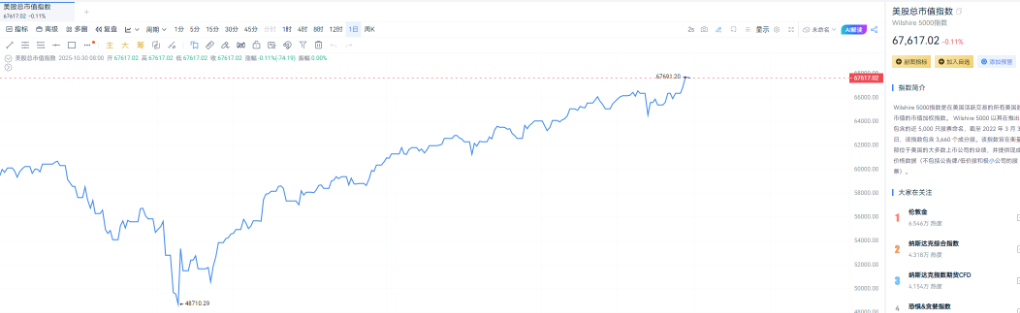

On October 30, at 8 AM UTC+8, the Federal Reserve announced a 25 basis point interest rate cut and confirmed the end of quantitative tightening on December 1. This significant decision, seen as the beginning of a global liquidity easing cycle, unexpectedly met with a cold reception in the cryptocurrency market. Bitcoin not only failed to rise but instead fell, continuing to fluctuate around the $110,000 mark, while traditional stock markets experienced a funding frenzy, with the Nasdaq breaking through the historical high of 26,397 points and Nvidia's market value surpassing $5 trillion. This stark contrast reveals a harsh reality: the cryptocurrency market is facing a deep liquidity crisis.

External Drain: Global Funds Flowing from "Small Ponds" to "Big Oceans"

Asset Performance Gap Accelerates Capital Outflow

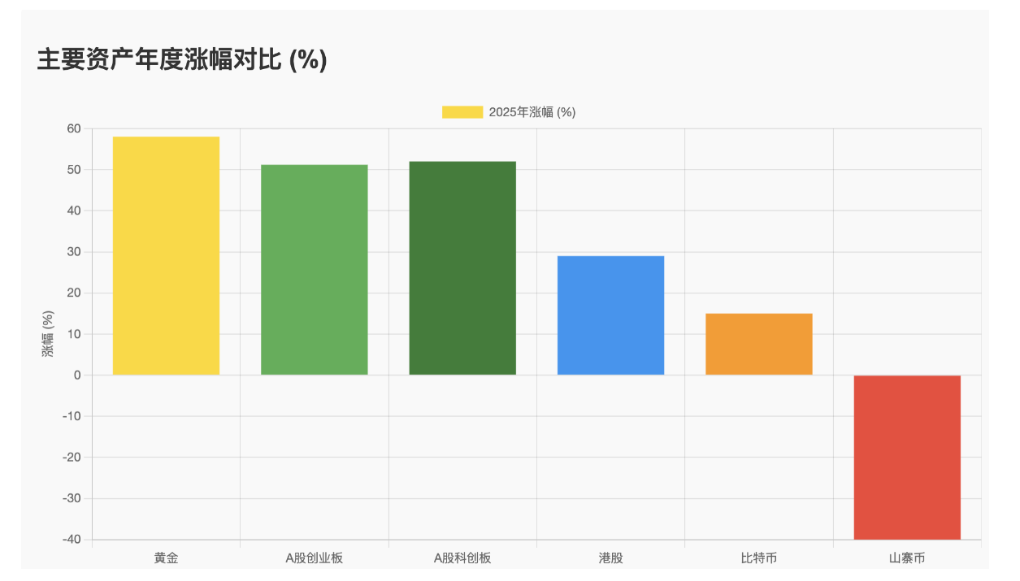

● AiCoin data shows that Bitcoin's approximately 17% increase this year is not only far below gold's over 50% performance but also lags behind the continuously hitting new highs of the Nasdaq index. This relative return gap makes institutions and retail investors more inclined to allocate funds to traditional assets.

