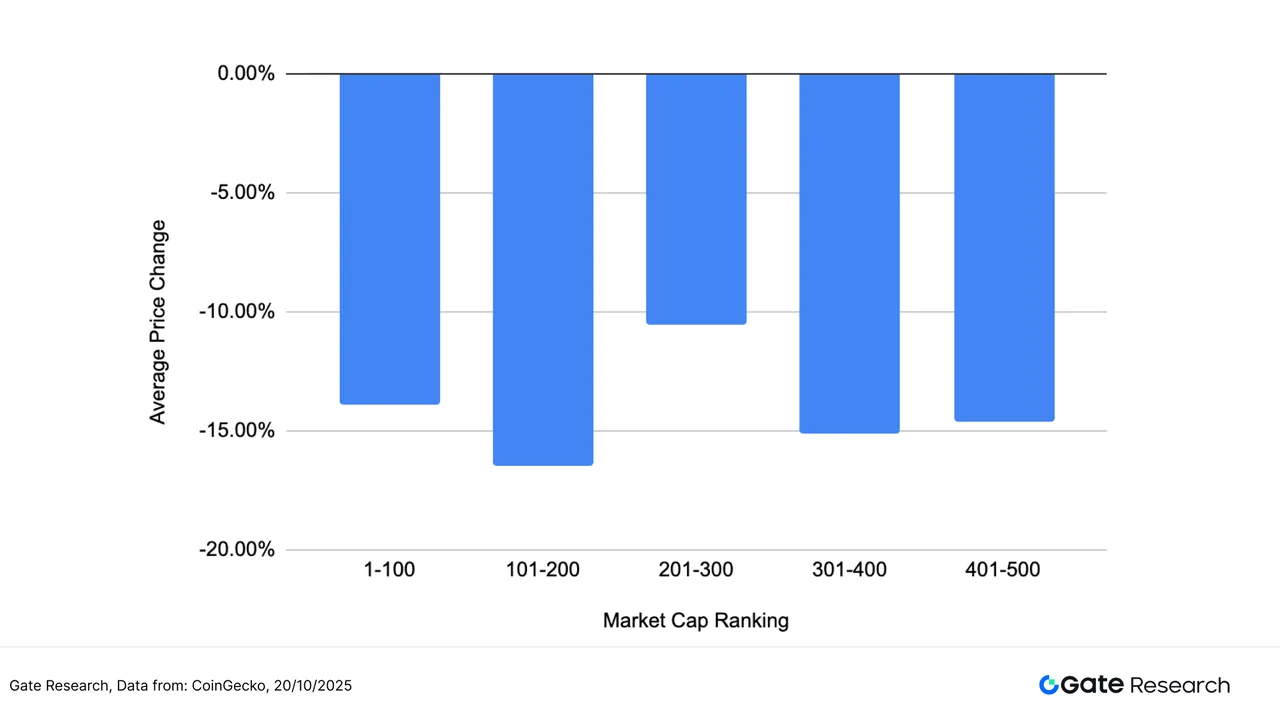

In reality, the high volatility of DeFi native assets (like ETH) means that if prices fluctuate wildly every day, then all financial transactions, lending, market making, liquidation thresholds, margin management, etc., will also go on a "roller coaster."

However, the essence is that ETH's volatility is an important driving force for the emergence of stablecoins, but not the only reason. Even if ETH's volatility is reduced, DeFi still needs a "settlement center" aligned with real-world value to handle fiat currency inflows and outflows, tax accounting, corporate reporting, cross-border payments, and other "off-chain demands."

This means that this coin needs to have bridge properties (on/off-ramp + accounting unit) and exist independently of the volatility of ETH and others.

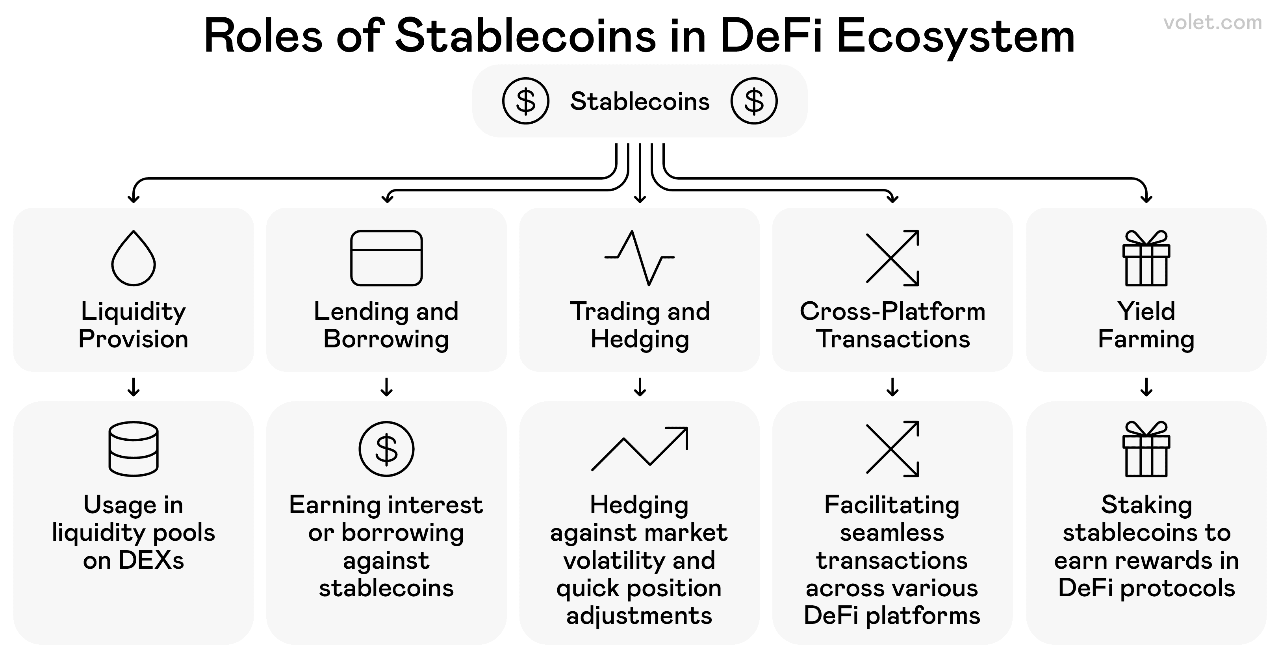

Thus, the roles of stablecoins include:

1. As a unit (numeraire): to price all assets, calculate returns, and settle fees.

2. As a medium: the most common pairing for trading is with stablecoins, resulting in shorter routes and smaller slippage.

3. As collateral: lower volatility allows for more controllable liquidation and manageable leverage.

4. As a clearing layer: facilitating fund transfers across protocols, chains, and exchanges, stablecoins serve as a "common language."

5. Bridging the fiat world: fiat ↔ on-chain, stablecoins are the smoothest "bridge."

This is why stablecoins are likened to the blood of the DeFi ecosystem: they play a fundamental and life-sustaining role in DeFi.

They transmit price signals, risk, and liquidity to every "organ" (protocol) while maintaining relative stability in the internal environment. If only high-volatility assets are used, the system would be like having high blood pressure and arrhythmia—exciting but not sustainable.

In other words, it is not just that "everyone needs a currency," but that for DeFi to function normally, a stable, priceable, liquid, and collateralizable settlement asset is required.

3. Underlying Motivation: Why Do Most Stablecoins Peg to the US Dollar?

Essentially, stablecoins pegging to the US dollar is a direct reflection of its dominant position in the global economy and finance.

"US dollar hegemony" is one way to describe it, but at a deeper level, it involves network effects + path dependence + settlement convenience:

Path dependence and network effects: The earliest and primary investors and users in the cryptocurrency market come from all over the world, but they have become accustomed to using the US dollar as the "universal language" for pricing and settlement. Choosing to peg to the US dollar aligns with the existing, strongest global financial consensus, allowing for widespread acceptance at the lowest cognitive cost.

Liquidity and depth: The dollar-centric mindset is deeply rooted in exchanges, and the US dollar has the deepest and broadest financial markets globally (such as US Treasury bonds). This means that stablecoin issuers (like Circle issuing USDC) can conveniently invest their reserves in these highly liquid and relatively safe assets to support the value of their stablecoins.

Global pricing habits: Despite various issues, the US dollar remains the world's primary reserve currency, considered a relatively stable value anchor. Commodities, cross-border trade, offshore financing… a large number of transactions are priced with the dollar as the anchor. This "common habit" is also carried over on-chain.

Clearing and compliance infrastructure: The banking, custody, and auditing ecosystems are more mature around the US dollar, making it easier to "land" on the fiat side.

Stablecoins pegging to the US dollar is not due to a technical necessity but rather a projection of real economic and political power in the digital world. It is a pragmatic business choice.

Conclusion

The statement "stablecoins are the blood of DeFi" accurately describes their indispensable role as a fundamental pricing unit, core trading medium, and key value store.

Stablecoins are not "issued just for the sake of issuing," but rather the most cost-effective and smooth coordination mechanism in a globalized crypto-financial system that requires high-frequency clearing and a unified accounting unit. The dominance of the dollar peg is due to network effects and the existing financial infrastructure in the real world that has paved the way.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。