● A fund manager on Wall Street admitted: “When traditional markets can provide more stable and richer returns, investors have no reason to keep their funds in the highly volatile cryptocurrency market.”

Market Size Disparity Leads to Natural Liquidity Spillover

● The total market capitalization of the cryptocurrency market, at $3-4 trillion, seems insignificant compared to the nearly $70 trillion U.S. stock market.

● A more intuitive comparison is that Nvidia's projected $500 billion GPU sales revenue over the next five quarters already exceeds the entire Ethereum ecosystem's market value accumulation over ten years. This scale disparity puts the cryptocurrency market at a natural disadvantage in the competition for funds, causing severe fluctuations with any large-scale capital inflow or outflow.

Weak Narratives Diminish Capital Attraction

● While the AI sector has launched heavyweight products like GPT-5 and Claude Code this year, the cryptocurrency industry's "AI narrative" remains at the conceptual stage.

● Market hotspots are scattered among DAT treasury, meme coins, and other fragmented concepts, failing to form sustained capital cohesion. “The lack of truly innovative narratives is like a lack of fresh water; liquidity drying up is just a matter of time.”

Multiple Factors Intensifying Liquidity Deterioration

"10·11" Crash as a Liquidity Turning Point

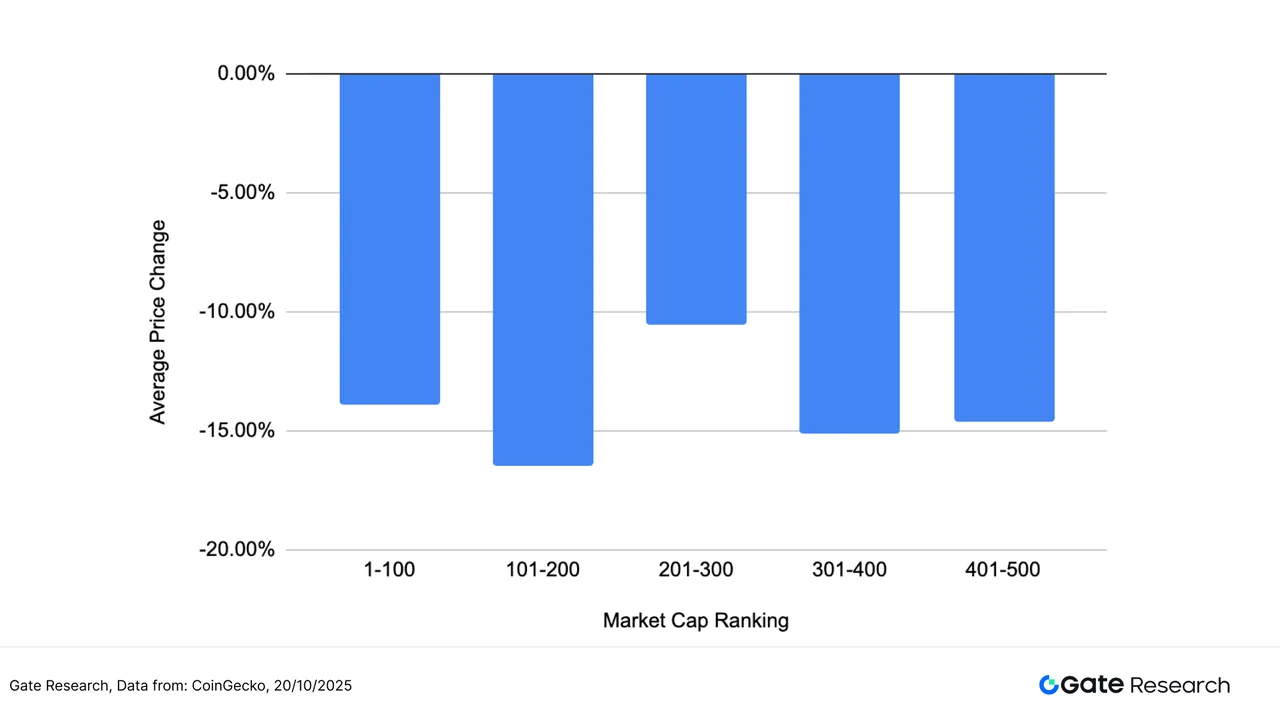

● The industry-wide crash on October 11 saw a liquidation scale of $30-40 billion, equivalent to a 1% instant evaporation of the market's total market capitalization, with over 1.6 million accounts liquidated. This not only directly drained a large amount of active capital but also severely undermined market confidence.

● A head of an exchange revealed: “After the crash, both institutional and retail investors' willingness to deposit funds has significantly decreased, leading to a sharp drop in market activity.”

Fragmented Hotspots Accelerate Capital Consumption

● Currently, the lifecycle of market hotspots generally does not exceed one week, with funds completing the entire process of entry, surge, distribution, and exit in a very short time. This extreme internal competition not only fails to attract new funds but also continuously consumes the vitality of existing capital.

Policy Uncertainty Suppresses Capital Inflow

● The "TACO-style" policy swings of the Trump administration have made the cryptocurrency market a victim of political gamesmanship. A market maker stated: “Policy uncertainty makes large funds choose to wait and see; they are unwilling to take unnecessary risks before policies become clear.”

Project "Financialization" Distorts Capital Flow

● An increasing number of projects rely on high-yield promises to attract funds, with phenomena like MegaETH's public sale being oversubscribed 20 times and Stable's first round of deposits being snapped up in seconds, which superficially shows ample funds but actually reflects capital idling due to a lack of innovation. These "financial projects" lock in a large amount of liquidity but fail to create real value for the ecosystem.

Deep Contradictions Behind the Liquidity Crisis

The Paradox of Institutionalization and Retail Exit

● With the involvement of traditional financial products like ETFs, the cryptocurrency market appears to be more "institutionalized," but in reality, it has lost its most active source of liquidity—retail investors. Data shows that the proportion of retail trading volume has dropped by over 40% from its peak in 2021.

Global Liquidity Easing and Market Isolation

● The Federal Reserve's liquidity injection should benefit all risk assets, but the cryptocurrency market has become a "liquidity sinkhole." This isolation phenomenon indicates that what constrains the cryptocurrency market is not the total global liquidity but its own attractiveness and acceptance capacity.

Stagnation of Technological Innovation and Excess of Financial Innovation

● While technological advancements like Layer 2 and modular public chains progress slowly, the market is flooded with various financial derivatives and wealth management protocols. This development model of "technological stagnation and financial frenzy" ultimately struggles to sustain itself due to a lack of a solid foundation.

Breaking the Deadlock: Returning to the Real

To break the current liquidity deadlock, joint efforts from multiple parties are needed:

● Project teams need to return to the essence of technology and create application scenarios with real demand.

● Exchanges should improve market structure and protect the interests of small and medium investors.

● Regulatory agencies need to provide clear policy expectations to reduce uncertainty.

● Institutional investors should focus on long-term value rather than short-term arbitrage.

The cryptocurrency market is experiencing the most severe liquidity crisis since 2022. The Federal Reserve's interest rate cut is like rain falling on a dry riverbed, but if the self-storage capacity is insufficient, no amount of external water sources can be retained. The investors currently remaining in the market are not only the last guardians of liquidity but also the sparks for the industry's rebirth.

Only by rebuilding the path of technological innovation and restoring the foundation of market trust can the cryptocurrency market truly emerge from the liquidity dilemma and usher in the next healthy development cycle.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。